Get in the KNOW

on LA Startups & Tech

X

Illustration by Ian Hurley

What Are LA’s Hottest Startups of 2022? See Who VCs Picked in dot.LA’s Annual Survey

Harri Weber

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

In Los Angeles—like the startup environment at large—venture funding and valuations skyrocketed in 2021, even as the coronavirus pandemic continued to surge and supply chain issues rattled the economy. The result was a startup ecosystem that continued to build on its momentum, with no shortage of companies raising private capital at billion-dollar-plus unicorn valuations.

In order to gauge the local startup scene and who’s leading the proverbial pack, we asked more than 30 leading L.A.-based investors for their take on the hottest firms in the region. They responded with more than two dozen venture-backed companies; three startups, in particular, rose above the rest as repeat nominees, while we've organized the rest by their amount of capital raised as of January, according to data from PitchBook. (We also asked VCs not to pick any of their own portfolio companies, and vetted the list to ensure they stuck to that rule.)

Without further ado, here are the 26 L.A. startups that VCs have their eyes on in 2022.

1. Whatnot ($225.4 million raised)

Whatnot was the name most often on the minds of L.A. venture investors—understandably, given its prolific fundraising year. Whatnot raised some $220 million across three separate funding rounds in 2021, on the way to a $1.5 billion valuation.

The Marina del Rey-based livestream shopping platform was founded by former GOAT product manager Logan Head and ex-Googler Grant LaFontaine. The startup made its name by providing a live auction platform for buying and selling collectables like rare Pokémon cards, and has since expanded into sports memorabilia, sneakers and apparel.

2. Boulevard ($40.3 million raised)

Boulevard’s backers include Santa Monica-based early-stage VC firm Bonfire Ventures, which focuses on B2B software startups. The Downtown-based company fits nicely within that thesis; Boulevard builds booking and payment software for salons and spas. The firm has worked with prominent brands such as Toni & Guy and HeyDay.

3. GOAT ($492.7 million)

GOAT launched in 2015 as a marketplace to help sneakerheads authenticate used Air Jordans and other collectible shoes. It has since grown at a prolific rate, expanding into apparel and accessories and exceeding $2 billion in merchandise sales in 2020. The startup sealed a $195 million funding round last summer that more than doubled its valuation, to $3.7 billion.

The Best of the Rest

VideoAmp ($578.6 raised)

Nielsen competitor VideoAmp gathers data on who's watching what across streaming services, traditional TV and social apps like YouTube. The company positions itself as an alternative to so-called "legacy" systems like Nielsen, which it says are "fragmented, riddled with complexity and inaccurate." In addition to venture funding, its total funding figure includes more than $165 million in debt financing.

Mythical Games ($269.4 million raised)

Seizing on the NFT craze, Mythical Games is building a platform that powers the growing realm of “play-to-earn games.” Backed by NBA legend Michael Jordan and Andreessen Horowitz, the Sherman Oaks-based startup’s partners include game publishers Abstraction, Creative Mobile and CCG Lab.

FloQast ($202 million raised)

FloQast founder Michael Whitmire says he got a “no” from more than 100 investors in the process of raising a seed round. Today, the accounting software company is considered a unicorn.

Nacelle ($70.8 million raised)

Nacelle produces docuseries, books, comedy albums and podcasts. The media company’s efforts include the Netflix travel series “Down To Earth with Zac Efron.”

Wave ($66 million raised)

A platform for virtual concerts, Wave has hosted performances by artists including Justin Bieber, Tinashe and The Weeknd. The company says it has raised $66 million to date from the likes of Warner Music and Tencent.

Papaya ($65.2 million raised)

Sherman Oaks-based Papaya looks to make it easier to pay “any” bill—from hospital bills to parking tickets—via its mobile app.

LeaseLock ($63.2 million raised)

Based in Marina del Rey, LeaseLock says it’s on a mission to eliminate security deposits for apartment renters.

Emotive ($58.1 million raised)

Emotive sells text message-focused marketing tools to ecommerce firms like underwear brand Parade and men's grooming company Beardbrand.

Dray Alliance ($55 million raised)

Based in Long Beach, Dray says its mission is to “modernize the logistics and trucking industry.” Its partners include Danish shipping company Maersk and toy maker Mattel.

Coco ($43 million raised)

Coco makes small pink robots on wheels (you may have seen them around town) that deliver food via a remote pilot. Its investors include Y Combinator and Silicon Valley Bank.

HiveWatch ($25 million raised)

HiveWatch develops physical security software. Its investors include former Twitter executive Dick Costollo and NBA star Steph Curry’s Penny Jar Capital.

Popshop ($24.5 million raised)

Whatnot competitor Popshop is betting that live-shopping is the future of ecommerce. The West Hollywood-based firm focuses on collectables such as trading cards and anime merchandise.

First Resonance ($19.4 million raised)

Founded by former SpaceX engineer Karan Talati, First Resonance runs a software platform for makers of electric cars and aerospace technology. Its clients include Santa Cruz-based air taxi company Joby Aviation and Alameda-based rocket company Astra.

