The Pandemic Has Changed the Music Industry Forever. Meet the LA Music-Tech Startups Poised to Reshape It.

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

- The pandemic has ravaged the music industry, but music-tech companies are poised to drive its growth into an industry where a music company is much more than music.

- Los Angeles is home to a bustling ecosystem of startups empowering musicians through a variety of next-generation technologies.

- The Takeaway: Innovations in music-tech offer new tools to independent artists to help them create music, manage money, reach fans and share their music in vivid, immersive ways.

The pandemic has hushed the music industry. Throbbing concert crowds have disappeared, artists' sales have plummeted and musicians' overall income has fallen precipitously. But a handful of Los Angeles-based tech startups are providing musicians with everything from socially-distanced collaborative recording to simplified back-office accounting.

"The L.A. music-tech scene is primed to drive this industry forward," says Ed Buggé, partner at L.A.-based entertainment law firm Hertz Lichtenstein & Young. "It's a hugely exciting time in the industry, with startup-driven disruption enabling new models for artists and media companies alike."

Buggé, who advises some of the world's leading tech and media companies, says the ecosystem of music-tech startups is poised to accelerate two big trends in the music industry.

One is the rise of independent artists. In 2018, indies – artists who own most or all of their material – earned 6.6% of total recorded music revenues. That's a 78% growth rate from 2015, which makes independent artists the fastest growing segment of the recorded music market. Entertainment research firm MIDiA says this change "could prove to be more impactful than even the rise of streaming."

The other trend startups are speeding up is the transformation of what a music company even is.

"Music is no longer just music," says Buggé, adding that audio is becoming inseparable from technologies spanning artificial intelligence, gaming, social media, as well as augmented and virtual reality.

Recording Studios at Home

Musicians today have far more access to high-quality production tools and capabilities than they once did.

Software packages like Logic Pro or Ableton have brought the recording studio's physical equipment and professional engineers right into an artist's living room, saving them thousands of dollars.

"In 2020, all you really need is the essentials – your phone, your laptop, and a good pair of headphones," says Americo Garcia, aka Boombox Cartel. Add in a good $100 microphone or two and an instrument and you've got a home studio.

"Back in the day you'd have to ship reels of tape and jump hoops and loops just to make a song happen. Nowadays you can email someone in Poland and say, 'hey man, let's start something,'" Garcia says. In addition to tools like Dropbox that enable file-sharing across the world, several companies have emerged to help musicians find and work with each other.

"If you think you need a label to blow up, you're wrong," Garcia says.

