dot.LA VC Sentiment Survey: Lots of Hiring, a Partial Return to Offices But Hold Off on Conferences

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Thanks to a sizzling startup scene and a receding pandemic, Los Angeles investors are feeling more optimistic this spring than they did at the end of last year.

They are expecting robust hiring, increasing valuations and a quick recovery of the U.S. economy, according to the dot.LA VC Sentiment Survey, a quarterly poll of the top VCs in Los Angeles.

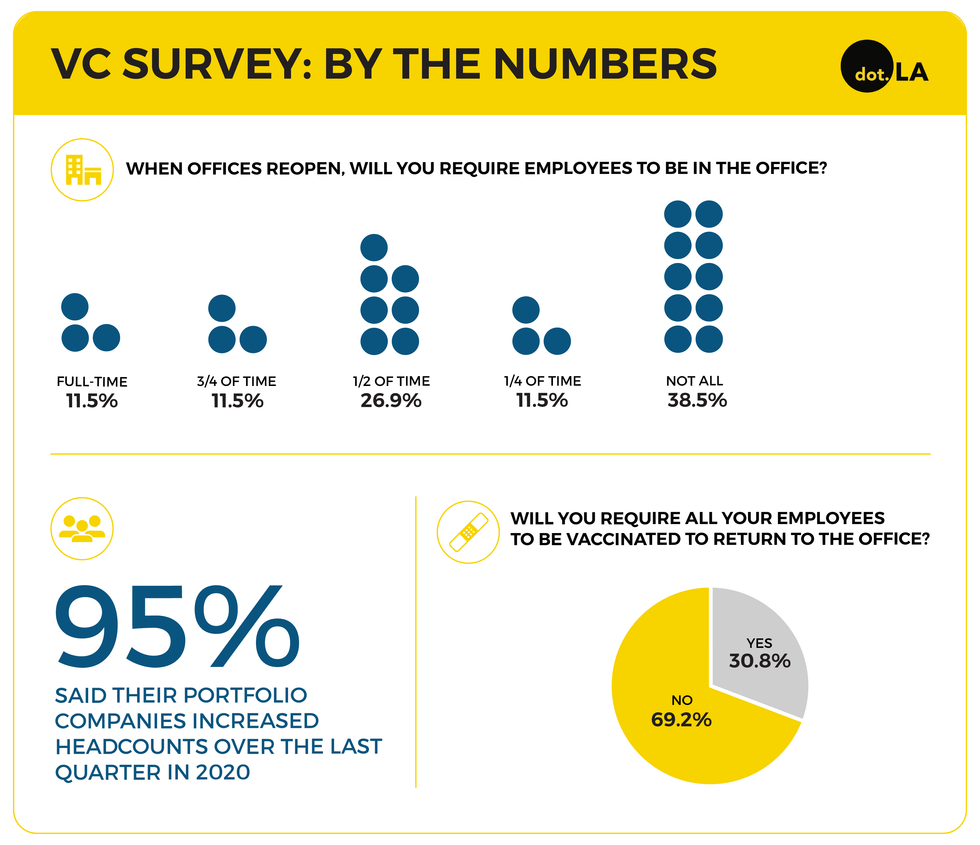

Nearly every investor said their portfolio companies had added headcount in the last quarter and expect to add more in the second, which was an improvement from the final quarter of 2020.

"The majority of our portfolio has seen exponential growth during the COVID shutdown combined with more accessible talent," said Matt Lydecker, lead investor at Luma Launch, an early stage fund based in Santa Monica. "Both of these variables have led to massive hiring over the last year."

Almost half of our 27 respondents said they expect the U.S. economy to recover faster than they did at the end of last year, before the vaccine rollout. Of those surveyed, 39% think the economy will recover in the first half of next year while 31% predict a recovery in the second half of 2022.

And 42% expect their employees to return to the office at least some of the time during the second half of this year while 27% do not think that will happen until 2022.

Interestingly, only 11% plan to require employees to be in the office full-time.

Josh Berman, co-founder of Troy Capital Partners, a multi-stage venture firm based in Santa Monica, said it is easier to get opinions quickly when everyone is working under the same roof. He also misses the impromptu brainstorming sessions that come together when his employees are in close physical proximity.

"When teammates are in the office it generates more energy and creativity and productivity," Berman said. "The more smart minds working on a project or idea the better."

But 39% of our respondents won't make employees come into the office at all, including Deborah Benton, founder and managing partner of Willow Growth Partners, an early-stage consumer VC firm.

"Our productivity has never been higher or our expenses lower," Benton explained. "Candidly, we prefer to spend time with our portfolio companies in their environment."

Luma Launch's Lydecker said while he misses face-to-face interactions, he will also not be requiring employees to be in the office.

"This past year has proven you can work anywhere and be successful," he said.

Only one-third of our respondents said they will mandate that their employees be vaccinated in order to return to the office. That includes Mark Mullen, co-founder and managing director of Bonfire Ventures, an early-stage venture firm specializing in business-to-business software.

"We have a team of six and we talk about everything," Mullen said. "We all want to get vaccinated and will. Three of us are fully vaxxed and three have had one shot, so it is not an issue."

Half our respondents said they had already been vaccinated, but that was before California opened up eligibility to anyone over 49 years old on April 1st.

While some major tech conferences, such as Code, plan to return to in-person gatherings in September, our survey suggests people might not feel comfortable attending that soon. Over 45% said they do not think they will want to go to a conference until the first half of next year. Thirty-five percent expect they will be ready later this year.

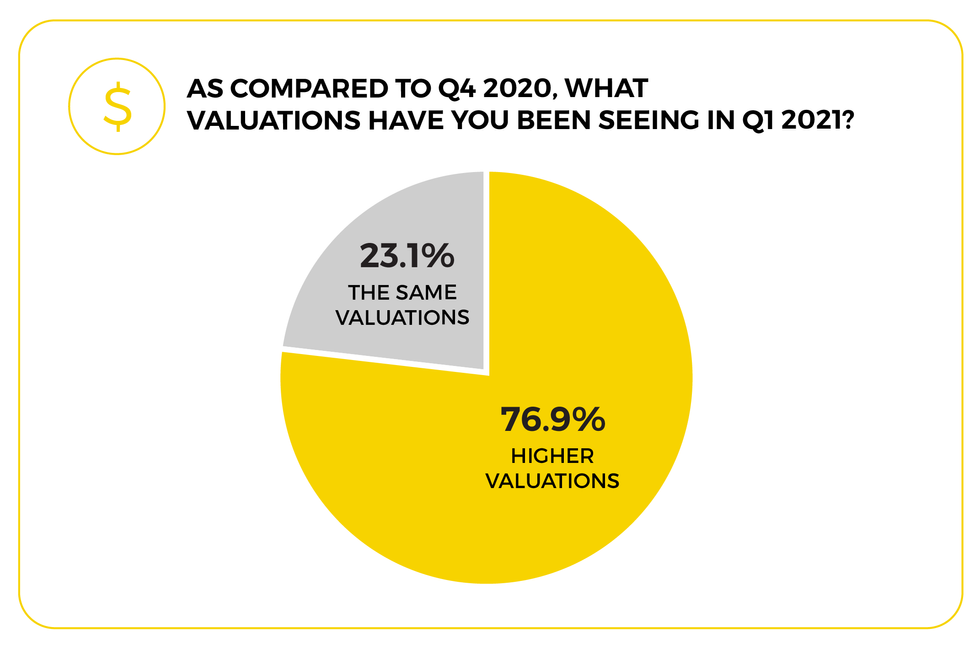

Against the backdrop of all these trends, it is getting more expensive to invest in startups. Seventy-seven percent of our respondents said they saw higher valuations last quarter, but that did not stop them from closing deals. Thirty-eight percent of investors said they made more deals while 46% reported making the same number.

Graphics by Candice Navi.

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: Skyryse

Image Source: Skyryse