It’s 8:30 a.m. on a Wednesday morning in Venice Beach. There’s plenty of beach parking. The boardwalk is nearly empty save for a couple Teslas, a handful of other cars and a big blue bus that says Fun Surf LA. I’m gearing up for day three of L.A. Tech Week amongst a collective of V.C.s, founders and fund managers.

When I arrive, admittedly a few minutes late, those who are there to learn how to surf are going through the motions of paddling and standing up on their surfboard in a single, fluid motion. Already in the water, however, the “Buccaneers” — a growing collective of L.A.-based tech workers who meet on Sundays are already out near the break, wooh-ing each other on as the mediocre sets roll in.

The waves are small and infrequent, leaving plenty of time to talk shop and network in between. Some say this is one reason why for Silicon Valley types, surfing has been touted as the “new golf.” Conversations run the gamut. Some are garden-variety introductions. Others denote the vibe shift that is L.A. tech. Those from out of town tell me they weren’t going to come until they saw some photos on Twitter that made “the FOMO real.” Others still are wondering who might be at the the week’s most coveted events — those hosted by Andreessen.

Covered in sand and salt, I leave the beach driving towards Tehrangeles where Launch It Labs co-founder Iman Khabazian is hosting an event for game developers at Flame — his uncle’s Persian restaurant on Santa Monica Boulevard. Launch It Labs is an L.A.-based company providing game developers a backend framework so they can focus their attention on their user interface. Under a sprawling outdoor canopy replete with string lights and mosaic, stain-glass chandeliers, Khabazian’s uncle serves the roughly 30 or so attendants skewers of kabob wrapped in lavash bread. The food is a standout in a week that’s featured sushi, sliders and a kitchen table-sized wooden cutting board featuring three different cuts of steak.

At Flame, I also meet Oliver Montalbano, one of the co-founders of Mozart — an L.A.-based Web3 gaming company building NFT APIs for game developers. As well as Ledy co-founders Mark Emtiaz and Mark D’Andrea who earlier this year put together a copy of a 1928 home in the flats of Beverly Hills in the 3D virtual world Decentraland. Per “The Hollywood Reporter,” the $9.418 million estate was among the first of its kind to come with the opportunity to purchase the sister residence built in Decentraland for an additional $100,000. Based on discussions with this small but enthusiastic crew of game developers, it’s fair to say that the call about the future of gaming is coming from inside the metaverse.

