Get in the KNOW

on LA Startups & Tech

X

Illustration by Ian Hurley

What Are LA’s Hottest Startups of 2022? See Who VCs Picked in dot.LA’s Annual Survey

Harri Weber

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

In Los Angeles—like the startup environment at large—venture funding and valuations skyrocketed in 2021, even as the coronavirus pandemic continued to surge and supply chain issues rattled the economy. The result was a startup ecosystem that continued to build on its momentum, with no shortage of companies raising private capital at billion-dollar-plus unicorn valuations.

In order to gauge the local startup scene and who’s leading the proverbial pack, we asked more than 30 leading L.A.-based investors for their take on the hottest firms in the region. They responded with more than two dozen venture-backed companies; three startups, in particular, rose above the rest as repeat nominees, while we've organized the rest by their amount of capital raised as of January, according to data from PitchBook. (We also asked VCs not to pick any of their own portfolio companies, and vetted the list to ensure they stuck to that rule.)

Without further ado, here are the 26 L.A. startups that VCs have their eyes on in 2022.

1. Whatnot ($225.4 million raised)

Whatnot was the name most often on the minds of L.A. venture investors—understandably, given its prolific fundraising year. Whatnot raised some $220 million across three separate funding rounds in 2021, on the way to a $1.5 billion valuation.

The Marina del Rey-based livestream shopping platform was founded by former GOAT product manager Logan Head and ex-Googler Grant LaFontaine. The startup made its name by providing a live auction platform for buying and selling collectables like rare Pokémon cards, and has since expanded into sports memorabilia, sneakers and apparel.

2. Boulevard ($40.3 million raised)

Boulevard’s backers include Santa Monica-based early-stage VC firm Bonfire Ventures, which focuses on B2B software startups. The Downtown-based company fits nicely within that thesis; Boulevard builds booking and payment software for salons and spas. The firm has worked with prominent brands such as Toni & Guy and HeyDay.

3. GOAT ($492.7 million)

GOAT launched in 2015 as a marketplace to help sneakerheads authenticate used Air Jordans and other collectible shoes. It has since grown at a prolific rate, expanding into apparel and accessories and exceeding $2 billion in merchandise sales in 2020. The startup sealed a $195 million funding round last summer that more than doubled its valuation, to $3.7 billion.

The Best of the Rest

VideoAmp ($578.6 raised)

Nielsen competitor VideoAmp gathers data on who's watching what across streaming services, traditional TV and social apps like YouTube. The company positions itself as an alternative to so-called "legacy" systems like Nielsen, which it says are "fragmented, riddled with complexity and inaccurate." In addition to venture funding, its total funding figure includes more than $165 million in debt financing.

Mythical Games ($269.4 million raised)

Seizing on the NFT craze, Mythical Games is building a platform that powers the growing realm of “play-to-earn games.” Backed by NBA legend Michael Jordan and Andreessen Horowitz, the Sherman Oaks-based startup’s partners include game publishers Abstraction, Creative Mobile and CCG Lab.

FloQast ($202 million raised)

FloQast founder Michael Whitmire says he got a “no” from more than 100 investors in the process of raising a seed round. Today, the accounting software company is considered a unicorn.

Nacelle ($70.8 million raised)

Nacelle produces docuseries, books, comedy albums and podcasts. The media company’s efforts include the Netflix travel series “Down To Earth with Zac Efron.”

Wave ($66 million raised)

A platform for virtual concerts, Wave has hosted performances by artists including Justin Bieber, Tinashe and The Weeknd. The company says it has raised $66 million to date from the likes of Warner Music and Tencent.

Papaya ($65.2 million raised)

Sherman Oaks-based Papaya looks to make it easier to pay “any” bill—from hospital bills to parking tickets—via its mobile app.

LeaseLock ($63.2 million raised)

Based in Marina del Rey, LeaseLock says it’s on a mission to eliminate security deposits for apartment renters.

Emotive ($58.1 million raised)

Emotive sells text message-focused marketing tools to ecommerce firms like underwear brand Parade and men's grooming company Beardbrand.

