Get in the KNOW

on LA Startups & Tech

X

Illustration by Ian Hurley

What Are LA’s Hottest Startups of 2022? See Who VCs Picked in dot.LA’s Annual Survey

Harri Weber

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

In Los Angeles—like the startup environment at large—venture funding and valuations skyrocketed in 2021, even as the coronavirus pandemic continued to surge and supply chain issues rattled the economy. The result was a startup ecosystem that continued to build on its momentum, with no shortage of companies raising private capital at billion-dollar-plus unicorn valuations.

In order to gauge the local startup scene and who’s leading the proverbial pack, we asked more than 30 leading L.A.-based investors for their take on the hottest firms in the region. They responded with more than two dozen venture-backed companies; three startups, in particular, rose above the rest as repeat nominees, while we've organized the rest by their amount of capital raised as of January, according to data from PitchBook. (We also asked VCs not to pick any of their own portfolio companies, and vetted the list to ensure they stuck to that rule.)

Without further ado, here are the 26 L.A. startups that VCs have their eyes on in 2022.

1. Whatnot ($225.4 million raised)

Whatnot was the name most often on the minds of L.A. venture investors—understandably, given its prolific fundraising year. Whatnot raised some $220 million across three separate funding rounds in 2021, on the way to a $1.5 billion valuation.

The Marina del Rey-based livestream shopping platform was founded by former GOAT product manager Logan Head and ex-Googler Grant LaFontaine. The startup made its name by providing a live auction platform for buying and selling collectables like rare Pokémon cards, and has since expanded into sports memorabilia, sneakers and apparel.

2. Boulevard ($40.3 million raised)

Boulevard’s backers include Santa Monica-based early-stage VC firm Bonfire Ventures, which focuses on B2B software startups. The Downtown-based company fits nicely within that thesis; Boulevard builds booking and payment software for salons and spas. The firm has worked with prominent brands such as Toni & Guy and HeyDay.

3. GOAT ($492.7 million)

GOAT launched in 2015 as a marketplace to help sneakerheads authenticate used Air Jordans and other collectible shoes. It has since grown at a prolific rate, expanding into apparel and accessories and exceeding $2 billion in merchandise sales in 2020. The startup sealed a $195 million funding round last summer that more than doubled its valuation, to $3.7 billion.

The Best of the Rest

VideoAmp ($578.6 raised)

Nielsen competitor VideoAmp gathers data on who's watching what across streaming services, traditional TV and social apps like YouTube. The company positions itself as an alternative to so-called "legacy" systems like Nielsen, which it says are "fragmented, riddled with complexity and inaccurate." In addition to venture funding, its total funding figure includes more than $165 million in debt financing.

Mythical Games ($269.4 million raised)

Seizing on the NFT craze, Mythical Games is building a platform that powers the growing realm of “play-to-earn games.” Backed by NBA legend Michael Jordan and Andreessen Horowitz, the Sherman Oaks-based startup’s partners include game publishers Abstraction, Creative Mobile and CCG Lab.

FloQast ($202 million raised)

FloQast founder Michael Whitmire says he got a “no” from more than 100 investors in the process of raising a seed round. Today, the accounting software company is considered a unicorn.

Nacelle ($70.8 million raised)

Nacelle produces docuseries, books, comedy albums and podcasts. The media company’s efforts include the Netflix travel series “Down To Earth with Zac Efron.”

Wave ($66 million raised)

A platform for virtual concerts, Wave has hosted performances by artists including Justin Bieber, Tinashe and The Weeknd. The company says it has raised $66 million to date from the likes of Warner Music and Tencent.

Papaya ($65.2 million raised)

Sherman Oaks-based Papaya looks to make it easier to pay “any” bill—from hospital bills to parking tickets—via its mobile app.

LeaseLock ($63.2 million raised)

Based in Marina del Rey, LeaseLock says it’s on a mission to eliminate security deposits for apartment renters.