Meet Your Bandmates

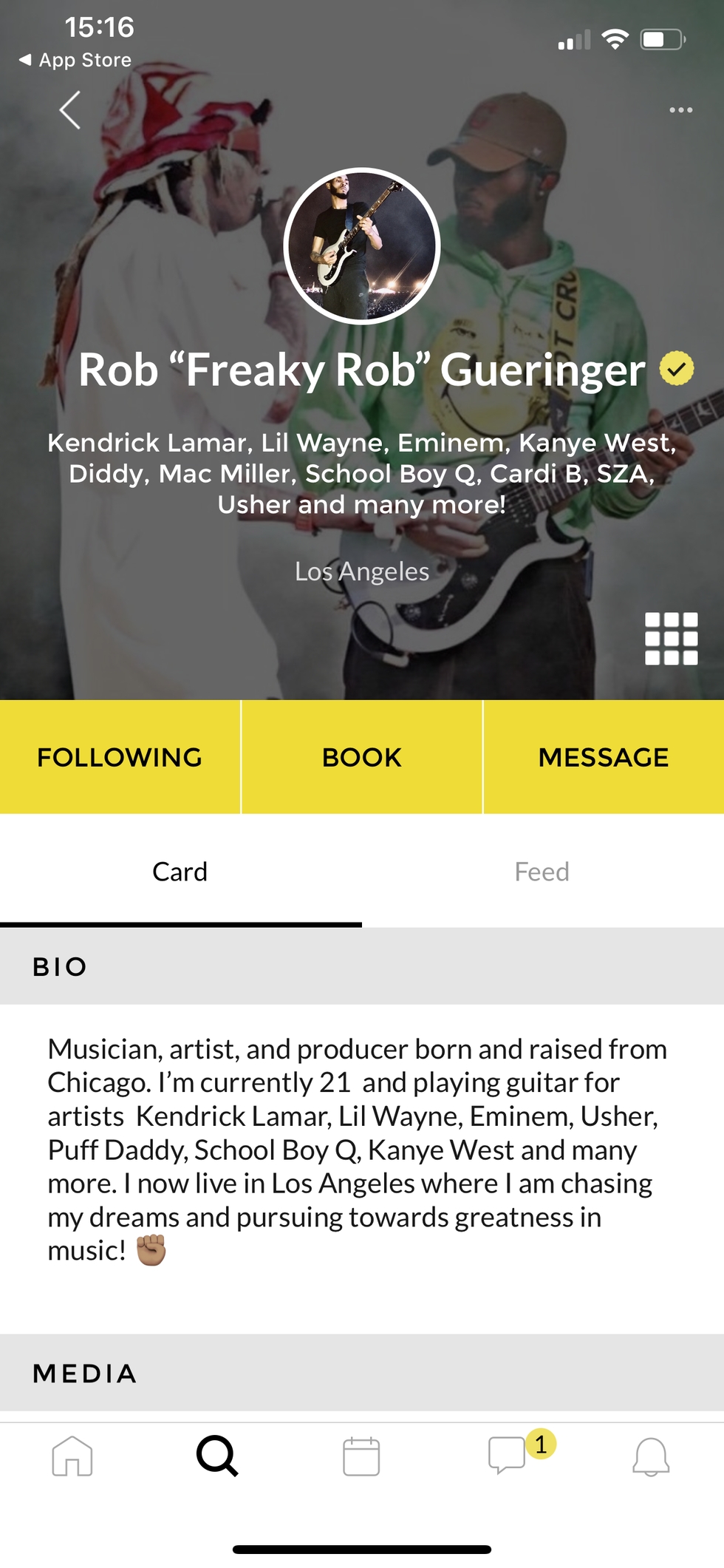

Musicians' Jammcard profiles help them to collaborate

L.A.-based Jammcard has been called the "LinkedIn for musicians." Founded in 2017 by professional drummer Elmo Lovano, the company has nearly 10,000 members and has raised around $2 million from Quincy Jones, Twitch co-founder Kevin Lin and Lionsgate President Robby Melnick.

Lovano formed the company to streamline the process by which professional musicians find each other, rather than relying on word-of-mouth. He estimates that as many as 95% of Jammcard members are independent, and that their median income is around $70,000.

"A lot of the people that are on Jammcard are the people that support the big artists; Kendrick Lamar's not on Jammcard, but his entire band and crew are," Lovano says. "Sound engineers, stage managers, guitar techs – we like to say that it's for 'anyone that's on the bus or in the studio'."

Lovano says Jammcard is finalizing partnerships with Sony and Fender and has recently expanded its platform to enable digital payments to members for collaborating, performing and teaching. Jammcard also recently partnered with New York-based Splice, an online music production service that offers downloadable samples and plugins that make it "a lot more accessible and intuitive to start creating music," says Ankur Patel, Splice's head of corporate development. Jammcard's artists can host their sound samples on Splice and share in the proceeds.

Soundstorming is another L.A. company using tech to enable artistic collaborations. Users upload small segments of their self-produced audio files, allowing other members on the platform to provide feedback and even layer in their own bass grooves, vocal melodies, and drum beats to collectively compose a new track.