Dray Alliance ($55 million raised)

Based in Long Beach, Dray says its mission is to “modernize the logistics and trucking industry.” Its partners include Danish shipping company Maersk and toy maker Mattel.

Coco ($43 million raised)

Coco makes small pink robots on wheels (you may have seen them around town) that deliver food via a remote pilot. Its investors include Y Combinator and Silicon Valley Bank.

HiveWatch ($25 million raised)

HiveWatch develops physical security software. Its investors include former Twitter executive Dick Costollo and NBA star Steph Curry’s Penny Jar Capital.

Popshop ($24.5 million raised)

Whatnot competitor Popshop is betting that live-shopping is the future of ecommerce. The West Hollywood-based firm focuses on collectables such as trading cards and anime merchandise.

First Resonance ($19.4 million raised)

Founded by former SpaceX engineer Karan Talati, First Resonance runs a software platform for makers of electric cars and aerospace technology. Its clients include Santa Cruz-based air taxi company Joby Aviation and Alameda-based rocket company Astra.

Open Raven ($19 million raised)

Founded by Crowdstrike and Microsoft alums, Open Raven aims to protect user data. The cybersecurity firm’s investors include Kleiner Perkins and Upfront Ventures.

Fourthwall ($17 million raised)

When an actor faces the camera and speaks directly to the audience, it’s known as “breaking the fourth wall.” Named after the trope, Venice-based Fourthwall offers a website builder that’s designed for content creators.

The Non Fungible Token Company ($15 million raised)

The Non Fungible Token Company creates NFTs for musicians under the name Unblocked. Its investors include Jay Z’s Marcy Venture Partners and Shawn Mendez.

Safe Health Systems ($15 million raised)

Backed by Mayo Clinic Ventures, Safe Health develops telehealth software and offers tools for enterprises to launch their own health care apps.

Intro ($11.6 million raised)

Intro’s app lets you book video calls with experts—from celebrity stylists, to astrologists, to investors.

DASH Systems ($8.5 million raised)

With the tagline “Land the package, not the plane,” DASH Systems is a Hawthorne-based shipping company that builds hardware and software for automated airdrops.

Ettitude ($3.5 million raised)

With a focus on sustainability, Ettitude is a direct-to-consumer brand that sells bedding, bathroom textiles and sleepwear.

Afterparty ($3 million raised)

Along similar lines as Unblocked, Afterparty creates NFTs for artists and content creators such as Clay Perry and Tropix.

Heart to Heart ($0.75 million raised)

Heart to Heart is an audio-focused dating app that “lets you listen to the story behind the pictures in a profile.” Precursor Ventures led the pre-seed funding round.

Frigg (undisclosed)

Frigg makes hair and beauty products that contain cannabinoids such as CBD. The Valley Village-based company raised an undisclosed seed round in August.

From Your Site Articles

- The Early-Stage Startups in LA Set to Take Off in 2021 - dot.LA ›

- Los Angeles Startups Closed a Record Number of Deals in Q3 - dot.LA ›

- dot.LA's Map of Startups in Los Angeles - dot.LA ›

- The Hottest LA Startups of 2020 - dot.LA ›

- Los Angeles Cleantech Incubator Launches Green Loan Fund - dot.LA ›

- dot.LA's Guide on L.A. Flight Startups Overair, Archer Aviation - dot.LA ›

- Here Are LA’s Hottest Startups for 2023 - dot.LA ›

- Nobody Studios Plans to Build 100 Startups in Five Years - dot.LA ›

- From GameTree to Sota — Ukrainian Founders Call LA Home - dot.LA ›

Related Articles Around the Web

Harri Weber

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

🔦 Spotlight

Hey LA,

This week’s most interesting story isn’t a flashy new feature, it’s a quieter flex: Snapchat is getting people to pay for Snapchat, on purpose.

Snap just proved “free app” isn’t the only business model

Snap says its direct revenue business is now running at a $1B annualized pace, with 25M+ subscribers paying across a growing menu of products like Snapchat+, Lens+, Snapchat Premium, and Memories Storage Plans. That matters because it’s not just a nice add-on to ads, it’s a different kind of relationship with users. Ads monetize attention. Subscriptions monetize intent.

And intent is sticky. If someone pulls out a card for you, they don’t churn the way an algorithm does.

Creator Subscriptions are the real tell

Snap is also launching Creator Subscriptions, starting with an alpha on February 23 for select U.S. creators, then expanding to Snap Stars in Canada, the U.K., and France in the following weeks. The offer is straightforward: subscriber-only Stories and Snaps, priority replies, and an ad-free experience inside that creator’s Stories.

The strategic move is even simpler. Snap wants “paying for closeness” to happen inside Stories and Chat, not on some external membership page. If they get that right, creators stop treating Snapchat as just a top-of-funnel channel and start treating it like a place to actually monetize their audience. Snap, meanwhile, gets a revenue stream that doesn’t care what CPMs are doing this quarter.

Meanwhile, IRL: lululemon’s Studio Yet.

Lululemon’s Studio Yet. pop-up is running Feb. 18 through March 8 at 8175 Melrose Ave. It’s a ticketed, limited-capacity lineup of workouts and community programming, with proceeds (less fees) supporting BlacklistLA.

Keep scrolling for the latest LA venture rounds, fund news and acquisitions.

🤝 Venture Deals

LA Companies

- Radiant announced a strategic investment from Lockheed Martin via Lockheed Martin Ventures, further oversubscribing the company’s current financing round. Radiant is developing its 1 MW Kaleidos portable nuclear microreactor and says it’s targeting a first reactor startup this summer at Idaho National Laboratory, with initial customer deployments planned for 2028. - learn more

- Mesh Optical Technologies announced it has raised over $50M, led by Thrive Capital, to scale production of its Alpha C1 optical transceiver, which converts electrical signals to light at 1.6 Tbps for AI data centers. The startup says its edge is manufacturing: it builds the optical engine using fast, repeatable flip-chip die bonding to make high-volume, U.S.-based production of optical links possible, backed by a team with experience from SpaceX and Intel.- learn more

LA Venture Funds

- Alexandria Venture Investments participated as an existing investor in Ten63 Therapeutics’ latest strategic financing, which also included participation from Morpheus Ventures and added new backers such as Chugai Venture Fund and the Gates Foundation, bringing total funding to more than $45M. Ten63 says it will use the capital to scale BEYOND, its AI-driven “Large Quantum Chemistry Model” platform for designing small-molecule drugs against historically “undruggable” targets, including programs in oncology and an HPV-focused effort supported by the Gates Foundation.- learn more

- B Capital participated in Code Metal’s $125M Series B, a round led by Salesforce Ventures that valued the company at $1.25B, alongside investors including Accel, J2 Ventures, Shield Capital, Smith Point Capital, and others.Code Metal says it will use the new capital to expand engineering, accelerate product development, grow government and commercial partnerships, and scale go-to-market for its “verifiable” AI code generation and translation platform used in mission-critical environments. - learn more

- Bonfire Ventures co-led Odynn’s $9.5M seed round alongside 8VC, with participation from Khosla Ventures and General Catalyst. Odynn says it’s building personalized AI infrastructure for travel companies, aiming to replace one-size-fits-all booking portals with dynamic experiences that tailor search, recommendations, and conversion flows to each traveler. - learn more

- MTech Capital led Qumis’s $4.3M oversubscribed seed round, which also brought in American Family Ventures as a new strategic investor and pushed total funding to $6.75M. The company says it’s building an attorney-trained AI platform for commercial insurance “coverage intelligence,” and will use the funding to expand go-to-market and deepen product capabilities as adoption grows among large brokers and carriers (including NFP). - learn more

- WndrCo participated in Mansa’s seed funding round, which the company says totaled $12M and was led by MaC Venture Capital. Mansa is now launching a vertical “micro-drama” format inside its app, debuting with the 27-episode original series The Heiress, The Baller & The Secret Society and positioning the feature as a mobile-first way to release serialized stories globally. - learn more