Open Raven ($19 million raised)

Founded by Crowdstrike and Microsoft alums, Open Raven aims to protect user data. The cybersecurity firm’s investors include Kleiner Perkins and Upfront Ventures.

Fourthwall ($17 million raised)

When an actor faces the camera and speaks directly to the audience, it’s known as “breaking the fourth wall.” Named after the trope, Venice-based Fourthwall offers a website builder that’s designed for content creators.

The Non Fungible Token Company ($15 million raised)

The Non Fungible Token Company creates NFTs for musicians under the name Unblocked. Its investors include Jay Z’s Marcy Venture Partners and Shawn Mendez.

Safe Health Systems ($15 million raised)

Backed by Mayo Clinic Ventures, Safe Health develops telehealth software and offers tools for enterprises to launch their own health care apps.

Intro ($11.6 million raised)

Intro’s app lets you book video calls with experts—from celebrity stylists, to astrologists, to investors.

DASH Systems ($8.5 million raised)

With the tagline “Land the package, not the plane,” DASH Systems is a Hawthorne-based shipping company that builds hardware and software for automated airdrops.

Ettitude ($3.5 million raised)

With a focus on sustainability, Ettitude is a direct-to-consumer brand that sells bedding, bathroom textiles and sleepwear.

Afterparty ($3 million raised)

Along similar lines as Unblocked, Afterparty creates NFTs for artists and content creators such as Clay Perry and Tropix.

Heart to Heart ($0.75 million raised)

Heart to Heart is an audio-focused dating app that “lets you listen to the story behind the pictures in a profile.” Precursor Ventures led the pre-seed funding round.

Frigg (undisclosed)

Frigg makes hair and beauty products that contain cannabinoids such as CBD. The Valley Village-based company raised an undisclosed seed round in August.

From Your Site Articles

- The Early-Stage Startups in LA Set to Take Off in 2021 - dot.LA ›

- Los Angeles Startups Closed a Record Number of Deals in Q3 - dot.LA ›

- dot.LA's Map of Startups in Los Angeles - dot.LA ›

- The Hottest LA Startups of 2020 - dot.LA ›

- Los Angeles Cleantech Incubator Launches Green Loan Fund - dot.LA ›

- dot.LA's Guide on L.A. Flight Startups Overair, Archer Aviation - dot.LA ›

- Here Are LA’s Hottest Startups for 2023 - dot.LA ›

- Nobody Studios Plans to Build 100 Startups in Five Years - dot.LA ›

- From GameTree to Sota — Ukrainian Founders Call LA Home - dot.LA ›

Related Articles Around the Web

Harri Weber

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

Perelel, the LA startup quietly fixing women’s health

10:21 AM | November 21, 2025

🔦 Spotlight

Happy Friday LA!

While the market obsesses over the latest AI tool, one of the most interesting checks this week went to something more basic and much harder to fake: women’s health.

Perelel, a doctor founded, research backed supplement company for women, just raised 27 million dollars in growth funding led by Prelude Growth Partners, with existing investors including Unilever Ventures, Willow Growth Partners and Selva Ventures coming back in. Co founded by CEO Victoria Thain Gioia, who comes from a background in finance and operating roles at consumer brands, former media executive Alex Taylor, and OB GYN Dr. Banafsheh Bayati, the company has spent the last five years quietly building a profitable business that has doubled revenue year over year and has some of the strongest subscriber retention in its category.

The wellness aisle is crowded with influencer brands and one size fits all multivitamins. Perelel is trying to be the adult in the room. The team designs products with OB GYN input, clinical backing and formulas tailored to specific chapters of a woman’s hormonal life, from fertility and pregnancy to postpartum, perimenopause and beyond. Most of its line now carries a Clean Label Project Purity Award, which is a polite way of saying they’re willing to have someone else check what’s actually in the bottle.

This round is less about a splashy launch and more about upgrading the cap table and the support system. The founders used the raise to buy out early angel investors and bring in Prelude Growth, a women-founded firm with a track record in modern consumer health and beauty. The new capital is aimed at deeper research, more life stage specific products and broader distribution rather than chasing the trend of the month.

In a category that has historically treated women’s health as an afterthought, a clinically serious, women led company raising growth capital to build a full lifecycle platform feels like a meaningful data point. Scroll down for this week’s LA venture deals, funds and acquisitions.

