Ecommerce sales ballooned during the pandemic and are expected to get even bigger — hitting the $1 trillion mark by 2022.

That's according to a study released by Adobe Analytics that found the lockdown economy has helped boost online shopping by an extra $183 billion since March 2020. That is a 20% growth, roughly the size of last year's holiday shopping season when buyers spent $188.2 billion online.

The report predicts it will only continue. Shoppers spent $813 billion online last year, up 42% from 2019. This year's spending is estimated to be somewhere between $850 billion and $930 billion. That means that by 2022 ecommerce spending might break the trillion dollar threshold for the first time.

"The pandemic has fast-forwarded ecommerce, driving levels of online sales we had not expected to see for a couple years. And consumers are not going back," said Adobe Digital Insights director Taylor Schreiner in an email. "People who successfully purchased loungewear in the last year for instance, are less concerned about the lack of a dressing room moving forward."

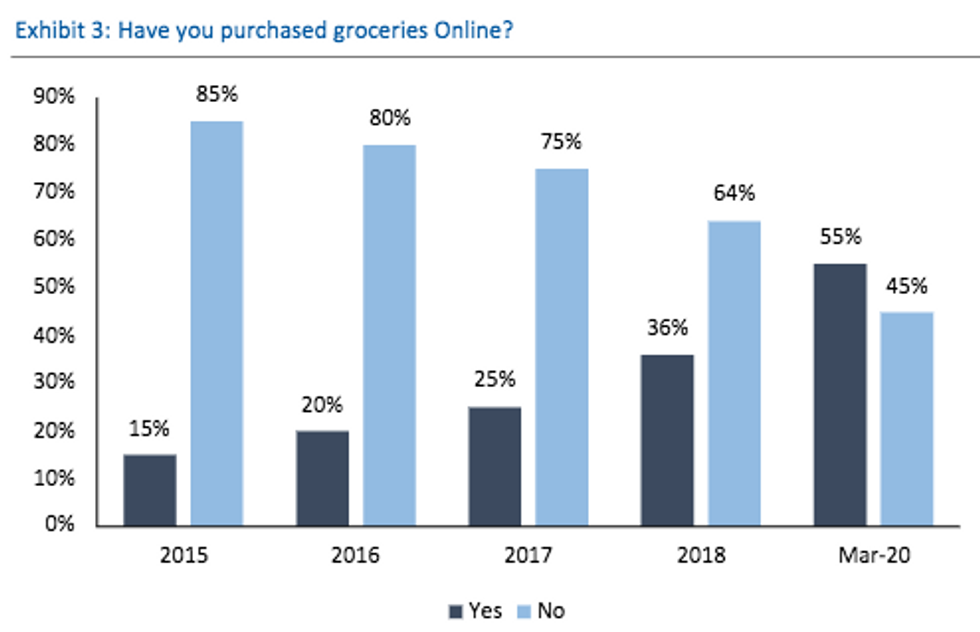

One of the biggest growth sectors have been online grocery shopping, with the rise of Instacart and grocery delivery services. Over the first three weeks of February 2021, it grew 230% in comparison to January 6 to January 26 the previous year, before the pandemic struck. Sporting goods also saw a 75% growth in that same period.

The way people shop is also changing — curbside and in store pickups of online orders grew 67% when comparing February 2021 to the previous year. Adobe surveyed 1,000 consumers, finding 30% actually preferred these pick up options to delivery.

"For many retailers, this service is no longer [just] 'nice to have.' Consumers value the convenience and speed, and it'll evolve how physical storefronts are developed moving forward," said Schreiner.

Buyers are also more likely to use a delayed payment option — selecting the option for "Buy Now, Pay Later" to place orders that are 18% larger — than standard payment options. This payment method grew 215% for the first two months of this year, in comparison to last year, which Adobe analysts attribute to "consumers [dealing] with financial uncertainty."

As customers were delaying paying, they were also shopping more. People spent more time scrolling throughout the day as bots reminded them of what was left in their cart.

Adobe's analysts note that "online shopping became a ubiquitous daily activity during the pandemic."

Sales and holiday shopping became less important. Memorial Day, Labor Day and President's Day all brought in less revenue than other days that same week. Even the traditional online holiday shopping spike — which usually lasts from Thanksgiving to Cyber Monday — dipped 9% from last season's haul, a change of $600 million.

The Digital Economy Index uses real time data from Adobe Analytics, which analyzes over a trillion site visits and online transactions across 100 million product SKUs.

"On a state level, California grew 35.4% year over year in the first two months of 2021," said Schreiner. "This is impressive growth for a market that was already adopting ecommerce at high rates prior to the pandemic."

According to HGInsights' index, more California companies use Adobe Analytics to track consumer behavior than other states.

- Influence in the Wake of Ecommerce - dot.LA ›

- How Ecommerce Will Grow After the Pandemic - dot.LA ›

- COVID-19 crisis sparks 'inflection point' for online grocery — and ... ›

- ReCharge Raises $277M for its Ecommerce Subscription - dot.LA ›

- How Influencers Became Key to Big Brands During the Pandemic - dot.LA ›

- The Arrive Platform Proposes an Easy Rental Model - dot.LA ›

- Upscribe Raises $4M for Its Ecommerce Subscription Model - dot.LA ›

- Event: Ecommerce Week LA - dot.LA ›

- Assembly Acquires Seattle-Based Enterprise Sales Firm Pacvue - dot.LA ›

- Americans Spent Less on this Year's Cyber Monday - dot.LA ›

- Black Friday To Hit Record - dot.LA ›

- E-commerce Trends in 2021 Here to Stay - dot.LA ›

RBC Chart

RBC Chart