Get in the KNOW

on LA Startups & Tech

XImage by Candice Navi

Here Are LA's Top VCs, According to Their Peers

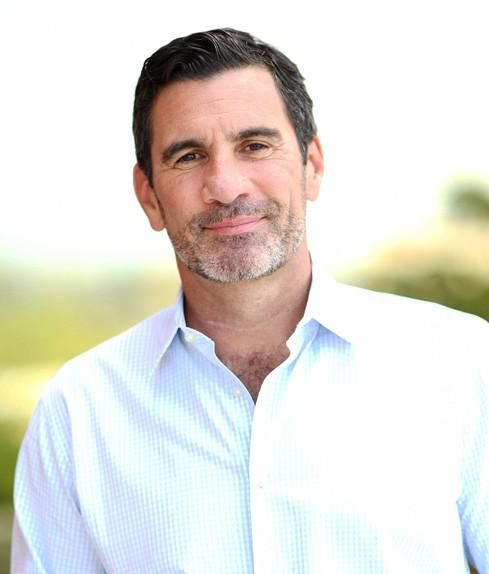

Ben Bergman

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Though Silicon Valley is still very much the capital of venture capital, Los Angeles is home to plenty of VCs who have made their mark – investing in successful startups early and reaping colossal returns for their limited partners.

Who stands out? We thought there may be no better judge than their peers, so we asked 28 of L.A.'s top VCs who impresses them the most.

The list includes many familiar names. Dana Settle, founding partner of Greycroft, and Mark Mullen, founding partner of Bonfire Ventures, garnered the most votes.

Settle manages West Coast operations for Greycroft, a New York firm with $1.8 billion in assets under management. She is one of only nine of the top 100 VCs nationally who are women, according to CB Insights.

Mullen is a founding partner of Bonfire Ventures, which closed a $100 million second fund in September to continue funding seed stage business-to-business (B2B) software startups. Mullen has also been an angel investor and is an LP in other funds focusing on other sectors, including MaC VC and BAM Ventures.

Below is the list of the top ranked investors by how many votes each received from their peers. When there was a tie, they appear in alphabetical order according to their last name:

Mark Mullen, Bonfire Ventures

Mark Mullen is a founding partner of Bonfire Ventures. He is also founder and the largest investor in Mull Capital and Double M Partners, LP I and II. A common theme in these funds is a focus on business-to-business media and communications infrastructures.

In the past, Mullen has served as the chief operating officer at the city of Los Angeles' Economic Office and a senior advisor to former Mayor Villaraigosa, overseeing several of the city's assets including Los Angeles International Airport and the Los Angeles Convention Center. Prior to that, he was a partner at Daniels & Associates, a senior banker when the firm sold to RBC Capital Markets in 2007.

Dana Settle, Greycroft

Dana Settle is a founding partner of Greycroft, heading the West Coast office in Los Angeles. She currently manages the firm's stakes in Anine Bing, AppAnnie, Bird, Clique, Comparably, Goop, Happiest Baby, Seed, Thrive Market, Versed and WideOrbit, and is known for backing female-founded companies.

"The real change takes place when female founders build bigger, independent companies, like Stitchfix, TheRealReal," she said this time last year in an interview with Business Insider. "They're creating more wealth across their cap tables and the cap tables tend to be more diverse, so that gives more people opportunity to become an angel investor." Prior to founding Greycroft, she was a venture capitalist and startup advisor in the Bay Area.

Erik Rannala, Mucker Capital

Erik Rannala is a founding partner at Mucker Capital, which he created with William Hsu in 2011. Before founding Mucker, Rannala was vice president of global product strategy and development at TripAdvisor and a group manager at eBay, overseeing its premium features business.

"As an investor, I root for startups. It pains me to see great teams and ideas collapse under the pressure that sometimes follows fundraising. If you've raised money and you're not sure what comes next, that's fine – I don't always know either," Rannala wrote in a blog post for Mucker.

Mucker has a portfolio of 61 companies, including Los Angeles-based Honey and Santa Monica-based HMBradley.

William Hsu, Mucker Capital

William Hsu is a founding partner at the Santa Monica-based fund Mucker Capital. He started his career as a founder, creating BuildPoint, a provider of workflow management solutions for the commercial construction industry not long after graduating from Stanford.

In an interview with Fast Company, he shared what he learned in the years following, as he led product teams at eBay, Green Dot and Spot Runner, eventually becoming the SVP and Chief Product Officer of At&T Interactive: "Building a company is about hiring correctly, adhering to a timeline, and rigorously valuing opportunity. It's turning something from inspiration and creative movement into process and rigor."

These are the values he looks for in founders in addition to creativity. "I like to see the possibility of each and every idea, and being imaginative makes me a passionate investor."

Jim Andelman, Bonfire Ventures

Jim Andelman is a founding partner of Bonfire Ventures, a fund that focuses on seed rounds for business software founders. Andelman has been in venture capital for 20 years, previously founding Rincon Venture Partners and leading software investing at Broadview Capital Partners.