Emotive ($58.1 million raised)

Emotive sells text message-focused marketing tools to ecommerce firms like underwear brand Parade and men's grooming company Beardbrand.

Dray Alliance ($55 million raised)

Based in Long Beach, Dray says its mission is to “modernize the logistics and trucking industry.” Its partners include Danish shipping company Maersk and toy maker Mattel.

Coco ($43 million raised)

Coco makes small pink robots on wheels (you may have seen them around town) that deliver food via a remote pilot. Its investors include Y Combinator and Silicon Valley Bank.

HiveWatch ($25 million raised)

HiveWatch develops physical security software. Its investors include former Twitter executive Dick Costollo and NBA star Steph Curry’s Penny Jar Capital.

Popshop ($24.5 million raised)

Whatnot competitor Popshop is betting that live-shopping is the future of ecommerce. The West Hollywood-based firm focuses on collectables such as trading cards and anime merchandise.

First Resonance ($19.4 million raised)

Founded by former SpaceX engineer Karan Talati, First Resonance runs a software platform for makers of electric cars and aerospace technology. Its clients include Santa Cruz-based air taxi company Joby Aviation and Alameda-based rocket company Astra.

Open Raven ($19 million raised)

Founded by Crowdstrike and Microsoft alums, Open Raven aims to protect user data. The cybersecurity firm’s investors include Kleiner Perkins and Upfront Ventures.

Fourthwall ($17 million raised)

When an actor faces the camera and speaks directly to the audience, it’s known as “breaking the fourth wall.” Named after the trope, Venice-based Fourthwall offers a website builder that’s designed for content creators.

The Non Fungible Token Company ($15 million raised)

The Non Fungible Token Company creates NFTs for musicians under the name Unblocked. Its investors include Jay Z’s Marcy Venture Partners and Shawn Mendez.

Safe Health Systems ($15 million raised)

Backed by Mayo Clinic Ventures, Safe Health develops telehealth software and offers tools for enterprises to launch their own health care apps.

Intro ($11.6 million raised)

Intro’s app lets you book video calls with experts—from celebrity stylists, to astrologists, to investors.

DASH Systems ($8.5 million raised)

With the tagline “Land the package, not the plane,” DASH Systems is a Hawthorne-based shipping company that builds hardware and software for automated airdrops.

Ettitude ($3.5 million raised)

With a focus on sustainability, Ettitude is a direct-to-consumer brand that sells bedding, bathroom textiles and sleepwear.

Afterparty ($3 million raised)

Along similar lines as Unblocked, Afterparty creates NFTs for artists and content creators such as Clay Perry and Tropix.

Heart to Heart ($0.75 million raised)

Heart to Heart is an audio-focused dating app that “lets you listen to the story behind the pictures in a profile.” Precursor Ventures led the pre-seed funding round.

Frigg (undisclosed)

Frigg makes hair and beauty products that contain cannabinoids such as CBD. The Valley Village-based company raised an undisclosed seed round in August.

From Your Site Articles

- The Early-Stage Startups in LA Set to Take Off in 2021 - dot.LA ›

- Los Angeles Startups Closed a Record Number of Deals in Q3 - dot.LA ›

- dot.LA's Map of Startups in Los Angeles - dot.LA ›

- The Hottest LA Startups of 2020 - dot.LA ›

- Los Angeles Cleantech Incubator Launches Green Loan Fund - dot.LA ›

- dot.LA's Guide on L.A. Flight Startups Overair, Archer Aviation - dot.LA ›

- Here Are LA’s Hottest Startups for 2023 - dot.LA ›

- Nobody Studios Plans to Build 100 Startups in Five Years - dot.LA ›

- From GameTree to Sota — Ukrainian Founders Call LA Home - dot.LA ›

Related Articles Around the Web

Harri Weber

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

Behind Her Empire: Beyond Capital CEO Eva Yazhari on Investing With Purpose

11:16 AM | May 28, 2021

This week, I sat down with Eva Yazhari, and CEO of Beyond Capital, an early-stage impact investment fund focused on education equity and global investments. Yazhari started her career on Wall Street, working alongside top investors. She loved investing, but felt driven by her strong values to do financial work with more of a social justice impact.

