Video Learning Startup Raises $29 Million To Tackle Post-Pandemic Education

Keerthi Vedantam is a bioscience reporter at dot.LA. She cut her teeth covering everything from cloud computing to 5G in San Francisco and Seattle. Before she covered tech, Keerthi reported on tribal lands and congressional policy in Washington, D.C. Connect with her on Twitter, Clubhouse (@keerthivedantam) or Signal at 408-470-0776.

With America facing an ongoing, pandemic-induced teacher shortage, schools in poorer communities are feeling the pinch the most. As a result, some have stopped offering classes deemed “non-essential,” such as art, music and AP-level courses.

“Your zip code and your parents’ socioeconomic status really dictate your high school experience right now—and that largely dictates your life trajectory,” according to Michael Vilardo, co-founder and president of online education startup Subject. “So if we help level the playing field to provide more equity, that is something to be really excited about.”

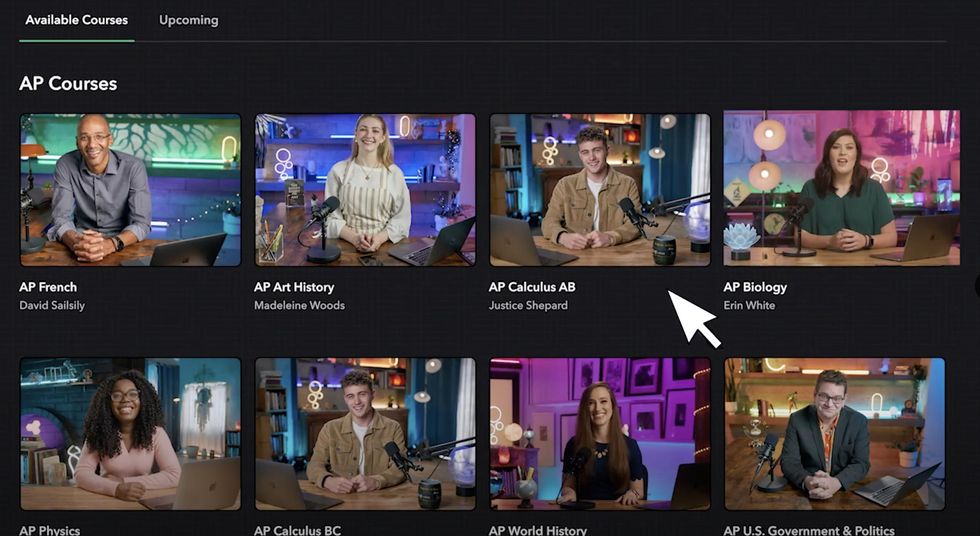

Formerly known as Emile Learning, Beverly Hills-based Subject looks to fill in the gaps for cash-strapped high schools by offering more than 50 accredited video courses across a range of academic disciplines in exchange of a monthly or annual subscription fee. On Tuesday, the startup announced both its name change and a new $29.4 million Series A funding round led by Silicon Valley venture firm Owl Ventures. Kleiner Perkins, SoftBank and Santa Monica-based Moving Capital also participated in the round, which takes Subject’s total funding to date to nearly $35 million.

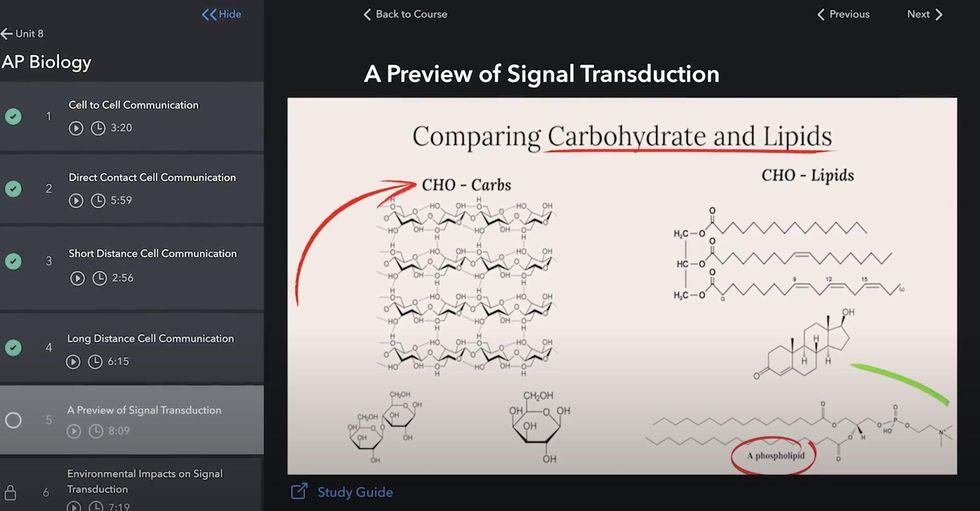

Subject is now approaching 70 partnerships with public schools, school districts, and charter and private schools across the country—allowing them to expand their course catalogs in everything from core curriculum classes like calculus and biology, to electives like computer science and acting.

“That means that those students now have access to over 50 classes, all for credit, in addition to what their school offers in the physical setting.” Vilardo said. “It just really provides a lot more opportunity to engage with courses that you never would have the chance to take otherwise.”

The classes are led by roughly 150 instructors, including the likes of Robinhood Chief Compliance Officer Benjamin Melnicki (who teaches an accredited class on NFTs) and former NFL linebacker Brandon Copeland (who leads a financial literacy course). Subject shoots the videos in a Beverly Hills production studio using a three-camera setup under cinematic-caliber lighting; the goal, Vilardo says, is to create content that looks like a Netflix-caliber docuseries.

Vilardo launched several startups and had stints at Uber and Nike before co-founding Subject alongside company CEO Felix Ruano in 2020. (The pair met at a 2019 networking event at UCLA, where Vilardo was getting his MBA.) After the pandemic hit and online learning rapidly gained a foothold, the pair saw an opportunity to build out a thorough library of educational content to supplement schools. Not only have they managed to build a viable startup so far, but Vilardo and Ruano are also among the all-too-few Latino founders to have raised money for their ventures from major Silicon Valley investors.

Subject is far from the only startup capitalizing on the pandemic-era phenomenon known as “Zoom University,” with peers like Skillshare also seeing significant growth over the past two years. Investments in edtech startups soared from $4.8 billion in 2019 to $12.6 billion in 2020, according to data from CB Insights.

- Emile's Short-Form Videos Help You Prep For Your AP Test - dot.LA ›

- Age of Learning Supplements Kids' Remote Learning - dot.LA ›

- LAUSD Spent Millions on Learning Apps That Felt Like a Maze - dot ... ›

- Titan School Solutions Acquired by LINQ for $75M - dot.LA ›

- Numerade Plans To Combat Online Schooling Issues - dot.LA ›

Keerthi Vedantam is a bioscience reporter at dot.LA. She cut her teeth covering everything from cloud computing to 5G in San Francisco and Seattle. Before she covered tech, Keerthi reported on tribal lands and congressional policy in Washington, D.C. Connect with her on Twitter, Clubhouse (@keerthivedantam) or Signal at 408-470-0776.

Image Source: Revel

Image Source: Revel