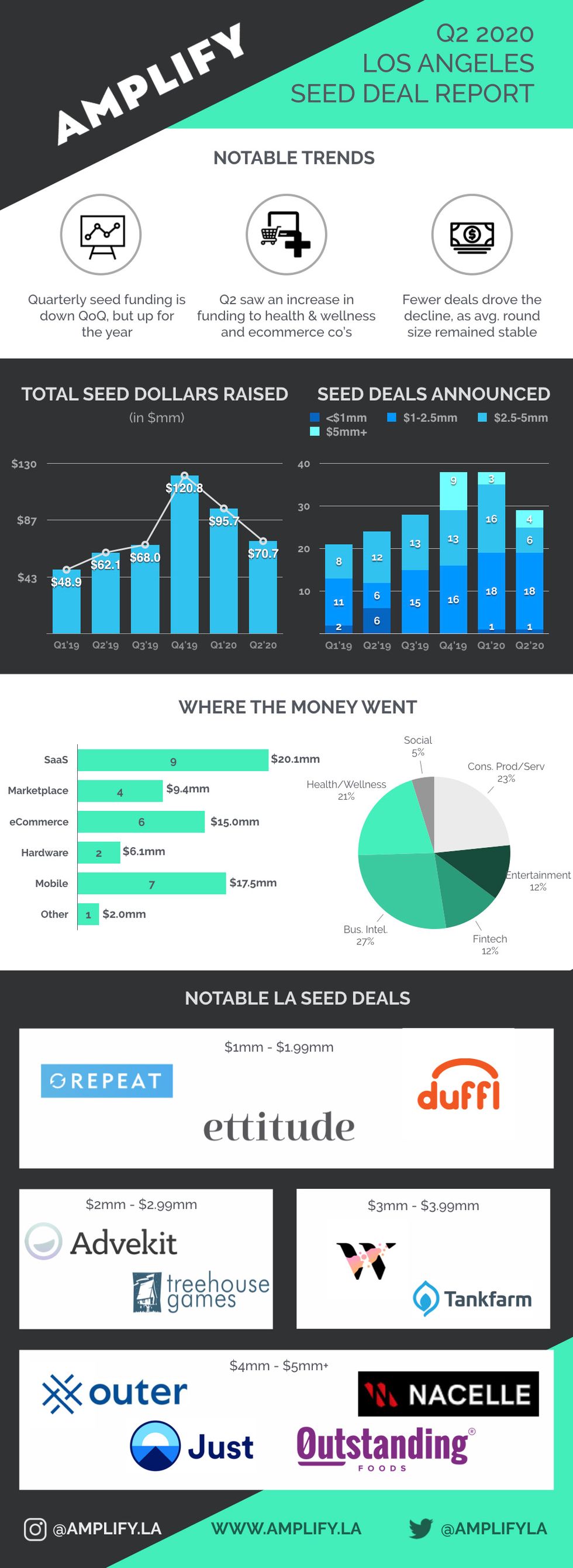

My final stop of the day brings me back to where the day began. Only this time, I’m on a hotel rooftop in Venice Beach. The luxurious event is hosted by Amplify.LA, Fika Ventures, and Stage Venture Partners. It’s billed as an opportunity to meet L.A.’s earliest stage investors and founders. There are at least twice as many men as there are women—many of whom are wearing Cuban collar shirts and tapered pants that expose a few inches of ankle skin.

Perhaps the youngest founders in attendance are two undergraduate students from UCLA who are pitching their app Chatterbox as Nextdoor but for Gen Z. They tell me that Gen Z, a cohort that never expects to own a home, doesn’t care about cats making too much noise in the neighborhood like their boomer-mindset parents. Instead, they’re interested in building some semblance of community from the ashes of the current housing crisis.

Also on the hotel rooftop is Bo Abrams, co-founder of Kommu, a lodging swapping platform that wants to capitalize on this current moment in nomadic living. His idea is to give people the ability to leverage their most expensive asset which in most cases is their apartments, in a peer-to-peer marketplace. Sort of like Airbnb but every host is somehow a part of your social network.

Earlier in the day, I met Ed Wilson, co-founder of L.A.-based fund Impulsum Ventures, where he helps companies build the next generation of tech royalty through investing his fund as well as via its 30-person development studio. I meet Wilson again at the Fika-hosted event.

One thing I’ve wondered throughout this week is how fruitful these sorts of networking get-togethers can be for founders, investors and entrepreneurs who attend them. I get that business cards are exchanged, LinkedIn QR codes are scanned and in some cases, meetings are promised. But, does anyone ever actually establish a truly viable connection?

Wilson who’s no stranger to these types of events puts it in terms I can understand. He refers to L.A. Tech Week and networking events writ large as “rocks.” His ethos, in a nutshell, is you never know who you’re going to meet or how you’re going to meet them. You just have to keep lifting rocks to find out what’s underneath.

- What People are Posting About LA Tech Week - dot.LA ›

- LA Tech Week is Coming to Town - dot.LA ›

- Here's What's Happening at LA Tech Week - dot.LA ›

- LA Tech Week Kicks Off with a Look at Proptech in SoCal - dot.LA ›

- LA Tech Week: NFT Cocktails, Sushi and Networking - dot.LA ›

- Here's What To Expect At LA Tech Week - dot.LA ›

- LA Tech Week: The Auctioning of an NFT From AI LA - dot.LA ›

- LA Tech Week: Supertext on Squeezing Limes at Globalization 101. - dot.LA ›

- A16z's Tech Week Returning to LA This June - dot.LA ›