Yazhari said she was inspired particularly by her grandfather — who moved to Tanzania to work as a doctor — to look outside common narratives and find opportunity to invest in innovation both in Africa and India. This is what drew her to leave Wall Street behind.

"I wasn't seeking meaning and purpose in my work at that point," Yazhari said. "And so once I did, I realized that creativity, using your skills for good and social justice, which was a pretty core theme in my upbringing…all three of those, I would call them core attributes comprise what I'm doing right now."

The core of her business is shifting Wall Street's paradigms to focus on women and people of color, and prioritizing leadership, justice and innovation. Her goal is to have a direct impact on those she classified as "very low income," surviving on $15 or less per day. To do so, she says she has to have an abundance mindset, meaning that she believes in mutual benefit for the most parties possible over maximizing capital by any means.

To Yazhari, the abundance mindset is the future of investment as innovation trends towards environmental and social returns. We also discussed her work as an author, how to find meaning in your work and her personal business insights as an investor.

"But the reason I think the abundance mindset is so critical is because if investors were to shift to that mindset, things would look really different. And it's essentially what we need when we're transitioning to an economy where social and environmental returns or risks are valued in the same way that financial risks are evaluated by investors."—Eva Yazhari

Eva Yazhari is the co-founder and CEO of Beyond Capital, a seasoned investor and the author of "The Good Your Money Can Do."

Want to hear more of the Behind Her Empire podcast? Subscribe on Stitcher, Apple Podcasts, Spotify, iHeart Radioor wherever you get your podcasts.

dot.LA Engagement Intern Colleen Tufts contributed to this post.

From Your Site Articles

- Los Angeles' Top Investors Under 30 According to Their Peers - dot.LA ›

- How Corporate America Can Help Foster Racial Equality - dot.LA ›

- Beyond Limits Raises $133M, Takes AI-backed Software Global ... ›

Related Articles Around the Web

Read moreShow less

Yasmin Nouri

Yasmin is the host of the "Behind Her Empire" podcast, focused on highlighting self-made women leaders and entrepreneurs and how they tackle their career, money, family and life.

Each episode covers their unique hero's journey and what it really takes to build an empire with key lessons learned along the way. The goal of the series is to empower you to see what's possible & inspire you to create financial freedom in your own life.

LA Tech Week: Final Days • Coco’s bots, Anduril’s helmet AI, Impulse’s moon freight

08:05 AM | October 17, 2025

🔦 Spotlight

Happy Friday Los Angeles,

Founders are closing out Tech Week, robots are getting a new research brain, space logistics are taking shape, and defense tech just moved mission command into a helmet.

Anduril’s EagleEye: mission command, heads up

Anduril introduced EagleEye, a helmet mounted system that puts maps, comms, sensor fusion, and on device AI directly in a warfighter’s line of sight, integrated with the Lattice stack. The goal is simple: less time looking down at a tablet and more decisions made at the edge.