Build Your Own Label

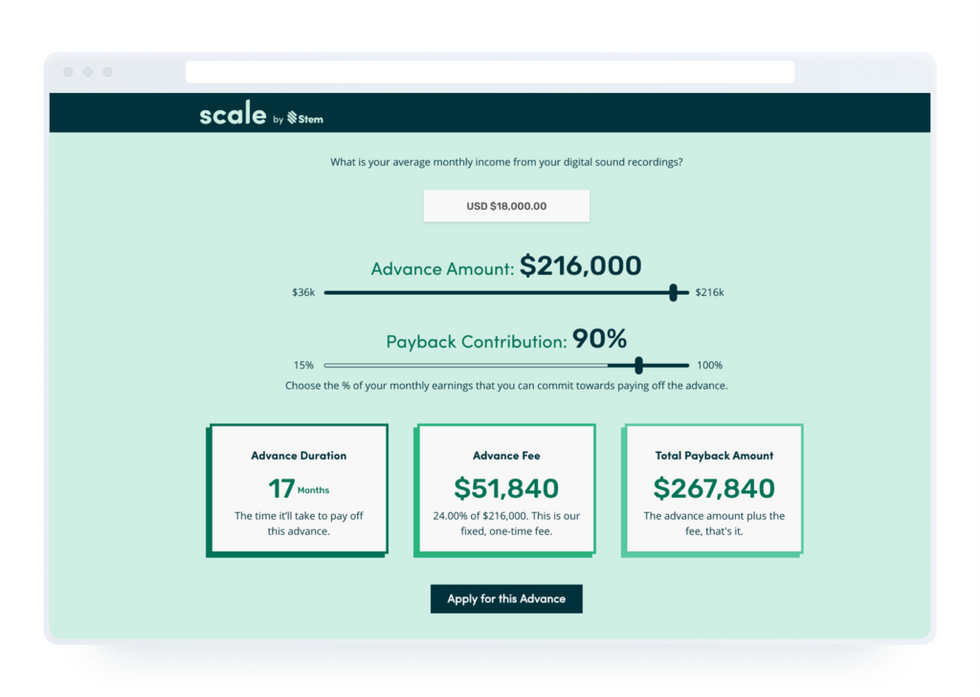

Former UTA agent Milana Lewis created Stem Disintermedia in 2015 to "alleviate back office work so an artist can eliminate those costs and release content more easily."

As an agent, Lewis saw how the complexities of music copyright were depriving musicians of opportunities to make money. "The administrative work was too burdensome for any individual artist to do," she told dot.LA. Artists would give up and say, ''I'm just going to put it up for free'" on sites like YouTube and Soundcloud.

Stem has raised over $12 million in funding, including two rounds from L.A. firm Upfront Ventures. The startup also recently launched its own $100 million debt-financing arm to allow artists to borrow money against their existing catalogs.

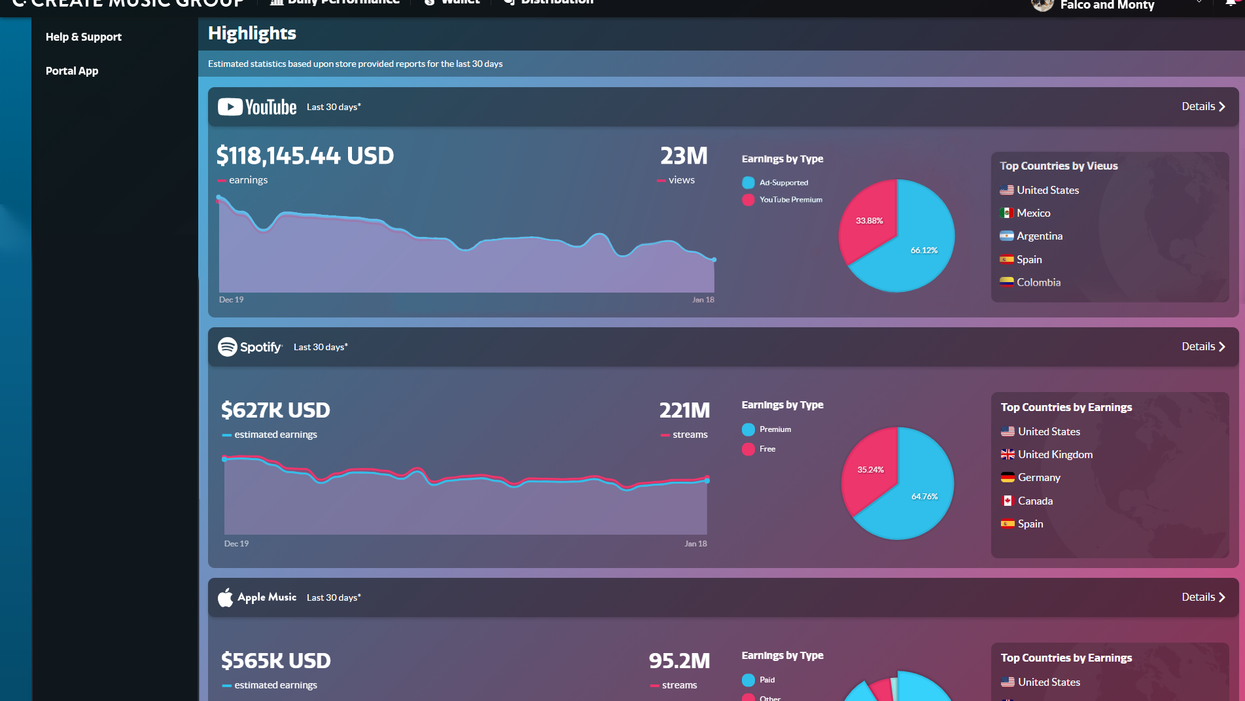

Create Music Group, another startup formed in 2015 that helps artists take control of their accounting and distribution, has a similar origin story.