🤝 Venture Deals

LA Venture Funds

- Anthos Capital participated in Kalshi’s new $1B funding round, which values the CFTC-regulated prediction market platform at $11B and was led by returning investors Sequoia Capital and CapitalG alongside Andreessen Horowitz, Paradigm and Neo. The capital will help Kalshi scale its event-contracts exchange, expand beyond politics into areas like macro data and business events, and compete more aggressively with rival prediction platforms as institutional and retail interest in trading real-world outcomes grows. - learn more

- UP Partners participated in Point One Navigation’s $35M Series C round, backing the San Francisco-based precise location startup alongside lead investor Khosla Ventures and fellow existing investors IA Ventures and Alumni Ventures. The company provides centimeter-level GNSS correction and positioning services for “physical AI” applications like autonomous vehicles, robots and smart equipment, and plans to use the new funding to expand its Polaris RTK network, enhance its location platform and grow its team across R&D, OEM integrations and international operations. - learn more

- Embark Ventures participated in QSimulate’s latest seed financing, which brings the Boston-based quantum simulation startup’s total funding to just over $11M. The company also launched QUELO v2.3, a new generation of its quantum-powered drug discovery platform that uses real-time quantum mechanics to model drug–protein interactions far faster than traditional methods, and it plans to use the capital to scale operations and support growing collaborations with major pharma and tech partners. - learn more

- Cultivate Next, Chipotle Mexican Grill’s venture fund, participated in Athian’s $4M Series A round, backing the Indianapolis-based startup alongside Ajinomoto Group Ventures, Mondelēz International’s Sustainable Futures platform and a roster of existing strategic investors from across the livestock and food value chain. Athian, founded in 2022, operates a platform that aggregates, verifies and monetizes on-farm greenhouse gas reductions so food brands can hit their Scope 3 climate targets, and it says it has already facilitated $18M in payments to farmers as it expands its protocols, species coverage and international footprint. - learn more

- Fika Ventures joined Coverbase’s $16M Series A as a returning investor from the seed round, backing the company alongside lead investor Canapi Ventures and others. The San Francisco based startup uses AI agents to automate vendor procurement and third-party risk review for regulated enterprises, serving customers like Coinbase, Okta and Nationwide, and the new funding will help it expand into contract management, continuous security monitoring and a larger go-to-market team. - learn more

- BroadLight Capital and HeartBeat Ventures are among the investors backing Function Health’s $298M Series B round, which values the company at $2.5B and supports its push to become a new standard in proactive, data-driven healthcare. The Austin-based startup offers a membership platform that combines extensive lab testing with AI to help people track and manage their health, and it’s using the new capital to launch its Medical Intelligence Lab, an initiative aimed at turning that data into personalized medical insights at scale. - learn more

- Hallwood Media joined Menlo Ventures and other investors in Suno’s $250M Series C round, which values the AI music startup at $2.45B. The Cambridge based company lets users generate fully produced songs from text prompts and is using the new funding to expand tools like its Suno Studio workstation and next-generation music models, even as it navigates high-profile copyright lawsuits from major record labels. - learn more

- Upfront Ventures joined the $7M seed round for alphaXiv, investing alongside co-leads Menlo Ventures and Haystack, plus Shakti VC, Conviction Embed and several high-profile angels. The San Francisco based company runs a platform that helps AI practitioners and researchers discover, compare and apply cutting-edge AI papers, benchmarks and implementations, and it plans to use the new funding to further bridge the gap between fast-moving AI research and real-world production deployments. - learn more

- Regeneration.vc joined TULU’s $37M Series A extension as an existing investor, backing the company alongside GreenSoil PropTech Ventures, Bosch Ventures, New Era Capital Partners and others. TULU runs an AI powered product access platform that installs shared, IoT enabled units inside residential and commercial buildings so residents can rent or buy items like appliances, e scooters and household essentials on demand, and the new funding will help the company scale its “TULU Brain” data engine and expand its footprint beyond the 500,000 residents it already serves across North America and Europe. - learn more

- WndrCo has joined Method Security’s $26M combined seed and Series A round, alongside Andreessen Horowitz, General Catalyst, Blackstone Innovations and others. The startup, which operates out of New York and Washington DC, is building an autonomous cyber platform that combines offensive and defensive tools into a digital twin of an organization, helping US government agencies, the Department of Defense and large enterprises continuously test and strengthen their defenses against AI driven threats, a thesis that fits neatly with WndrCo’s focus on infrastructure and security. - learn more

- Coral Tree Partners has led a new Series B round for KERV.ai, backing the Austin based company as it scales its AI-powered contextual commerce and video advertising platform. The funding will be used to invest in R&D, technology, talent and infrastructure so KERV.ai can further expand its interactive, shoppable video solutions and first-party data targeting tools for brands, agencies and publishers, while pushing into new markets and strategic partnerships. - learn more

- CIM Group and Group 11 are backing Venn’s new $52M Series B, with CIM co-leading the round alongside NOA and Group 11 re-upping as an existing investor. The New York and Tel Aviv based company builds an operating system for multifamily housing that unifies data and workflows so landlords and operators can run buildings more efficiently and treat them like modern consumer brands. Over the last 18 months, Venn says it has expanded across dozens of U.S. states, partnered with hundreds of owners and operators, and grown annual recurring revenue ninefold, setting up this round to fuel further product development and market expansion. - learn more