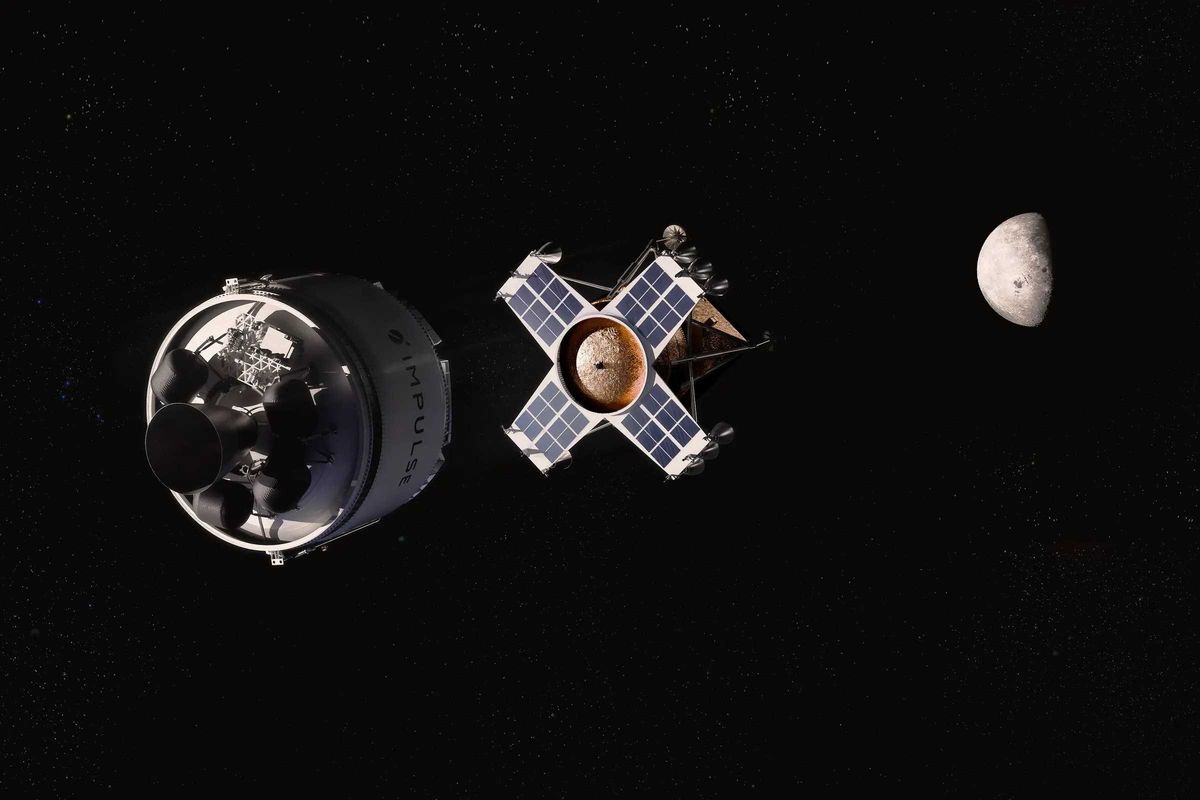

Impulse Space: a practical path to lunar deliveries

Impulse outlined a two piece ride to the Moon. Its Helios stage ferries an Impulse built lander to lunar orbit in about a week, the lander detaches, then descends to the surface without in-space refueling. The company says each mission could carry about three tons and that starting in 2028 it could run two missions per year for roughly six tons total, filling the gap between today’s small CLPS deliveries and future heavy landers.

Coco Robotics: new lab, new chief AI scientist

Coco named UCLA’s Bolei Zhou chief AI scientist and is launching a physical AI research lab to turn years of curbside driving data into faster, more autonomous sidewalk deliveries. Expect quicker iteration from data collection to local models on the bots.

LA Tech Week: last three days

We are down to the final few days of LA Tech Week 2025. If you are still slotting meetings or panels, use the rundowns to plan your route:

Scroll for the most recent LA venture deals, funds, and acquisitions.

🤝 Venture Deals

LA Companies

- Second Nature, an AI role-play training platform for sales and service teams, raised $22M Series B led by Sienna VC with participation from Bright Pixel, StageOne Ventures, Cardumen, Signals VC, and Zoom (also a customer). The company will use the funding to expand operations and advance its platform, which generates AI-driven practice scenarios and feedback for enterprise clients like Oracle, Zoom, Adobe, Teleperformance, and Check Point. - learn more

- Pelage Pharmaceuticals, a Los Angeles–based biotech developing regenerative treatments for hair loss, raised a $120M Series B co-led by ARCH Venture Partners and GV. Participants include Main Street Advisors, alongside Visionary Ventures and YK Bioventures; proceeds advance PP405, a topical small molecule that reactivates dormant hair-follicle stem cells, toward Phase 3 in 2026 following positive Phase 2a data. - learn more