- Alpha Edison co-led Ownwell’s $50M Series B, with Wonder Ventures participating alongside investors including Mercato Partners, Intuit Ventures, Left Lane Capital, First Round Capital, Long Journey Ventures, and PROOF Fund. The round includes $30M in equity and $20M in debt financing from Western Alliance Bank, and Ownwell says it will use the capital to expand nationally and simplify the property-tax appeal process through a new “National Appeals Packet” product. - learn more

- Three Six Zero participated as an existing investor in Hook’s $10M Series A, which was led by Khosla Ventures with participation from Point72 Ventures, Imaginary Ventures, and Waverley Capital, bringing Hook’s total funding to $16M. Hook is an artist-first social platform that lets fans legally remix licensed songs using simple AI-powered tools and share them across social platforms, and it says the new capital will fund user growth plus product expansion like an Android app, richer creation formats, and deeper ecosystem integrations. - learn more

- Overture Ventures participated as an existing investor in Zero Homes’ $16.8M Series A, which was led by Prelude Ventures alongside SJF Ventures and the Exelon Foundation. Zero Homes says it’s using the funding to expand into new markets, broaden its home-upgrade offerings, and grow its contractor network, powered by a smartphone-based “digital twin” approach that produces upgrade designs and pricing remotely. - learn more

- Rebel Fund participated in Sphinx’s $7.1M seed round, which was led by Cherry Ventures alongside Y Combinator, Deel Ventures, and Singularity Capital. Sphinx is building browser-native compliance agents that work inside banks’ and fintechs’ existing tools to automate AML, KYC, and KYB work, with the new funding earmarked to scale that “agentic compliance workforce.” - learn more

- Matter Venture Partners led ChipAgents’ oversubscribed $50M Series A1, bringing total capital raised to $74M, with participation from existing investors Bessemer Venture Partners, Micron, MediaTek, and Ericsson. ChipAgents says it will use the new funding to scale its agentic AI platform for chip design and verification, expand engineering and research, and accelerate global deployment of multi-agent “chip teams,” alongside a new HQ buildout in Santa Clara. - learn more

- MemorialCare Innovation Fund participated in SpendRule’s $2M round, which was led by Abundant Venture Partners with additional backing from Zeal Capital Partners. SpendRule is emerging from stealth with an AI-driven platform that helps hospitals validate invoices against complex contract terms before payments go out, aiming to reduce overspending and “contract leakage” across purchased services. The company says early customers include health systems like MemorialCare, Kettering Health, and MUSC Health. - learn more

LA Exits

- Fred Segal is being acquired by Aritzia, which is buying the brand’s rights/IP (terms not disclosed) and planning a revival under its ownership. Melrose Avenue is central to the deal too, since Aritzia is also taking a lease on Fred Segal’s iconic ivy-covered site at 8100 Melrose as part of the comeback plan. - learn more

- The Expert is being acquired by Havenly in an all-equity deal (terms not disclosed), bringing The Expert’s high-end virtual designer consultations and trade-oriented marketplace into Havenly’s broader home and commerce ecosystem. Lee Anne Blake will join Havenly as chief commercial officer, and while The Expert will remain a standalone website, Havenly plans to plug in its tech to strengthen The Expert’s purchasing and procurement tools for designers. - learn more

Read moreShow less

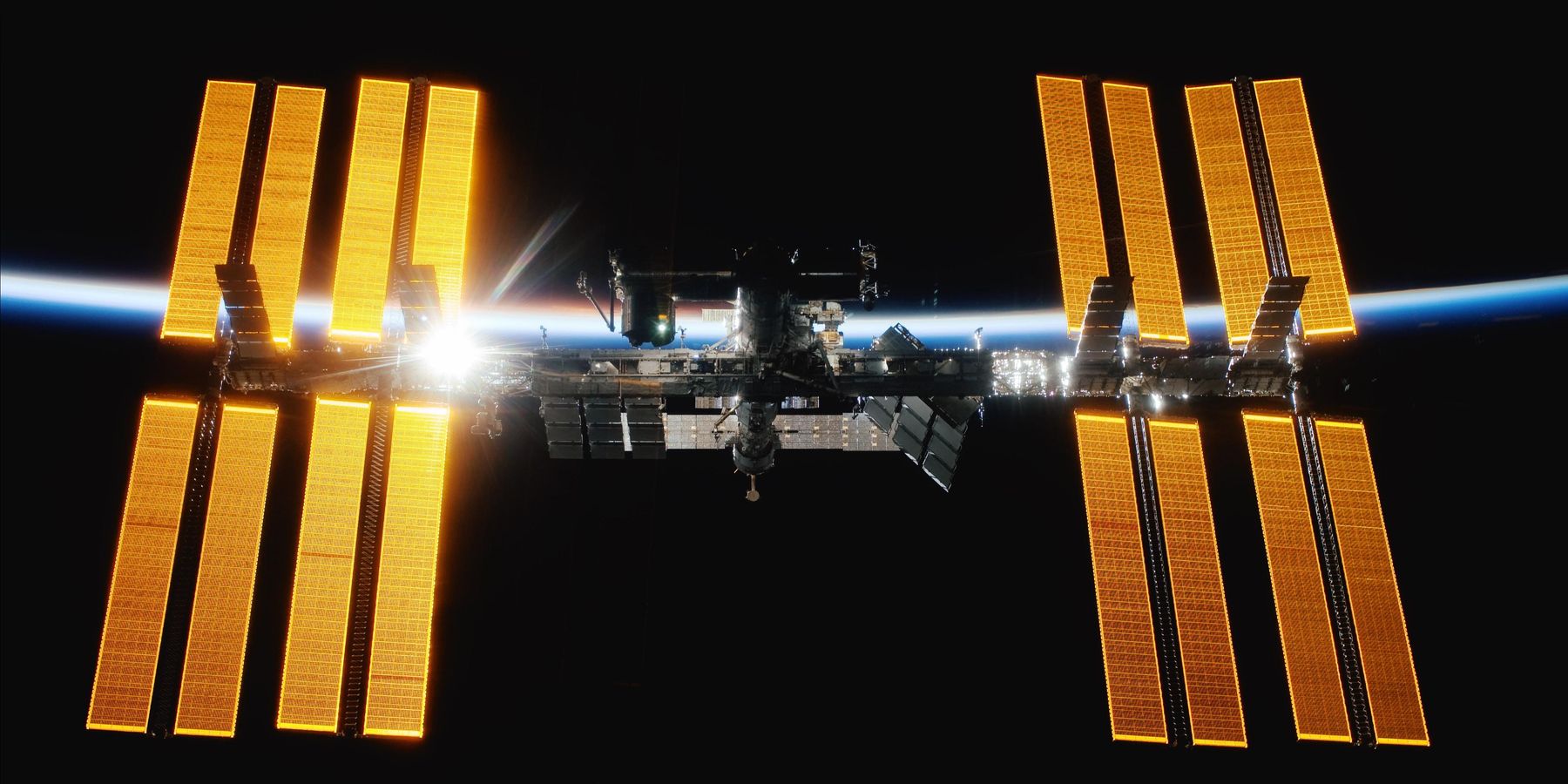

Twenty Years Ago Today, NASA First Sent a Woman to the ISS. Here’s What She Sees for Future Missions.

07:00 AM | March 08, 2021

Twenty years ago today Lt. Gen. Susan Helms arrived at the International Space Station where she would go on to carry out a historic mission.

During a five-month stint at the station, she emerged to take a spacewalk with fellow astronaut Jim Voss that spanned nearly nine hours, breaking world records for both the longest spacewalk ever and the longest completed by a woman.

Since then, she's been on another mission to inspire a new generation of aerospace pioneers and help them build their own legacy.

Melanie Stricklan co-founder and CEO of El Segundo-based Slingshot Aerospace, credits Helms with helping launch the startup that counts NASA among its clients. To date, the company has raised over $17 million from investors including L.A.-based Stage Venture Partners and Noname Ventures. And Helms' guidance and insight has been key to that.

"She is a pioneer. She made way for lots of other women to go to service academies and after that to pursue engineering degrees like she did," Stricklan told dot.LA. "She was the first military woman in space; the first woman to inhabit the ISS."

Stricklan, who was an Air Force military officer for over two decades before she took her degree in aeronautical space engineering to found Slingshot Aerospace in 2017, met Helms when she was Stricklan's superior in the service.

Helms' mentorship has helped Stricklan and Slingshot secure contracts from NASA, the U.S. Space Force and Air Force, as well as private contractors like Boeing, Northrop Grumman and BAE Systems.

But Helms also boosted Stricklan's confidence as she helped develop Slingshot Aerospace.

The company sells two products. Slingshot Laboratory is a mixed-reality space simulation training tool that can be used by NASA astronauts and K-12 students. Although it's still in beta mode, it's being used to train university students and the Space Force Guardians.

Then there's Slingshot Orbital, an air traffic control-like system for space travel. The system gives the government a more accurate idea of exactly what's going on up there, without having to actually send more crafts into space. Helms talks about Slingshot as if she's making a pitch for her own company. Slingshot Orbital, she said, is key to protecting the U.S. from foreign threats in space as access to the stars becomes more democratized.

"Space has now become so accessible, you have to start thinking of it as a place where conflict could take place," Helms said. "Therefore, you have to focus on it with resources and defensive strategies."

Both point out that every launch produces debris, and even an accidental collision with another country's tech could have disastrous consequences.

"Space is one of the most critical environments to make accurate decisions in, especially with all of the hundreds of new satellites increasingly filling orbits," Stricklan said. "(There's) millions of pieces of debris... It's not a hair-on-fire moment, space is big."

Both have been working in the industry to help the next generation of women in space

"We're no longer hitchhiking on Russian rockets, which I love," Stricklan said. "I love the fact that women are leading the charge," Stricklan said.

Most major aerospace firms now have a woman in their C-suite — Leanne Caret is the CEO of Boeing Defense, Space and Security; and Marilyn Hewson ran Lockheed Martin for seven years until June 2020.

"Elon gets a lot of credit for what SpaceX is doing but [its CEO] Gwynne Shotwell is terrific. When we got our ticket back as a U.S. entity to go into space on the first privatized ride, she helped Elon get there," Stricklan said.

In 2019, 75% of all the major science divisions in NASA were run by women, the organization said. This includes Sandra Cauffman, a Costa Rican-born engineer who was the first woman to be appointed to the NASA Inventions and Contributions Board in 1994.

Helms now serves as the vice president of Texas-based Astra Femina, a nonprofit dedicated to encouraging young women to pursue careers in space. Astra Femina was founded by Sandra Magnus, a former Department of Defense chief engineer and one of the few astronauts to fly on the final Space Shuttle mission in 2011.

"Some of them have to just see it to be it," Stricklan said about young women interested in the field.

Helms won't be satisfied until there's finally a woman who sets foot on the moon.

"The astronaut office was 25% female when I showed up," Helms said. "What I'm looking for are the days when it's 50/50. There's people that say, why go back to the moon if we've already been there, and my answer is well, only 50% of you have been there. When you talk about human exploration, you're talking about humans in general."

The anniversary has her feeling nostalgic.

"I'm feeling kind of sad that the spacecraft I flew on that day isn't around anymore," Helms said. " I usually don't think about the anniversary that much, but since it's the 20 year anniversary and it sets us on International Women's Day in particular, it seems especially poignant."

From Your Site Articles

- Slingshot Aerospace, The Third Floor Work with Space Force - dot.LA ›

- Slingshot Aerospace's Melanie Stricklan on 'Female Founders ... ›

- Slingshot Aerospace Melanie Stricklan on Aerospace's Future - dot.LA ›

- Red 6 Raises $30M for Military Training in Augmented Reality - dot.LA ›

Related Articles Around the Web

Read moreShow less

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

https://twitter.com/samsonamore

samsonamore@dot.la

RELATEDTRENDING

LA TECH JOBS