He's no stranger to enterprise software — he also was a member of the Technology Investment Banking Group at Alex. Brown & Sons and worked at Symmetrix, a consulting firm focusing on technology application for businesses.

In a podcast with LA Venture's Minnie Ingersoll earlier this year, he spoke on the hesitations people have about choosing to start a company.

"It's two very different things: Should I coach someone to be a VC or should I coach someone to enter the startup ecosystem? On the latter question, my answer is 'hell yeah!'"

Josh Diamond, Walkabout Ventures

Josh Diamond founded Walkabout Ventures, a seed fund that primarily focuses on financial service startups. The firm raised a $10 million fund in 2019 and is preparing for its second fund. Among its 19 portfolio companies is HMBradley, which Diamond helped seed and recently raised $18 in a Series A round.

"The whole reason I started this is that I saw there was a gap in the funding for early stage, financial service startups," he said. As consumers demand more digital access and transparency, he said the market for financial services is transforming — and Los Angeles is quickly becoming a hub for fintech companies. Before founding Walkabout, he was a principal for Clocktower Technology Ventures, another Los Angeles-based fund with a similar focus.

Kara Nortman, Upfront Ventures

Kara Nortman was recently promoted to managing partner at Upfront Ventures, making her one of the few women – along with Settle – to ascend to the highest ranks of a major VC firm.

Though Upfront had attempted to recruit her before she joined in 2014, she had declined in order to start her own company, Moonfrye, a children's ecommerce company that rebranded to P.S. XO and merged with Seedling. Upfront invested in the combination, and shortly after, Nortman joined the Upfront team.

Before founding Moonfrye, she was the SVP and General Manager of Urbanspoon and Citysearch at IAC after co-heading IAC's M&A group.

In an interview with dot.LA earlier this year, she spoke on how a focus for her as a VC is to continue to open doors for founders and funders of diverse backgrounds.

"Once you're a woman or a person of color in a VC firm, it is making sure other talented people like you get hired, but also hiring people who are not totally like you. You have to make room for different kinds of people. And how do you empower those people?"

Brett Brewer, Crosscut Ventures

Brett Brewer is a co-founder and managing director of Crosscut Ventures. He has a long history in entrepreneurship, starting a "pencil selling business in 4th grade." In 1998, he co-founded Intermix Media. Under their umbrella were online businesses like Myspace.com and Skilljam.com. After selling Intermix in 2005, he became president of Adknowledge.com.

Brewer founded Santa Monica-based Crosscut in 2008 alongside Rick Smith and Brian Garrett. His advice to founders on Crosscut's website reflects his experience: "Founders have to be prepared to pivot, restart, expect the unexpected, and make tough choices quickly... all in the same week! It's not for the faint of heart, but after doing this for 20 years, you can spot the fire (and desire) from a mile away (or not)."

Eva Ho, Fika Ventures

Eva Ho is a founding partner of Fika Ventures, a boutique seed fund, which focuses on data and artificial intelligence-enabled technologies. Prior to founding Fika, she was a founding partner at San Francisco-based Susa Ventures, another seed-stage fund with a similar focus. She is also a serial entrepreneur, most recently co-founding an L.A. location data provider, Factual. She also co-founded Navigating Cancer, a health startup, and is a founding member of All Raise, a nonprofit that supports and provides resources to female founders and funders.

In an interview with John Livesay shortly before founding Fika, Ho spoke to how her experience at Factual helped focus what she looks for in founders. "I always look for the why. A lot of people have the skills and the confidence and the experience, but they can't convince me that they're truly passionate about this. That's the hard part — you can't fake passion."

Brian Lee, BAM Ventures

Brian Lee is a co-founder and managing director of BAM Ventures, an early-stage consumer-focused fund. In an interview with dot.LA earlier this year, Lee shared that he ended up being the first investor in Honey, which was bought by PayPal for $4 billion, through investing in founders and understanding their "vibe."

"There's certain criteria that we look for in founders, a proprietary kind of checklist that we go through to determine whether or not these are the founders that we want to back…. [Honey's founders] knew exactly what they were building, and how they were going to get there."

His eye for the right vibe in a founder is one gleaned from experience. Lee is a serial entrepreneur, founding LegalZoom.com, ShoeDazzle.com and The Honest Company.

Alex Rubalcava, Stage Venture Partners

Alex Rubalcava is a founding partner of Stage Venture Partners, a seed venture capital firm that invests in emerging software technology for B2B markets. Prior to joining, he was an analyst at Santa Monica-based Anthem Venture Partners, an investor in early stage technology companies. It was his first job after graduating from Harvard, and during his time at Anthem the fund was part of Series A in companies like MySpace, TrueCar and Android.

He has served as a board member in several Los Angeles nonprofits and organizations like KIPP LA Schools and South Central Scholars.

"Warren Buffett says that he's a better businessman because he's an investor, and he's a better investor because he's a businessman. I feel the same way about VC and value investing. Being good at value investing can make you good at venture capital, and vice versa," Rubalcava said in an interview with Shai Dardashti of MOI Global.