"We realized the YouTube landscape was poorly mismanaged," recalls Sam Casucci, partner and senior vice president of digital strategy at Create, recently named the second-fastest growing company in the country in the annual Inc. 5000 list. Create employs about 120 people and serves over 10,000 clients – mostly indie artists and labels, the company says. "There was a lot of music and (rights holders) who weren't getting paid what they should be," Casucci says. Create has since built technology on top of YouTube's rights-management platform to help artists make money.

Independent artist and Create client Ray J told dot.LA, "They help you study everything that's going on and help you find money you might not have even known existed."

"When you sign to a major label you don't really get to see what's going on behind the scenes," says Ray J. "You can become your own record label now."

Get Paid

Elsewhere in L.A., Pex helps artists manage their monetization by following the data associated with their songs across the web. Wilson Hays, head of business development, says Pex monitors over 20 billion songs and videos on dozens of social media platforms.

The company indexes all that data – which comprises over three-times as much content as what's on YouTube, Hays says – and uses patented technology to allow the people behind the music to track and measure its online activity. It even allows artists to easily issue take-down notices if they wish.

Pex's song-tracking dashboard

"YouTube has Content ID and Facebook has Rights Manager, but outside those platforms, in the wild, you don't know how your content is being shared, moved, monetized, or pirated," Hays says. "We want to put control back in rights holders' hands."

That sort of control offers benefits to artists that they wouldn't necessarily have with a traditional label deal. One benefit is that payments come in faster. It also gives artists more freedom to manage their career trajectory.

And that freedom gives artists the choice in how they use the many emerging mediums by which they can share their music.

Reach an Audience

An artist who wants to interact directly with fans can post their songs on a host website like YouTube, TikTok, Soundcloud or Bandcamp and chat with their audiences on social media channels. But these platforms have limitations.

A post on Instagram, for example, carries no guarantee that it will reach an artist's fans; most followers do not see every post. Artists must also contend with the fact that the interests of social media platforms are not always aligned with their own.

Jake Udell, a music manager and entrepreneur with a reputation for digital wizardry, recognized social media's limitations early on.

"The thing I kept noticing was that the algorithms were making it really challenging for us to reach our audiences," Udell told dot.LA. "I didn't think there was a fix, though. We'd given up and sort of ceded our audiences to these social platforms."

Then he conducted an experiment. Tickets went on sale for an artist of his who had about twice as many fans in L.A. than New York. Not surprisingly, about twice as many purchases came in for the L.A. shows than the New York ones. Udell then decided to collect around 1,000 phone numbers from fans at a New York show.

"We found some random texting service online and just blasted them out," he recalls. "What happened next changed the way I thought about building audiences online forever."

7,000 tickets to two New York shows immediately sold out. Udell wrote about it on his blog, which is how he met Matthew Pelltier, chief executive of L.A.-based Community.com, where Udell is now head of activation.

"The algorithm has not really been an enabler" for musicians, Udell says. "What if we could just meet the fans where they're already at?"

That's exactly what Community does, he says, by providing artists (and other "Leaders") a SaaS platform for exchanging text messages with fans en masse.

"I think about it like this," Udell says. "How many social platforms have you joined over the last 10 years? Versus how many times did your phone number change?...The phone number is a true atomic unit of identity; it's not going anywhere."

What's more, Udell says 98% of text messages get opened in the first three minutes.

"On other platforms there's a guarantee of instant publishing, but there's no guarantee of instant distribution," he says. Whereas with Community, "the idea that you will always be able to reach your fans, this community, via text, is a really empowering thing not just for you personally but for your business."

Big-timers like Jennifer Lopez use Community, as do aspiring local band types. Prices depend on audience size. One feature: ability to segment fan outreach so that, for instance, a band coming to a specific town can message only the locals – "See you at the show tonight?"