- Walkabout Ventures led Barker’s $3.5M seed round, backing the New York based fintech as it builds warrantied AI valuations for illiquid, hard-to-price assets in asset-backed lending. Barker’s platform uses an “agentic valuation system” and insurance from Munich Re to warranty its AI-generated prices on assets like aircraft, equipment, art and GPUs, so lenders are protected if the collateral ultimately sells for less than the model predicted, and the new funding will help the company expand into more asset classes and deepen partnerships across banks and private lenders. - learn more

- Freeflow Ventures joined Erg Bio’s $6.5M seed round, investing alongside lead Azolla Ventures, Chevron Technology Ventures, Plug and Play and other strategic backers. Erg Bio is developing its Aspire platform, a flexible, low-temperature pretreatment and catalytic process that turns agricultural and forestry waste into intermediates for synthetic aviation fuel and critical biobased chemicals, and the new capital will help scale the technology, expand engineering and bioprocessing teams, and move toward pilot-scale demos. - learn more

- Pinegrove Venture Partners participated in Ramp’s new $300M financing round, joining Lightspeed Venture Partners and a long list of existing and new backers as the company’s valuation hit $32B. The New York based spend management and corporate card platform now generates over $1B in annualized revenue, serves more than 50,000 business customers and processes upwards of $100B in annual purchase volume, and this fresh capital will support continued product expansion and enterprise growth. - learn more

- Alexandria Venture Investments and B Capital joined Solve Therapeutics’ new $120M financing round, backing the San Diego based biotech alongside lead investor Yosemite and a broader syndicate that includes Merck & Co. and other life sciences funds. The company is developing next-generation antibody-drug conjugates for solid tumors using its proprietary CloakLink linker platform, and it plans to use the capital to advance its lead programs SLV-154 and SLV-324 through Phase 1b trials and further build out its ADC and diagnostics pipeline. - learn more

- Factorial Funds joined Sakana AI’s $135M Series B round, backing the Tokyo-based startup as it doubles down on building efficient, Japan-focused AI models rather than chasing ever-larger, compute-heavy systems. The financing, which values Sakana at about $2.65B, will help expand its “sustainable AI” research and grow its team as it rolls out sovereign, culturally tailored AI solutions for Japanese enterprises and sectors like finance, manufacturing, and government. - learn more

- Smash Capital joined AVP and other investors in backing Flatpay’s latest round, which raised roughly €145–170M and crowned the Danish SMB payments startup as Europe’s newest fintech unicorn at around a €1.5B valuation. The company, which offers flat-rate card terminals and POS systems for small merchants, has scaled to roughly 60,000 customers and over €100M in ARR, and will use the fresh capital to accelerate European expansion, deepen its product stack and significantly grow headcount. - learn more

- Fusion joined No Barrier’s oversubscribed $2.7M seed round, investing alongside lead backers A-Squared Ventures, Esplanade Ventures and Rock Health Capital to scale the company’s AI-first approach to medical interpretation. The San Francisco based startup integrates real-time, HIPAA-compliant language interpretation into hospital systems and EHRs across 40+ languages, and will use the new funding to expand deployment across U.S. care settings and further reduce health disparities for patients with limited English proficiency. - learn more

- Matter Venture Partners joined Vertex Ventures and other global investors in backing Ruochuang Technology’s Pre A round, which totals tens of millions of dollars to fuel the company’s next stage of growth. The startup develops low speed robotics and related IoT hardware, spanning technology R and D, device manufacturing and sales, and this new capital will help it deepen intelligent hardware research and expand its market footprint as demand for smart manufacturing and IoT applications accelerates. - learn more

- B Capital joined Shipday’s $7M Series A as a participating investor, re-upping after leading the company’s 2023 seed round and backing the Menlo Park–based startup alongside co-leads ECP Growth and Ibex Investors. Shipday provides an AI-powered last-mile delivery and logistics platform for SMBs like restaurants and local retailers, and it plans to use the new funding to build out features such as its AgentFlow automation engine, deepen integrations, and expand its global reach beyond the 5,000 businesses it already serves in 100+ countries. - learn more

- MANTIS Venture Capital participated in Bedrock Data’s $25M Series A round, joining lead investor Greylock Partners alongside Mangusta Capital, Pier 88 Investment Partners and others to back the Menlo Park based data security startup. Bedrock Data provides an AI-native, data-centric security and governance platform powered by its “Metadata Lake,” and it plans to use the new funding to accelerate product development and expand go-to-market efforts as enterprises look to secure data across cloud, SaaS and AI systems at multi-petabyte scale. - learn more

- TenOneTen Ventures and Wedbush Ventures joined Meadow AI’s $6M in total funding, including a $4.5M seed round they backed alongside co-lead Leadout Ventures and other investors. The Seattle-based startup is emerging from stealth with a multimodal AI platform that helps restaurants and retailers monitor real-time operations and automate “secret shopper” audits across 10–300-location chains, already driving more than $2.5M in contracted ARR as it targets further growth in physical retail. - learn more

LA Exits

- Neotech, a long-time provider of high-reliability electronic manufacturing services, has been acquired by private equity firm Arkview Capital in a deal that marks a major new chapter for the company. With Arkview as its new owner, Neotech plans to strengthen its balance sheet, invest in next-generation manufacturing, and expand its capabilities across core markets like defense, aerospace, medical and industrial electronics, while continuing to emphasize quality, reliability and customer service. - learn more

Read moreShow less

CHAOS in the Skies, Valar in the Core and Robotaxis on the 405

09:24 AM | November 14, 2025

🔦 Spotlight

Hello LA!

