Get in the KNOW

on LA Startups & Tech

X

Evan Xie

LA’s Hottest Startups for 2023

Decerry Donato

Decerry Donato is a reporter at dot.LA. Prior to that, she was an editorial fellow at the company. Decerry received her bachelor's degree in literary journalism from the University of California, Irvine. She continues to write stories to inform the community about issues or events that take place in the L.A. area. On the weekends, she can be found hiking in the Angeles National forest or sifting through racks at your local thrift store.

Los Angeles, like the rest of the startup world, saw a dip in global venture funding. As of November 2022, funding reached $22 billion, which is 69% lower than the previous year.

Despite the massive downturn in funding due to the decline in technology stocks at the end of 2021 combined with concerns about rising inflation, it did not stop the startups on this list from raising funding. We asked more than 30 leading L.A.-based investors for their take on the hottest firms in the region. (We also asked VCs not to pick any of their own portfolio companies, and vetted the list to ensure they stuck to that rule.)

They selected a few live-shopping platforms, space startups and payment software companies and we've organized the list based on the amount of capital raised as of January, according to data from PitchBook.

Here are the eight L.A. startups VCs have their eyes on as they look ahead to 2023.

Anduril ($2.32B raised)

Given how much the company has raised to date, it was no surprise that Costa Mesa-based defense technology startup and U.S. military contractor Anduril was the name that most often came up among L.A. venture investors.

Oculus co-founder Palmer Luckey, Founders Fund partner Trae Stephens, ex-Palantir executives Matt Grimm and Brian Schimpf founded Anduril in 2017. The startup is most known for its core software product, an operating system called Lattice, which is used to detect potential security threats.

To date, the startup has received investments from Andreessen Horowitz, Founders Fund, General Catalyst, D1 Capital Partners and venture capitalist Elad Gil.

ServiceTitan ($1.1B raised)

Earlier this year, the Glendale-based firm filed for an initial public offering. Since its founding in 2012, the company’s co-founders, Ara Mahdessian and Vahe Kuzoyan built its software for a wide range of service industries, from plumbing and landscaping to pest control and HVAC.

The company’s growth is largely driven by its ability to acquire other businesses, including landscaping software provider Aspire and pest control-focused platforms ServicePro and, earlier this month, FieldRoutes.

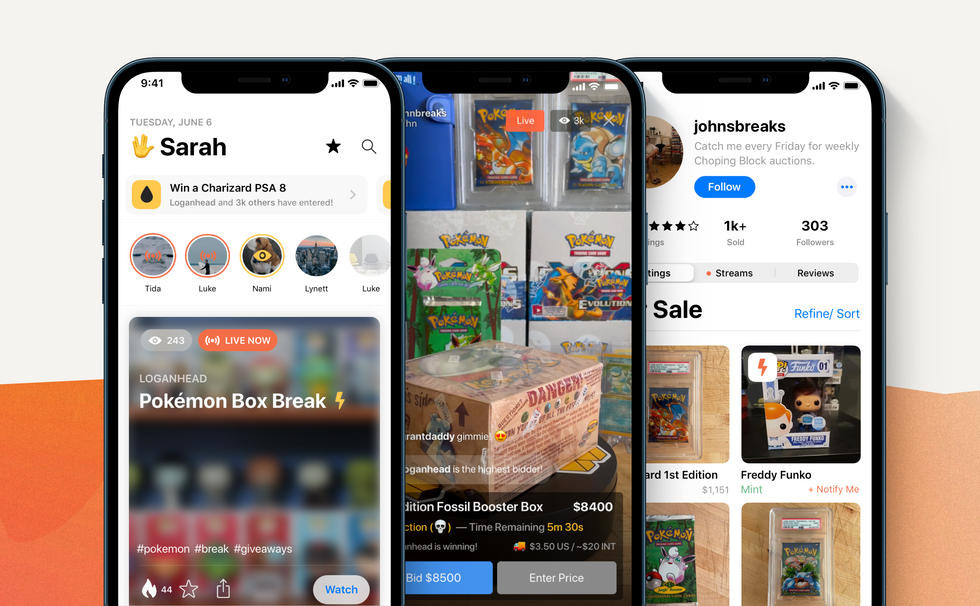

Whatnot ($484.41M raised)

The Marina del Rey-based livestream shopping platform makes the ‘Hottest Startups’ list for a second year in a row. The online marketplace was founded by former GOAT product manager Logan Head and ex-Googler Grant LaFontaine and made its name by providing a live auction platform for buying and selling collectables like rare Pokémon cards, and has since expanded into sports memorabilia, sneakers and apparel.

