🔦 Spotlight

Hello Los Angeles,

AI just became Mattel’s newest playmate.

This week, Mattel announced a new partnership with OpenAI, setting the stage for a toy box transformation powered by artificial intelligence. The El Segundo-based toy giant will use ChatGPT to breathe new life into its iconic brands, including Barbie, Hot Wheels, and Masters of the Universe. The collaboration will start with interactive AI experiences and creative tools to support product development internally.

It's a bold move for Mattel, which has been steadily shifting its identity from a traditional toy maker to a modern entertainment company. Between box office hits like Barbie and now this AI integration, Mattel is showing that legacy brands can still lead the charge into the future. The partnership supports CEO Ynon Kreiz’s long-term vision to expand Mattel's intellectual property into a broader, multi-platform universe. OpenAI is now playing a key role in that strategy.

This also points to a larger trend unfolding in Los Angeles. The lines between tech, entertainment, and consumer products are blurring quickly. AI isn’t coming to the mainstream; it’s already here. And if Barbie is getting an upgrade, other LA-born icons may not be far behind.

We’re keeping an eye on how this unfolds and whether it becomes more than just a flashy concept. One thing’s certain: Mattel isn’t just playing around.

Catch the latest LA venture deals, acquisitions, and fund updates below.

🤝 Venture Deals

LA Companies

- Coco Robotics, a Santa Monica-based startup specializing in last-mile autonomous delivery robots, has raised $80M in a strategic funding round led by angel investors Sam Altman and Max Altman, with participation from Pelion Venture Partners, Offline Ventures, Ryan Graves, and others. The company will use the funding to scale its AI-powered platform, grow its zero-emission robot fleet to 10,000 vehicles by 2026, expand partnerships with delivery platforms like Uber and DoorDash, and broaden its presence in more cities across the U.S. and internationally. - learn more

- PopID, a fintech startup specializing in biometric payment and loyalty authentication using face and palm recognition, has closed a new equity financing round backed by major strategic investors including Verifone, PayPal, Commerce Ventures, Chipotle’s Cultivate Next, and Visa Ventures. The fresh capital will support the expansion of its global biometric network by leveraging Verifone’s terminal infrastructure to integrate secure and seamless biometric payments and loyalty programs across merchants worldwide. - learn more

- Rosebud, an AI-powered journaling app designed to serve as a personal growth mentor, has raised $6M in seed funding led by Bessemer Venture Partners. The funds will be used to expand the team, advance its proprietary memory-driven AI engine, and pursue partnerships with therapists, educational institutions, businesses, and clinics to enhance access and deepen the app’s reflective capabilities. - learn more

- Impulse Space, the in-space mobility startup founded by ex-SpaceX engineer Tom Mueller, has raised $300M in a Series C funding round led by Linse Capital with participation from Trousdale Ventures and others, bringing its total financing to $525M. The company designs and builds orbital transfer vehicles—like Mira and upcoming Helios—to transport satellites between orbits, and the new funds will scale production, hire new staff, accelerate R&D (including electric propulsion), and fulfill a backlog of over 30 commercial and government contracts worth nearly $200 million. - learn more

- dataplor, a Manhattan Beach, CA-based provider of global location intelligence, has secured a $20.5M Series B round led by F‑Prime Capital. The funds will help dataplor scale its privacy-focused point-of-interest and foot traffic mobility products, expand global coverage, enhance data capabilities, and accelerate product growth for enterprise clients seeking real-time consumer insights. - learn more

LA Venture Funds

- WndrCo participated in Meter’s $170M Series C financing. Meter provides a full-stack, enterprise-grade internet infrastructure solution that covers routing, switching, WiFi, and cellular for businesses ranging from single offices to large data centers. The new funds will accelerate global expansion, grow its channel partnerships with companies like CDW, Microsoft, and WWT, and support further deployment and R&D. - learn more

- Sound Ventures participated in Landbase’s $30M Series A round, co-leading the investment alongside Picus Capital. Landbase uses AI, leveraging a GPT‑4o-based model trained on 40 million marketing campaigns, to automate and enhance outbound sales outreach, helping small and mid‑size businesses build trust and scale customer acquisition. The funding will support expansion of its team, product development, and go‑to‑market efforts as it rapidly grows its customer base. - learn more

- Rebel Fund participated in Outset’s $17M Series A round, which was led by 8VC. Outset uses AI-powered agents to conduct and analyze in-depth video interviews at enterprise scale, serving clients like Nestlé, Microsoft, and WeightWatchers. The new funding will accelerate growth by expanding its go‑to‑market and engineering teams, enhancing its AI agent capabilities, and scaling its platform globally. - learn more

- Anthos Capital returned as a participant in Laurel’s $100M Series C round, led by IVP. Laurel, the world’s first AI-powered “Time Platform” for professional services firms, automates time tracking and links how employees spend their time directly to business outcomes. The new funding will be used to scale the platform globally, enhance AI-driven time categorization and analytics, and help firms optimize resource allocation and profitability. - learn more

- Vamos Ventures participated in Trustible’s $4.6M Series Seed round led by Lookout Ventures. Trustible provides an AI governance platform that helps enterprises inventory AI use cases, manage risk, comply with regulations like the EU AI Act, and accelerate responsible adoption. The funding will power product development, hire engineering and go‑to‑market talent (particularly in the D.C. area), and scale operations to help enterprise and public-sector customers deploy AI safely. - learn more

- Village Global participated in Qanooni’s $2M pre‑seed round, joined by Oryx Fund, TA Ventures, and a group of strategic angels. Qanooni, founded in 2024 and based in the UAE, builds an AI-powered legal platform that integrates directly into Microsoft Outlook and Word to help lawyers draft, review, and manage documents using their own style and standards. The new funding will fuel expansion into the UAE and UK and advance its proprietary AI engine tailored for legal workflows. - learn more

- Muse Capital and Rocana Venture Partners participated in Eli Health’s $12M USD Series A round, led by BDC Capital’s Thrive Venture Fund, boosting the company’s total funding to around $20M USD. Eli Health has developed the Hormometer™, a real-time, saliva-based hormone monitoring system currently in beta for cortisol with plans to expand to progesterone and other biomarkers. The new capital will scale production, add biomarkers, support commercialization, and accelerate global rollout of its instant hormone health platform. - learn more

- Crossover VC participated in ai.work’s $10M seed round led by A* and lool ventures. ai.work has emerged from stealth to launch an “AI Workers” platform—autonomous agents designed to streamline enterprise workflows across IT, HR, Legal, Finance, and more. The funding will be used to scale operations, accelerate product development, and deploy AI Workers into pilot programs with large enterprises. - learn more

- MANTIS Venture Capital participated in AIM’s $50M funding round. The company has built the first embodied AI platform that retrofits heavy machinery, like bulldozers and excavators, for autonomous operation, aiming to boost safety, efficiency, and productivity in construction and mining. The new capital will help AIM scale deployments, advance its AI technology, and expand its plug-and-play autonomy solutions across heavy equipment fleets worldwide. - learn more

- Watertower Ventures led Finofo's $3.3M seed round, with continued backing from Motivate Venture Capital, SaaS Ventures, and several angel investors. Finofo offers a modern business banking platform that automates accounts payable, treasury, and global receivables, enabling seamless, low-fee payments across more than 90 countries with ERP integration. The funds will support expanded AP and AR automation features, the launch of a small-business plan, and hiring across product, engineering, and go-to-market teams. - learn more

- Finality Capital Partners participated in RISE Chain’s latest $4M raise, bringing its total funding to $8M. RISE Chain is building an ultra-fast Ethereum Layer 2 blockchain using "Shreds" architecture to deliver sub-5 millisecond transaction confirmations and scale toward 100,000 transactions per second. The new capital will support the mainnet launch, accelerate product and app development, and expand its real-time performance capabilities for advanced DeFi and high-frequency applications. - learn more