- Launchpad, an AI-first robotics company for factory automation, raised an $11M Series A to speed product development and meet demand across the U.S., U.K., and Europe. The round was co-led by Lavrock Ventures and Squadra Ventures, with participation from Ericsson Ventures, Lockheed Martin Ventures, Cox Exponential, and the Scottish National Investment Bank; it follows $2.5M in grant funding from Scottish Enterprise. - learn more

- Mythical Games raised a Series D round, with a strategic investment from Eightco Holdings alongside ARK Invest and the World Foundation. The partnership focuses on human verification and digital identity in gaming, tapping Worldchain/Worldcoin’s Proof-of-Human infrastructure. The transaction is expected to close the week of October 20. - learn more

- Electric Entertainment, the L.A. studio behind “Leverage,” “The Librarians,” and “The Ark,” secured a $20M investment from Content Partners Capital. The funding follows CPC’s launch of an investment arm in April 2024 and is aimed at supporting Electric’s growth across production and distribution. - learn more

- Everyset raised $9M to launch Background Payroll, a SAG-AFTRA approved platform that automates timecards and payroll for background performers, including overtime, penalties, and premiums. The round was led by Crosslink Capital and Haven Ventures, and the company says studios such as Netflix, CBS, Apple TV, Sony, and Amazon already use its tools as it expands into fully integrated background payroll. - learn more

- TORL Biotherapeutics raised $96M in Series C funding to advance TORL-1-23, its Claudin-6 targeted antibody-drug conjugate, through a pivotal Phase 2 study in platinum-resistant ovarian cancer and into a confirmatory Phase 3 program. The company also reported that updated Phase 1 data for TORL-1-23 will be presented at ESMO 2025, bringing total funding since its 2019 founding to more than $450 million. - learn more

- The Plug, a plant-based liver health brand, raised $5M in a venture round of equity and debt to fuel marketing and retail expansion after rolling out its Pill Jar in June and entering all Total Wine & More locations nationwide in September. The company is keeping the round open for additional strategic investors and says it recently hit its first profitable month, is pursuing a partnership with a $500 million nutrition telehealth company, and is targeting a 40% boost to gross margins through a new operational milestone. - learn more

LA Venture Funds

- Clocktower Technology Ventures participated in MGT’s $21.6M Series B, an oversubscribed round led by Mubadala Capital with Tacora Capital and existing backers also joining. The AI-native commercial P&C neo-insurer for small businesses will use the capital to accelerate R&D, deepen vertical AI capabilities, and expand its E&S initiatives nationwide. - learn more

- M13 participated in Daylight’s $75M financing, which combines $15M in equity led by Framework Ventures with a $60M project facility led by Turtle Hill Capital. Daylight is building a decentralized energy network that turns homes into mini power plants via a subscription model and crypto-enabled incentives, aiming to lower costs and dispatch battery power back to the grid. - learn more

- Presight Capital co-led Peptilogics’ $78M Series B2, with Beyond Ventures participating, to fund a Phase 2/3 pivotal trial of zaloganan (PLG0206) for prosthetic joint infections. The raise brings Peptilogics’ total equity financing to about $120M and positions the company to begin the pivotal program in late 2025, pending approvals. - learn more

- Patron participated in Ego AI’s $6.7M seed round to help the YC-backed startup launch human-like AI characters for games via its new character.world engine. The round also included Y Combinator, Accel, and Boost VC, and the capital will support research on Ego’s proprietary model, which combines small language models with reinforcement learning, plus partnerships in Singapore to scale compute and development. - learn more

- Untapped Ventures participated in Woz’s $6M seed round, joining Cervin Ventures (lead), Y Combinator, Burst Capital, MGV, and the Lacob family. The funding will help Woz scale its platform that blends agentic AI with expert human oversight to deliver production-ready mobile apps for enterprises. - learn more

