Good morning Los Angeles!

If you want to be featured or know folks who want to be featured, feel free to contact me on LinkedIn. This week, we talked to entrepreneur Daniel Broukhim about his ecommerce subscription service, FabFitFun.

🏃♀️ Quick hits

Cofounder Brothers: Daniel co-founded FabFitFun with his brother Michael in 2013, pivoting from running a digital agency and lifestyle newsletter. The core business is a seasonal subscription box service delivering full-size beauty, fashion and lifestyle products.

Expansive Mindset: Daniel attributes their success to differentiating with full-size products across categories, evolving the membership offerings over time, and maintaining operational and financial discipline.

New Frontiers: FabFitFun has expanded into a membership model with sales, brand partnerships, trade financing and other offerings beyond just subscription boxes. Daniel sees opportunities in further growing the membership.

During the pandemic, we had an explosion of ecommerce activity as everyone sheltered at home waiting for the vaccine. In that time, an already massive user behavior exploded. It went from a convenience to a mainstay of our weekly behaviors. But in the last 2 decades, we’ve already seen waves of ecommerce trends and startups come and go, the game has changed and it was fascinating for us to speak with FabFitFun, an ecommerce box subscription service company that has survived and thrived through multiple headwinds of the ecommerce waves.

So what is FabFitFun?

"FabFitFun is a membership and as part of that membership you get a seasonally curated box with full size beauty, health, fitness, fashion, wellness, home, technology products and you're paying $60 a season but you're getting a guarantee of at least $200 and an average of about $300 in products."

But it didn’t start out like that. Daniel Broukhim, cofounder and co-CEO, told us about how it all started.

"My brother and I started the business together. Initially, we were running as a digital agency and building products for other people. One of those was a newsletter that we had developed for Rachel Zoe called The Zoe Report. We built a newsletter called FabFitfun initially as a healthy lifestyle newsletter. And then we were running that for a few years and then we realized that the newsletter business wasn't the direction that we wanted to go in. We decided to take a new direction and launch an e-commerce business, partially because as a newsletter and media business, we're going to VIP events and events and they give us these swag bags and we thought to ourselves, oh, why not take that swag bag concept and consumerize it?

By following their noses and seeing opportunities in front of them, the two brothers, Michael Broukhim and Daniel Broukhim, landed into a business that they really loved and turned out to be very lucrative. But it wasn’t without its stumbles, with a capital intensive business like ecommerce, even though money was constantly coming in, they had to leverage quite a bit until they finally raised and took it to the next level.

"By the time we actually did raise money, we were a million dollars in credit card debt in and out within two weeks. I don't even think our investors knew that, but we just kind of pushed it right to the limits."

It’s always bizarre to hear stories like this, when entrepreneurs go all the way to the edge and still make it out, with the scar tissue but wisdom to take on the next challenge. We wondered what made the brothers keep going.

"We also had seen some other subscription services do well, including some subscription boxes, but they were mostly focused on single categories like beauty or food. And a lot of them were giving you sample size products. We're like, oh, why not supersize the experience, give people something where they're really getting value for what they're paying for much more like free samples in a box and have an eye towards building a broader membership over time."

"We added bells and whistles to the memberships itself, like our sales. We generate more revenue from our sales than we do from the box itself in some ways…or an equal amount. And I don't think any other subscription box company has that dynamic, but we do. So we really are in fact a real membership."

It’s this broader and opportunistic mindset that converged with a larger potential and sustainable userbase that has stuck with them til today. But we think it’s also the entrepreneurial and compatible spirits of the brothers that really made this happen, at the core.

"Co-funding with my brother has been great. You know, I think naturally it's a progression. And I'm happy to say that things have gotten better with time. Now it's like, hey, you know, flip a coin, loser gets to do more work than the other person. It's like you get older and you're like, okay, you know, I love working. I love what we're doing, but if you want to take on that responsibility, go for it and I'll take on this one."

Daniel also took us through the more obvious basic things of business, “just like discipline around finances and how you spend and how efficient you are at running your company” as well as the difficult moments “"There are moments where I was like, oh, this is really stressful. There were some moments where I thought I might not make it."

But we think this speaks to the resilience of the team. At one point, Daniel had cancer, but his attitude about it speaks to the deep strength of the team to build, sell, and surive “I had cancer but at no point in time did I think FabFitFun wasn't going to be the company that stood the test of time."

Today, there still new horizons for the company as they shift to expanding their offerings even further:

"We're also opening up the platform so that people can shop whether or not they have a membership and at the very least browse it. People don't realize how much stuff we sell and how good the prices are and how good the products are. And so we want to give people an ability to experience FabFitFun without necessarily having to commit or commit to something that might be the subscription box because maybe not everyone's a subscription box subscriber, but there is something else that they would sign up for as part of the membership and that would propel them to become a FabFitFun member and then experience all the other things that we have to offer them."

Keeping this in mind, we finally asked them what their advice was to startups and businesses trying to tough out the economic downturn. After all, this wasn’t their first rodeo.