Mark Suster, Upfront Ventures

Mark Suster, managing partner at Upfront Ventures, is arguably L.A.'s most visible VC, frequently posting on Twitter and on his blog, not only about investing but also more personal topics like weight loss. In more normal years, he presides over LA's biggest gathering of tech titans, the Upfront Summit. Before Upfront, he was the founder and chief executive officer of two software companies, BuildOnline and Koral, which was acquired by Salesforce. Upfront backed both of his companies, and eventually he joined their team in 2007.

In a piece for his blog, "Both Sides of the Table," Suster wrote about the importance of passion — not just for entrepreneurs and their businesses, but for the VCs that fund them as well.

"On reflection of the role that I want to play as a VC it is clearly in the camp of passion. I really want to start my journeys only with people with whom I want to work closely with for the next 5–7 years or more. I only want to work on projects in which I believe can produce truly amazing change in an industry or in the world."

Lead art by Candice Navi.

From Your Site Articles

- Here Are Los Angeles' Top Venture Capitalists - dot.LA ›

- Ten Venture Capital Firms Commit to 'Diversity' Rider' - dot.LA ›

- Navigating the Venture Capital World as a Black Person - dot.LA ›

- The Largest Venture Capital Raises in Los Angeles in 2020 - dot.LA ›

- Los Angeles Venture Funds Grow, but Spend Less in LA - dot.LA ›

- dot.LA's Venture Capital Survey for Q1 2021 - dot.LA ›

- Meet Scott Lenet, Co-Founder, President and Educator - dot.LA ›

- LA VC's Hosted Their First Party in 14 Months - dot.LA ›

- Los Angeles’ Top Investors Under 30 According to Their Peers - dot.LA ›

- TX Zhuo is Behind Fika Ventures' $77 million Fund ›

- Los Angeles Notches Record Levels of VC Investment in Q2 - dot.LA ›

- VCs See Valuations Reach Record Highs as Optimism Stays High - dot.LA ›

- Top LA Angel Investors 2021: McInerney, Rascoff and Lee - dot.LA ›

- LA Venture: Chirag Chotalia on Threshold Ventures - dot.LA ›

- CrossCut Ventures' Rick Smith on Coming to Venture Capital - dot.LA ›

- Event: Investors & Entrepreneurs Networking in Los Angeles - dot.LA ›

- Los Angeles Startups Closed a Record Number of Deals in Q3 - dot.LA ›

- Southern California Venture Capitalists See a Tech Bubble - dot.LA ›

- Pear VC’s Pejman Nozad on Early-Stage VC - dot.LA ›

- Bonfire Ventures Is Raising a $165 Million For Its Third Fund - dot.LA ›

- 5 Highlights From a Record-Smashing 2021 for SoCal Startups and VCs - dot.LA ›

- Los Angeles Venture Capital Activity Was Up in Q3 - dot.LA ›

- LA Is The Third-Largest Startup Ecosystem in the U.S. - dot.LA ›

- LA's Top Venture Capitalists of 2022 - dot.LA ›

- Crosscut’s Brett Brewer on Starting Intermix Media and Myspace - dot.LA ›

- Venture Deals in LA Are Slowing Down - dot.LA ›

- Venture Deals Fall in LA Amid Economic Worries - dot.LA ›

- LA Seed Deals Hold Steady Despite Despite Economic Worries - dot.LA ›

- PitchBook Reports Fewer Tech Investments - dot.LA ›

- LA Venture Investments to Women & Founders of Color Dropped - dot.LA ›

- GoFreight Raises $23 Million, Valcre Secures $12.7M - dot.LA ›

- Here Are The Top Venture Capitalists In 2023 - dot.LA ›

- Pagos Secures $34M, Champions Round Picks Up $7M - dot.LA ›

- Toba Capital's Patrick Mathieson On How to Support Founders - dot.LA ›

- B Capital's Howard Morgan On Key To Early Stage Investing - dot.LA ›

Related Articles Around the Web

Ben Bergman

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

https://twitter.com/thebenbergman

ben@dot.la

LA Tech Week: Final Days • Coco’s bots, Anduril’s helmet AI, Impulse’s moon freight

08:05 AM | October 17, 2025

🔦 Spotlight

Happy Friday Los Angeles,

Founders are closing out Tech Week, robots are getting a new research brain, space logistics are taking shape, and defense tech just moved mission command into a helmet.

Anduril’s EagleEye: mission command, heads up

Anduril introduced EagleEye, a helmet mounted system that puts maps, comms, sensor fusion, and on device AI directly in a warfighter’s line of sight, integrated with the Lattice stack. The goal is simple: less time looking down at a tablet and more decisions made at the edge.