It’s no secret that its success is in part, due to the partnerships Whatnot inked this year, like UFC fighter Jorge Masdival to sell sports collectibles on the platform. Along with science fiction/fantasy comics publisher Heavy Metal to bring out original content for the Whatnot community.

Boulevard ($110.35M raised)

Los Angeles-based salon booking app Boulevard attracted backers including Santa Monica-based early-stage VC firm Bonfire Ventures, which focuses on B2B software startups. The startup builds booking and payment software for salons and spas and now it now serves 25,000 professionals across 2,000 salons. Boulevard has also worked with prominent brands such as Toni & Guy and HeyDay.

Varda Space ($53M raised)

Space manufacturing startup Varda focuses on designing, developing, and manufacturing products that benefit from low gravity. The products that the El segundo-based company manufactures in space are intended to be brought back down with the hope that it will improve life on earth. The forward-thinking company was founded by Founders Fund partner Delian Asparouhov and former SpaceX officer Will Bruey.

Papaya (65.2 million)

Sherman Oaks-based Papaya was founded by Patrick Kann and Jason Metzler. The company was built to make it easier for consumers to pay “any” bills — whether it's a hospital bill or a parking ticket — all on the mobile app. To pay, users take a picture of their bill and type in the amount they want to send as long as the end user has a mailing address or an online payment portal. Papaya utilizes optical character recognition, a software that enables the app to look at every bill — no matter what the format is — and recognize each piece of information.

Impulse Space ($30 million raised)

Based in El Segundo, Impulse Space creates orbital maneuvering vehicles capable of delivering multiple payloads to unique orbits from a single launch. Founded in 2021 by former SpaceX exec Tom Mueller built his company as a last-mile delivery partner for future inter-space missions, like servicing space stations. In July, the space startup inked a deal with Long Beach-based reusable rocket maker Relativity Space to accelerate the entry of its rover into Mars.

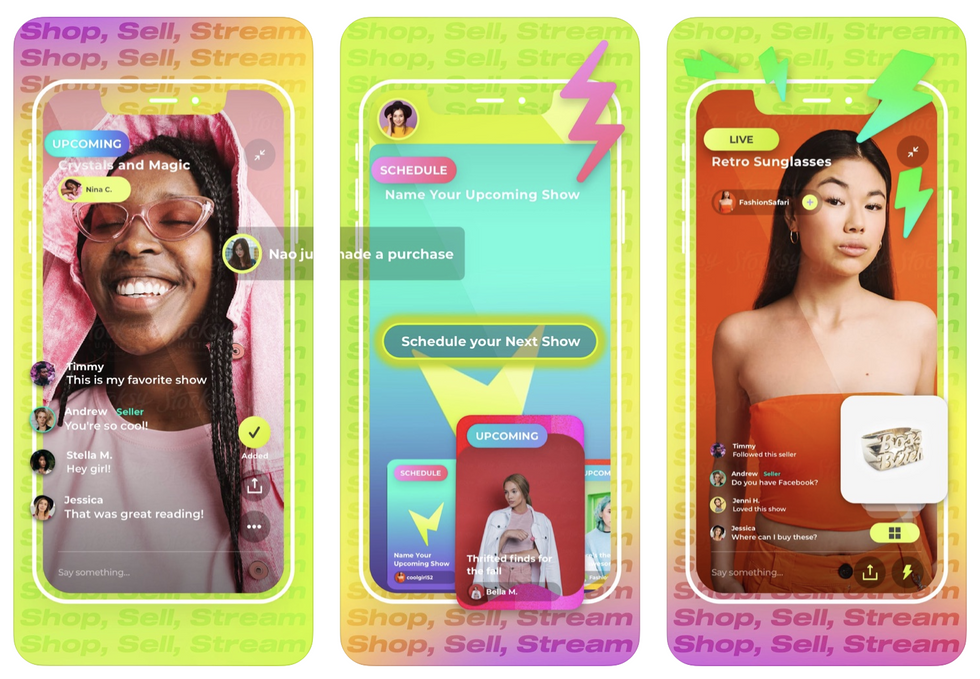

Popshop Live (24.5 million raised)

Whatnot competitor Popshop Live is betting that live-shopping is the future of ecommerce. The West Hollywood-based company primarily focuses on selling collectables such as trading cards and anime merchandise.

