Lots of Deals in Q1, Despite COVID-19. But Don't Expect it to Last

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

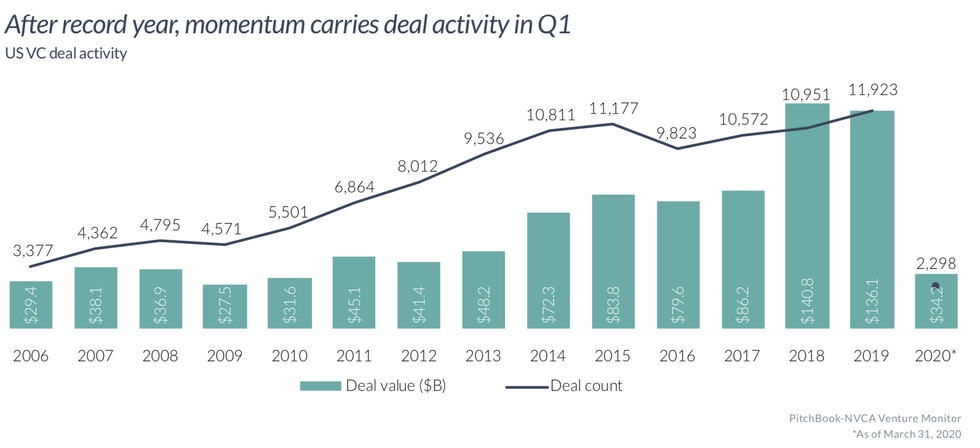

Deal activity continued at a swift pace in the first quarter of 2020 despite the unwelcome arrival of the COVID-19 pandemic, which will grind deals to a halt for the rest of the year, lower valuations, and shift the balance of power from founders to investors for the first time in years, according to the latest PitchBook-NVCA Venture Monitor released Tuesday.

While the novel coronavirus has sent shockwaves through many areas of the economy, its full effect on VC deal activity has yet to be seen in the data. In many ways, the latest numbers present the snapshot of the heady last months of a record bull market that now seems like a bygone era.

Deal flow in greater Los Angeles hit $2,830.79, the most since the second quarter of last year. Most of those deals actually closed in March, while the coronavirus was enveloping the economy.

"The last few weeks have been a whirlwind for the country, including the startup ecosystem. With the economy at a standstill, maintaining operations, sales, and headcount at companies is the priority, but it is understandably proving challenging with most of the population sheltered in place," said Bobby Franklin, President and CEO of NVCA in a statement accompanying the report. "The reality is that it will be a tough road ahead in 2020, but as we've seen in past downturns, resilience is in the fabric of this industry. Some of the most successful venture-backed companies were born in difficult times."

Here's what else stands out in the report:

- Venture deal activity saw $34.2 billion invested across 2,298 deals in the first quarter of 2020.

- Valuations remained elevated, and median early stage deal value reached an all-time high in Q1. Following a new record in 2019 for late-stage deal count, momentum continued into 2020 with deal value already surpassing $23 billion. Contributing to those numbers were 49 late-stage VC mega deals ($100 million+) that have closed in the first quarter.

- VC exit activity got off to a slower start in Q1 compared to last year's record-breaking activity, yet still posted a robust quarterly total with $19.3 billion exited across 183 deals. Large exits still had an active first quarter, with 10 deals over $500 million completed. In a reversal from the last couple of years, acquisitions made up the majority of capital exited during Q1 2020, ousting IPOs from their throne for the first time since 2016.

- The COVID-19 crisis put a damper on VC-backed IPOs in March that is expected to remain through the rest of the year given how closely the IPO window for private businesses is linked to the conditions in the public market. Comparing figures from the last global financial crisis, only 13 VC-backed IPOs closed in 2008, and only 11 closed in 2009. With 10 completed in Q1 2020, IPO activity in 2020 is expected to drop drastically after eclipsing 80 listings in both 2018 and 2019.

- By quarter's end, VC funds raised $21 billion across 62 vehicles. Capital has been increasingly concentrated in larger vehicles as median fund size has grown steadily in recent years. Nearly a dozen mega-funds ($500+ million) have closed so far in 2020.

- Venture investors, who had $121 billion in dry powder as of mid-year 2019, have not stopped investing, but many are being more conservative in their approach. The focus has primarily turned to their existing portfolio companies, ensuring companies have enough cash runway and stressing efficiency.

- Some new deals are still happening, but most of these had already been underway before the pandemic.

- Valuations have not shifted much yet, but indications from VCs and startups suggest that valuations are likely to be challenged in the coming quarters. Some deals have been renegotiated given the new investing climate and public market dips.

- Late-stage valuations will see the biggest impact—after reaching record highs in 2019—and will come down over the next few months as they're more apt to be valued based on publicly traded peers. Early-stage valuations will be less affected.

- One more thing to keep in mind: During the 2008-2009 global financial crisis, angel and seed deals actually increased, bucking the trends across the industry during that time. (Today's angel and seed market is much different, with 5 times as much yearly activity.)

Biggest Q1 Deals in the L.A. Area

- los-angeles-startups - dot.LA ›

- Los Angeles' Tech and Startup Scene is Growing. - dot.LA ›

- Los Angeles Venture Capital is Funding More Israeli Startups - dot.LA ›

- U.S. Venture Capital Fell by 46% From March to April - dot.LA ›

- Silicon Valley Is Doing Nearly as Many Deals as Last Year - dot.LA ›

- Catch Up With This Week's Startup News in Our Weekly Video Recap - dot.LA ›

- Rep. Jimmy Gomez Wants to Limit Police Use of Facial Recognition Tech - dot.LA ›

- Startup Dealmaking in Los Angeles is Down - dot.LA ›

- Seed Funding Has Fallen in LA, But It Could Have Been Worse - dot.LA ›

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: Revel

Image Source: Revel