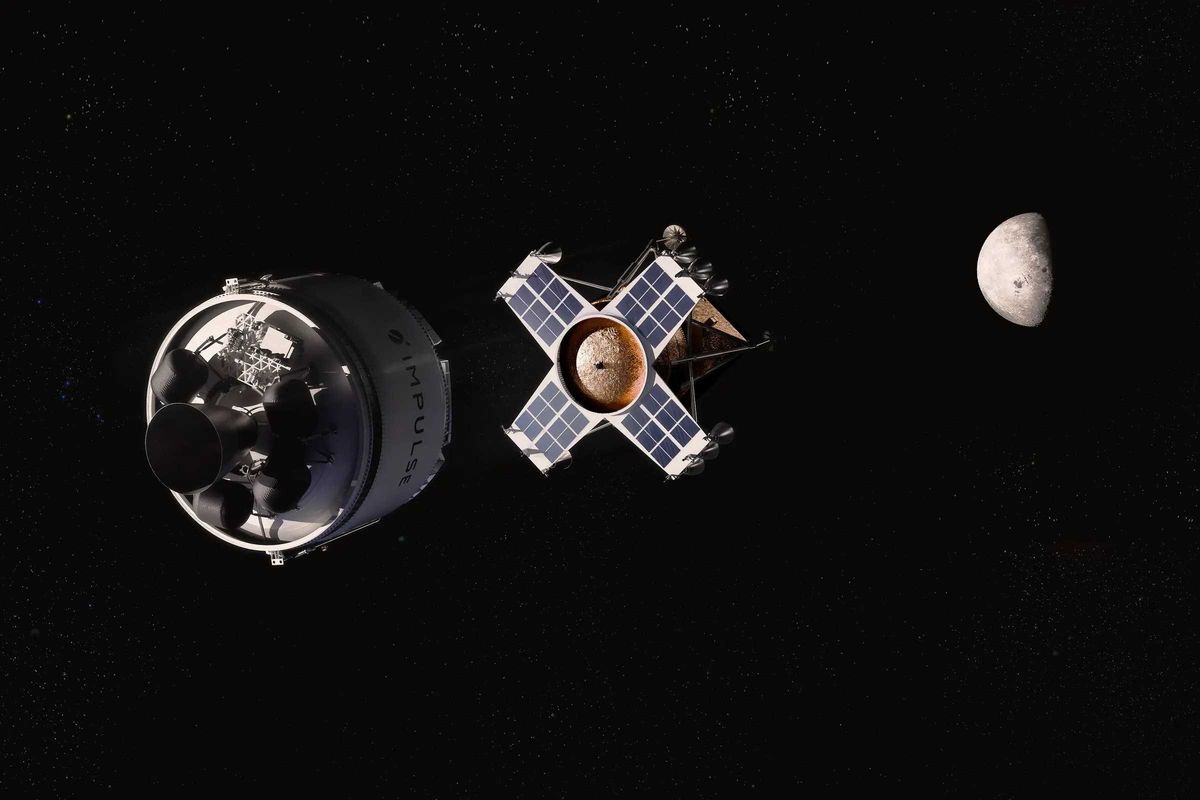

Impulse Space: a practical path to lunar deliveries

Impulse outlined a two piece ride to the Moon. Its Helios stage ferries an Impulse built lander to lunar orbit in about a week, the lander detaches, then descends to the surface without in-space refueling. The company says each mission could carry about three tons and that starting in 2028 it could run two missions per year for roughly six tons total, filling the gap between today’s small CLPS deliveries and future heavy landers.

Coco Robotics: new lab, new chief AI scientist

Coco named UCLA’s Bolei Zhou chief AI scientist and is launching a physical AI research lab to turn years of curbside driving data into faster, more autonomous sidewalk deliveries. Expect quicker iteration from data collection to local models on the bots.

LA Tech Week: last three days

We are down to the final few days of LA Tech Week 2025. If you are still slotting meetings or panels, use the rundowns to plan your route:

Scroll for the most recent LA venture deals, funds, and acquisitions.

🤝 Venture Deals

LA Companies

- Second Nature, an AI role-play training platform for sales and service teams, raised $22M Series B led by Sienna VC with participation from Bright Pixel, StageOne Ventures, Cardumen, Signals VC, and Zoom (also a customer). The company will use the funding to expand operations and advance its platform, which generates AI-driven practice scenarios and feedback for enterprise clients like Oracle, Zoom, Adobe, Teleperformance, and Check Point. - learn more

- Pelage Pharmaceuticals, a Los Angeles–based biotech developing regenerative treatments for hair loss, raised a $120M Series B co-led by ARCH Venture Partners and GV. Participants include Main Street Advisors, alongside Visionary Ventures and YK Bioventures; proceeds advance PP405, a topical small molecule that reactivates dormant hair-follicle stem cells, toward Phase 3 in 2026 following positive Phase 2a data. - learn more

- Launchpad, an AI-first robotics company for factory automation, raised an $11M Series A to speed product development and meet demand across the U.S., U.K., and Europe. The round was co-led by Lavrock Ventures and Squadra Ventures, with participation from Ericsson Ventures, Lockheed Martin Ventures, Cox Exponential, and the Scottish National Investment Bank; it follows $2.5M in grant funding from Scottish Enterprise. - learn more

- Mythical Games raised a Series D round, with a strategic investment from Eightco Holdings alongside ARK Invest and the World Foundation. The partnership focuses on human verification and digital identity in gaming, tapping Worldchain/Worldcoin’s Proof-of-Human infrastructure. The transaction is expected to close the week of October 20. - learn more

