Gen Z pop icon Olivia Rodrigo’s number one song on Spotify is titled Driver’s License. The song begins “I got my driver’s license last week / Just like we always talked about.” It’s an interesting choice from Miss Rodrigo, because according to The Internet, Gen Z is less interested in getting their driver’s license and driving in general than previous generations. Yes, no matter where you look, there are articles suggesting that, ironically, the generation nicknamed “The Zoomers” doesn’t really want to…zoom.

Analysts have pointed to everything from Uber to anxiety to Facetime as reasons why Gen Z is less inclined to get behind the wheel than previous generations. From a climate perspective this is terrific news. Less cars on the road means less pollution, less demand for fossil fuels, less lithium mining needed for EVs, less congestion. If you’re trying to sell cars to the next generation, on the other hand, the trend may be alarming. The question is, are the trends legitimate?

GfK is a market research firm that studies consumer attitudes and behavior. Their researchers have been tracking buyer attitudes towards car ownership continuously since the 1980s but this latest study paints a more complex picture of the situation.

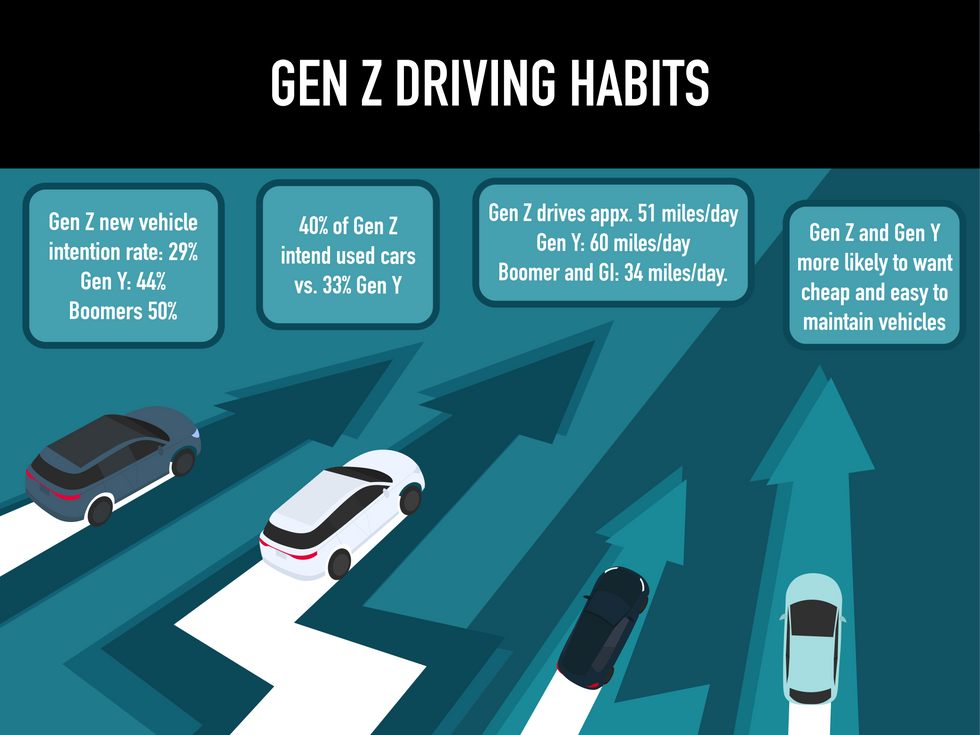

For one, Gen Z is driving just about the same distance as other generations: Gen Z drives 51 miles on average per day, comparable to the total US population average of 47 miles/day. Gen Y (Millennials) drives the most at 60 miles/day; Boomer and GI drive the least at 34 miles/day.

Attitudes towards buying cars are similarly middle of the road. Gen Z was the least likely to say they intended to buy a new car. Intention rate was only 29% for Gen Z compared 44% for Gen Y and 50% for the Boomers. However, Gen Z was more likely to say they were considering buying a used car than Millenials, with ~40% of Zoomers intending to buy used versus 33% Gen Y.

While these stats don’t exactly probe into whether Gen Z is waiting longer to get their licenses (there is some good data to support this assertion) they do illustrate that Gen Z has a fairly similar relationship with cars as Millenials.

GfK is currently working on a follow up study that interrogates whether the differences in Gen Z’s automotive proclivities are the same as previous generations when they were the same age. “You hear a lot that Gen Z is so different, but then we asked the same questions: Are they really different? Or is it a life stage thing?” says Lisa Kong, Vice President at GfK. “Do they turn around and want a car when they get older?”

One thing that GfK’s data supports is that Gen Z is entering into the car market at a point when car prices–both new and used–are at an all-time high. The higher the bar to entry into a market, the lower the overall enthusiasm is going to be. If car ownership feels out of reach anyway, there’s less incentive to get a license and probably less enthusiasm to learn to drive.

Again, easy to paint the situation as similar to how previous generations have wrung their hands at Millennials’ apparent disinterest in homeownership when the reality is they’re simply priced out of the market. As the youngest of-age cohort with the least disposable income, Gen Z’s strong preference for used cars versus new also supports this line of thinking.

- Gen Z Hates Ads—Unless They’re On TikTok. Here’s Why ›

- Autonomous Vehicle Companies Doubled Their Testing Miles In California Last Year ›

- Ride-Hailing Service Alto Debuts in Los Angeles, Going After Uber and Lyft ›

- At Electrify Expo 2022, Cars Aren't the Only EVs Sparking Interest ›