As soon as I stepped into the new Amazon Fresh store in Woodland Hills an employee asked if I wanted to shop with a regular cart or use their 'dash cart.'

The 35,000 square foot store that opened to the public on Friday is Amazon's first so-called smart grocery store as the e-commerce giant attempts to remake in-person shopping and push into the supermarket space.

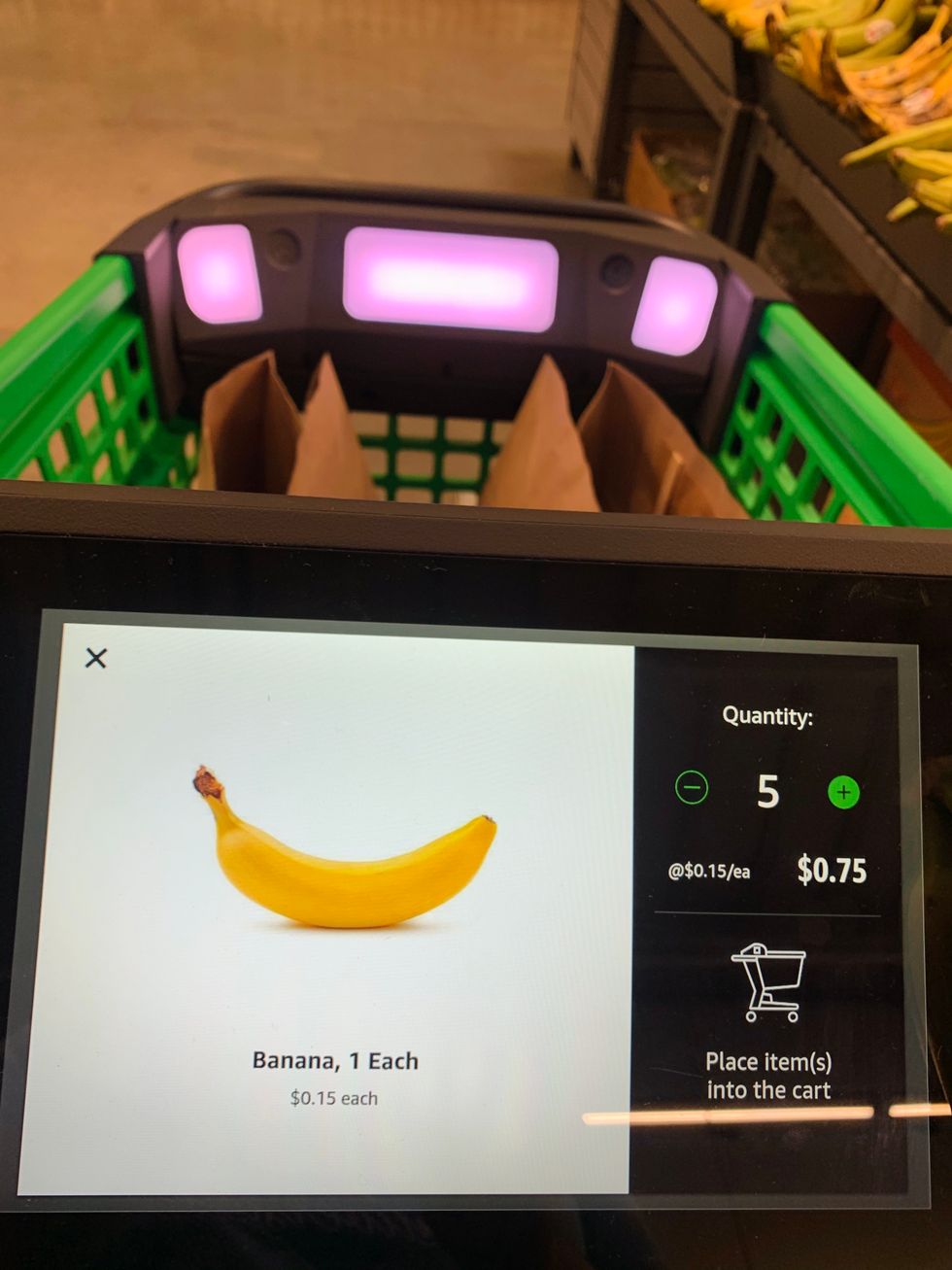

The dash cart is the center of that effort. The toy-like cart has a screen in the middle of the handles that walks you through a tutorial on how to process the different items and which also allows you to see the total price of your trip as you're shopping. It's bright green and black and smaller than your average grocery cart with no place for the dangling legs of a toddler.