- Electric Entertainment, the L.A. studio behind “Leverage,” “The Librarians,” and “The Ark,” secured a $20M investment from Content Partners Capital. The funding follows CPC’s launch of an investment arm in April 2024 and is aimed at supporting Electric’s growth across production and distribution. - learn more

- Everyset raised $9M to launch Background Payroll, a SAG-AFTRA approved platform that automates timecards and payroll for background performers, including overtime, penalties, and premiums. The round was led by Crosslink Capital and Haven Ventures, and the company says studios such as Netflix, CBS, Apple TV, Sony, and Amazon already use its tools as it expands into fully integrated background payroll. - learn more

- TORL Biotherapeutics raised $96M in Series C funding to advance TORL-1-23, its Claudin-6 targeted antibody-drug conjugate, through a pivotal Phase 2 study in platinum-resistant ovarian cancer and into a confirmatory Phase 3 program. The company also reported that updated Phase 1 data for TORL-1-23 will be presented at ESMO 2025, bringing total funding since its 2019 founding to more than $450 million. - learn more

- The Plug, a plant-based liver health brand, raised $5M in a venture round of equity and debt to fuel marketing and retail expansion after rolling out its Pill Jar in June and entering all Total Wine & More locations nationwide in September. The company is keeping the round open for additional strategic investors and says it recently hit its first profitable month, is pursuing a partnership with a $500 million nutrition telehealth company, and is targeting a 40% boost to gross margins through a new operational milestone. - learn more

LA Venture Funds

- Clocktower Technology Ventures participated in MGT’s $21.6M Series B, an oversubscribed round led by Mubadala Capital with Tacora Capital and existing backers also joining. The AI-native commercial P&C neo-insurer for small businesses will use the capital to accelerate R&D, deepen vertical AI capabilities, and expand its E&S initiatives nationwide. - learn more

- M13 participated in Daylight’s $75M financing, which combines $15M in equity led by Framework Ventures with a $60M project facility led by Turtle Hill Capital. Daylight is building a decentralized energy network that turns homes into mini power plants via a subscription model and crypto-enabled incentives, aiming to lower costs and dispatch battery power back to the grid. - learn more

- Presight Capital co-led Peptilogics’ $78M Series B2, with Beyond Ventures participating, to fund a Phase 2/3 pivotal trial of zaloganan (PLG0206) for prosthetic joint infections. The raise brings Peptilogics’ total equity financing to about $120M and positions the company to begin the pivotal program in late 2025, pending approvals. - learn more

- Patron participated in Ego AI’s $6.7M seed round to help the YC-backed startup launch human-like AI characters for games via its new character.world engine. The round also included Y Combinator, Accel, and Boost VC, and the capital will support research on Ego’s proprietary model, which combines small language models with reinforcement learning, plus partnerships in Singapore to scale compute and development. - learn more

- Untapped Ventures participated in Woz’s $6M seed round, joining Cervin Ventures (lead), Y Combinator, Burst Capital, MGV, and the Lacob family. The funding will help Woz scale its platform that blends agentic AI with expert human oversight to deliver production-ready mobile apps for enterprises. - learn more

- Perseverance Capital participated in Kailera Therapeutics’ $600M Series B, which was led by Bain Capital Private Equity. The funding advances KAI-9531, an injectable dual GLP-1/GIP agonist, into global Phase 3 trials by year end and supports a broader pipeline of oral and injectable obesity therapies. - learn more

- March Capital participated in Lila Sciences’ $350M Series A, which lifts the company’s total funding to $550M. The capital will scale Lila’s AI Science Factories and commercialize its “scientific superintelligence” platform for partners across materials, energy, and biopharma. - learn more

- Mucker Capital participated in Pear Suite’s $7.6M Series A, which was co-led by Rock Health Capital and Nexxus Holdings. The L.A. based company equips community health workers with an AI-powered platform and provider network, and it will use the funding to expand product development, grow its network, and support new Medicaid and Medicare health plan contracts. Other investors include Enable Ventures, The SCAN Foundation, Acumen America, Impact Engine, and the California Health Care Foundation. - learn more

- Upfront Ventures participated in Renew’s $12M Series A, which was led by Haymaker Ventures with Goldcrest Capital and several Renew customers also investing. Renew’s AI-powered resident retention platform helps apartment operators automate renewals and prevent fraud, and the company says the new funding will scale the product and launch what it calls the industry’s first Resident Referral Network. - learn more

- Acre Venture Partners co-led Ascribe Bio’s oversubscribed $12M Series A with Corteva to scale its natural crop protection platform and launch Phytalix, a broad spectrum “biofungicide without compromise.” The funding advances Ascribe’s small molecule technology derived from the soil microbiome toward commercial rollout, with participation from Syngenta Group Ventures, Trailhead Capital, Silver Blue, Cultivation Capital, and others. - learn more

- Alexandria Venture Investments participated in Tr1X’s $50M financing, announced alongside FDA clearance of the IND for TRX319, an allogeneic CAR-Tr1 Treg cell therapy for progressive multiple sclerosis. The funding extends Tr1X’s runway into 2027 and supports a Phase 1/2a dose-escalation trial slated to start in early 2026, while the company continues its TRX103 studies in Crohn’s disease and other indications. - learn more