In the summer of 2021, the company bolstered its team by hiring former Instagram and Instacart executive Bangaly Kaba to lead platform growth and former head of Uber Eats Jason Droege to lead expansion.

From Your Site Articles

- Here Are the dot.LA/PitchBook 50 Hottest Los Angeles Startups for Q2 ›

- Here Are the LA Seed Startups Top VCs Wish They'd Invested In ›

- LA is the Third-Largest Startup Ecosystem in the US ›

- What Are LA’s Hottest Startups of 2022? See Who VCs Picked in dot.LA’s Annual Survey ›

- How To Startup: Part 1: Ideation ›

- What Are LA’s Hottest Startups of 2021? We Asked Top VCs to Rank Them ›

- Nobody Studios Plans to Build 100 Startups in Five Years - dot.LA ›

- From GameTree to Sota — Ukrainian Founders Call LA Home - dot.LA ›

Related Articles Around the Web

Decerry Donato

Decerry Donato is a reporter at dot.LA. Prior to that, she was an editorial fellow at the company. Decerry received her bachelor's degree in literary journalism from the University of California, Irvine. She continues to write stories to inform the community about issues or events that take place in the L.A. area. On the weekends, she can be found hiking in the Angeles National forest or sifting through racks at your local thrift store.

Pontifax AgTech's Gil Demeter on Investing in the Next Generation of Robotics and Bioscience

07:22 AM | January 15, 2021

Photo by Jan Kopřiva on Unsplash

On this week's episode of LA Venture, hear from Gil Demeter, the vice president at Pontifax AgTech. We had a great discussion about next generation robotics and bioscience. Pontifax AgTech has over $465 million in assets under management, and is one of the largest food and agtech funds in the world.

Key Takeaways

- Pontifax is a growth-stage investor in food and agriculture technology, and invests somewhere in between late-stage venture and early-stage growth.

- Typically, their investments range from $15 to $25 million in initial capital and typically twice that over the lifetime of the company.

- Gil notes that farmers are pretty sophisticated when it comes to new tech and utilize multiple pieces of software. Growers don't necessarily have the whole institution backed up to analyze it.

- Gil says labor and water are the two biggest issues for growers, distributors, and many others in the agricultural ecosystem.

- When it comes to agriculture, gene editing is huge, as is innovation around natural, usually organic solutions to spur growth in crops without having to put more inputs, chemicals or expensive seed into the process to yield a better result.

- Food tech has blown up in the last five years and intersects with interest in health tech - including food and diet.

Gil Demeter is vice president at Pontifax AgTech.

Want to hear more of L.A. Venture? Listen on Apple Podcasts, Stitcher, Spotify or wherever you get your podcasts.

From Your Site Articles

- LA Venture Podcast: Lux Capital Bets On Deep-Tech Founders ... ›

- Los Angeles Venture Capitalists on the LA Venture Podcast - dot.LA ›

- Tracy Gray And Why Exports Are The Untapped Opportunity for the US ›

- The 22 Fund's Tracy Gray on Exports Untapped Opportunity - dot.LA ›

- Westlake Village BioPartners Aims to Catalyze Biotech in LA - dot.LA ›

- Westlake Village BioPartners Aims to Catalyze Biotech in LA - dot.LA ›

Related Articles Around the Web

Read moreShow less

Minnie Ingersoll

Minnie Ingersoll is a partner at TenOneTen and host of the LA Venture podcast. Prior to TenOneTen, Minnie was the COO and co-founder of $100M+ Shift.com, an online marketplace for used cars. Minnie started her career as an early product manager at Google. Minnie studied Computer Science at Stanford and has an MBA from HBS. She recently moved back to L.A. after 20+ years in the Bay Area and is excited to be a part of the growing tech ecosystem of Southern California. In her space time, Minnie surfs baby waves and raises baby people.

Here's How To Get a Digital License Plate In California

03:49 PM | October 14, 2022

Photo by Clayton Cardinalli on Unsplash

Thanks to a new bill passed on October 5, California drivers now have the choice to chuck their traditional metal license plates and replace them with digital ones.

The plates are referred to as “Rplate” and were developed by Sacramento-based Reviver. A news release on Reviver’s website that accompanied the bill’s passage states that there are “two device options enabling vehicle owners to connect their vehicle with a suite of services including in-app registration renewal, visual personalization, vehicle location services and security features such as easily reporting a vehicle as stolen.”

Reviver Auto Current and Future CapabilitiesFrom Youtube

There are wired (connected to and powered by a vehicle’s electrical system) and battery-powered options, and drivers can choose to pay for their plates monthly or annually. Four-year agreements for battery-powered plates begin at $19.95 a month or $215.40 yearly. Commercial vehicles will pay $275.40 each year for wired plates. A two-year agreement for wired plates costs $24.95 per month. Drivers can choose to install their plates, but on its website, Reviver offers professional installation for $150.

A pilot digital plate program was launched in 2018, and according to the Los Angeles Times, there were 175,000 participants. The new bill ensures all 27 million California drivers can elect to get a digital plate of their own.

California is the third state after Arizona and Michigan to offer digital plates to all drivers, while Texas currently only provides the digital option for commercial vehicles. In July 2022, Deseret News reported that Colorado might also offer the option. They have several advantages over the classic metal plates as well—as the L.A. Times notes, digital plates will streamline registration renewals and reduce time spent at the DMV. They also have light and dark modes, according to Reviver’s website. Thanks to an accompanying app, they act as additional vehicle security, alerting drivers to unexpected vehicle movements and providing a method to report stolen vehicles.

As part of the new digital plate program, Reviver touts its products’ connectivity, stating that in addition to Bluetooth capabilities, digital plates have “national 5G network connectivity and stability.” But don’t worry—the same plates purportedly protect owner privacy with cloud support and encrypted software updates.

5 Reasons to avoid the digital license plate | Ride TechFrom Youtube

After the Rplate pilot program was announced four years ago, some raised questions about just how good an idea digital plates might be. Reviver and others who support switching to digital emphasize personalization, efficient DMV operations and connectivity. However, a 2018 post published by Sophos’s Naked Security blog pointed out that “the plates could be as susceptible to hacking as other wireless and IoT technologies,” noting that everyday “objects – things like kettles, TVs, and baby monitors – are getting connected to the internet with elementary security flaws still in place.”

To that end, a May 2018 syndicated New York Times news service article about digital plates quoted the Electronic Frontier Foundation (EFF), which warned that such a device could be a “‘honeypot of data,’ recording the drivers’ trips to the grocery store, or to a protest, or to an abortion clinic.”

For now, Rplates are another option in addition to old-fashioned metal, and many are likely to opt out due to cost alone. If you decide to go the digital route, however, it helps if you know what you could be getting yourself into.

From Your Site Articles

- 8 Alternatives to Uber and Lyft in California - dot.LA ›

- Automotus Will Monitor Santa Monica's New Drop-Off Zone - dot.LA ›

- Metropolis CEO Alex Israel on Parking's Future - dot.LA ›

Related Articles Around the Web

Read moreShow less

Steve Huff

Steve Huff is an Editor and Reporter at dot.LA. Steve was previously managing editor for The Metaverse Post and before that deputy digital editor for Maxim magazine. He has written for Inside Hook, Observer and New York Mag. Steve is the author of two official tie-ins books for AMC’s hit “Breaking Bad” prequel, “Better Call Saul.” He’s also a classically-trained tenor and has performed with opera companies and orchestras all over the Eastern U.S. He lives in the greater Boston metro area with his wife, educator Dr. Dana Huff.

steve@dot.la

RELATEDTRENDING

LA TECH JOBS