I grabbed the dash cart. To start I had to open my Amazon app to sync it to the cart.

I held my account's QR code in front of a camera affixed to the cart and once scanned, the cart made a pinging sound and told me I could start shopping. Now everything I put in the cart would be charged to my account.

The cart is not required, though. And shoppers can still opt to go through a checkout stand with a clerk.

Amazon Fresh opened their store to the public last week after previously being invitation only.

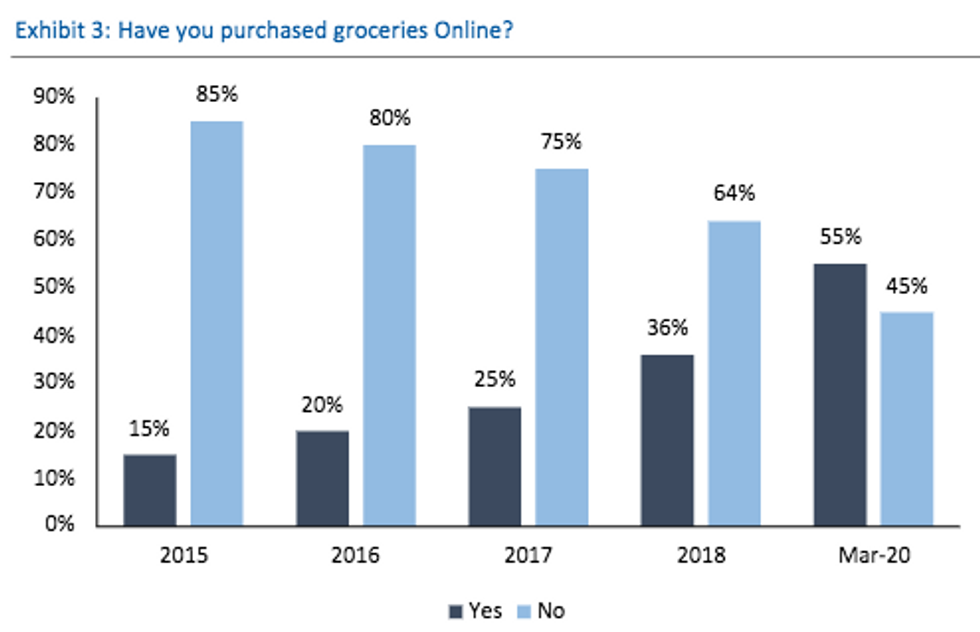

The Woodland Hills location at 6245 Topanga Canyon Blvd is likely a window into the future of Amazon grocery shopping. It allows customers to shop in-store, pick up Amazon Fresh online orders within the hour and even includes a return drop off center. It comes in the middle of a pandemic in which the online retailer has seen their grocery sales triple year-over-year.

At the same time, growth of their Prime membership which is key to the grocery store experience is accelerating.