- LFX Venture Partners participated in FleetWorks’ $17M funding, which supports the launch and expansion of its “always-on” AI dispatcher for the U.S. trucking industry. The round was led by First Round Capital with participation from Y Combinator and Saga Ventures, and the company says the capital will go toward hiring, commercial rollout, and product development. FleetWorks’ platform automates freight matching between carriers and brokers to speed up bookings and reduce manual calls, emails, and texts. - learn more

- Clocktower Technology Ventures participated in Yendo’s $50M Series B. The fintech behind a vehicle-secured credit card will use the funding to expand its AI credit platform toward an inclusive digital bank that taps “trapped” consumer equity, aiming to unlock up to $4 trillion from assets like cars and homes for underserved borrowers. - learn more

- Alpha Edison participated in TransCrypts’ $15M seed round. The company builds a blockchain-based verified-credentials platform to fight AI-driven fraud and plans to expand beyond employment verification into health and education records. - learn more

- Alexandria Venture Investments participated in Nilo Therapeutics’ $101M Series A, which launched the company to develop medicines that modulate neural circuits to restore immune balance in disease. The round was led by The Column Group, DCVC Bio, and Lux Capital; Nilo also appointed Kim Seth, Ph.D., as CEO and plans to build out New York labs and advance preclinical programs. - learn more

- Chapter One participated in Glue’s $20M Series A. Glue builds an “agentic team chat” platform that embeds MCP-powered AI directly in workplace messaging, with 35 in-app integrations and support for thousands more via custom MCP servers. The funding will help expand product development and infrastructure as Glue pushes this model to more teams. - learn more

- StillMark participated in Meanwhile’s $82M raise, backing the Bermuda-regulated bitcoin life insurer as it expands bitcoin-denominated savings, retirement, and life insurance products for individuals and institutions. The round was co-led by Bain Capital Crypto and Haun Ventures with participation from Apollo, Northwestern Mutual Future Ventures, and Pantera Capital, and brings Meanwhile’s 2025 funding to $122 million after an earlier $40 million Series A. - learn more

- Blue Bear Capital co-led Energy Robotics’ $13.5M Series A with Climate Investment. The Darmstadt-based company provides AI software that lets robots and drones autonomously inspect critical infrastructure, and it will use the funding to scale deployments across energy, chemical, industrial, and utility sites. Customers already include majors like Shell, BP, BASF, Merck, and E.ON, and the company reports more than one million inspections completed to date. - learn more

- B Capital participated in EvenUp’s $150M Series E, which values the AI legal-tech company at over $2 billion. EvenUp builds AI tools for personal-injury law firms and plans to use the new capital to scale its platform and product suite; the round was led by Bessemer Venture Partners, with investors including REV (LexisNexis) and others. - learn more

- WndrCo participated in Zingage’s $12.5M seed round to build an AI care-delivery platform for home-based healthcare. Zingage is rolling out “Operator,” which automates scheduling, staffing, billing, and compliance for home care agencies, and “Perform,” which boosts caregiver retention, with the new capital supporting product expansion and go-to-market. The round was led by Bessemer Venture Partners with additional investors including TQ Ventures and South Park Commons. - learn more

- Alexandria Venture Investments participated in AeroRx Therapeutics’ $21M Series A, which was led by Avalon BioVentures with Correlation Ventures also investing. The funding advances AERO-007, a first-in-class nebulized LABA/LAMA for COPD, into late-stage clinical development aimed at patients who struggle with handheld inhalers. - learn more

- Alexandria Venture Investments participated in Affinia Therapeutics’ $40M Series C, alongside lead investor NEA and new investor Eli Lilly, to advance its AAV gene therapy pipeline. Proceeds will fund an IND submission in Q4 2025 and initial clinical work for AFTX-201 in BAG3 dilated cardiomyopathy, with a Phase 1/2 trial targeted for Q1 2026. - learn more

- Clocktower Ventures participated in Vycarb’s $5M seed round, which was led by Twynam with participation from MOL Switch, Hatch Blue, Idemitsu, and SGInnovate. The Brooklyn startup develops sensor-driven, water-based carbon capture and storage systems that convert CO₂ into stable bicarbonate, with the new funding aimed at scaling deployments at industrial sites. - learn more

LA Exits

- Empaxis Data Management was acquired by Communify, which is integrating Empaxis’ custodial and accounting data connections and operations expertise into its financial AI platform. The aim is to remove fragmented data so wealth and asset managers can deploy MIND AI apps like Client Stories and Portfolio Stories more quickly with cleaner, unified data. Communify also cites pre-integrations with over 175 market-data vendors to speed rollouts. - learn more

- TrueCar is being acquired by founder-led Fair Holdings (Scott Painter) in an all-cash deal at $2.55/share (~$227M), with Painter set to return as CEO. A 30-day go-shop runs through Nov. 13, 2025; largest holder Caledonia supports the acquisition, which is expected to close Q4 2025 or early 2026 pending approvals. - learn more

