Get in the KNOW

on LA Startups & Tech

X

Illustration by Ian Hurley

What Are LA’s Hottest Startups of 2022? See Who VCs Picked in dot.LA’s Annual Survey

Harri Weber

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

In Los Angeles—like the startup environment at large—venture funding and valuations skyrocketed in 2021, even as the coronavirus pandemic continued to surge and supply chain issues rattled the economy. The result was a startup ecosystem that continued to build on its momentum, with no shortage of companies raising private capital at billion-dollar-plus unicorn valuations.

In order to gauge the local startup scene and who’s leading the proverbial pack, we asked more than 30 leading L.A.-based investors for their take on the hottest firms in the region. They responded with more than two dozen venture-backed companies; three startups, in particular, rose above the rest as repeat nominees, while we've organized the rest by their amount of capital raised as of January, according to data from PitchBook. (We also asked VCs not to pick any of their own portfolio companies, and vetted the list to ensure they stuck to that rule.)

Without further ado, here are the 26 L.A. startups that VCs have their eyes on in 2022.

1. Whatnot ($225.4 million raised)

Whatnot was the name most often on the minds of L.A. venture investors—understandably, given its prolific fundraising year. Whatnot raised some $220 million across three separate funding rounds in 2021, on the way to a $1.5 billion valuation.

The Marina del Rey-based livestream shopping platform was founded by former GOAT product manager Logan Head and ex-Googler Grant LaFontaine. The startup made its name by providing a live auction platform for buying and selling collectables like rare Pokémon cards, and has since expanded into sports memorabilia, sneakers and apparel.

2. Boulevard ($40.3 million raised)

Boulevard’s backers include Santa Monica-based early-stage VC firm Bonfire Ventures, which focuses on B2B software startups. The Downtown-based company fits nicely within that thesis; Boulevard builds booking and payment software for salons and spas. The firm has worked with prominent brands such as Toni & Guy and HeyDay.

3. GOAT ($492.7 million)

GOAT launched in 2015 as a marketplace to help sneakerheads authenticate used Air Jordans and other collectible shoes. It has since grown at a prolific rate, expanding into apparel and accessories and exceeding $2 billion in merchandise sales in 2020. The startup sealed a $195 million funding round last summer that more than doubled its valuation, to $3.7 billion.

The Best of the Rest

VideoAmp ($578.6 raised)

Nielsen competitor VideoAmp gathers data on who's watching what across streaming services, traditional TV and social apps like YouTube. The company positions itself as an alternative to so-called "legacy" systems like Nielsen, which it says are "fragmented, riddled with complexity and inaccurate." In addition to venture funding, its total funding figure includes more than $165 million in debt financing.

Mythical Games ($269.4 million raised)

Seizing on the NFT craze, Mythical Games is building a platform that powers the growing realm of “play-to-earn games.” Backed by NBA legend Michael Jordan and Andreessen Horowitz, the Sherman Oaks-based startup’s partners include game publishers Abstraction, Creative Mobile and CCG Lab.

FloQast ($202 million raised)

FloQast founder Michael Whitmire says he got a “no” from more than 100 investors in the process of raising a seed round. Today, the accounting software company is considered a unicorn.

Nacelle ($70.8 million raised)

Nacelle produces docuseries, books, comedy albums and podcasts. The media company’s efforts include the Netflix travel series “Down To Earth with Zac Efron.”

Wave ($66 million raised)

A platform for virtual concerts, Wave has hosted performances by artists including Justin Bieber, Tinashe and The Weeknd. The company says it has raised $66 million to date from the likes of Warner Music and Tencent.

Papaya ($65.2 million raised)

Sherman Oaks-based Papaya looks to make it easier to pay “any” bill—from hospital bills to parking tickets—via its mobile app.

LeaseLock ($63.2 million raised)

Based in Marina del Rey, LeaseLock says it’s on a mission to eliminate security deposits for apartment renters.

Emotive ($58.1 million raised)

Emotive sells text message-focused marketing tools to ecommerce firms like underwear brand Parade and men's grooming company Beardbrand.

Dray Alliance ($55 million raised)

Based in Long Beach, Dray says its mission is to “modernize the logistics and trucking industry.” Its partners include Danish shipping company Maersk and toy maker Mattel.

Coco ($43 million raised)

Coco makes small pink robots on wheels (you may have seen them around town) that deliver food via a remote pilot. Its investors include Y Combinator and Silicon Valley Bank.

HiveWatch ($25 million raised)

HiveWatch develops physical security software. Its investors include former Twitter executive Dick Costollo and NBA star Steph Curry’s Penny Jar Capital.

Popshop ($24.5 million raised)

Whatnot competitor Popshop is betting that live-shopping is the future of ecommerce. The West Hollywood-based firm focuses on collectables such as trading cards and anime merchandise.

First Resonance ($19.4 million raised)

Founded by former SpaceX engineer Karan Talati, First Resonance runs a software platform for makers of electric cars and aerospace technology. Its clients include Santa Cruz-based air taxi company Joby Aviation and Alameda-based rocket company Astra.

Open Raven ($19 million raised)

Founded by Crowdstrike and Microsoft alums, Open Raven aims to protect user data. The cybersecurity firm’s investors include Kleiner Perkins and Upfront Ventures.

Fourthwall ($17 million raised)

When an actor faces the camera and speaks directly to the audience, it’s known as “breaking the fourth wall.” Named after the trope, Venice-based Fourthwall offers a website builder that’s designed for content creators.

The Non Fungible Token Company ($15 million raised)

The Non Fungible Token Company creates NFTs for musicians under the name Unblocked. Its investors include Jay Z’s Marcy Venture Partners and Shawn Mendez.

Safe Health Systems ($15 million raised)

Backed by Mayo Clinic Ventures, Safe Health develops telehealth software and offers tools for enterprises to launch their own health care apps.

Intro ($11.6 million raised)

Intro’s app lets you book video calls with experts—from celebrity stylists, to astrologists, to investors.

DASH Systems ($8.5 million raised)

With the tagline “Land the package, not the plane,” DASH Systems is a Hawthorne-based shipping company that builds hardware and software for automated airdrops.

Ettitude ($3.5 million raised)

With a focus on sustainability, Ettitude is a direct-to-consumer brand that sells bedding, bathroom textiles and sleepwear.

Afterparty ($3 million raised)

Along similar lines as Unblocked, Afterparty creates NFTs for artists and content creators such as Clay Perry and Tropix.

Heart to Heart ($0.75 million raised)

Heart to Heart is an audio-focused dating app that “lets you listen to the story behind the pictures in a profile.” Precursor Ventures led the pre-seed funding round.

Frigg (undisclosed)

Frigg makes hair and beauty products that contain cannabinoids such as CBD. The Valley Village-based company raised an undisclosed seed round in August.

From Your Site Articles

- The Early-Stage Startups in LA Set to Take Off in 2021 - dot.LA ›

- Los Angeles Startups Closed a Record Number of Deals in Q3 - dot.LA ›

- dot.LA's Map of Startups in Los Angeles - dot.LA ›

- The Hottest LA Startups of 2020 - dot.LA ›

- Los Angeles Cleantech Incubator Launches Green Loan Fund - dot.LA ›

- dot.LA's Guide on L.A. Flight Startups Overair, Archer Aviation - dot.LA ›

- Here Are LA’s Hottest Startups for 2023 - dot.LA ›

- Nobody Studios Plans to Build 100 Startups in Five Years - dot.LA ›

- From GameTree to Sota — Ukrainian Founders Call LA Home - dot.LA ›

Related Articles Around the Web

Harri Weber

Harri is dot.LA's senior finance reporter. She previously worked for Gizmodo, Fast Company, VentureBeat and Flipboard. Find her on Twitter and send tips on L.A. startups and venture capital to harrison@dot.la.

