CPUC Votes To Change The Way California Will Compensate Rooftop Solar Energy

David Shultz reports on clean technology and electric vehicles, among other industries, for dot.LA. His writing has appeared in The Atlantic, Outside, Nautilus and many other publications.

Yesterday the California Public Utility Commission (CPUC) voted unanimously to enact sweeping changes to the way the state will compensate rooftop solar energy. The decision, which came after more than three hours of public comment in which rate payers, environmental advocates, and solar industry workers voiced their near-universal opposition to the policy change, will effectively reduce how much money new solar customers can expect to recoup by 75% or more.

At a time when California is attempting to transition to clean energy, opponents argued that the change to the net energy metering program (NEM) would cripple the rooftop solar industry and hamper the state’s progress on clean energy in favor of supporting the utility company’s monopoly on energy. In comments that were occasionally emotional to the point of being vitriolic, callers attempted to shame CPUC and cast them as shills for the corporate interests of Pacific Gas & Electric and Southern California Edison.

In fact, for many Californians who called into the vote today, the conversation seemed to have far less to do with how to make the transition equitable, and instead hinged upon the perception that the decision would be an economic windfall to utility companies and harm grid resilience. Rate payers railed against the utility company’s record-setting profits and negligent business practices that have cost the state billions in fire damages in addition to human lives. For many callers, the debate hinged on reducing reliance on monopolistic corporations rather than equitable decarbonization strategies.

Still, three hours of desperate pleading for a “no” vote did not sway the Commission. And the future of rooftop solar will look considerably different in California going forward. The new plan will tie the rates that solar customers receive to the time that they sell then energy back to the grid, thereby massively incentivizing investment in battery storage to complement solar systems.

The decision was destined to be controversial no matter the specifics. Back in 2021, the CPUC announced its intent to change the NEM rates with an even more drastic plan that included rate reductions and also essentially levied a $50 monthly tax on rooftop solar users. The backlash sent CPUC back to the drawing board to craft a more modest proposal. But early versions of today’s ruling were still cast as far too drastic by the solar industry and by opponents of the program.

The debate surrounding the changes is complex, but at its heart, the controversy boils down to two problems, according to the CPUC. One, the prior structure placed the cost of rooftop solar unfairly onto lower income residents. And two, the prior structure had become outdated, and rooftop solar owners were being overpaid for the energy their panels produced.

The Inequality Issue

Under the old NEM system, residents with rooftop solar were allowed to use any energy from their system to pay for their own energy costs instead of buying from the utility companies. Any extra energy they generated could be sold back to the grid at the standard rate that the Utility Company would charge to customers–between 23 and 35 cents per kilowatt-hour. At the end of the billing period, solar customers only pay for the energy they use minus what they sell back, hence the “net” in net energy metering.

But the utility companies don’t simply eat that cost. In fact, they don’t take a financial hit at all. In California, utility companies are paid a fixed amount for the service they provide. The companies charge a fixed rate for electricity that’s multiplied by how much energy is used by a household (or company or church etc). When less electricity is used, like in the case of rooftop solar, the utility companies respond by increasing the rate to ensure they’re paid their full amount. The more rooftop solar that gets added, the higher the rate goes. (This is an oversimplification, and the Utilities Commission technically has to approve any rate hikes on the basis of whether they’re warranted or not, but it captures what’s happening here nonetheless.)

This policy heavily incentivized residents to install rooftop solar so they use less electricity from the grid. But in doing so, it left those that can’t afford solar to pay the difference. An analysis by the Public Advocates Office at the CPUC showed that residents without rooftop solar were paying an extra $67 to $128 per year due to the cost of the old NEM programs. With the average cost of rooftop solar installation hovering around $12,000-$16,000, the prior policy was criticized as a regressive cost shift that functionally taxed the poor and gave to the rich. The CPUC and the utility companies argued that today’s decision is about rectifying that inequality.

Aligning Payouts with the Value of Energy

In addition to improving the inequality for lower income residents, the CPUC also claims that their new net energy metering policy (dubbed NEM 3.0) will modernize the incentive structure to align with the needs of the grid.

As mentioned above, under the previous version of NEM, residents typically received between 25 and 35 cents per kWh of energy they sold back to the grid, because that’s what the utility companies would’ve charged. In other words, the retail price. But for utility companies, that price also includes money spent on grid hardening, infrastructure, maintenance, vegetation management, R&D, and myriad other fixed costs.

Couple that with the fact that adding energy to the grid,n the middle of the day, when the grid is ripe with solar and other renewables, the value of adding more energy to the system can drop to basically zero. “Retail net energy metering was a good way to get industry started,” says Matt Baker, the Director of the CPUC's Public Advocates Office. “It's a terrible way to try to decarbonize after we've already gotten started.”

Which is why under NEM 3.0, solar customers will be compensated based on when they export their energy to the grid, with different values assigned to each hour of the day, each month, and weekdays versus weekends. These rates also vary by utility company, but on average, solar customers can expect to receive about five to eight cents per kilowatt-hour starting in April 2023, which obviously constitutes a major reduction.

Batteries Take the Limelight

Due to the increased importance of timing in the new export rates under NEM 3.0, batteries have become a major pillar of the new policy since they let owners store their solar energy and sell it back to the grid when demand and export rates are higher. In fact, the new policy effectively makes it economically untenable to install rooftop solar without one. “So whereas before, you would get 30 cents a kilowatt-hour in the middle of the day, now that will be paid at avoided costs–five, six, seven cents, depending on where you are,” says Baker. “But in the evening, you can earn 20 times that amount. You can earn a dollar or more [per kilowatt-hour] depending on where you are.” The idea, says Baker, is to incentivize customers to sell their energy back when the grid is low on renewables and energy demand is highest. But even the CPUC admits that the proposed changes will make rooftop solar less profitable for residents overall. The goal, the Commission says, is to have solar systems pay for themselves within nine years, versus the four or five that most customers experienced under NEM 2.0.

Industry Frustrated by Short “Glide Path”

It’s important to note that all of these changes in NEM 3.0 will only affect new rooftop solar projects. Existing NEM 1.0 and 2.0 customers will retain their current rates for 20 years. NEM 3.0 also includes provisions that add extra money–a few cents per kilowatt-hour–to the rates that customers will receive for the next several years as the transition plays out.

But opponents argue that’s simply not enough and that the plan’s aggressive export pricing reductions will cripple the solar industry. “All the good innovation and progress that we want to see in California will be severely hampered if they go forward with what's on paper right now,” said Bernadette Del Chiaro Executive Director, California Solar & Storage Association (CALSSA) in the lead up to the vote this week. Del Chiaro agrees that the grid needs more batteries and that the current model unfairly places the cost of rooftop solar onto lower-income residents. But she says NEM 3.0 is too drastic, and the changes should come more gradually. “We all want to see more energy storage, but you can't get there overnight. And what the commission wants to do is make the future appear on April 15, 2023, when these new regulations would go into effect,” said Del Chiaro earlier in the week. “That simply will just throw the whole market over a cliff. It's too drastic, it's too extreme, and it runs counter to everything California wants to see.”

Del Chiaro and many other solar industry representatives have begged the Commission for a longer “glide path” towards its goals. They argue that battery technology is still too expensive–it typically increases the cost of a solar system by about a third–and regulators should wait for the technology to mature and come down in cost before essentially mandating its adoption. The CPUC points to the many government incentives at both the state and federal level that are targeted at reducing the cost of battery installation. But again, Del Chiaro and CALSSA counter that timing is the problem and many of these programs are not yet online and will likely still not be available when NEM 3.0 goes into effect in April.

The solar industry also wants to see the export rate reduction occur more gradually. Walker Wright, the Vice President of Public Policy at Sunrun, one of the nation’s largest rooftop solar providers, said he thought an initial 35% reduction in export rates would’ve been much more reasonable than the 75% that the CPUC pushed through today. “It all goes back to the timeline on how we can get there so that the industry doesn't see damage,” said Wright earlier in the week. “I just think it needs to be less drastic at the beginning.”

If NEM 3.0 does drive solar adoption downward, which seems likely, it will slow California’s progress on achieving its ambitious renewable energy goals and likely allow companies like PG&E to retain their monopoly on the energy market for longer. The CPUC is keenly aware of the tradeoffs, but their vote today seems to indicate that they consider them worthwhile.

- Are EV School Buses the Key to Charging California’s Power Grid? ›

- PG&E Launches Vehicle-to-Everything Pilot Program (With Massive Caveats) ›

- How Haven Energy is Making Battery Installation Easier - dot.LA ›

David Shultz reports on clean technology and electric vehicles, among other industries, for dot.LA. His writing has appeared in The Atlantic, Outside, Nautilus and many other publications.

Image Source: Perelel

Image Source: Perelel

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

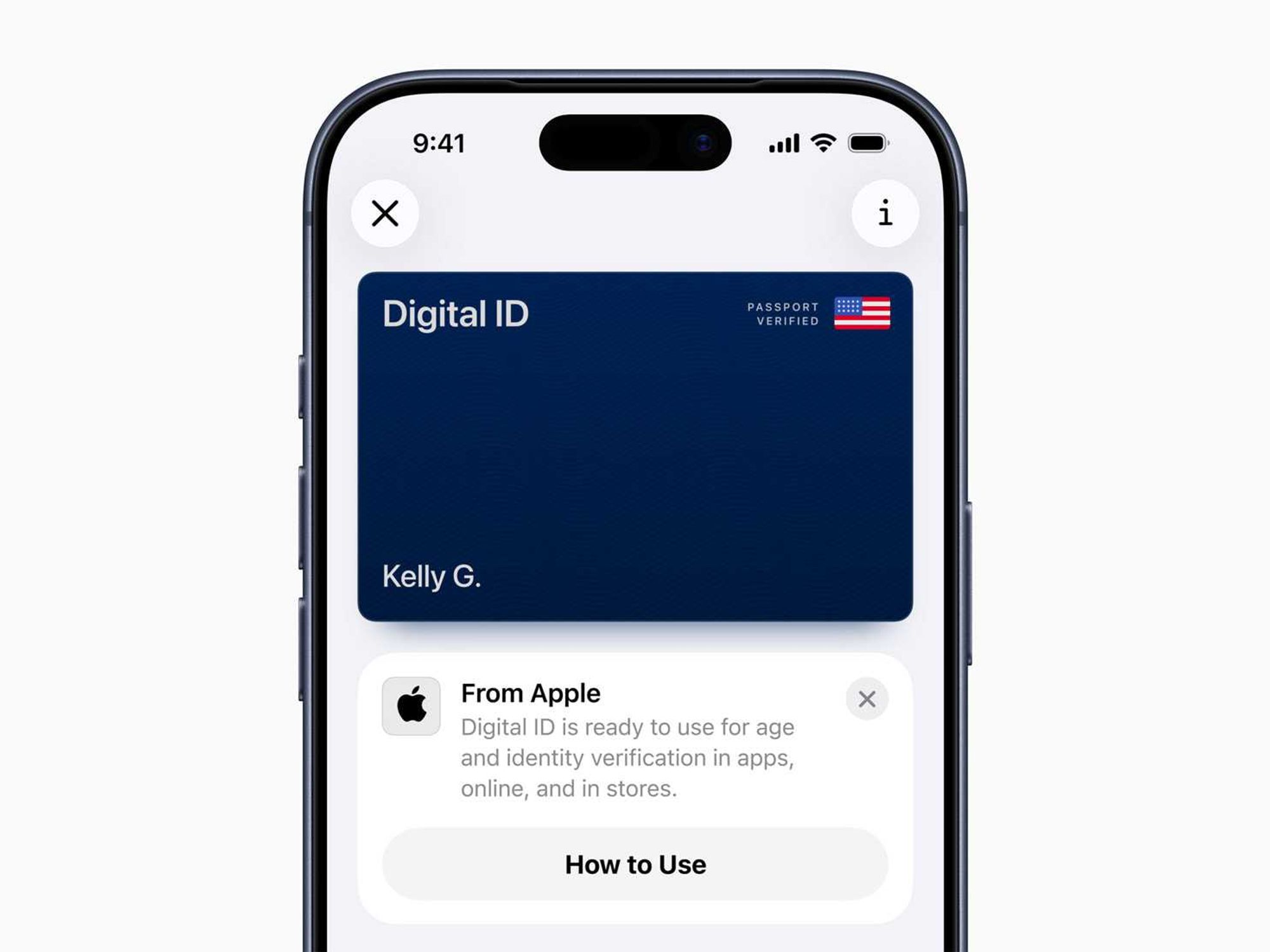

Image Source: Waymo Image Source: Apple

Image Source: Apple