- Kate Somerville Skincare was acquired by Rare Beauty Brands, as Unilever moves to divest the prestige label it has owned for a decade. The deal includes the skincare and body-care lines as well as the brand’s Melrose Place clinic in Los Angeles; terms weren’t disclosed and closing is expected in Q4 2025 pending approvals. - learn more

- 3GC Group was acquired by Pandoblox, combining 3GC’s enterprise IT operations and cybersecurity services with Pandoblox’s Themis AI data platform to form a unified, AI-ready data and IT operations offering for mid-market companies. The deal aims to solve fragmented data and IT workflows so growing businesses can get enterprise-grade intelligence, security, and support through a single partner. - learn more

- The Free Press was acquired by Paramount, and co-founder Bari Weiss will become editor in chief of CBS News as part of the deal. Paramount says the move pairs CBS News’ scale with The Free Press’ voice, with Weiss reporting to CEO David Ellison and working to “modernize” the brand. - learn more

Read moreShow less

Resy Cofounder’s New App Lands in LA: A Loyalty Tool Restaurants Actually Want

10:08 AM | October 24, 2025

🔦 Spotlight

Hello LA,

Blackbird, the loyalty and payments startup from Resy and Eater co-founder Ben Leventhal, officially landed in LA this week. The product is simple in the wild: you check in, pay through the app, and earn rewards that restaurants can actually act on, helping them spot and serve regulars without guessing. The LA launch goes live with more than 50 partners centered on the Westside, including names like Gjelina and Felix, plus spots across groups such as Rustic Canyon and Citrin, with expansion planned beyond Venice and Santa Monica.

Under the hood, Blackbird has been building a national network and says it is live at more than 1,000 restaurants. The company raised fresh capital earlier this year to expand markets and roll out cross-restaurant rewards, positioning LA as a key beachhead for growth. If you dine out a lot, the appeal is that the app collapses discovery, payment, and loyalty into one flow. If you run a dining room, the promise is cleaner data on guests you actually see, instead of a generic points program that lives somewhere else.

For LA specifically, the draw is that this model fits how the city eats. We spread across neighborhoods, follow chefs, and rotate between a small set of favorites and a long list of next-ups. A networked loyalty layer that recognizes that pattern could move real dollars, particularly for independents that want to keep the relationship direct. We’ll be watching how quickly the footprint moves east from the coast and which operators lean into memberships and targeted rewards first.

Scroll for this week’s LA venture deals, funds, and acquisitions.

🤝 Venture Deals

LA Companies

- GammaTime, a Los Angeles based premium micro drama platform founded by former Miramax CEO Bill Block, raised $14M seed led by vgames and Pitango, with participation from Alexis Ohanian, Kris Jenner, Kim Kardashian, and Traverse Ventures. The app is live on iOS and Android, features more than 20 vertical phone native originals, and plans new series from “CSI” creator Anthony E. Zuiker as it scales a freemium model for U.S. audiences. - learn more

- Wolf Games, a generative-AI gaming startup backed by Dick Wolf, raised a $9M Series A led by Main Street Advisors. The company also inked a partnership with NBCUniversal to develop interactive games using NBCU IP, built on Wolf Games’ platform for creating “living, cinematic” game worlds. Notable participants include Maverick Carter, Tom Werner, and Rashid Johnson, alongside returning investors Jimmy Iovine, Paul Wachter, and Dick Wolf. - learn more

- Quantum Elements, a Los Angeles based startup, launched Constellation, an AI native platform that helps teams build quantum software and co design hardware using agentic AI, natural language prompts, and a large noisy qubit simulator. The company emerged from stealth with funding from QDNL Participations and support from USC Viterbi, and says Constellation can speed code generation, debugging, and testing for applications in pharma, energy, and finance. - learn more

- Arbor Energy raised a $55M Series A co-led by Lowercarbon Capital and Voyager Ventures, with Gigascale Capital and Marathon Petroleum Corporation participating, to accelerate deployment of its zero-emission, fuel-flexible turbines. The funding completes a 1 MW pilot called ATLAS and advances HALCYON, a 25 MW modular turbine that uses oxy-combustion with supercritical CO₂ for efficient, carbon-neutral baseload power aimed at data centers, utilities, and industrial customers. - learn more

- Dialogue AI raised a $6M seed led by Lightspeed Venture Partners to scale its AI-native research platform, which uses a live conversational AI interviewer to run real-time customer interviews and deliver insights faster. Participants include Seven Stars, Uncommon Projects, the Tornante Company, and notable angels, and the funds will accelerate product and go-to-market efforts with early customers such as Wayfair, Square, Nextdoor, and Suno. - learn more

LA Venture Funds

- March Capital participated in Uniphore’s $260M Series F, joining strategic investors NVIDIA, AMD, Snowflake, and Databricks. The funding will accelerate development and adoption of Uniphore’s Business AI Cloud and expand its partner ecosystem, alongside investors like NEA, BNF Capital, National Grid Partners, and Prosperity7 Ventures. - learn more

- Beast Ventures participated in Nutropy’s latest funding round to scale precision-fermented casein for next-gen dairy ingredients. The France-based startup will use the capital to ramp production and deliver larger samples of its “cheeseable milk” powder to food manufacturers as it targets a 2027 launch. - learn more

- Patron participated in Notch’s $8M seed financing round, alongside investors such as Wing, Samsung, and Balaji, to scale the company’s AI platform for generating performance ads. Notch has since launched a “URL-to-animated-ads” feature that turns a product link into ready-to-run animated creatives within minutes, supporting a faster workflow for marketers rolling out motion ads. - learn more

- B Capital participated in CurbWaste’s $28M Series B, which was led by Socium Ventures with Flourish Ventures, TTV Capital, and Squarepoint Capital also joining. The funding brings total capital to $50M and will accelerate product and go-to-market work on CurbWaste’s operating system for independent waste haulers, including AI-driven dispatch, reporting, and payments. - learn more

- Thin Line Capital participated in SenseNet’s $14M Series A to scale its AI wildfire-detection network in the United States. The round was led by Stormbreaker with Fusion Fund, Plaza Ventures, FOLD36 Capital, and B Current also joining; funds go toward new offices and installations as SenseNet fuses gas sensors, AI cameras, satellites, and weather data to spot fires before they are visible. The company says it already monitors about 130 million acres and can flag ignitions within minutes. - learn more

- MANTIS Venture Capital participated in Keycard’s $38M financing for its identity and access platform for AI agents. The combined seed and Series A were led by Andreessen Horowitz, Acrew Capital, and Boldstart Ventures, and coincide with Keycard’s early-access launch. Keycard says its system issues short-lived, auditable identity tokens to help developers govern agent actions and data across apps. - learn more

- WndrCo participated in Defakto’s $30.75M Series B, a round led by XYZ Venture Capital with The General Partnership and Bloomberg Beta also joining. Defakto, formerly SPIRL, builds a Non-Human Identity and Access Management platform that replaces static credentials with dynamic, auditable identities for services, pipelines, workloads, and AI agents across multi-cloud environments. The company will use the capital to accelerate product development and expand go-to-market efforts. - learn more

- CIV co led 1001’s $9M round alongside General Catalyst and Lux Capital to build an AI native operating system for decision making in critical industries. 1001 combines live data ingestion, operational mapping, AI driven decisioning, and governance to help operators act in real time, with early pilots in aviation, logistics, and large infrastructure projects. The raise also includes backers like Chris Ré and Amjad Masad and will fund early deployments and hiring in Dubai, London, and beyond. - learn more

- Brentwood Associates led Throne Labs’ $15M Series B initial close to expand the company’s smart restroom infrastructure across new and existing U.S. markets. Existing investors including Uncorrelated Ventures, DiPalo Ventures, Rabil Ventures, and Arpiné Capital participated as Throne scales its network of sensor-equipped, ADA-compliant restrooms and city partnerships. - learn more

- M13 led Estuary’s $17M Series A, with participation from FirstMark and Operator Partners, to scale the company’s “right-time data” platform. Estuary unifies change data capture, streaming, and batch into one managed system with BYOC deployment so enterprises can control latency and feed AI applications more reliably; funds will support product and go-to-market expansion. - learn more

- Strong Ventures provided follow-on funding in Unjeonseonsaeng’s ₩2.8B (~$2.0M) Series A, backing the driving-school comparison and booking platform as it scales nationwide. New investors Fast Ventures and Korea Credit Guarantee Fund joined the round, with proceeds going to expand the company’s SaaS tools for driving schools and enhance data-driven features like AI recommendations and advertising. The startup reports monthly GMV above ₩1B and its first profitable quarter in 2025. - learn more

- Interlagos led Adaptyx Biosciences’ $14M seed, with Hyperlink Ventures participating alongside Overwater Ventures, Starbloom Capital, Stanford University, the Chan Zuckerberg Biohub, and others. Adaptyx is developing a biowearable for continuous, multi-analyte molecular monitoring; the raise brings total funding to about $23M and supports R&D, clinical progress toward FDA clearance, and platform scaling. - learn more

- B Capital participated in Faeth Therapeutics’ new $25M financing, which brings the company’s total funding to $92M and supports a randomized Phase 2 trial of its PIKTOR regimen in endometrial cancer with the GOG Foundation. The raise, led by S2G Ventures with additional new and existing backers, follows Phase 1b data showing an 80% overall response rate and 11-month median PFS when PIKTOR was combined with paclitaxel. - learn more

- Btech Consortium participated in PortX’s strategic growth round, joining renewed backers alongside new investors Allied Solutions and the American Bankers Association. The funding extends PortX’s Series B and underscores industry support for its AI-powered data integration platform for banks and credit unions. - learn more

LA Exits

- Breez was acquired by JumpCloud to bolster JumpCloud’s identity threat detection and response capabilities and accelerate its security roadmap. The deal brings Breez’s ITDR technology and team into JumpCloud’s platform; terms were not disclosed. The Breez group is led by former Adobe executive Abhinav Srivastava. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS