LA Tech Week—a weeklong showcase of the region’s growing startup ecosystem—is coming this August.

The seven-day series of events, from Aug. 15 through Aug. 21, is a chance for the Los Angeles startup community to network, share insights and pitch themselves to investors. It comes a year after hundreds of people gathered for a similar event that allowed the L.A. tech community—often in the shadow of Silicon Valley—to flex its muscles.

From fireside chats with prominent founders to a panel on aerospace, here are some highlights from the roughly 30 events happening during LA Tech Week, including one hosted by dot.LA.

DoorDash’s Founding Story: Stanley Tang, a cofounder and chief product officer of delivery giant DoorDash, speaks with Pear VC's founding managing partner, Pejman Nozad. They'll discuss how to grow a tech company from seed stage all the way to an initial public offering. Aug. 19 at 10 a.m. to 12 p.m. in Santa Monica.

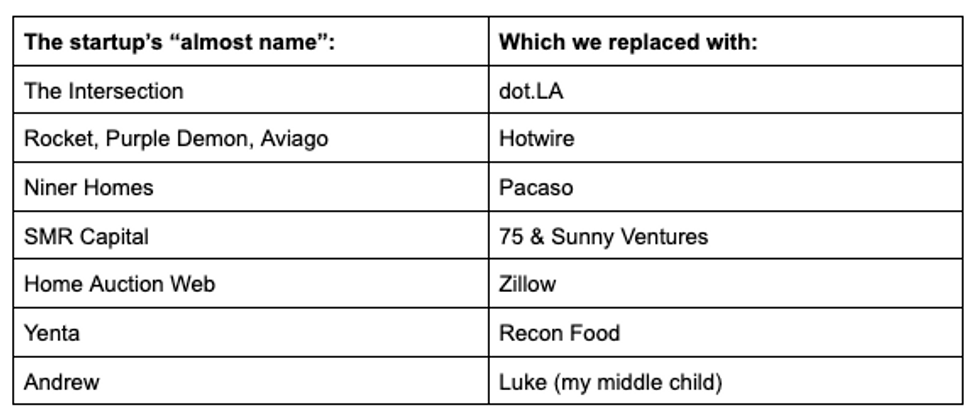

The Founders Guide to LA: A presentation from dot.LA cofounder and executive chairman Spencer Rascoff, who co-founded Zillow and served as the real estate marketplace firm’s CEO. Aug. 16 from 6 p.m. to 9 p.m. in Brentwood.

Time To Build: Los Angeles: Venture capital firm Andreessen Horowitz (a16z) hosts a discussion on how L.A. can maintain its momentum as one of the fastest-growing tech hubs in the U.S. Featured speakers include a16z general partners Connie Chan and Andrew Chen, as well as Grant Lafontaine, the cofounder and CEO of shopping marketplace Whatnot. Aug. 19 from 2 p.m. to 8 p.m. in Santa Monica.

How to Build Successful Startups in Difficult Industries: Leaders from Southern California’s healthcare and aerospace startups gather for panels and networking opportunities. Hosted by TechStars, the event includes speakers from the U.S. Space Force, NASA Jet Propulsion Lab, Applied VR and University of California Irvine. Aug. 15 from 1 p.m. to 5 p.m. in Culver City.

LA Tech Week Demo Day: Early stage startups from the L.A. area pitch a panel of judges including a16z’s Andrew Chen and Nikita Bier, who co-founded the Facebook-acquired social media app tbh. Inside a room of 100 tech leaders in a Beverly Hills mansion, the pitch contest is run by demo day events platform Stonks and live-in accelerator Launch House. Aug. 17 from 12:30 p.m. to 3 p.m. in Beverly Hills.

Registration information and a full list of LA Tech Week events can be found here.

- dot.LA: Los Angeles Tech and Startup News ›

- Here's What's Happening at LA Tech Week - dot.LA ›

- LA Tech Week: NFT Cocktails, Sushi and Networking - dot.LA ›

- LA Tech Week: A Case for the CryptoMondays - dot.LA ›

- Former Zillow CEO Spenser Rascoff Advises LA tech week - dot.LA ›

- LA Tech Week: Women’s Health, the Metaverse & VC - dot.LA ›

- LA Tech Week: Powerlifting, Digital Nomads and Sexy Tech - dot.LA ›

- What People are Posting About LA Tech Week - dot.LA ›

- LA Tech Week Kicks Off with a Look at Proptech in SoCal - dot.LA ›

- L.A. Tech Week: Surfing, Kabobs and Gen Z's NextDoor - dot.LA ›

- LA Tech Week: 3D Printed Homes, Micromobility and Metaverse - dot.LA ›

- A16z's Tech Week Returning to LA This June - dot.LA ›

- All the Latest From LA Tech Week 2023 - dot.LA ›