Get in the KNOW

on LA Startups & Tech

XMeWe Billed Itself as the Anti-Facebook. Now It's Going Hollywood.

Rachel Uranga

andRachel Uranga is dot.LA's Managing Editor, News. She is a former Mexico-based market correspondent at Reuters and has worked for several Southern California news outlets, including the Los Angeles Business Journal and the Los Angeles Daily News. She has covered everything from IPOs to immigration. Uranga is a graduate of the Columbia School of Journalism and California State University Northridge. A Los Angeles native, she lives with her husband, son and their felines.

Francesca Billington

Francesca Billington is a freelance reporter. Prior to that, she was a general assignment reporter for dot.LA and has also reported for KCRW, the Santa Monica Daily Press and local publications in New Jersey. She graduated from Princeton in 2019 with a degree in anthropology.

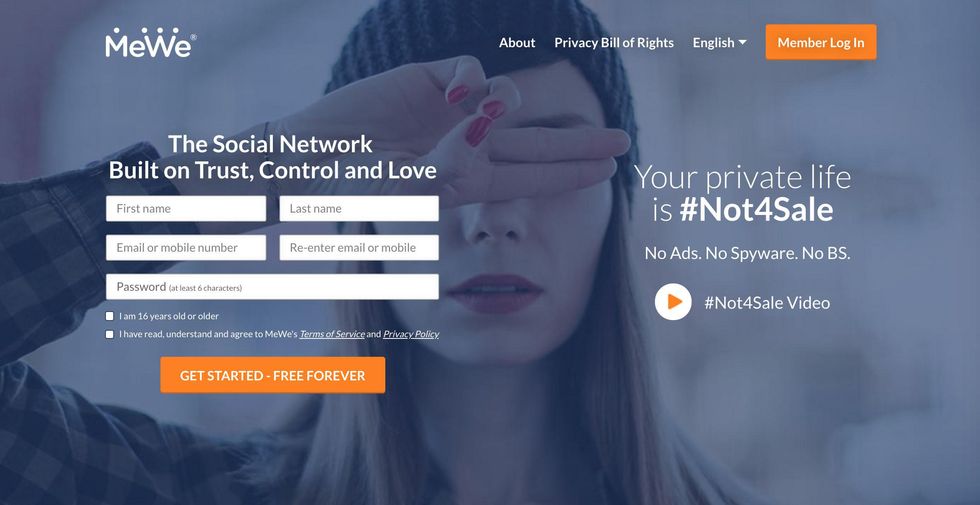

The new chief executive of MeWe, the social network that billed itself the anti-Facebook, wants to lure in Hollywood talent — and is eyeing advertisers.

The move, steered by veteran tech and Hollywood executive Jeffrey Edell, is a departure for the Los Angeles company, which promises users it'll protect their privacy and prohibit manipulative algorithms with an ad-free network.

"I want to stay true to the privacy and those efforts, but I don't think it makes sense personally to be the quote anti-Facebook publicly," said Edell, who most recently was president of the entertainment and licensing company WTG Enterprises.

MeWe chief executive Jeffrey Edell

Since replacing founder Mark Weinstein — now the company's "chief evangelist" — last week as the network's chief executive, Edell has already signed on the comic duo Cheech Marin and Tommy Chong, better known as Cheech & Chong, to help promote the site.

"What I want to do is make the experience at MeWe an experience of chat and socializing around content, whether it be voice content like music or content that you would see documentaries, niche-based content, things like that," Edell said. "It would be really cool to have the ability to Chromecast or Rokucast, if you will, content that we would licensed or in our control and be able to have chat groups and socialize in and around that content."

The former chairman of Intermix Media, the parent company of MySpace, and a longtime executive for media distribution and licensing companies, Edell said he will use his Hollywood connections to build up partnerships. He noted that MeWe is already in talks with A-level talent.

About 17 million users are signed up worldwide for the free version of MeWe, about half in North America. The Culver City-based site appealed to some of those users by selling itself as privacy focused, with a "Privacy Bill of Rights" that vowed not to manipulate, filter or change newsfeeds or use facial recognition technology.

It kept those protections.

Unlike Facebook or Twitter, MeWe's revenue comes from subscribers who pay a monthly or annual fee to talk with a camera, access private chat rooms and get free emojis and other perks. Weinstein told dot.LA in March that the social platform makes $1 million each month from those subscribers alone.

Weinstein wouldn't disclose how many users pay for their accounts, but said 95% use the free version. MeWe has raised about $24 million from "high net-worth individuals," Edell said. And it's seeking another $20 million of funding from venture firms as it looks forward to creating new offices in a post-pandemic world.

Edell vowed to "stay true to the concept of privacy and security and protection of people's personal information." But, he says, he's open to partnering with advertisers to "give people the opportunity to make choices of what it is they want to see, listen to and do."

Until recently, the social network has relied on users' discontent with big social networks like Facebook to grow its base. When Facebook rolled out new WhatsApp privacy policies in January, upset users flocked to MeWe. The site gained 2.5 million users in one week. Some observers said it became a haven for anti-vaxxers and extremists.

Edell wants the site to appeal to users widely and while continuing to moderate content, although he didn't say how.

"If you're going to have crazy theories, again as long as you're not damaging to people, you're not pointing a gun at Obama's head, you're not raiding the Capitol to get to Nancy Pelosi... then a person should be available to be as silly as they want and they can not make sense or make sense, just don't cross the line," he said.

"The subscription model is going to stay," Edell said. "And there won't be a situation where I know exactly how you behave, so I send you an advertisement to buy Nike shoes and get creepy like that, but I'm thinking there has to be a way – as we move towards the future – to give you the option to figure out what it is you want, and then give you a place within the platform you can go and get it," he said.

For instance, he said, members might be able to opt into stores or groups with advertisers. That strategy will be key, he said, if it's to make a dent in Hollywood, where studios and talent alike depend on social media.

"We just have to be more sensitive towards the entertainment community and the people that are going to be on that platform and not create conflict," he said. "That doesn't mean we still can't be different."

From Your Site Articles

Related Articles Around the Web

Rachel Uranga

Rachel Uranga is dot.LA's Managing Editor, News. She is a former Mexico-based market correspondent at Reuters and has worked for several Southern California news outlets, including the Los Angeles Business Journal and the Los Angeles Daily News. She has covered everything from IPOs to immigration. Uranga is a graduate of the Columbia School of Journalism and California State University Northridge. A Los Angeles native, she lives with her husband, son and their felines.

Francesca Billington

Francesca Billington is a freelance reporter. Prior to that, she was a general assignment reporter for dot.LA and has also reported for KCRW, the Santa Monica Daily Press and local publications in New Jersey. She graduated from Princeton in 2019 with a degree in anthropology.

https://twitter.com/racheluranga

rachel@dot.la

JetZero Just Raised $175M to Rewrite How We Fly

07:06 AM | January 16, 2026

🔦 Spotlight

Happy Friday, Los Angeles ✈️

While everyone in tech is still busy arguing about the next AI model, one startup based out of Long Beach just raised a whole lot of money to change the shape of the airplane itself.

JetZero closed a $175 million Series B to build its blended wing body “all-wing” airliner, with B Capital leading the round alongside United Airlines Ventures, Northrop Grumman, 3M Ventures, Trucks VC and RTX Ventures. The company is working toward a full-scale Demonstrator aircraft that targets at least 30% better fuel efficiency than today’s tube-and-wing jets, with a first flight planned for 2027 and a commercial Z4 airliner to follow in the early 2030s.

This is not a small bet. JetZero’s pitch is that airlines and regulators need a way to hit climate targets without waiting on sci-fi batteries or hydrogen infrastructure, and that a radically more efficient airframe is the most realistic path. It is also very much an LA story: deep aerospace talent, strategic money at the table, and a product that looks like a mashup of climate tech, defense tech and old-school manufacturing rather than another SaaS dashboard.

There is still a long way to go. The next few years are about turning simulations and wind-tunnel charts into flight data, working with regulators and proving that a manta-ray-shaped jet can slot into a world built for Boeings and Airbuses. But if JetZero gets anywhere close, it will mean that one of the most ambitious hardware bets in commercial aviation is being engineered out of Long Beach.

Scroll on for the latest LA venture rounds, fund news and acquisitions.

🤝 Venture Deals

LA Companies

- No Agent List secured $10M in private investment to launch its AI powered real estate platform ahead of a planned Spring 2026 debut. The Los Angeles based company aims to put “agent level” tools directly in the hands of buyers, sellers and vendors, offering direct access to off market properties, FSBOs, distressed assets, foreclosures, tax liens and auctions that have traditionally been gated by agents and insiders. The funding will support product development and rollout of the platform, which promises more control over transactions while using AI to surface opportunities and streamline the deal process. - learn more

- Hadrian, the Los Angeles based advanced manufacturing startup, announced new capital led by accounts advised by T. Rowe Price Associates to accelerate its push to “reindustrialize” American manufacturing. The financing, which also includes Altimeter Capital, D1 Capital Partners, StepStone Group, 1789 Capital, Founders Fund, Lux Capital, a16z, Construct Capital and others, values the company at $1.6B and will be used to expand its high-throughput factories, grow its workforce and deploy more AI, software and automation across its “factories-as-a-service” platform for aerospace, defense and critical infrastructure customers.- learn more

LA Venture Funds

- Blue Bear Capital joined Hydrosat’s $60M Series B, backing the thermal infrared satellite data company alongside lead investors Hartree Partners, Subutai Capital Partners and Space 4 Earth. The funding will help Hydrosat expand its constellation beyond its two current satellites, ramp global coverage and deepen its AI-powered “thermal intelligence” products for water resource management, agriculture, civil government and defense customers worldwide. - learn more

- Elysian Park Ventures led a $12M growth round for Diamond Kinetics, backing the Pittsburgh-based baseball tech company as it doubles down on youth development. The new capital will help Diamond Kinetics scale sidelineHD, its AI-powered youth baseball and softball live streaming and highlights platform, and expand its broader suite of training tools as MLB’s Trusted Youth Development Platform. - learn more

- MANTIS Ventures participated in Depthfirst’s $40M Series A round, backing the San Francisco based applied AI lab alongside lead investor Accel, Alt Capital, BoxGroup, Liquid 2 Ventures and SV Angel. Depthfirst is building an AI-native “General Security Intelligence” platform that uses autonomous agents to detect, triage and remediate software vulnerabilities across code and infrastructure, aiming to outpace a new wave of AI-powered cyberattacks. The fresh capital will fund R&D, go-to-market efforts and hiring as the company scales its security platform for enterprise customers. - learn more

- Cedars-Sinai Health Ventures participated in Vista AI’s $29.5M Series B, joining a slate of leading health systems backing the company’s automated MRI scanning software. The Palo Alto-based startup will use the funding to expand its FDA-cleared cardiac MRI platform to additional anatomies like brain, prostate and spine, and to roll out remote scanning services that let hospitals without in-house MRI expertise offer advanced imaging while easing backlogs and technologist shortages - learn more

- Fourward Ventures is leading a new strategic growth investment in Mermaid Gin, backing the Isle of Wight–based premium spirits brand as it accelerates expansion in the U.S. market. The round brings Fourward’s founder Will Ward onto the board as lead investor and is paired with a national distribution partnership with Southern Glazer’s Wine & Spirits, plus the appointment of longtime Moët Hennessy veteran Jim Clerkin as CEO for the U.S. push. The capital and partnership are aimed at scaling Mermaid Gin in the fast-growing U.S. super-premium gin segment while preserving its sustainability-focused, Isle of Wight roots. - learn more

- Hyperion Capital joined Haiqu’s $11M seed round, backing the quantum software startup alongside Primary Venture Partners, Collaborative Fund, Alumni Ventures, Qudit Ventures, Silicon Roundabout Ventures, Harlow Capital, Toyota Ventures and MaC Venture Capital. Haiqu is building a hardware-aware quantum operating system and middleware layer that boosts the performance of today’s noisy quantum hardware, with the new funding going toward productizing its platform and enabling near-term commercial use cases in areas like finance, cybersecurity and scientific computing. - learn more

- Sound Ventures led WitnessAI’s $58M strategic funding round, backing the Mountain View based AI security and governance platform alongside investors including Fin Capital, Qualcomm Ventures, Samsung Ventures and Forgepoint Capital Partners. The company will use the capital to accelerate global go-to-market efforts and expand its platform, which secures AI agents and models by monitoring agent activity, linking human and agent actions, and blocking prompt injection and other attacks in real time. WitnessAI also unveiled new agentic AI governance tools that give enterprises deeper observability and policy control as they scale AI agents across their operations. - learn more

- Alexandria Venture Investments joined Proxima’s oversubscribed $80M seed financing, backing the newly rebranded AI-native biotech (formerly VantAI) alongside lead investor DCVC, NVentures (NVIDIA’s venture arm), Braidwell, Roivant and others. Proxima is building a generative AI driven platform for “proximity-based medicines” that modulate protein protein interactions, including molecular glues and PROTACs, to go after historically undruggable targets in oncology, immunology and beyond. The new capital will accelerate its NeoLink structural proteomics and Neo AI model stack, and advance a pipeline of first-in-class proximity-modulating therapeutics toward the clinic. - learn more

- Clocktower Technology Ventures participated in WeatherPromise’s oversubscribed $12.8M Series A, backing the weather-guarantee startup alongside lead investor Maveron, 1Sharpe, Lerer Hippeau, Commerce Ventures, MS Transverse, Start Ventures, 1Flourish and others. WeatherPromise partners with major travel brands like Marriott, Expedia and JetBlue to offer “weather guarantees” that automatically refund trips when conditions are worse than promised, driving demand for travel, events and outdoor experiences. The new capital will accelerate product development, expand strategic partnerships and scale the platform across more consumer categories. - learn more

- MANTIS Ventures participated in Sandstone’s $10M seed round, backing the AI-native legal tech startup alongside lead investor Sequoia Capital and others. Sandstone is building an operating system for in-house legal teams that uses AI agents to route requests, draft and review contracts, and surface answers directly inside tools like email, Slack and Salesforce, turning institutional legal knowledge into reusable workflows. The new capital will help the Brooklyn-based company scale its product and grow its customer base of corporate legal departments. - learn more

- Strong Ventures participated in Hupo’s $10M Series A round, backing the Singapore-based AI sales coaching startup alongside lead investor DST Global Partners, Collaborative Fund, January Capital and Goodwater Capital. Hupo’s platform uses AI to coach frontline banking, insurance and financial services sales teams in real time, helping them ramp faster and close more deals across highly regulated markets in APAC and Europe. The new funding will support product development, expansion of its coaching features and scaling enterprise deployments as the company eyes broader international growth. - learn more

- Freeflow Ventures joined Vivere Oncotherapies’ more than $10M funding round, backing the UC Berkeley spinout alongside YK Bioventures, Pillar, Berkeley Frontier Fund and the National Cancer Institute. Vivere is developing targeted immunotherapies for “cold” solid tumors like colorectal and ovarian cancers, aiming to activate the immune system against tumors that typically evade detection and resist existing treatments. The new capital will support advancement of its proprietary bioengineering platform and pipeline of therapies for patients with few effective options today. - learn more

- Alexandria Venture Investments joined Precede Biosciences’ $63.5M Series B equity round, part of an $83.5M total financing package that also includes a $20M strategic, non-dilutive credit facility. The Boston based precision diagnostics and data company is scaling its blood-based platform, which measures target expression and pathway activity to support next-generation cancer therapies like drug, radio and immune conjugates. The new capital will help Precede meet growing demand from biopharma partners developing these precision medicines and accelerate commercialization and health system adoption. - learn more

- Alexandria Venture Investments participated in Recludix Pharma’s new equity financing round alongside Access Biotechnology, NEA and Westlake BioPartners, with additional strategic investment from Eli Lilly. The San Diego based, clinical-stage biotech will use the $123M in total equity raised to advance clinical development of its novel SH2 domain inhibitor pipeline for inflammatory diseases and to tap Lilly’s TuneLab AI/ML platform to accelerate discovery across its broader SH2 domain program. - learn more

- BOLD Capital Partners participated in MagicCube’s $10M funding round, backing the Cupertino-based software security company alongside strategic investor Verifone and other existing backers. MagicCube plans to use the capital to expand beyond its core tap-to-phone payments offering into biometrics, identity verification and AI-driven device security, while scaling its Software Defined Trust platform that delivers hardware-grade protection through software on standard mobile and IoT devices.- learn more

LA Exits

- Webalo is being acquired by Prometheus Group, which is folding the Los Angeles based “no-code for the frontline” platform into its enterprise asset management software suite. The deal will combine Webalo’s mobile, real-time workflows for frontline workers with Prometheus Group’s planning and scheduling tools, aiming to create a closed-loop digital execution platform that connects shopfloor actions directly back into systems of record like SAP and Oracle. - learn more

Read moreShow less

Brex’s $5.15B Deal With Capital One Marks A New Era For Fintech

11:18 AM | January 23, 2026

🔦 Spotlight

Happy Friday, Los Angeles. 💳

The first big fintech plot twist of 2026 is here. Capital One is buying Brex in a cash and stock deal valued at about $5.15 billion, in what the companies are calling the largest bank - fintech deal in history.

From college dropouts to a multibillion exit

Brex launched in 2017, when Brazilian founders Henrique Dubugras and Pedro Franceschi, then in their early 20s after dropping out of Stanford, set out to fix the “startup card” problem. That project turned into an AI-native finance platform that now serves tens of thousands of companies, from early-stage startups to hundreds of public enterprises.

A few years into that journey, both founders moved to Los Angeles and continued running Brex from here as the company embraced a fully remote model. Now that same LA-based duo is steering a multibillion-dollar acquisition that will plug their software directly into one of the biggest banks in the country. Pedro will stay on as CEO of Brex inside Capital One, with the brand and product continuing rather than disappearing into a rebrand.

Why this looks like a win

“Big bank buys fintech” can sound like the end of the startup story, but here it reads more like an expansion pack. Capital One gets Brex’s cloud-based spend stack, AI-powered controls and roughly $13 billion in commercial deposits. Brex gets a massive balance sheet, a regulated rails partner and access to the mainstream business market it has been edging toward for years.

For founders and operators here, it is also quiet validation that building hard fintech infrastructure still pays off. Brex spent years doing the unglamorous work of licenses, compliance, underwriting and integrations. The outcome isn’t a hype cycle spike; it is a classic, real-money exit for a very modern stack.

What it signals for LA’s ecosystem

LA is not getting a new headquarters out of this. Brex has embraced a “no HQ” model. What the city does have is a pair of founders who chose to build their lives here and just proved that you can run a global finance platform from Los Angeles and end up selling it to a top-six U.S. bank.

It also fits a broader pattern our ecosystem is leaning into. Whether it is fintech, defense tech or climate, the most interesting LA stories right now are not about front-end apps. They are about deep, regulated infrastructure that incumbents eventually need more than startups need them.

For Brex, this is the start of a new chapter inside Capital One. For LA, it is one more data point that the city’s founders can build products the rest of the financial system has to buy.

Scroll on for the latest LA venture rounds, fund news and acquisitions.

🤝 Venture Deals

LA Companies

- L-Nutra secured a new $36.5M investment from Mubadala, bringing its total Series D proceeds to $83.5M. The company, which develops longevity-focused and medical nutrition therapies, plans to use the funding to accelerate global expansion, advance clinical research, and scale adoption of its nutrition programs across healthcare providers and consumers. - learn more

- RiskFront AI raised $3.3M in pre-seed funding to make financial crime and compliance work far less manual. The US-based startup uses “agentic AI” to automate time-consuming tasks like research, data analysis and documentation, with its Airos platform handling much of the day-to-day workload so human analysts can focus on higher-value judgment calls. The new capital will help expand engineering and product teams and deepen integrations with banks and fintechs already piloting the system. - learn more

- Balance Homes relaunched with a $30M investment led by Falco Group to scale its equity-sharing model for homeowners who are “house rich but cash and credit constrained.” The company buys a co-ownership stake in a home to free up trapped equity so owners can pay down mortgages and high-interest debt while staying in their homes, instead of being forced to sell. After stabilizing its existing portfolio following EasyKnock’s shutdown, Balance Homes is now resuming originations in six states, with plans to expand as affordability and household debt pressures intensify. - learn more

LA Venture Funds

- Distributed Global co-led Superstate’s $82.5M Series B, backing the Robert Leshner - founded tokenization platform as it builds regulated, on-chain capital markets infrastructure. The round, alongside Bain Capital Crypto and other institutional investors, will help Superstate expand beyond its existing tokenized U.S. Treasury funds to a full issuance layer for SEC-registered equities on Ethereum and Solana. The company, which already manages over $1.1B in tokenized assets, plans to scale its Opening Bell platform and transfer agent stack so public companies can issue and manage compliant on-chain shares directly. - learn more

- Krew Capital participated in GIGR (Playad.ai)’s $5.4M pre-seed round, backing the San Francisco based startup as it builds multi-agent AI workflows for marketing teams. GIGR’s Playad platform starts with interactive ads, using AI agents to help marketers create, test and iterate on playable and other ad formats much faster while turning performance data into continuous creative improvement. The new funding will support product development, expansion of its AI-native creative workflow and scaling to more customers looking to cut production costs and tighten the loop between ad performance and creative decisions. - learn more

- Trousdale Ventures participated in AheadComputing’s additional $30M Seed2 round, backing the Portland-based chip startup as it reimagines CPU architecture for the AI era. AheadComputing is developing high-performance RISC-V based CPUs and breakthrough microarchitecture aimed at handling the growing wave of AI data center, workstation and embedded workloads where CPU performance has become a bottleneck. The new funding, which brings total capital raised to $53M, will support R&D, software innovation and test chip development as the company races to deliver next-generation general purpose processors. - learn more

- Untapped Ventures participated in Nexxa.ai’s $9M seed round, backing the Sunnyvale-based startup as it scales specialized AI agents for heavy-industry workflows. Nexxa’s Nitro platform layers multi-agent automation on top of existing tools used in sectors like rail, construction, manufacturing and critical infrastructure, helping engineers plan and execute complex projects without ripping out legacy systems. The new funding brings Nexxa.ai’s total capital raised to $14M and will go toward expanding deployments, forward-deployed engineering teams and support for more industrial customers. - learn more

- UP.Partners participated in Zanskar’s $115M Series C, backing the Salt Lake City based geothermal startup as it uses AI to uncover overlooked conventional geothermal resources across the Western U.S. The company has already validated several high-potential sites and plans to use the funding to expand its discovery platform and begin developing multiple greenfield power plants, with a goal of bringing significant new clean baseload capacity to the grid before 2030. - learn more

- Smash Capital participated in Stream’s $90M Series D, backing the UK based workplace finance startup as it ramps expansion into the U.S. market. Formerly known as Wagestream, Stream partners with employers to offer workers tools like earned wage access, savings, budgeting and pensions in a single app, targeting financial stress for lower and middle income employees. The new funding, led by Sofina, brings total capital raised to about $228M and will help Stream scale its multi-product platform across more brands and workers globally. - learn more

- Fika Ventures participated in Ivo’s $55M funding round, backing the San Francisco based legal AI startup alongside lead investor Blackbird and others. Ivo builds contract intelligence tools for in-house legal teams and enterprises, using a highly structured approach that breaks reviews into hundreds of smaller AI tasks to boost accuracy and reduce hallucinations. The new capital, which reportedly values the company at around $355M, will go toward accelerating product development and hiring more sales and go-to-market talent to meet growing demand. - learn more

- Amplify.LA participated in Overworld’s latest funding round, backing the AI startup as it unveils a real-time diffusion world model for playable, AI-native worlds. Overworld’s system runs locally and generates persistent, interactive environments on the fly, aiming to become core infrastructure for next-generation games, simulations and creative tools built around world models rather than static assets. The new capital will support further development of its Waypoint 1 research preview and help the team expand its platform for researchers, engineers and builders working on interactive AI experiences. - learn more

- Dangerous Ventures participated in Carbogenics’ $3M investment and grant funding round, backing the Edinburgh-based bio-carbon startup as it scales its carbon removal technology. Carbogenics turns difficult-to-recycle organic waste into CreChar, a biochar product that boosts biogas production, supports wastewater treatment and locks away carbon. The new funding will help the company expand manufacturing in the US, grow its centralized UK operations and deploy its biocarbon products across the UK, Europe and North America. - learn more

LA Exits

- Farcaster is being acquired by Neynar, the infrastructure company that already powers much of the Farcaster ecosystem, in a full-stack handoff from Merkle Manufactory. Neynar will assume control of the decentralized social protocol’s smart contracts, code repositories, official app and Clanker client, while Farcaster co-founders Dan Romero and Varun Srinivasan step back from day-to-day operations after five years. The deal keeps the network running without disruption and sets Neynar up to roll out a new, builder-focused roadmap for on-chain social. - learn more

- ScribbleVet has been acquired by Instinct Science, which is folding the veterinary AI-scribing startup into its Instinct EMR platform to create what it calls an “intelligent-native” practice management system. The combined offering aims to move traditional PIMS beyond record-keeping by embedding AI scribing, workflow automation and clinical decision support in one system, reducing documentation burden and helping veterinary teams focus more on patient care. ScribbleVet’s team is joining Instinct, with founder and CEO Rohan Relan taking on a key role leading product strategy for intelligence features across the platform. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS