Online Grocery Apps Are Thriving During the COVID-19 Crisis. Are They Here to Stay?

More people are ordering groceries online due to the novel coronavirus outbreak, leading to a permanent consumer purchasing shift — and a giant revenue boost for Amazon.

That's according to an analysis from

RBC Capital Markets, which just ran its fifth annual user survey on online grocery trends. It concluded that Amazon's online grocery arm could produce $70 billion in gross merchandise volume by 2023 — more than 3X from 2019 — becoming a material portion of its total revenue.

"We view Amazon as one of the largest structural beneficiaries of this accelerated secular shift to online grocery shopping, along with Walmart and Instacart," wrote RBC analyst Mark Mahaney in the report.

The 1,500-person survey, conducted over the past two weeks, found that 42% of respondents purchase groceries online at least once a week, up from 22% in 2018. Amazon is the most frequent destination for shoppers, with 60% using the tech giant to buy groceries online, compared to 47% for Walmart.

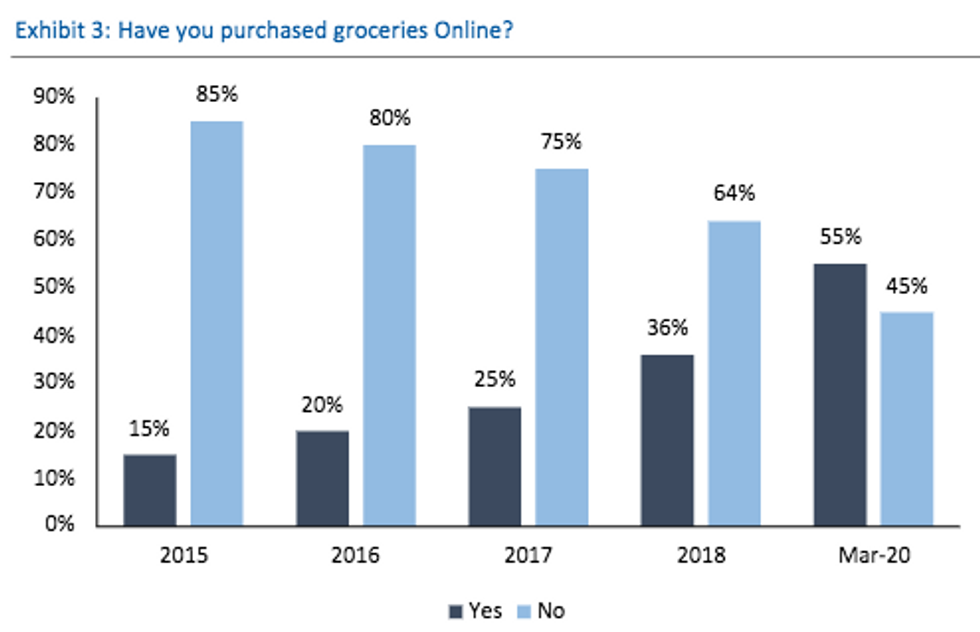

Mahaney said the pandemic has "created an inflection point for online grocery shopping." One-third of respondents said they made their first online grocery purchase in the past month. More than half of online grocery shoppers surveyed said COVID-19 is "leading them to permanently boost their willingness to buy groceries online." And of the people who don't buy groceries online, 41% (up from 19% in 2018) said they would do so in the next six months.

"We believe that online grocery shopping may now be coming a habitual practice among shoppers," Mahaney wrote.

RBC also found that online grocery purchase frequency, basket size, spend, and intent to spend reached all-time highs.

The report cited increased recent Google searches for "online grocery," surging app downloads for Amazon's Prime Now and other delivery services, and an Adobe study that cited 100% growth in daily sales for U.S. online grocery shopping last month as social distancing orders keep people inside their homes.

RBC also spoke with Instacart president Nilam Ganenthiran, who said customer demand over the last few weeks has hit record levels and is up 300% year-over-year. The company said it will hire 300,000 shoppers over the next three months to keep up. This week it added new features to open up more delivery windows.

The New York Times reported that orders for Amazon groceries have been as much as 50 times higher than normal. The company has struggled to fulfill orders, with some customers reporting extended delays or no open delivery windows for weeks.

"This, to us, implies that there is demand for online grocery shopping, and service providers are struggling to meet this customer need," Mahaney wrote. "Could this be a short-term issue? Probably. That said, we believe COVID-19 has brought a dramatic increase in awareness for the value, ease and convenience of online grocery shopping that could last for a long time."

The spike in online grocery purchasing could also help Amazon boost its Prime membership base. Amazon requires a $119/year Prime membership to access its 2-hour Prime Now delivery service and Amazon Fresh.

Nearly 75% of the survey respondents said they were Prime members, up from 59% last year. RBC estimates that there are about 90 million U.S. Prime subscribers, of Amazon's reported 150 million members worldwide (Amazon does not disclose country-specific numbers).

This past October,

Amazon made grocery delivery a built-in benefit of Prime membership — no longer charging an extra $15 per month, or $180 per year, for Amazon Fresh delivery on top of the $119 annual Prime fee.

"I've been working in grocery delivery a long time, and I think this offering is truly a game-changer," Stephenie Landry, Amazon's vice president of grocery delivery, said in an interview with GeekWire in October. She predicted that free Amazon Fresh grocery delivery would become "one of the most loved benefits of Prime."

Amazon's online grocery arm also includes its AmazonFresh Pickup service. The company also offers BOPIS (Buy Online PIckup in Store) at Whole Foods, which it acquired for $13.7 billion three years ago.

Amazon offers discounts to Prime members when they shop at Whole Foods, and has integrated Whole Foods ordering into its Alexa voice assistant.

Groceries are an estimated $678 billion U.S. market that is increasingly going digital. Research firm eMarketer estimates that U.S. food and beverage e-commerce sales will grow 23.4 percent to more than $32 billion this year, making it "both the fastest-growing and least penetrated ecommerce category." Those projections came before the COVID-19 crisis.

"Aside from the many brick-and-mortar retailers watching foot traffic and sales drop to near zero, the most profound shift in consumer behavior is happening in grocery ecommerce—and this shift is likely to have one of the longest-lasting consequences," eMarketer wrote.

Amazon has been trying to solve the economic problem of grocery delivery for more than a decade, dating back to the 2007 launch of Amazon Fresh as a pilot in Seattle.

The infrastructure and other costs associated with delivery cut into the already thin profit margins of the grocery business. But the expanding consumer appetite for online grocery ordering appears to be changing things.

"Years ago people didn't think that consumers would buy things like clothing online," Amazon's Landry said in October. "And now we know that consumers are doing it in great numbers. We believe we're at a similar turning point for fresh groceries and we're ready to make a fresh grocery delivery a great new part of Prime."

Also aiding Amazon's grocery delivery efforts is the company's huge investment in its delivery network that is enabling 1-day delivery promises for Prime members.

Instacart, Walmart, Target, Kroger, and others are also investing heavily in online grocery. Walmart, which brought in more than $250 billion in revenue for fiscal year 2020, said in September it would offer grocery pickup from 3,100 stores and grocery delivery from 1,600 stores by the end of 2019.

Walmart's expansion into online ordering, and Amazon's expansion into brick-and-mortar retail, show how the retail industry is increasingly becoming one large market, blending online and in-person sales.

RBC's Mahaney said Amazon's grocery sales could reach around one-third the size of Walmart by 2023.

"Given that Amazon has over the past 25 years reached closed to parity with Walmart in terms of non-grocery global retail sales and online adoption is dramatically greater today than it was 5, 10, 20, 25 years ago, we believe our one-third ramp is gut-check reasonable," the report noted.

This story first appeared on GeekWire

- Hard Hat Sensors Track Distancing at Construction Sites - dot.LA ›

- dot.LA Virtual Pitch Showcase Featuring eCommerce Startups - dot.LA ›

- Coronavirus Updates: Amazon Ready to Postpone 'Prime Day' Due to Pandemic - dot.LA ›

- Tapcart Soars as Retail Scrambles to Create a Better Mobile Experience - dot.LA ›

- Tapcart Soars as Retail Scrambles to Create a Better Mobile Experience - dot.LA ›

- L.A. Caps Grubhub, Postmates, Other Delivery Apps Service Charges At 15% - dot.LA ›

- Boosted Commerce Raises $87 Million - dot.LA ›

- How Ecommerce Will Grow After the Pandemic - dot.LA ›

- Online Shopping's Future: Livestreaming, AR and Influencers - dot.LA ›

- ECommerce Expected To Hit $1 Trillion in Sales by 2022 - dot.LA ›

Image Source: Revel

Image Source: Revel