'Fasten Your Seatbelts' For Bumpy Times Ahead in Startupland, Say Analysts

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

A pair of new outlooks offer a sobering view of the next quarters for venture capital, where startup investment will fall significantly, funds will focus on their existing companies at the expense of new ones and distributions to LPs will turn negative for the first time since 2012.

"Fasten your seatbelts," wrote the National Venture Capital Association (NCVA) in a report assessing the impact of the novel coronavirus. "It's going to be a bumpy ride."

The industry trade group notes that about 300 startups have laid off about 30,000 employees nationwide since March 11. "This is likely just the tip of the iceberg for what will be tough times for startups over the coming months," the report says.

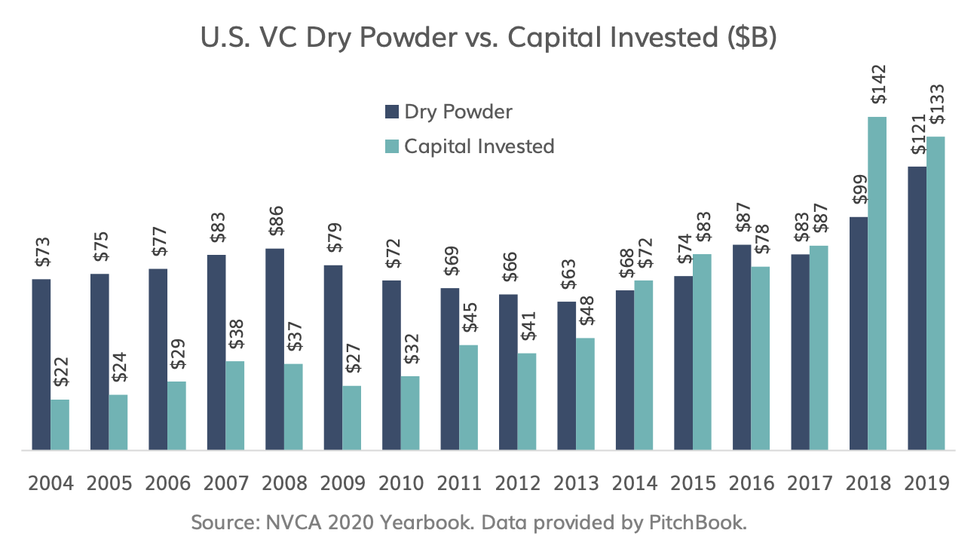

A bright spot is that VC funds have plenty of dry powder at the ready – some $120 billion at the start of this year – but about half of typical portfolios are reserved to shore up existing companies with follow-on investments. That means if VCs continue to invest at the same pace, that $120 billion will vanish in a year.

Funds looking to raise more capital will likely find it much harder as LPs face financial strain of their own and are less willing to commit to a riskier and less liquid asset class. During the global crisis, VC fundraising fell by nearly 60% from 2008 to 2009.

The NCVA also expects a sharp pullback from non-traditional VC investors such as private equity and corporate venture capital (CVC), Last year, investments with CVC funds made up 46% of total deal value, so any reduction would be acutely felt by the startup ecosystem.

"The reality is that companies will shut down—at a higher rate than what is inherent to this risky industry—and there will be waves of layoffs," the NVCA says.

The news is not much better in another note, published Tuesday by Pitchbook. Here are the main takeaways:

- Older vintages currently are more at risk than they were during the global financial crisis because they are taking longer to liquidate and therefore retaining more unrealized value.

- Net cash flows to LPs have been positive each year since 2012; however, they believe this will change in 2020 as distributions historically have fallen further than contributions during recessions.

- Many VCs today are often relying on new fundraising to support follow-on financings, with less capital being held in reserves. Due to the prospect of an ongoing economic disruption, they anticipate many VC funds will shift their capital deployment to concentrate more on supporting existing portfolio companies.

- venture-capital - dot.LA ›

- Should Startups Apply for the Payroll Protection Program? - dot.LA ›

- U.S. Venture Capital Fell by 46% From March to April - dot.LA ›

- U.S. Venture Capital Fell by 46% From March to April - dot.LA ›

- Coronavirus Updates: Why Smaller Venture Funds Are in Danger - dot.LA ›

- Silicon Valley Is Doing Nearly as Many Deals as Last Year - dot.LA ›

- Seed Funding Has Fallen in LA, But It Could Have Been Worse - dot.LA ›

- LA Venture Podcast: A Conversation With Alex Gurevich of Javelin Venture Partners - dot.LA ›

- Javelin Venture Partners' Alex Gurevich on How he Invests - dot.LA ›

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: Revel

Image Source: Revel