Tour Virtually

Wave turns performers into digital avatars and puts them on virtual stages where they can entertain and interact with fans, who tune in via VR headset, gaming console or web browser.

"We started the company four years ago to help musicians make money," Wave chief executive Adam Arrigo told dot.LA. "We've been touring musicians and we know how hard it is."

Wave has now hosted over 50 events. Its recent concert featuring The Weeknd in partnership with TikTok reportedly drew a digital audience of over 2 million fans.

Arrigo says his former role as a designer for the Rock Band video game franchise showed him how novel technologies can empower musicians.

"From working on that game I learned that when you create new experiences you can create additional revenue streams for the industry," he says.

Building on a blueprint established in part by L.A.-based Brud (whose digital influencer and singer Lil' Miquela currently has 2.6 million Instagram followers and attracts millions of views on YouTube), Strangeloop Studios is currently designing a cast of animated characters of its own.

Co-founder and chief executive Ian Simon, who is also on the creative team at Wave, says, "the long-term vision is to be a studio; to bring in storytellers and visual artists and creators to tell stories using these characters. The characters are a medium in themselves."

Those characters present musicians with scalable creative opportunities. "You can play the same show with the same character in multiple places at the same time," Simon says. "They're vessels for human collaboration – multiple musicians contributing songs, various visual artists creating content and fans informing the narrative and aesthetic trajectory of the characters."

"People are already listening to music on screens, even if the screen isn't really being leveraged," says Simon, whose small team includes former visual designers for megastars like Kendrick Lamar and Flying Lotus.

Immersive Music

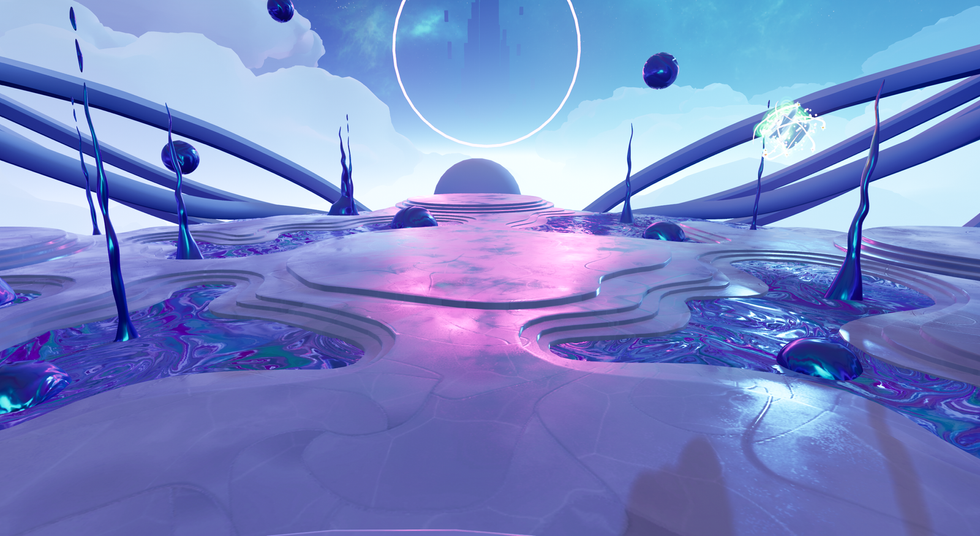

ViRvii – a portmanteau of virtual, visual, and immersive – gives artists a new "paintbrush" for creating immersive fan experiences, says founder Juan Dueñas, who formerly founded My Mixtapez and was an early user of Oculus' development kit.

Dueñas says ViRvii will allow fans to "hang out" inside The Beatles' Yellow Submarine while the album plays in the background, for instance. Contemporary artists will be able to design VR experiences to accompany their releases. Despite the high-tech approach, Dueñas says he wants users to be able to get a homespun feeling of "sitting around a stereo or record player and smoking a joint and drinking a beer with friends and listening to your favorite album."

Formed in 2019 and now with a staff of 30, the L.A.-based startup recently announced a partnership with Facebook and its Oculus VR subsidiary.

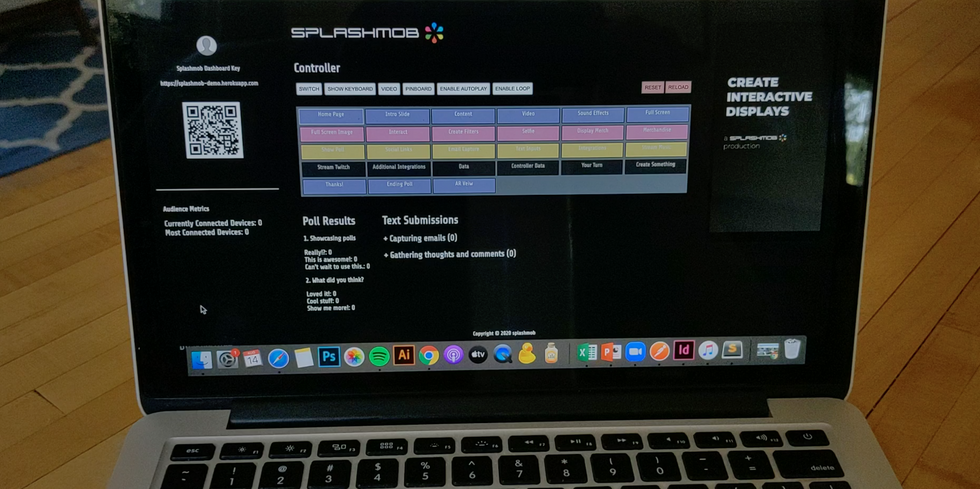

Splashmob gives performers control of their audience's cell phone screens. They can preprogram the screens of anyone who opts in with features like polls, audiovisual media to accompany the main show, and merchandise sales portals. The screens can also be controlled in real-time, not unlike an effects technician manipulating phone screens rather than lights and sound.

Founder Blaise Thomas was formerly a sound engineer in London, where his work in recording studios and live performances got him thinking about how to enhance concerts, whether in-person or streamed.

"The flashlight on the phone is all well and good," Thomas says, "but how far can that go?"

Splashmob has collaborated with Dani Van de Sande and her L.A. startup, ULO, which along with Splashmob and Strangeloop was part of the 2020 Techstars Music cohort.

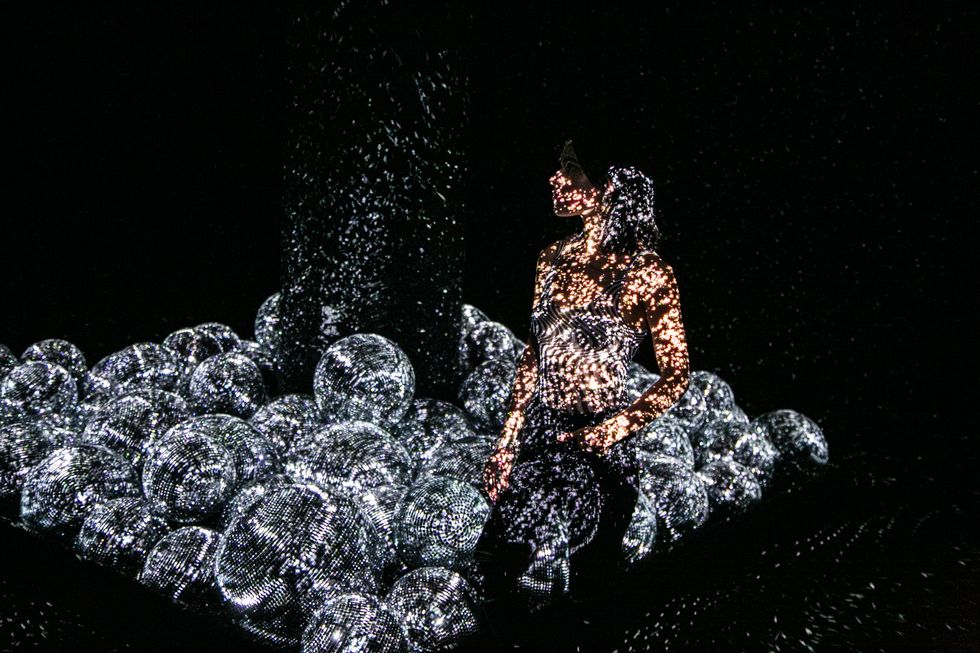

"Imagine you're wandering around Melrose Avenue on your way to dinner," Van de Sande writes, "and out of the corner of your eye you spot a bright, iridescent light. It looks otherworldly, like something from another universe."

These cocoon-like walk-in installations, called ULOs ("unidentified landing objects"), offer immersive, interactive experiences for the adventurous souls who enter. ULO plans to dot them around city-scapes.

"We're another avenue where artists can do something beyond releasing a video – by creating an experience for people," says Van de Sande, who formerly worked on augmented reality at L.A.-based Snap.

These new visually oriented channels for sharing music may help to shrink the gap between the ear and the eye that Spotify founder Daniel Ek often invokes when he describes the growth potential for his company. Why, he has publicly wondered, is the total video market worth around 10-times more than audio, even though consumers spend about equal time with each?

Get a Side Gig

Cameo offers anybody with over 20,000 Instagram followers the opportunity to build a profile on its platform and set a price for which they will record a personalized video message. The company was formed in Chicago, but its chief executive Steven Galanis recently moved to L.A. With his move, Cameo's center of gravity has shifted.

"L.A. is the best place for me to be for Cameo right now," Galanis recently told dot.LA. "I've been focused on being the tech company to work for in Chicago and I think that's mission accomplished in many ways. Now my objective is to make Cameo that place in L.A."

L.A. was once the destination for artists with a guitar case and a dream. Now, many of them can pursue those dreams from home. Music-tech companies, however, are flocking in.

"It's not an accident that Techstars Music is in L.A.," says Bob Moczydlowsky, who runs the accelerator, which recently opened its 2021 cohort application, with an emphasis on attracting a diverse candidate pool. Moczydlowsky attributes L.A.'s centrality in this flourishing wave of music and tech innovation to two main factors. First is the access to an ecosystem of artists, managers, labels and touring companies. Second is the venture money in Silicon Valley.

"L.A. is less than an hour from the money and down the street from the culture," he says.

The growing entrepreneurial energy in L.A. looks set to provide Angelenos a front-row seat to a new, lasting stage for entertainment technology innovation.

---

Sam Blake primarily covers entertainment and media for dot.LA. Follow him on Twitter @hisamblake and email him at samblake@dot.LA

- Column: How Music Tech is Making it Easier, and Harder, for Artists ... ›

- Music Industry Vows a 'Blackout' Tuesday - dot.LA ›

- Spotify Earnings: The Music Streaming War Is Heating Up ›

- TikTok Says it Will Pay Creators— and Universal Music Group - dot.LA ›

- 12 LA-Based Music Tech Startups To Watch - dot.LA ›

- Music Tech is Making it Easier — and Harder — for Artists - dot.LA ›

- Music Tectonics Conference Announces its 2020 Lineup - dot.LA ›

- Output Raises $46M to Make Creating Easier for Musicians - dot.LA ›

- Tencent Doubles Stake in Universal Music Group - dot.LA ›

- Music Tech Trends to Watch in 2021 - dot.LA ›

- 1RIC Studio Aims to Kick Off a New Era of Artist-Fan Engagement - dot.LA ›

- Pex Copyright Management System Gets $57M - dot.LA ›

- SoundCloud Will Experiment With a New Way To Pay Artists - dot.LA ›

- Spotify's Latest Acquisition built Locker Room - dot.LA ›

- Lil Miquela, Virtual Influencer, Releases More NFTs - dot.LA ›

- OneOf Raises $63M for an Artist-Focused, Green NFT Platform - dot.LA ›

- Fanimal Aims to Take on Digital Ticketing’s Biggest Players - dot.LA ›

- The Return of LA Concerts, Sports and Performances - dot.LA ›

- Music Marketplaces Are Supplanting Record Labels (Column) - dot.LA ›

- Snafu Records Wants to Replace Record Executives with AI - dot.LA ›

- Behind the Scenes of The Rattle's Secretive Artist Co-Op - dot.LA ›

- Wave XR CEO Adam Arrigo: Live Music's Future Is Hybrid - dot.LA ›

- Music Tectonics Returns to LA - dot.LA ›

- Stem Raises $20 million to Expand Reach - dot.LA ›

- Stem Raises $20 million to Expand Reach - dot.LA ›

- Trubify, Tuney,, Gigmor: LA Startups Hope To Change Music Industry - dot.LA ›

- Spotify To Officially Shut Down Heardle on May 5th - dot.LA ›

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

Image Source: Revel

Image Source: Revel