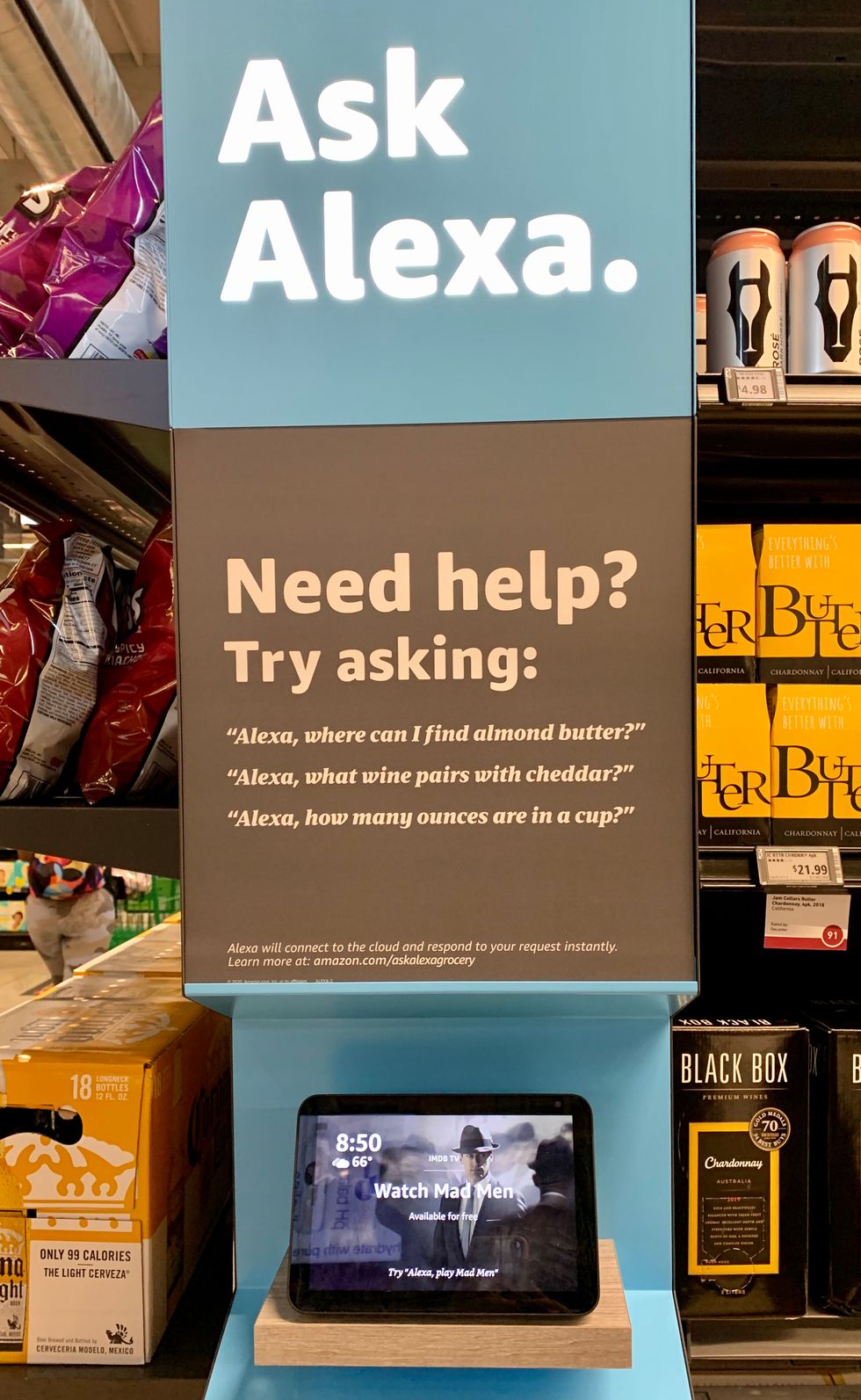

When I arrived on a Monday morning, the aisles were eerily quiet. Clerks that normally stock aisles or buzz around the cash register were nearly non-existent. But Alexa seemed to be everywhere.

She's also available at different stands throughout the store to help customers locate specific items.

The store has a variety of produce, a meat and seafood section, and even a kitchen area where you can pick up prepared items like sushi or pizza. It felt like Whole Foods cafeteria-like layout but a bit less expensive. The chicken tenders looked especially appealing.

The different aisles carry your typical brand name items like Quakers and Coca-Cola, but there's often signs pointing out items that are locally grown and produced. Across the store, Amazon had their own packaged goods sprinkled throughout, including in the meat and seafood section, which was filled with Fresh-branded options.

Fresh produce has a number code that needs to be entered into the monitor on the dash cart, once detected and placed in the cart it weighs the item to give the total price. Barcode items are scanned as you place them in the cart through the use of the cameras and sensors placed in the front area of the cart.

Both options release a ding sound to let you know the item has been added correctly, but the process is hardly seamless. I had to re-enter items like my strawberry flavored Chobani a few times until the cart was able to detect it.

The cart itself was very small as it can only hold two bags before overflowing with items which is not ideal for a family looking to shop for a week's worth of groceries.

Yet, the simplicity of the checkout almost felt unreal. To checkout, all I had to do was walk through the dash cart lane. Once I walked over a mat, an automated message appeared on my cart monitor showing my bill. That was it. I was done. But the experience was so new, I wasn't even sure that I paid. I asked the clerk, 'Oh, is that it?" Yep, he replied and told me to watch my email for a receipt.

I grabbed my bags and walked out, having minimal interaction with humans.

- Amazon's New Smart Grocery Cart Will Debut in Woodland Hills ... ›

- Amazon unveils its own smart grocery cart, in new effort to automate ... ›

- Amazon Unveils its New Go Grocery Stores - dot.LA ›

- How Ecommerce Will Grow After the Pandemic - dot.LA ›

- Amazon Is Opening Its First Clothing Store in Glendale - dot.LA ›

- Inside Amazon Style's New Flagship Store In Glendale - dot.LA ›

- Amazon Go Store Opens In Whittier California - dot.LA ›

- Amazon Go Store Opens In Whittier California - dot.LA ›

- Battery Company Storedot Opens In Irvine - dot.LA ›

RBC Chart

RBC Chart