If you are reading this while watching the clouds stack up over the city, you are not wrong. The forecast is calling for heavy rain and possible flooding through Sunday, so consider this your permission slip to cancel a few plans, stay dry and catch up on what the hard-tech crowd has been building this week.

Let us start with the least subtle name in local defense tech. CHAOS Industries just closed a $510 million dollar round led by Valor Equity Partners, valuing the company at $4.5 billion dollars and pushing its total funding past the $1 billion dollar mark in under three years. The company builds Coherent Distributed Networks radar, essentially a mesh of smaller, lower cost sensors that can pick up drones and other low flying threats minutes earlier than legacy radar systems, a gap that has become painfully obvious on modern battlefields. The new capital is going toward product development and manufacturing so militaries and border agencies can actually field these systems at scale rather than treating them as one-off experiments.

What makes CHAOS interesting is not just the size of the round but the architecture choice. Instead of a single massive radar on a hill, they are betting on distributed, software first networks that can be upgraded, repositioned and re-tasked as threats change. It is a very cloud-era way of thinking about defense hardware, and it is pulling engineers from a mix of aerospace, gaming and traditional software backgrounds into a category that used to be the domain of slow, closed incumbents.

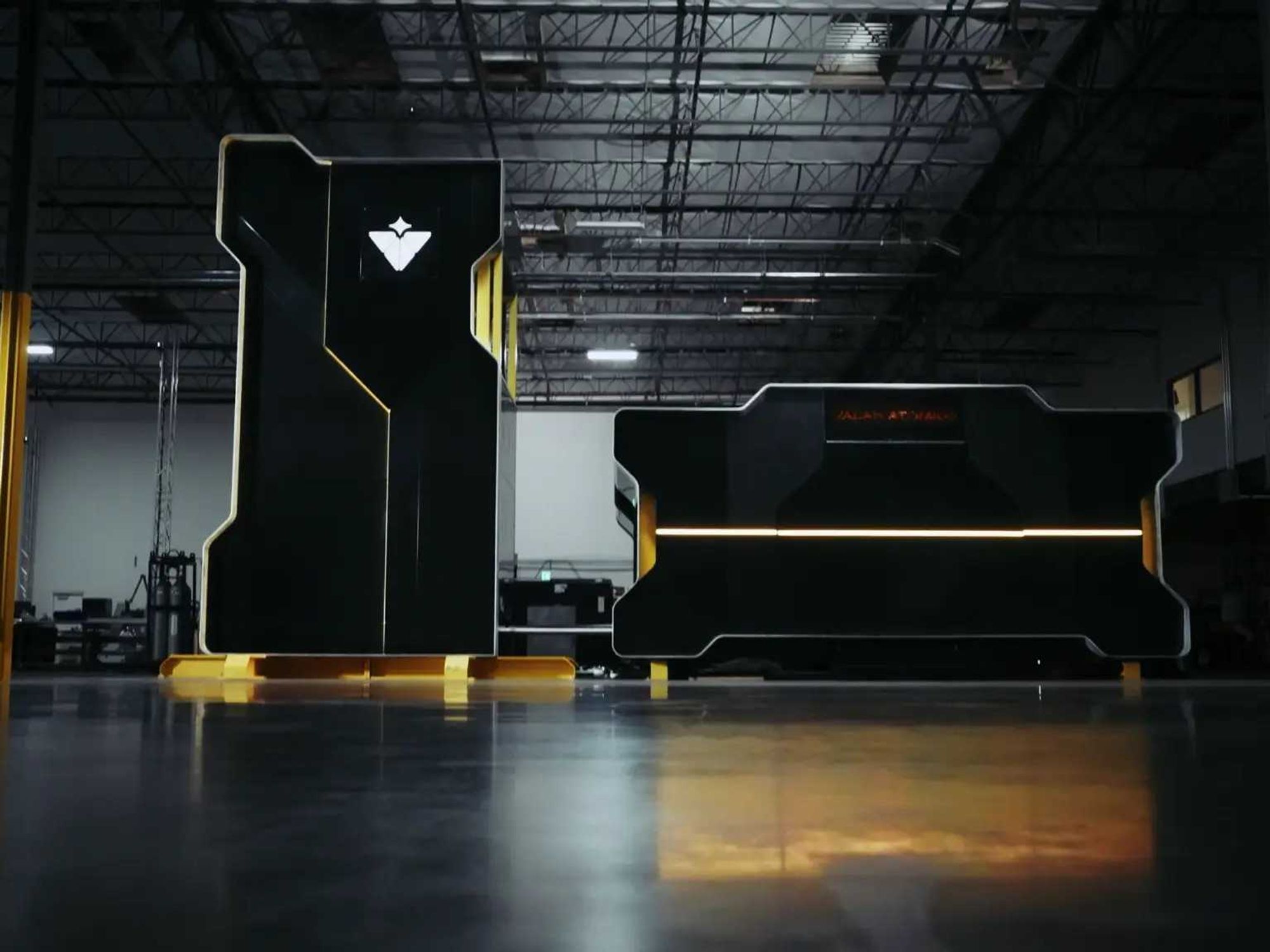

If CHAOS is focused on keeping the skies manageable, Valar Atomics wants to keep the lights on for everything that needs compute. The Hawthorne based nuclear startup raised $130 million dollars in Series A funding led by Snowpoint Ventures, with participation from Crosscut Ventures and a roster of deep tech backers that includes Palmer Luckey and Palantir CTO Shyam Sankar. Valar is building compact, high temperature gas reactors that use TRISO fuel and helium coolant, designed for strong safety characteristics and very high operating temperatures.

Instead of a single gigantic nuclear plant, Valar’s plan is to mass produce one standardized reactor design and cluster hundreds of them on “gigasites” that sit directly behind the meter for big energy users. Think hydrogen production, AI data centers, heavy industry and synthetic fuel plants, not just electrons on the grid. Construction is already underway on a first test reactor in Utah, targeted for completion in 2026, and the company is positioning itself as part of a new wave of nuclear companies that treat reactors as a product you replicate, not a megaproject you tolerate.

On the consumer side, your weekend mobility options are getting an upgrade too, weather permitting. Waymo has begun routing paid robotaxi rides onto freeways in Los Angeles, alongside San Francisco and Phoenix, after years of staying mostly on surface streets. The company says freeway segments can cut some trip times by as much as half, making a driverless ride to LAX or a cross town trek on the 405 feel less like a novelty and more like a practical option. Regulators and human drivers now have to figure out what it means to share the fast lane with cars that never get tired and never text at red lights.

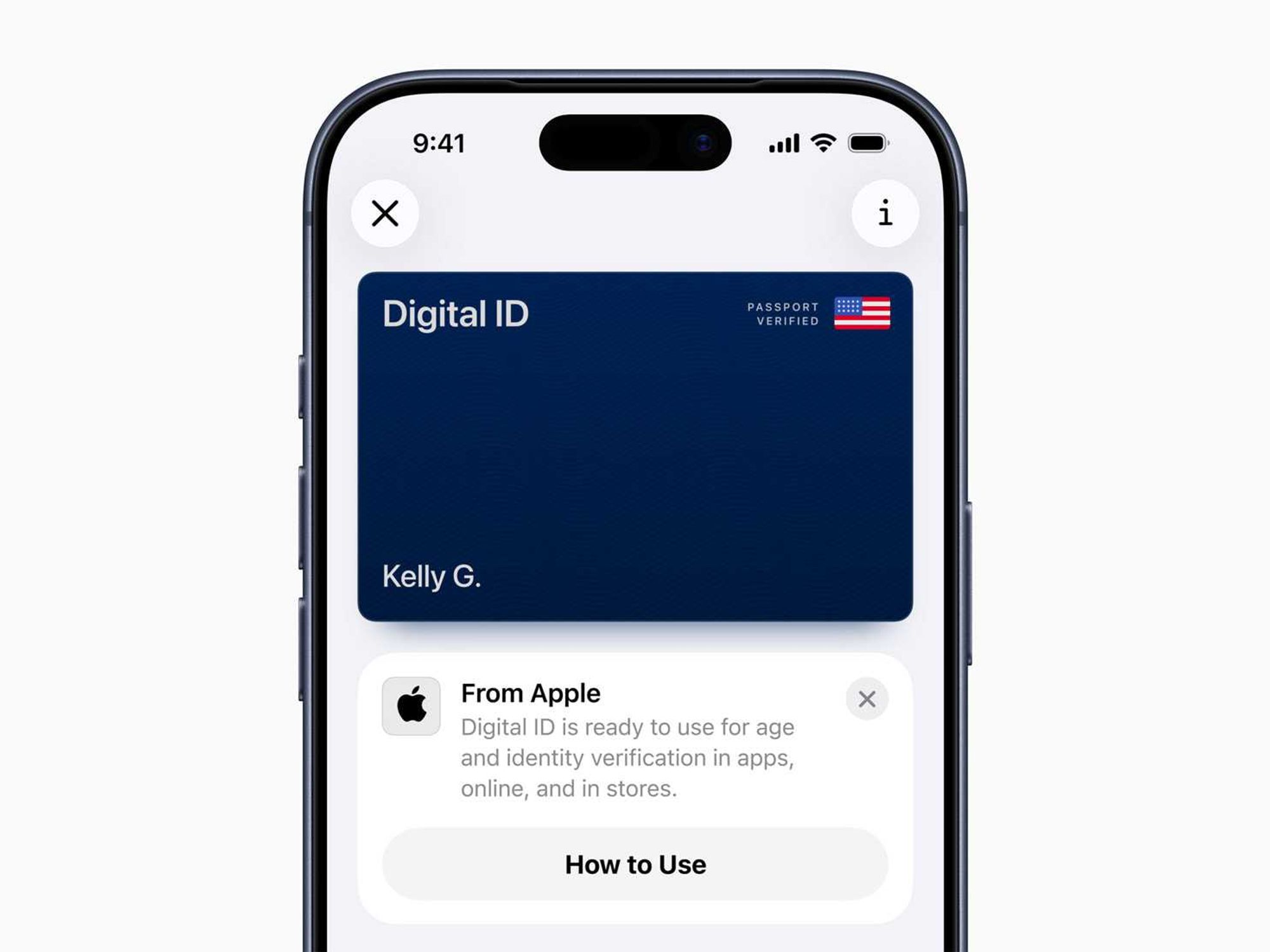

Apple is also coming for the least fun part of any LA trip: the airport ID check. The new Digital ID feature lets you create a passport based identity inside Apple Wallet that TSA will accept at more than 250 airports for domestic travel, including LAX. You scan your passport, verify with Face ID and then present your Digital ID at TSA checkpoints using your iPhone or Apple Watch without handing over your device. It will not replace a physical passport for international flights, but it does mean boarding passes, credit cards and ID can all live in the same tap-to-go flow the next time you sprint to Terminal 4.

Between radar that sees drones earlier, reactors that promise industrial scale clean power and robotaxis that hop on the freeway, a lot of the future is quietly being wired in while you hunt for an umbrella. Stay safe, stay dry this weekend and keep scrolling for this week’s venture rounds, fund announcements and acquisitions.

🤝 Venture Deals

LA Companies

- Skims has raised $225M in new funding at a $5B valuation, in a round led by Goldman Sachs Alternatives with participation from BDT & MSD Partners. The company plans to use the capital to accelerate its shift toward brick-and-mortar retail and international expansion, while continuing to invest in product innovation across intimates, shapewear, apparel, and activewear, including its new NikeSKIMS collaboration; Skims is on track to surpass $1B in net sales in 2025, just six years after launch. - learn more

- Neros has raised $75M in a Series B round led by Sequoia Capital, with participation from existing investors Vy Capital US and Interlagos, bringing its total funding to over $120M. The El Segundo based defense drone startup will use the capital to massively scale production of its Archer and Archer Strike FPV drone platforms and ground control systems, expand industrial capacity, and deepen a China-free, allied supply chain. The raise coincides with Neros being selected as one of the primary FPV drone suppliers for the U.S. Army’s Purpose-Built Attritable Systems program, following a major Marine Corps drone order. - learn more

LA Venture Funds

- BAM Ventures joined Exowatt’s new $50M financing round, backing the Miami based company’s push to deliver dispatchable, American made solar power to AI data centers and other energy hungry industrial sites. The round, an extension of Exowatt’s $70M Series A led by MVP Ventures and 8090 Industries, brings the company’s total funding to $140M in under two years. Exowatt will use the capital to expand U.S. manufacturing and scale deployments of its modular P3 system, which stores solar energy as heat and converts it to electricity on demand to provide round the clock, grid independent power. - learn more

- WndrCo joined the $145M Series B round for Alembic, the AI marketing analytics startup it first backed in early 2024, as the company’s valuation jumped to $645M. The round was led by Prysm Capital and Accenture and will help Alembic scale its platform, which uses AI to link brand marketing across channels like TV, podcasts and social media to real sales outcomes. Alembic also plans to use part of the funding to build a new Nvidia powered supercomputing cluster in San Jose to support growing demand from enterprise customers. - learn more

- Magnify Ventures joined Joy’s $14M Series A round, backing the San Francisco based startup’s push to build an AI powered parenting platform that blends machine intelligence with real human experts. Co-led by Forerunner and Raga Partners, the funding coincides with the launch of the Joy Parenting Club app, which gives new parents and parents of toddlers 24/7 access to certified coaches plus AI driven guidance, milestone tracking and personalized product recommendations. Joy plans to use the capital to further develop its AI model, expand partnerships with baby and parenting brands, and grow its expert network to support families through more stages of childhood. - learn more

- Overture VC, via its climate focused Overture Climate fund, reupped in Harbinger’s $160M Series C round as the medium duty electric and hybrid truck maker continues to scale its U.S. built EV platform. The round was co led by FedEx, Capricorn’s Technology Impact Fund, and THOR Industries, and includes existing backers like Tiger Global, Ridgeline, Maniv Mobility, Schematic Ventures, Ironspring Ventures, ArcTern Ventures, Litquidity Ventures, and The Coca Cola System Sustainability Fund. Harbinger will use the capital to ramp production of its electric stripped chassis platform and fulfill an initial FedEx order for 53 Class 5 and 6 trucks, supporting large fleet electrification and last mile delivery use cases. - learn more

- Sound Ventures joined the $60M Series B round for GC AI, an AI platform built for in-house legal teams, alongside lead investors Scale Venture Partners and Northzone. The new funding values the San Francisco based startup at $555M and brings its total capital raised to $73M. GC AI will use the money to accelerate product development and deepen its integrations and AI agents, building on rapid growth to more than 1,000 customers, $10M in ARR, and 1.75 million legal prompts processed in under a year. - learn more

- Fulcrum Venture Group doubled down on its backing of Code Metal, joining the startup’s $36.5M Series A to support its push to bring verifiable AI powered code translation to mission critical industries. Led by Accel at a $250M valuation, the round also brought in RTX Ventures, Bosch Ventures, Smith Point Capital, Overmatch VC, AE Ventures, Shield Capital, J2 Ventures, and several strategic angels. Code Metal will use the capital to expand its platform across defense, automotive, and semiconductor customers, promising formally verified, regulation-ready code that can be ported between chips and modernized much faster than traditional methods. - learn more

- MarcyPen Capital Partners led Rebel’s $25M oversubscribed Series B to scale the company’s returns recommerce marketplace, which helps retailers resell open box and overstock goods instead of sending them to landfills. The new capital will fund expansion into outdoor and sporting goods categories with existing retail partners and support broader growth of Rebel’s tech platform, which processes and resells returned products at up to 70 percent off retail while tackling the trillion dollar returns problem. - learn more

- Halogen Ventures joined Auditocity’s $2M seed round alongside Techstars, Innovate Alabama, and several angel investors to help scale the company’s AI driven HR compliance auditing platform. The Alabama based startup plans to use the capital to expand nationally and deepen its intelligent automation tools so HR teams can spot compliance risks in real time and resolve issues before they become costly problems. - learn more

- Upfront Ventures joined Majestic Labs’ more than $100M financing as the AI infrastructure startup emerged from stealth with a new memory centric server architecture. Founded by ex Google and Meta executives, the company claims its all in one servers deliver up to 1000 times the memory capacity of top tier GPU systems, effectively replacing multiple racks with a single box for the largest AI workloads. Majestic will use the capital to grow its team, finish its full software stack, and run pilot deployments with customers looking to cut power use and costs while training massive models. - learn more

- Alexandria Venture Investments and Freeflow Ventures joined an oversubscribed round of more than $100M for Iambic, a San Diego based biotech using an AI driven discovery platform to develop new cancer therapies. The clinical stage company will use the fresh capital to expand its operations and advance a pipeline that includes IAM1363, a HER2 targeted candidate that has already shown early anti tumor activity, as well as additional AI designed programs and pharma partnerships. - learn more

- EGB Capital joined Extellis’ $6.8M oversubscribed seed round, backing the Durham based startup’s push to deliver reliable, all weather satellite imagery at industrial scale. Led by Oval Park Capital with participation from Duke Capital Partners, First Star Ventures, New Industry Ventures, Front Porch Venture Partners, and Blue Lake VC, the funding will support Extellis’ first satellite launch and initial product rollout. - learn more

- Core Innovation Capital joined Arrived’s $27M Series B style funding round, backing the Seattle startup’s push to make fractional real estate investing feel more like buying stocks. Led by Neo with participation from Forerunner Ventures, Bezos Expeditions, and other investors, the new capital will help Arrived scale its “stock market for real estate” platform and recently launched Secondary Market, which lets investors buy and sell shares of individual rental homes across the U.S. with just a few clicks. - learn more

- Strong Ventures participated in a new pre Series A round for Provotive, the company behind AI packaging design platform Packative. The round was led by Japanese VC firm Miraise, with Korean fund VNTG and a Japan based strategic CVC also joining. Provotive plans to use the capital to expand its AI driven packaging services across Japan, Korea, and the broader Asian market, helping brands quickly generate localized, customized packaging at scale. - learn more

LA Exits

- Nativo is being acquired by family safety and location app Life360 in a cash and stock deal valued at about $120M. The acquisition folds Nativo’s native ad platform, programmatic tools, and publisher network into Life360’s advertising business so brands can reach families both inside the Life360 app and across CTV, mobile, and premium web environments. The companies say the combined platform will offer a full funnel, privacy minded, “family safe” ad solution and expect the deal to close in January 2026, pending customary approvals. - learn more

- RealtyMogul, an online real estate crowdfunding and investment platform, has been acquired from its venture backers by The Wideman Company, a cash flow focused, high touch real estate investment firm. The deal gives RealtyMogul a long term owner while keeping its brand and digital marketplace intact, supporting a member base that has invested more than $1.2B of equity into properties valued above $8B. The Wideman Company says the acquisition will bring additional capital and strategic support to expand RealtyMogul’s offerings and deal flow for individual investors and real estate sponsors. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS