Venture Deals Fall in LA Amid Economic Worries

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

Much like the rest of the U.S., the Los Angeles region is facing a venture capital slowdown.

Venture capitalists are investing less money and striking fewer deals with L.A. startups lately, according to PitchBook Data and interviews with experts. There’s been a sharp drop in the amount of money flowing back to investors, too, with a decline in public offerings or other exits by VC-backed companies.

The second quarter was still a strong one for L.A. by pre-pandemic standards, but it marks a significant slowdown after a record-smashing 2021. The cooling deal activity could continue during the current third quarter and beyond amid an uncertain economic environment and an overdue correction in startup valuations, VC executives told dot.LA.

“You’re starting to see deal flow slow down and you're starting to see a lot of venture investors take a wait and see approach,” said Brian Lee, co-founder and managing director of L.A.-based BAM Ventures.

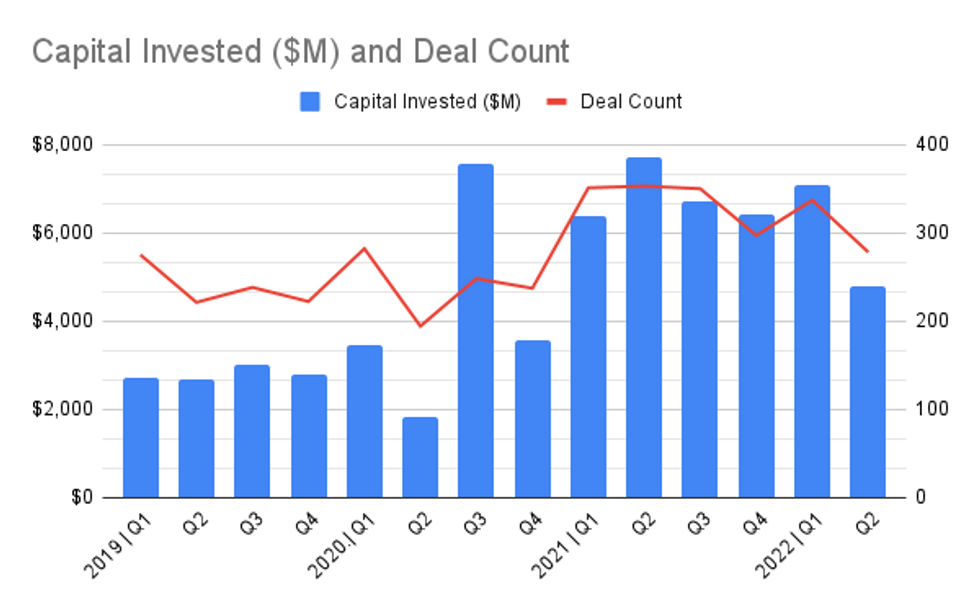

PitchBook and the National Venture Capital Association recently released their second quarter Venture Monitor report on the investment landscape. According to PitchBook, VCs invested nearly $4.8 billion in the L.A. metropolitan area during the second quarter this year, a nearly 38% decline from the nearly $7.7 billion invested during the same period a year earlier. The number of deals dropped year-over-year from 353 to 278 from April through June.

Deal activity during the three-month period is also down from the first quarter of this year, when startups collectively received $7 billion from VCs across 337 deals. Still, L.A.’s second quarter deal count and investment volume were at or above quarterly figures in 2019 and 2020, according to PitchBook.

“The second quarter still maintained a lot of momentum from 2021 and the first quarter, especially if you're looking at the actual capital going to startups remaining historically high,” PitchBook Venture Analyst Cameron Stanfill told dot.LA. “There's still a lot of money that's going into startups right now.”

And L.A. has been one the strongest markets so far this year, trailing only the Bay Area and New York regions in deal count and deal value, according to the Venture Monitor report. As of June 30, there were 669 deals here collectively worth $12.6 billion.

Still, experts say investors are being more rigorous and selective. Taj Ahmad Eldridge, a co-founder and general partner at Include Ventures, said he’s seen funds “taking their time” to do more due diligence before making an investment.

“They're looking for more traction on the customer side,” he said of what funds are seeking lately. Startups do “not necessarily have to have some revenue piece of that, but at least just a pathway to where they could figure this out”

Indeed, startup founders are having a harder time raising funds just from intangibles like vision, a beta product or celebrity involvement, said Joey Boukadakis, founder of L.A.-based General Specific, which advises early and growth stage startups.

“The main variable it feels like investors are focusing on is this signal that someone is willing to pay you for something,” Boukadakis said. “Companies with some kind of revenue around what they're doing in today's world most likely have a better chance of having conversations and bringing on additional capital.”

That could be bad news in the short term for startups in emerging tech spaces like Web3, a decentralized vision for the internet based on blockchain technology. Crypto and NFTs may very well change the digital world as we know it, but not anytime soon.

Investing activity in Web3 hasn’t stalled, but valuations in that space have “come down quite a bit,” said Anna Barber, partner at L.A. VC firm M13. (Disclosure: M13 is an investor in dot.LA)

“We're talking about an emerging market where six months to a year ago, there might have been more appetite for risk,” she said. “We’re very interested in the sector. We're continuing to invest. I think it's more about measuring risk and potential differently in terms of how and when and how much to invest.”

The amount of capital flowing back to investors dried up during the second quarter. Pitchbook recorded 24 venture-backed company exits collectively worth $95.75 million in the L.A. region during the second quarter. This is a sharp drop from the whopping $5.7 billion that returned to investors across 27 deals during the same period last year. This decline comes amid a fall in initial public offerings, public listings and special purpose acquisition company (SPAC) mergers, PitchBook noted.

Early-stage investments, which are generally the most distant from the public market, appear to be largely insulated from current economic troubles. Nationwide, there’s been little slowdown in angel and seed round investment activity, per PitchBook Data.

That tracks with what Minnie Ingersoll has seen as a partner at early stage investor TenOneTen Ventures. She noted the L.A.-based VC just closed an investment last week and another in June, keeping pace with the firm’s usual deal flow.

“I would say there has been less change than I have expected,” Ingersoll said.

One change she has noticed is an increase in extension or “bridge rounds.” These smaller raises are aimed at giving startups more breathing room to weather an economic storm that could last months if not years.

“That's giving them extra runway,” Ingersoll said. “And that means they don't have to go hit the market right now.”

- Venture Deals in LA Are Slowing Down, And Other Takeaways From ... ›

- Here Are Los Angeles' Top Venture Capitalists - dot.LA ›

- How a Fragile Economic Climate is Impacting SoCal VCs - dot.LA ›

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

Image Source: Revel

Image Source: Revel