How To Startup Part 6: How to Find Product-Market Fit

Spencer Rascoff serves as executive chairman of dot.LA. He is an entrepreneur and company leader who co-founded Zillow, Hotwire, dot.LA, Pacaso and Supernova, and who served as Zillow's CEO for a decade. During Spencer's time as CEO, Zillow won dozens of "best places to work" awards as it grew to over 4,500 employees, $3 billion in revenue, and $10 billion in market capitalization. Prior to Zillow, Spencer co-founded and was VP Corporate Development of Hotwire, which was sold to Expedia for $685 million in 2003. Through his startup studio and venture capital firm, 75 & Sunny, Spencer is an active angel investor in over 100 companies and is incubating several more.

For any business to survive, there must be consumers who will buy what it sells. As a startup founder, it’s crucial to assess the market’s demand for your product or service. Knowing whether your product satisfies market needs is the difference between a successful company and a failed product. That’s where product-market fit comes along.

What Is Product-Market Fit?

Product-market fit (“PMF”) means that you have what people want. It means being able to demonstrate that your service serves a need, and that people are willing to pay for it. PMF matters more to the future of your business than building the perfect team or creating masterful marketing tactics. It’s the lifeblood of any business. And every startup’s top priority should be finding PMF as quickly as possible.

When finding PMF, you should ask yourself what exactly your product or service is being hired to do. For example, it’s very clear what users want out of Pacaso. Consumers use Pacaso to help them pay less money to buy a second home. Recon Food (one of my other startups) is still finding its PMF – some people use it to post photos of food they’ve cooked, some use it to decide what to order at a restaurant, and some use it for entertainment to look at great photos of food. We are still asking ourselves what service Recon Food is being hired to do, and what features we should ship next.

When trying to discover if you really have product-market fit, here are some important questions to answer:

- Are people genuinely excited about your minimum viable product (MVP)?

- Are users finding and using your product organically?

- Are you retaining customers/users?

- Are your early users referring the service to other people?

- Are people willing to pay for it?

Measuring PMF

The measurement stage is vital as it allows you to learn whether you are on the right track or not and make changes accordingly. There are several data points and metrics that you can use to validate whether your product is headed in the right direction:

- Paid growth. How many new customers use your product via paid channels like Instagram, TikTok, Google Ads, etc.

- Organic growth. How many new customers are acquired without paying. For example, word of mouth or free referrals.

- Conversion. How many people who download or try your product actually use it or pay for it.

- Retention. Out of an initial user group, how many come back and keep using the product.

- Customer acquisition cost (CAC). How much you pay to acquire customers. The most basic way to calculate this is to divide your total marketing costs (including marketing and sales headcount) by the number of customers acquired.

- Customer lifetime. The average amount of time you can retain a customer on the platform (usually measured in months).

- Customer lifetime value (LTV). The total worth of a customer over the entire period of your business relationship. You can calculate this by finding your gross profit per customer each period and multiplying it by your customer lifetime. Your LTV:CAC ratio should always be >1 because otherwise, you lose money with each new customer.

Timing

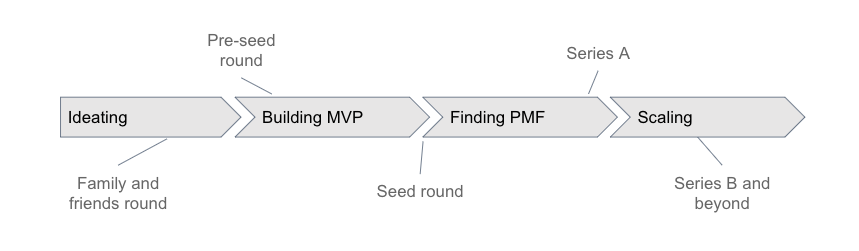

Raising outside capital should enable you to build your minimum viable product and find product-market fit. You should ideally validate your market demand during the MVP phase. See below.

Once you’ve actually achieved product-market fit, you can start focusing on growth. Be proud if you make it to this step as it’s a hard one to achieve for many startups. But you’re not done here.

While the earliest version of Snapchat was a simple disappearing photo-sharing app only for iPhones, they’ve since evolved into a messaging platform and one of the world’s top media-sharing apps. As the market changes, your product needs to change as well to maintain its PMF. Snapchat is an excellent example that product-market fit is a never-ending journey. Once you have it, you must work hard to maintain it.

Spencer Rascoff serves as executive chairman of dot.LA. He is an entrepreneur and company leader who co-founded Zillow, Hotwire, dot.LA, Pacaso and Supernova, and who served as Zillow's CEO for a decade. During Spencer's time as CEO, Zillow won dozens of "best places to work" awards as it grew to over 4,500 employees, $3 billion in revenue, and $10 billion in market capitalization. Prior to Zillow, Spencer co-founded and was VP Corporate Development of Hotwire, which was sold to Expedia for $685 million in 2003. Through his startup studio and venture capital firm, 75 & Sunny, Spencer is an active angel investor in over 100 companies and is incubating several more.

Image Source: Revel

Image Source: Revel