- Perseverance Capital participated in Kailera Therapeutics’ $600M Series B, which was led by Bain Capital Private Equity. The funding advances KAI-9531, an injectable dual GLP-1/GIP agonist, into global Phase 3 trials by year end and supports a broader pipeline of oral and injectable obesity therapies. - learn more

- March Capital participated in Lila Sciences’ $350M Series A, which lifts the company’s total funding to $550M. The capital will scale Lila’s AI Science Factories and commercialize its “scientific superintelligence” platform for partners across materials, energy, and biopharma. - learn more

- Mucker Capital participated in Pear Suite’s $7.6M Series A, which was co-led by Rock Health Capital and Nexxus Holdings. The L.A. based company equips community health workers with an AI-powered platform and provider network, and it will use the funding to expand product development, grow its network, and support new Medicaid and Medicare health plan contracts. Other investors include Enable Ventures, The SCAN Foundation, Acumen America, Impact Engine, and the California Health Care Foundation. - learn more

- Upfront Ventures participated in Renew’s $12M Series A, which was led by Haymaker Ventures with Goldcrest Capital and several Renew customers also investing. Renew’s AI-powered resident retention platform helps apartment operators automate renewals and prevent fraud, and the company says the new funding will scale the product and launch what it calls the industry’s first Resident Referral Network. - learn more

- Acre Venture Partners co-led Ascribe Bio’s oversubscribed $12M Series A with Corteva to scale its natural crop protection platform and launch Phytalix, a broad spectrum “biofungicide without compromise.” The funding advances Ascribe’s small molecule technology derived from the soil microbiome toward commercial rollout, with participation from Syngenta Group Ventures, Trailhead Capital, Silver Blue, Cultivation Capital, and others. - learn more

- Alexandria Venture Investments participated in Tr1X’s $50M financing, announced alongside FDA clearance of the IND for TRX319, an allogeneic CAR-Tr1 Treg cell therapy for progressive multiple sclerosis. The funding extends Tr1X’s runway into 2027 and supports a Phase 1/2a dose-escalation trial slated to start in early 2026, while the company continues its TRX103 studies in Crohn’s disease and other indications. - learn more

- LFX Venture Partners participated in FleetWorks’ $17M funding, which supports the launch and expansion of its “always-on” AI dispatcher for the U.S. trucking industry. The round was led by First Round Capital with participation from Y Combinator and Saga Ventures, and the company says the capital will go toward hiring, commercial rollout, and product development. FleetWorks’ platform automates freight matching between carriers and brokers to speed up bookings and reduce manual calls, emails, and texts. - learn more

- Clocktower Technology Ventures participated in Yendo’s $50M Series B. The fintech behind a vehicle-secured credit card will use the funding to expand its AI credit platform toward an inclusive digital bank that taps “trapped” consumer equity, aiming to unlock up to $4 trillion from assets like cars and homes for underserved borrowers. - learn more

- Alpha Edison participated in TransCrypts’ $15M seed round. The company builds a blockchain-based verified-credentials platform to fight AI-driven fraud and plans to expand beyond employment verification into health and education records. - learn more

- Alexandria Venture Investments participated in Nilo Therapeutics’ $101M Series A, which launched the company to develop medicines that modulate neural circuits to restore immune balance in disease. The round was led by The Column Group, DCVC Bio, and Lux Capital; Nilo also appointed Kim Seth, Ph.D., as CEO and plans to build out New York labs and advance preclinical programs. - learn more

- Chapter One participated in Glue’s $20M Series A. Glue builds an “agentic team chat” platform that embeds MCP-powered AI directly in workplace messaging, with 35 in-app integrations and support for thousands more via custom MCP servers. The funding will help expand product development and infrastructure as Glue pushes this model to more teams. - learn more

- StillMark participated in Meanwhile’s $82M raise, backing the Bermuda-regulated bitcoin life insurer as it expands bitcoin-denominated savings, retirement, and life insurance products for individuals and institutions. The round was co-led by Bain Capital Crypto and Haun Ventures with participation from Apollo, Northwestern Mutual Future Ventures, and Pantera Capital, and brings Meanwhile’s 2025 funding to $122 million after an earlier $40 million Series A. - learn more