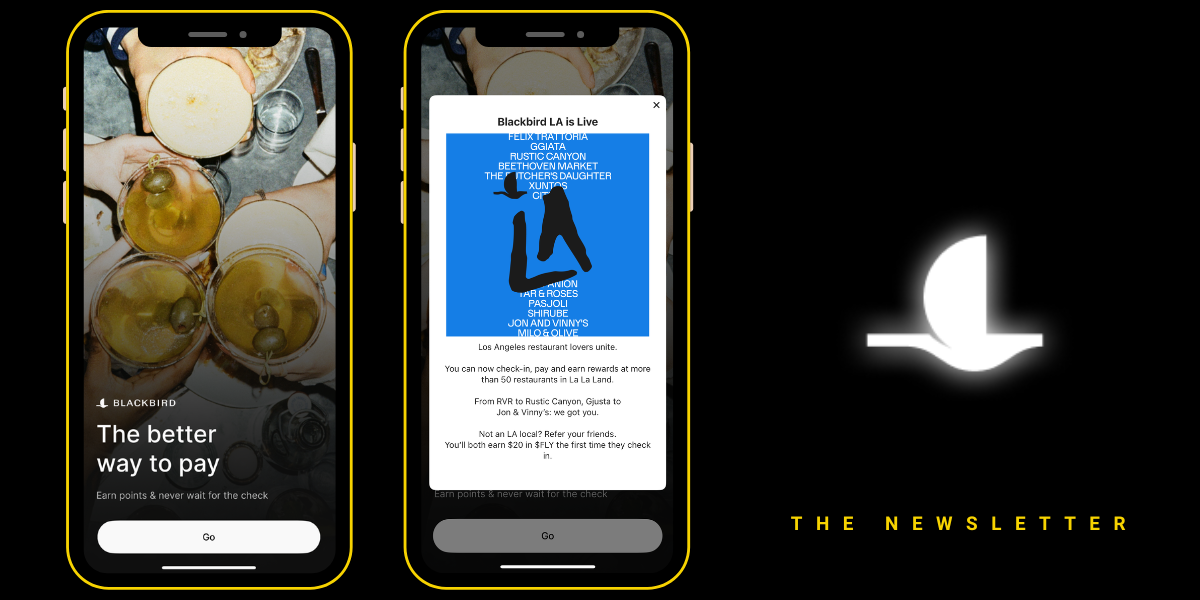

Resy Cofounder’s New App Lands in LA: A Loyalty Tool Restaurants Actually Want

10:08 AM | October 24, 2025

🔦 Spotlight

Hello LA,

Blackbird, the loyalty and payments startup from Resy and Eater co-founder Ben Leventhal, officially landed in LA this week. The product is simple in the wild: you check in, pay through the app, and earn rewards that restaurants can actually act on, helping them spot and serve regulars without guessing. The LA launch goes live with more than 50 partners centered on the Westside, including names like Gjelina and Felix, plus spots across groups such as Rustic Canyon and Citrin, with expansion planned beyond Venice and Santa Monica.

Under the hood, Blackbird has been building a national network and says it is live at more than 1,000 restaurants. The company raised fresh capital earlier this year to expand markets and roll out cross-restaurant rewards, positioning LA as a key beachhead for growth. If you dine out a lot, the appeal is that the app collapses discovery, payment, and loyalty into one flow. If you run a dining room, the promise is cleaner data on guests you actually see, instead of a generic points program that lives somewhere else.

For LA specifically, the draw is that this model fits how the city eats. We spread across neighborhoods, follow chefs, and rotate between a small set of favorites and a long list of next-ups. A networked loyalty layer that recognizes that pattern could move real dollars, particularly for independents that want to keep the relationship direct. We’ll be watching how quickly the footprint moves east from the coast and which operators lean into memberships and targeted rewards first.

Scroll for this week’s LA venture deals, funds, and acquisitions.

🤝 Venture Deals

LA Companies

- GammaTime, a Los Angeles based premium micro drama platform founded by former Miramax CEO Bill Block, raised $14M seed led by vgames and Pitango, with participation from Alexis Ohanian, Kris Jenner, Kim Kardashian, and Traverse Ventures. The app is live on iOS and Android, features more than 20 vertical phone native originals, and plans new series from “CSI” creator Anthony E. Zuiker as it scales a freemium model for U.S. audiences. - learn more

- Wolf Games, a generative-AI gaming startup backed by Dick Wolf, raised a $9M Series A led by Main Street Advisors. The company also inked a partnership with NBCUniversal to develop interactive games using NBCU IP, built on Wolf Games’ platform for creating “living, cinematic” game worlds. Notable participants include Maverick Carter, Tom Werner, and Rashid Johnson, alongside returning investors Jimmy Iovine, Paul Wachter, and Dick Wolf. - learn more

- Quantum Elements, a Los Angeles based startup, launched Constellation, an AI native platform that helps teams build quantum software and co design hardware using agentic AI, natural language prompts, and a large noisy qubit simulator. The company emerged from stealth with funding from QDNL Participations and support from USC Viterbi, and says Constellation can speed code generation, debugging, and testing for applications in pharma, energy, and finance. - learn more

- Arbor Energy raised a $55M Series A co-led by Lowercarbon Capital and Voyager Ventures, with Gigascale Capital and Marathon Petroleum Corporation participating, to accelerate deployment of its zero-emission, fuel-flexible turbines. The funding completes a 1 MW pilot called ATLAS and advances HALCYON, a 25 MW modular turbine that uses oxy-combustion with supercritical CO₂ for efficient, carbon-neutral baseload power aimed at data centers, utilities, and industrial customers. - learn more

- Dialogue AI raised a $6M seed led by Lightspeed Venture Partners to scale its AI-native research platform, which uses a live conversational AI interviewer to run real-time customer interviews and deliver insights faster. Participants include Seven Stars, Uncommon Projects, the Tornante Company, and notable angels, and the funds will accelerate product and go-to-market efforts with early customers such as Wayfair, Square, Nextdoor, and Suno. - learn more

LA Venture Funds

- March Capital participated in Uniphore’s $260M Series F, joining strategic investors NVIDIA, AMD, Snowflake, and Databricks. The funding will accelerate development and adoption of Uniphore’s Business AI Cloud and expand its partner ecosystem, alongside investors like NEA, BNF Capital, National Grid Partners, and Prosperity7 Ventures. - learn more

- Beast Ventures participated in Nutropy’s latest funding round to scale precision-fermented casein for next-gen dairy ingredients. The France-based startup will use the capital to ramp production and deliver larger samples of its “cheeseable milk” powder to food manufacturers as it targets a 2027 launch. - learn more

- Patron participated in Notch’s $8M seed financing round, alongside investors such as Wing, Samsung, and Balaji, to scale the company’s AI platform for generating performance ads. Notch has since launched a “URL-to-animated-ads” feature that turns a product link into ready-to-run animated creatives within minutes, supporting a faster workflow for marketers rolling out motion ads. - learn more

- B Capital participated in CurbWaste’s $28M Series B, which was led by Socium Ventures with Flourish Ventures, TTV Capital, and Squarepoint Capital also joining. The funding brings total capital to $50M and will accelerate product and go-to-market work on CurbWaste’s operating system for independent waste haulers, including AI-driven dispatch, reporting, and payments. - learn more

- Thin Line Capital participated in SenseNet’s $14M Series A to scale its AI wildfire-detection network in the United States. The round was led by Stormbreaker with Fusion Fund, Plaza Ventures, FOLD36 Capital, and B Current also joining; funds go toward new offices and installations as SenseNet fuses gas sensors, AI cameras, satellites, and weather data to spot fires before they are visible. The company says it already monitors about 130 million acres and can flag ignitions within minutes. - learn more

- MANTIS Venture Capital participated in Keycard’s $38M financing for its identity and access platform for AI agents. The combined seed and Series A were led by Andreessen Horowitz, Acrew Capital, and Boldstart Ventures, and coincide with Keycard’s early-access launch. Keycard says its system issues short-lived, auditable identity tokens to help developers govern agent actions and data across apps. - learn more

- WndrCo participated in Defakto’s $30.75M Series B, a round led by XYZ Venture Capital with The General Partnership and Bloomberg Beta also joining. Defakto, formerly SPIRL, builds a Non-Human Identity and Access Management platform that replaces static credentials with dynamic, auditable identities for services, pipelines, workloads, and AI agents across multi-cloud environments. The company will use the capital to accelerate product development and expand go-to-market efforts. - learn more

- CIV co led 1001’s $9M round alongside General Catalyst and Lux Capital to build an AI native operating system for decision making in critical industries. 1001 combines live data ingestion, operational mapping, AI driven decisioning, and governance to help operators act in real time, with early pilots in aviation, logistics, and large infrastructure projects. The raise also includes backers like Chris Ré and Amjad Masad and will fund early deployments and hiring in Dubai, London, and beyond. - learn more

- Brentwood Associates led Throne Labs’ $15M Series B initial close to expand the company’s smart restroom infrastructure across new and existing U.S. markets. Existing investors including Uncorrelated Ventures, DiPalo Ventures, Rabil Ventures, and Arpiné Capital participated as Throne scales its network of sensor-equipped, ADA-compliant restrooms and city partnerships. - learn more

- M13 led Estuary’s $17M Series A, with participation from FirstMark and Operator Partners, to scale the company’s “right-time data” platform. Estuary unifies change data capture, streaming, and batch into one managed system with BYOC deployment so enterprises can control latency and feed AI applications more reliably; funds will support product and go-to-market expansion. - learn more

- Strong Ventures provided follow-on funding in Unjeonseonsaeng’s ₩2.8B (~$2.0M) Series A, backing the driving-school comparison and booking platform as it scales nationwide. New investors Fast Ventures and Korea Credit Guarantee Fund joined the round, with proceeds going to expand the company’s SaaS tools for driving schools and enhance data-driven features like AI recommendations and advertising. The startup reports monthly GMV above ₩1B and its first profitable quarter in 2025. - learn more

- Interlagos led Adaptyx Biosciences’ $14M seed, with Hyperlink Ventures participating alongside Overwater Ventures, Starbloom Capital, Stanford University, the Chan Zuckerberg Biohub, and others. Adaptyx is developing a biowearable for continuous, multi-analyte molecular monitoring; the raise brings total funding to about $23M and supports R&D, clinical progress toward FDA clearance, and platform scaling. - learn more

- B Capital participated in Faeth Therapeutics’ new $25M financing, which brings the company’s total funding to $92M and supports a randomized Phase 2 trial of its PIKTOR regimen in endometrial cancer with the GOG Foundation. The raise, led by S2G Ventures with additional new and existing backers, follows Phase 1b data showing an 80% overall response rate and 11-month median PFS when PIKTOR was combined with paclitaxel. - learn more

- Btech Consortium participated in PortX’s strategic growth round, joining renewed backers alongside new investors Allied Solutions and the American Bankers Association. The funding extends PortX’s Series B and underscores industry support for its AI-powered data integration platform for banks and credit unions. - learn more

LA Exits

- Breez was acquired by JumpCloud to bolster JumpCloud’s identity threat detection and response capabilities and accelerate its security roadmap. The deal brings Breez’s ITDR technology and team into JumpCloud’s platform; terms were not disclosed. The Breez group is led by former Adobe executive Abhinav Srivastava. - learn more

Read moreShow less

LA Venture: How WorkLife Ventures Founder Brianne Kimmel Became a Top Angel Investor

05:23 AM | August 26, 2021

How do angel investors get in front of companies prior to investing? Brianne Kimmel, founder of WorkLife Ventures, might know a way or two.

On this episode of the LA Venture podcast, Kimmel discusses her work as an investor — how she gets into rounds, how she established herself as a top angel investor and then transitioned into a fund manager and her thoughts on work and life.

"I highly encourage people to build a list of companies that you would love to work with because founders really appreciate when you become very excited about their product and when you make that next step of finding ways to be helpful," Kimmel says.

Business Insider recently named Kimmel as a "top angel investor everyone should know," and for good reason. Kimmel is an early investor in companies like Hopin, Pipe, Webflow, Tandem and many others.

Kimmel tells L.A. Venture that her road to launching a venture capital firm did not come without obstacles. Traditional VCs and others discouraged her from trying to start her own fund.

"I had talked to a number of traditional VC firms. And many of them were like, 'this isn't going to happen. Like, you can go get your MBA and you could probably come in as an associate. But I think what you're trying to do is like a pretty big career leap'," she said.

But she launched her own firm, anyway. She adds that it has been a lot of "hard work and a lot of learning and educating myself on evenings and weekends."

Kimmel shares insight on the Gen Z communities she's a part of and talks about how they are choosing jobs based on their values and how companies are adapting.

Kimmel is a believer in product-led growth and that bottom up software-as-a-service is replacing the past enterprise sales notion of steak dinners and the like. She also believes that the tools available today empower everyone to be an entrepreneur and says that is the future of work.

dot.LA Audience Engagement Editor Luis Gomez contributed to this post.

Want to hear more of L.A. Venture? Listen on Apple Podcasts, Stitcher, Spotify or wherever you get your podcasts.

From Your Site Articles

Related Articles Around the Web

Read moreShow less

Minnie Ingersoll

Minnie Ingersoll is a partner at TenOneTen and host of the LA Venture podcast. Prior to TenOneTen, Minnie was the COO and co-founder of $100M+ Shift.com, an online marketplace for used cars. Minnie started her career as an early product manager at Google. Minnie studied Computer Science at Stanford and has an MBA from HBS. She recently moved back to L.A. after 20+ years in the Bay Area and is excited to be a part of the growing tech ecosystem of Southern California. In her space time, Minnie surfs baby waves and raises baby people.

RELATEDTRENDING

LA TECH JOBS