- Emerging Ventures participated in Taiv’s $14.4M CAD (≈ $10.5 M USD) Series A round, led by Denmark’s IDC Ventures. Taiv equips bars, restaurants, and retail venues with free hardware that transforms existing TVs into targeted advertising and content delivery tools, then shares ad revenue with the venues. The funding will power expansion across North America (starting in Canada this summer), grow the team, and enhance its AI-driven content delivery platform. - learn more

- Matter Venture Partners led an $18.4M investment in Kargo. The company offers an AI-driven inventory management system, including hardware like "Towers" and Lifts, that automatically captures and processes freight data at warehouse loading docks to improve accuracy, real-time visibility, and operational efficiency. The new funding will be used to develop new products, expand deployment across their customer base, and scale their computer vision platform in global supply chains. - learn more

- Bam Ventures and Trust Fund participated in the $10.6M funding round for Nectar Social, a Seattle-based startup that helps brands convert social media engagement into revenue using AI-powered “social copilot” agents. The platform consolidates comments, DMs, mentions, influencer outreach, and analytics into one interface to streamline brand interactions and boost performance. The funding will support product development, team expansion, and scaling operations with enterprise customers. - learn more

- MTech Capital participated in Voxel’s $44M Series B funding round. The company has developed an AI-powered workplace safety platform that integrates with existing cameras to detect hazards and unsafe behavior in real time, reducing accidents and operational risks. The new funding will accelerate R&D in computer vision, deepen its AI capabilities, and grow its team of industry experts to scale deployments across high-risk industries such as manufacturing, logistics, and ports. - learn more

- Hennessey Digital, a leading legal marketing agency known for its SEO, digital PR, PPC, and web design services, has been acquired by Herringbone Digital. The acquisition expands Herringbone’s platform into the legal marketing space while retaining Hennessey’s leadership and team. With added resources and support, Hennessey Digital plans to scale its services and integrate new AI-driven marketing tools to better serve law firms nationwide. - learn more

- Prosthetic Records has been acquired by MNRK Music Group and will now operate under its MNRK Heavy division. The deal brings Prosthetic’s extensive heavy metal catalog - featuring pioneering acts like Lamb of God, Animals as Leaders, and The Acacia Strain - under MNRK’s umbrella. MNRK plans to amplify the label’s legacy through anniversary reissues, remastered editions, curated collections, and new releases from standout acts such as Pupil Slicer and God Alone. - learn more

- RKO Pictures, the legendary film studio behind classics like King Kong and Citizen Kane, has been acquired by Concord Originals, the film and TV division of Concord. The deal gives Concord derivative and adaptation rights to over 5,000 RKO titles, including sequels, remakes, stage adaptations, and unproduced screenplays. RKO will continue as an imprint under Concord Originals, co-led by Sophia Dilley and Mary Beth O’Connor, with plans to revive its storied catalog through reissues, new productions, and adaptations. - learn more

- StartADAM has been acquired by LeapXpert, bringing its AI-powered chat agent technology and founding team into LeapXpert’s fold. The acquisition enhances LeapXpert’s communication intelligence platform with advanced AI features, new messaging channel support, and deeper CRM integrations. StartADAM’s founders, including co-founder Adam Stone, who became LeapXpert’s VP of AI Product will lead development to scale these capabilities globally. - learn more

- CASHét has been acquired by Entertainment Partners, integrating its suite of digital payment services including p-cards, automated accounts payable, and vendor verification into EP’s production finance ecosystem. The acquisition ensures that CASHét will continue supporting productions worldwide, regardless of their payroll or accounting systems, while expanding its services into new global markets. With this move, EP enhances its end-to-end financial workflow offerings, bringing faster, more secure, and fraud-resistant payment tools to film and TV productions. - learn more

- Element Brand Group has been acquired by The Lede Company, with founder Heather Leeds Greenfield joining as a partner and head of brand partnerships. Greenfield’s senior team, including two SVPs, will move over to expand The Lede Company’s integrated marketing and communications offerings. The acquisition strengthens Lede’s cultural campaign capabilities and equips both firms with enhanced resources and scale for brand-driven initiatives. - learn more

Image Source: Perelel

Image Source: Perelel

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

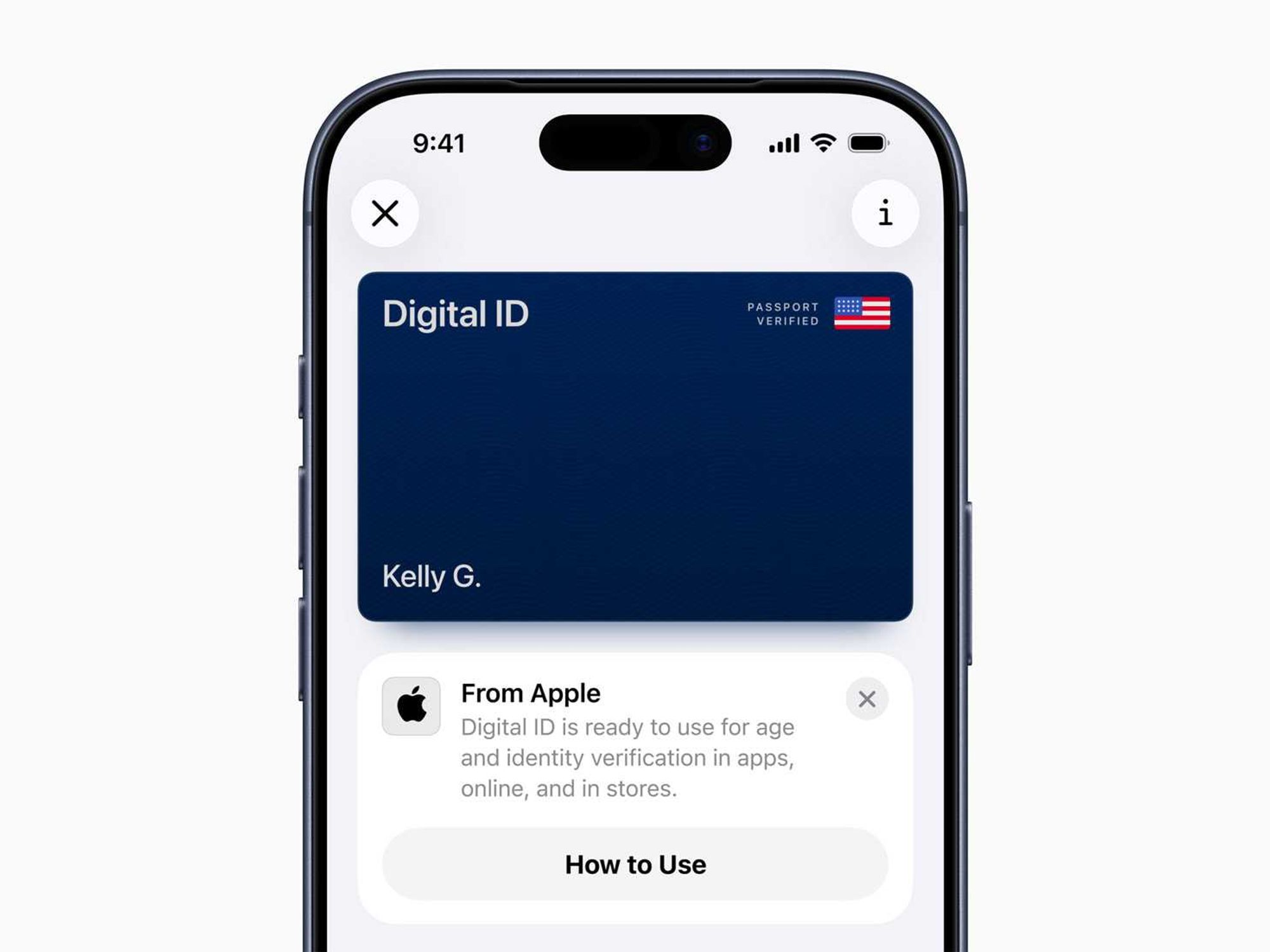

Image Source: Waymo Image Source: Apple

Image Source: Apple