- Blue Bear Capital co-led Energy Robotics’ $13.5M Series A with Climate Investment. The Darmstadt-based company provides AI software that lets robots and drones autonomously inspect critical infrastructure, and it will use the funding to scale deployments across energy, chemical, industrial, and utility sites. Customers already include majors like Shell, BP, BASF, Merck, and E.ON, and the company reports more than one million inspections completed to date. - learn more

- B Capital participated in EvenUp’s $150M Series E, which values the AI legal-tech company at over $2 billion. EvenUp builds AI tools for personal-injury law firms and plans to use the new capital to scale its platform and product suite; the round was led by Bessemer Venture Partners, with investors including REV (LexisNexis) and others. - learn more

- WndrCo participated in Zingage’s $12.5M seed round to build an AI care-delivery platform for home-based healthcare. Zingage is rolling out “Operator,” which automates scheduling, staffing, billing, and compliance for home care agencies, and “Perform,” which boosts caregiver retention, with the new capital supporting product expansion and go-to-market. The round was led by Bessemer Venture Partners with additional investors including TQ Ventures and South Park Commons. - learn more

- Alexandria Venture Investments participated in AeroRx Therapeutics’ $21M Series A, which was led by Avalon BioVentures with Correlation Ventures also investing. The funding advances AERO-007, a first-in-class nebulized LABA/LAMA for COPD, into late-stage clinical development aimed at patients who struggle with handheld inhalers. - learn more

- Alexandria Venture Investments participated in Affinia Therapeutics’ $40M Series C, alongside lead investor NEA and new investor Eli Lilly, to advance its AAV gene therapy pipeline. Proceeds will fund an IND submission in Q4 2025 and initial clinical work for AFTX-201 in BAG3 dilated cardiomyopathy, with a Phase 1/2 trial targeted for Q1 2026. - learn more

- Clocktower Ventures participated in Vycarb’s $5M seed round, which was led by Twynam with participation from MOL Switch, Hatch Blue, Idemitsu, and SGInnovate. The Brooklyn startup develops sensor-driven, water-based carbon capture and storage systems that convert CO₂ into stable bicarbonate, with the new funding aimed at scaling deployments at industrial sites. - learn more

LA Exits

- Empaxis Data Management was acquired by Communify, which is integrating Empaxis’ custodial and accounting data connections and operations expertise into its financial AI platform. The aim is to remove fragmented data so wealth and asset managers can deploy MIND AI apps like Client Stories and Portfolio Stories more quickly with cleaner, unified data. Communify also cites pre-integrations with over 175 market-data vendors to speed rollouts. - learn more

- TrueCar is being acquired by founder-led Fair Holdings (Scott Painter) in an all-cash deal at $2.55/share (~$227M), with Painter set to return as CEO. A 30-day go-shop runs through Nov. 13, 2025; largest holder Caledonia supports the acquisition, which is expected to close Q4 2025 or early 2026 pending approvals. - learn more

- Kate Somerville Skincare was acquired by Rare Beauty Brands, as Unilever moves to divest the prestige label it has owned for a decade. The deal includes the skincare and body-care lines as well as the brand’s Melrose Place clinic in Los Angeles; terms weren’t disclosed and closing is expected in Q4 2025 pending approvals. - learn more

- 3GC Group was acquired by Pandoblox, combining 3GC’s enterprise IT operations and cybersecurity services with Pandoblox’s Themis AI data platform to form a unified, AI-ready data and IT operations offering for mid-market companies. The deal aims to solve fragmented data and IT workflows so growing businesses can get enterprise-grade intelligence, security, and support through a single partner. - learn more

- The Free Press was acquired by Paramount, and co-founder Bari Weiss will become editor in chief of CBS News as part of the deal. Paramount says the move pairs CBS News’ scale with The Free Press’ voice, with Weiss reporting to CEO David Ellison and working to “modernize” the brand. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS