Los Angeles, like the rest of the startup world, saw a dip in global venture funding. As of November 2022, funding reached $22 billion, which is 69% lower than the previous year.

Despite the massive downturn in funding due to the decline in technology stocks at the end of 2021 combined with concerns about rising inflation, it did not stop the startups on this list from raising funding. We asked more than 30 leading L.A.-based investors for their take on the hottest firms in the region. (We also asked VCs not to pick any of their own portfolio companies, and vetted the list to ensure they stuck to that rule.)

They selected a few live-shopping platforms, space startups and payment software companies and we've organized the list based on the amount of capital raised as of January, according to data from PitchBook.

Here are the eight L.A. startups VCs have their eyes on as they look ahead to 2023.

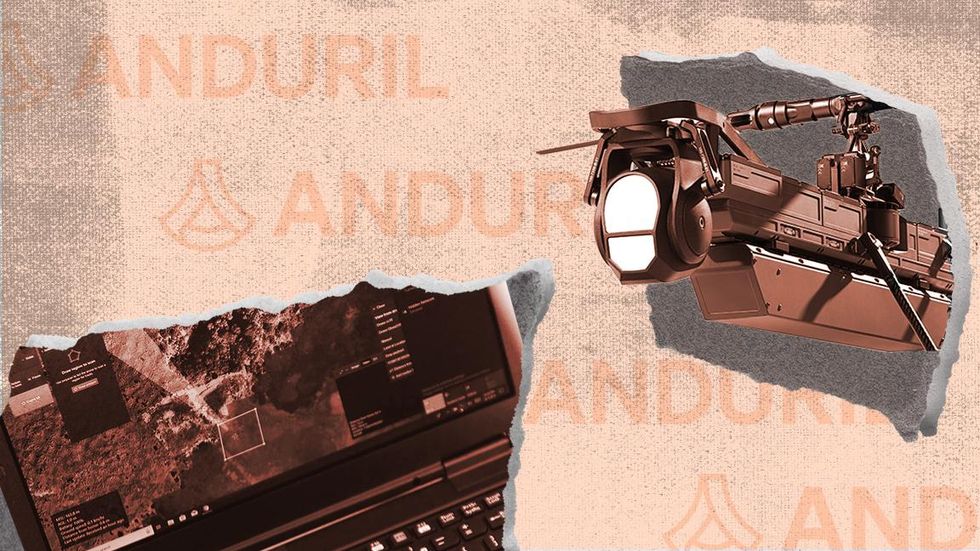

Anduril ($2.32B raised)

Given how much the company has raised to date, it was no surprise that Costa Mesa-based defense technology startup and U.S. military contractor Anduril was the name that most often came up among L.A. venture investors.

Oculus co-founder Palmer Luckey, Founders Fund partner Trae Stephens, ex-Palantir executives Matt Grimm and Brian Schimpf founded Anduril in 2017. The startup is most known for its core software product, an operating system called Lattice, which is used to detect potential security threats.

To date, the startup has received investments from Andreessen Horowitz, Founders Fund, General Catalyst, D1 Capital Partners and venture capitalist Elad Gil.

ServiceTitan ($1.1B raised)

Earlier this year, the Glendale-based firm filed for an initial public offering. Since its founding in 2012, the company’s co-founders, Ara Mahdessian and Vahe Kuzoyan built its software for a wide range of service industries, from plumbing and landscaping to pest control and HVAC.

The company’s growth is largely driven by its ability to acquire other businesses, including landscaping software provider Aspire and pest control-focused platforms ServicePro and, earlier this month, FieldRoutes.

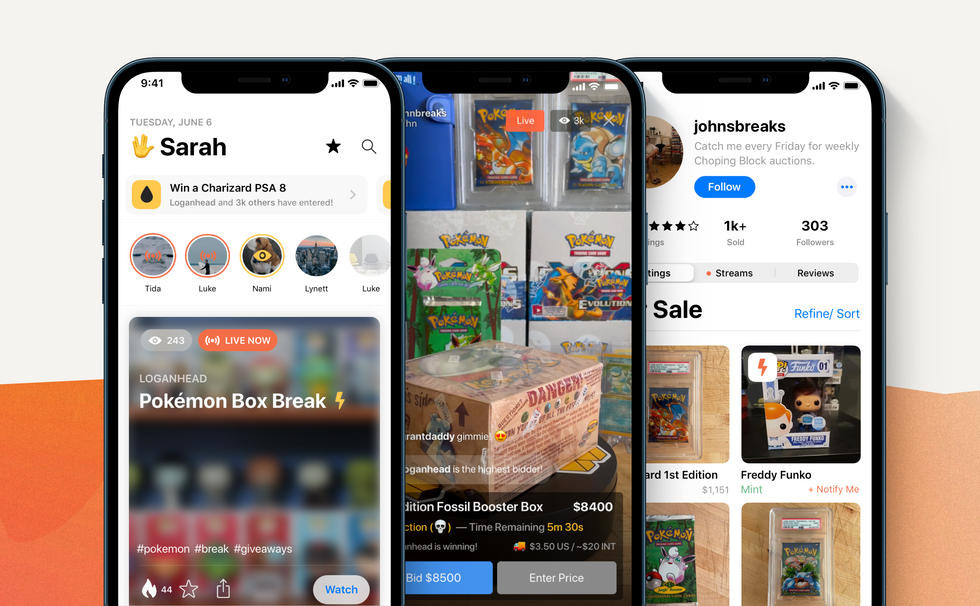

Whatnot ($484.41M raised)

The Marina del Rey-based livestream shopping platform makes the ‘Hottest Startups’ list for a second year in a row. The online marketplace was founded by former GOAT product manager Logan Head and ex-Googler Grant LaFontaine and made its name by providing a live auction platform for buying and selling collectables like rare Pokémon cards, and has since expanded into sports memorabilia, sneakers and apparel.

It’s no secret that its success is in part, due to the partnerships Whatnot inked this year, like UFC fighter Jorge Masdival to sell sports collectibles on the platform. Along with science fiction/fantasy comics publisher Heavy Metal to bring out original content for the Whatnot community.

Boulevard ($110.35M raised)

Los Angeles-based salon booking app Boulevard attracted backers including Santa Monica-based early-stage VC firm Bonfire Ventures, which focuses on B2B software startups. The startup builds booking and payment software for salons and spas and now it now serves 25,000 professionals across 2,000 salons. Boulevard has also worked with prominent brands such as Toni & Guy and HeyDay.

Varda Space ($53M raised)

Space manufacturing startup Varda focuses on designing, developing, and manufacturing products that benefit from low gravity. The products that the El segundo-based company manufactures in space are intended to be brought back down with the hope that it will improve life on earth. The forward-thinking company was founded by Founders Fund partner Delian Asparouhov and former SpaceX officer Will Bruey.

Papaya (65.2 million)

Sherman Oaks-based Papaya was founded by Patrick Kann and Jason Metzler. The company was built to make it easier for consumers to pay “any” bills — whether it's a hospital bill or a parking ticket — all on the mobile app. To pay, users take a picture of their bill and type in the amount they want to send as long as the end user has a mailing address or an online payment portal. Papaya utilizes optical character recognition, a software that enables the app to look at every bill — no matter what the format is — and recognize each piece of information.

Impulse Space ($30 million raised)

Based in El Segundo, Impulse Space creates orbital maneuvering vehicles capable of delivering multiple payloads to unique orbits from a single launch. Founded in 2021 by former SpaceX exec Tom Mueller built his company as a last-mile delivery partner for future inter-space missions, like servicing space stations. In July, the space startup inked a deal with Long Beach-based reusable rocket maker Relativity Space to accelerate the entry of its rover into Mars.

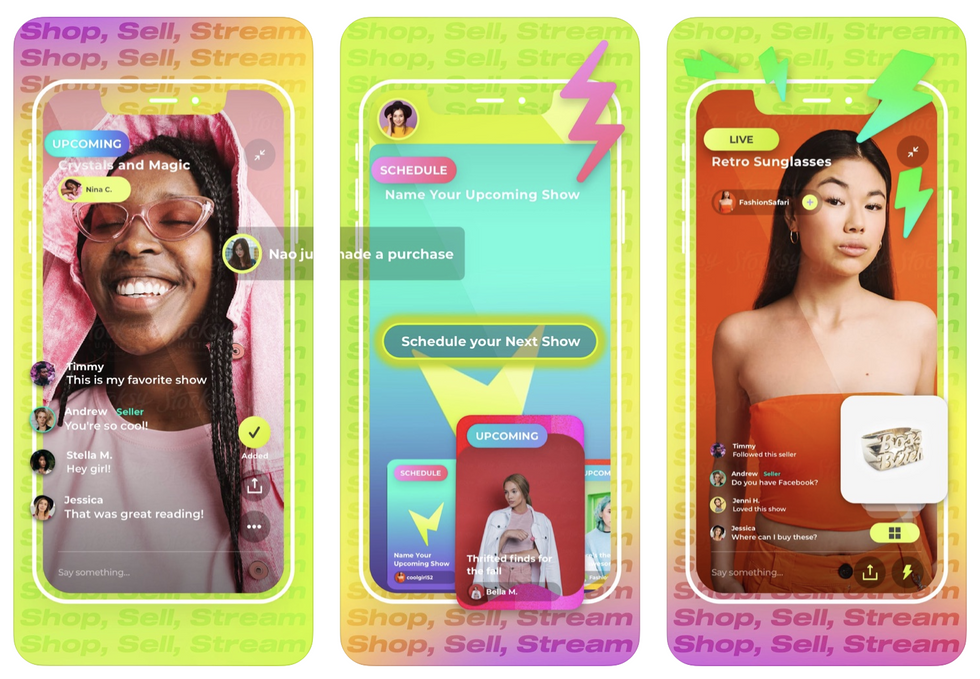

Popshop Live (24.5 million raised)

Whatnot competitor Popshop Live is betting that live-shopping is the future of ecommerce. The West Hollywood-based company primarily focuses on selling collectables such as trading cards and anime merchandise.

In the summer of 2021, the company bolstered its team by hiring former Instagram and Instacart executive Bangaly Kaba to lead platform growth and former head of Uber Eats Jason Droege to lead expansion.

- Here Are the dot.LA/PitchBook 50 Hottest Los Angeles Startups for Q2 ›

- Here Are the LA Seed Startups Top VCs Wish They'd Invested In ›

- LA is the Third-Largest Startup Ecosystem in the US ›

- What Are LA’s Hottest Startups of 2022? See Who VCs Picked in dot.LA’s Annual Survey ›

- How To Startup: Part 1: Ideation ›

- What Are LA’s Hottest Startups of 2021? We Asked Top VCs to Rank Them ›

- Nobody Studios Plans to Build 100 Startups in Five Years - dot.LA ›

- From GameTree to Sota — Ukrainian Founders Call LA Home - dot.LA ›