“Even though there's less money in the ecosystem, fundraising becomes a little tougher. I mean, you think if you can really build a business in this environment, you can do anything. So I always have sort of an eye towards action. If someone really wants to get going and do it, then I would tell them there should be nothing holding them back."

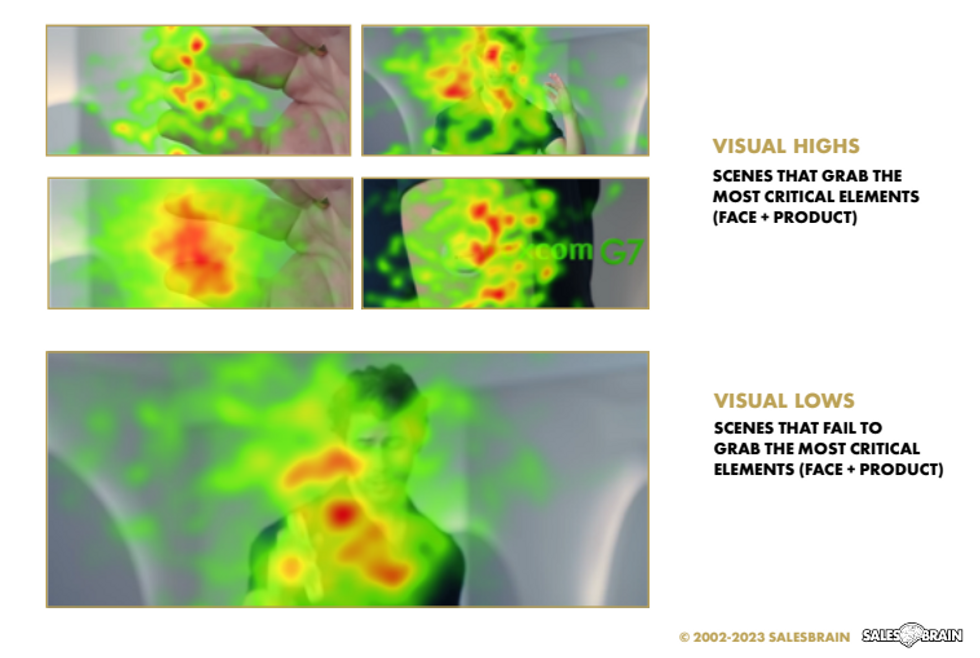

This heat map shows where people's eyes were drawn during a specific commercial. Photo: Kern/SalesBrain

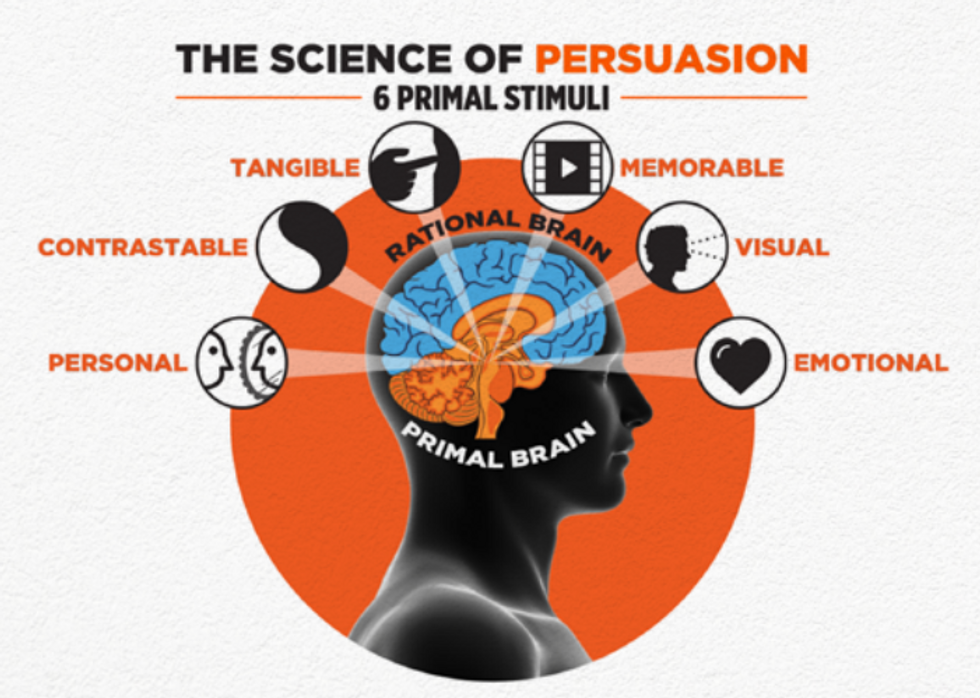

This heat map shows where people's eyes were drawn during a specific commercial. Photo: Kern/SalesBrain  SalesBrain's six stimuli visualized. “All rights reserved Salesbrain 2002-2023” by permission from Salesbrain

SalesBrain's six stimuli visualized. “All rights reserved Salesbrain 2002-2023” by permission from Salesbrain