🔦 Spotlight

The 2023 PledgeLA Venture Data Report serves up a tech-infused reality check with a small side of optimism, like when you failed an exam but took consolation in the fact that you didn’t fail quite as hard as everyone else in the class. 🤓📊📈

PledgeLA is a coalition of tech companies and venture capital firms working to increase diversity, equity, and community engagement by holding the region accountable with quantifiable progress tracking. Their report followed the investments of 75 LA-based venture funds in 2022, including regional powerhouses like Upfront Ventures, M13, and Fifth Wall.

Some key takeaways: in the report, 50% of all companies receiving funding from a PledgeLA-tracked venture fund were led by an all-white founding team, while companies with all Black or Latinx founders received only 9% of funding rounds, and all-female founding teams received a paltry 11% of funding rounds. Not super representative of the diversity in Los Angeles.

That said, in comparison to the national averages, LA wasn’t so bad. We saw a higher representation of all-female, Black, and Latinx founding teams relative to the US at large. Nationwide, teams led by Black and Latinx founders accounted for <3% of venture deal count according to data from Crunchbase and Techcrunch. And across the US, all-female founding teams accounted for 6.8% of venture rounds in 2022 according to Pitchbook.

So where do we land?

On the negative side, there is still a long way to go to achieving representative venture funding in the LA ecosystem, but we can see that Los Angeles' VC firms have harnessed their unique energy to begin to address these disparities. Firms with diversity-focused theses and those helmed by underrepresented minority leaders are playing the role of superheroes, making investments in Latinx, female, and Black founders at a pace that rivals a speedy express delivery. This offers a promising vision for the future, echoing a sentiment that the city's innovation ecosystem is actively redefining the rules of the game on a national scale.

To better grades ahead. 💯

Want to invest in real estate but don’t have the time or money to buy and manage a whole property?

Investors are flocking to Arrived, a Jeff Bezos-backed real estate investing platform that even Zillow Co-founder Spencer Rascoff loves using. It's a beautiful app and web platform that already has over 353,000 people who have invested over $100M in real estate properties. We don't blame them - Arrived takes the guesswork out. You just:

- Browse expert curated vacation rentals and long-term rentals (only <0.2% of properties pass their expert diligence process before being offered to you)

- With just a few clicks, select the properties you like and invest anywhere from $100 to $50,000+ per property

- Sit back while Arrived takes care of the management and operations for you. Simple.

Real estate has outperformed the S&P 500 over the past 20 years as an asset class - but it's not easy to get into. Arrived's seamless platform fixes this. So what's stopping you from becoming a real estate mogul?

🤝 Venture Deals

LA Startups

- Caelux, a solar coatings startup, raised a $12M Series A led by Temasek and joined by Reliance New Energy and Khosla Ventures - learn more

- Sapphire Technologies, a maker of turboexpanders, raised a $10M Series B led by Energy Capital Ventures and joined by Marathon Petroleum, Chevron Technology Ventures and Equinor Ventures - learn more

- D'Amelio Brands, a company founded by TikTok stars Charli and Dixie D'Amelio and their parents, raised a $5M funding round from Fifth Growth Fund - learn more

- ShipCalm, a startup that provides small e-commerce businesses with logistics and fulfillment support, raised a $2M funding round led by Montage Capital - learn more

- Robomart, a maker of electric self-driving stores, raised a $2M Seed Round led by W Ventures, Wasabi Ventures, SOSV, HAX and Hustle Fund - learn more

LA Funds

- 75 & Sunny Labs launched heyLibby, an AI assistant for SMBs - learn more

⚒️ Open Roles

Operations Associate @ NEXT Careers

LA-based NEXT Careers is hiring an Operations Associate. This role involves both operations and community-facing support for Fellows in the NEXT program, who are mid-career and exec-level startup job-seekers. Hybrid 3 days per week in Culver City or Playa Vista. You'll get to meet and help support hundreds of the most talented people on the market right now. Reach out if you’re interested, and we’ll connect you to the team, or apply directly here.

Are you a tech firm, startup, or VC with open roles? Reach out to be featured on next week’s Newsletter!

📅 LA Tech Calendar

Friday, August 18th

- Founders Live LA🗽 - This in-person event is your opportunity to network with like-minded entrepreneurs, investors, and industry experts!

Monday, August 21st

- Tech Networking - Studio City!🗽 - Bringing the thriving tech community of Los Angeles together once again, in the Valley!

Tuesday, August 22nd

- Develop a Successful Blockchain Tech Startup Business Today! - Blockchain Startup Hackathon and Workshops

Wednesday, August 23rd

- Los Angeles Film & NFT Web3 Meetup🗽 - NFT's in Film/Media, and Music will shape all areas/facets of our daily lives!

Thursday, August 24th

- Armenians in Tech + Entertainment Happy Hour🗽 - Join Armenians working in tech and entertainment for an after-work happy hour!

- GENERATIVE LA—LIGHTSPEED X SCOPELY X ACTIVISION (August 30th)🗽 - Bringing together local founders, engineers, designers and product leaders building the future of AI!

Other events to add to the calendar

🗽 - Free

🌍 Around The Internet

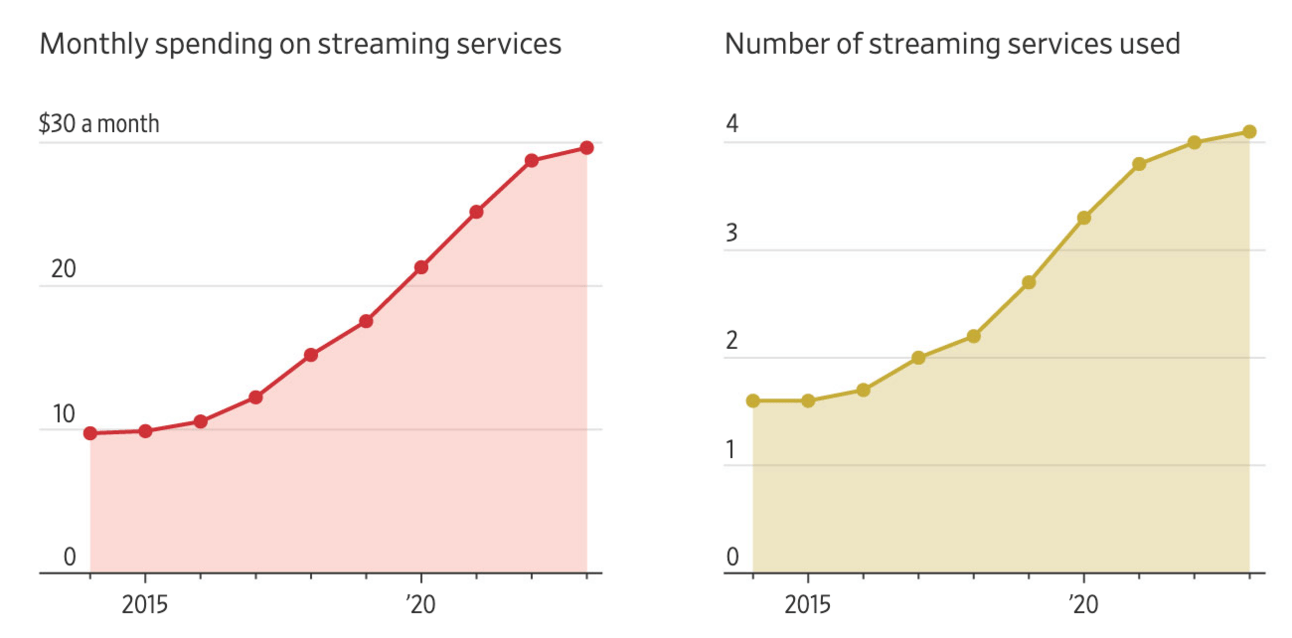

We are exiting the growth-focused subsidized streaming service chapter and entering the profitable streaming service phase with prices increasing on average by nearly 25% over the next year (yikes!) to offset losses and achieve profitability. 💸🎥 📺

This trend includes companies like Disney, Netflix and others as they test customer loyalty and the tolerance for higher costs. To counter churn, ad-supported options and bundling are being offered, with the industry navigating a delicate balance between retaining subscribers and increasing revenues.

Source: WSJ

📙 What We’re Reading

Our friends at CuratedLA just did a profile on dot.LA CEO Wil Chockley! Learn about Wil’s passion for dinosaurs, his take on LA tech and more here.

The the CuratedLA platform contains a daily feed of news, eats, events, happenings, discussions, and LA need-to-knows without showcasing political opinions or morbid headlines; to have fun with wit and positivity while creating an LA vibe.

CuratedLA is sent every morning, M - F, at 6:00am. It is completely free to subscribe, submit content, and to catch the discussion of local waves on the CuratedLA Surfboard.

We’re also reading…

- Pacaso’s Spencer Rascoff on the Revitalized Experience Economy and More Pandemic Shifts - read more

- Video game voice actors have a keen interest in the (potential) AI protection outcomes resulting from the SAG-AFTRA strike - read more

- NASA’s Psyche mission is schedule to take off in early October - read more

- Future Fisker owners will be able to utilize Tesla’s 12,000 supercharger stations starting in 2025 - read more

Love our newsletter? Share it through your social channels!