Exclusive: LA Ecommerce, SaaS Startups Get the Bulk of Seed Funding in Q2

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

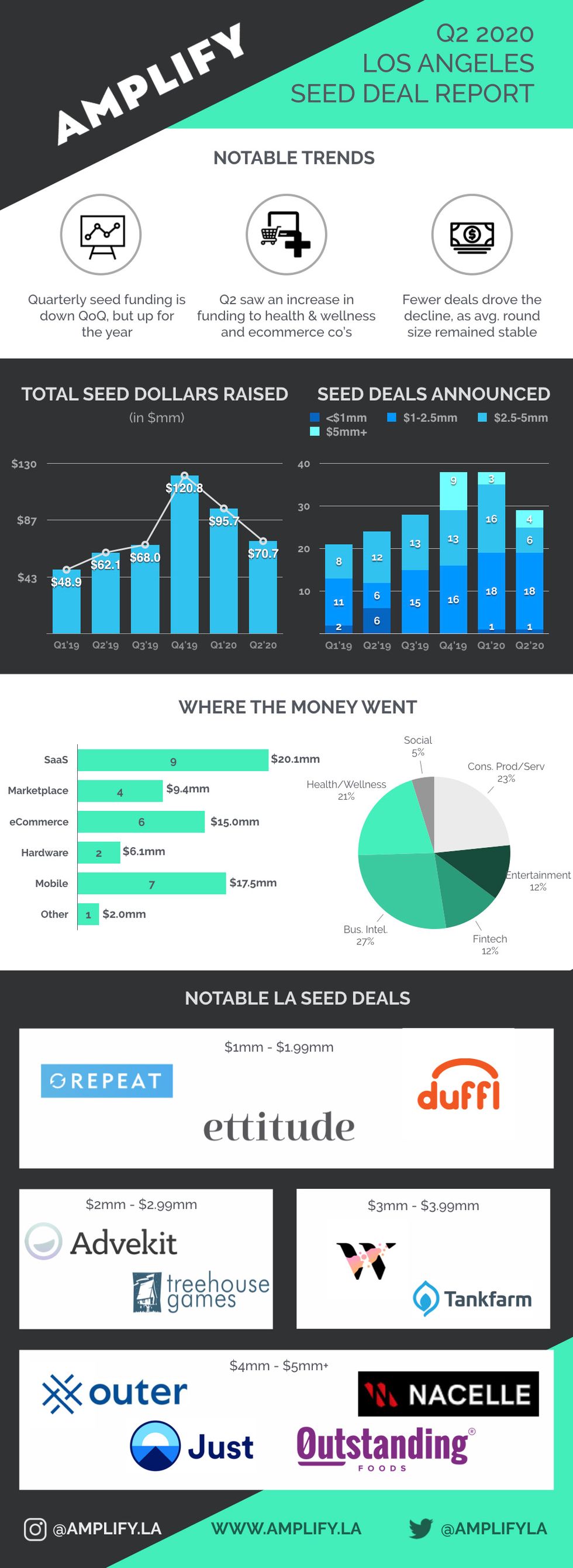

- L.A. companies raised a total of $71 million in seed funding, a 26% decline from the first quarter of the year.

- Ecommerce and Software-as-a-Service (SaaS) companies fared best during the pandemic

- Analysts were surprised investment hadn't dropped further.

Mirroring national trends, seed stage investment in Los Angeles slowed during the second quarter of 2020 as venture capitalists focused on shoring up their existing portfolio companies to weather the pandemic. L.A. companies raised a total of $71 million in seed funding, a 26% decline from the first quarter of the year, according to a report released Tuesday from the pre-seed fund Amplify.LA.

But considering the severity of the pandemic, the drop off could have been much worse. More seed deals were completed in the most recent quarter than the same period last year. And there was no decrease in valuations, with seed round sizes holding steady at an average of around $2.5 million.

"I was surprised, like many others, that the funding environment has been as resilient as it has been," Connor Sundberg, a senior associate at Amplify.LA who compiled the report, said by email. "I think in situations like the current pandemic, there's a tendency to jump to the first-order consequences – closures, consumer fears, uncertainty – and sometimes miss the second and third order effects. We've had companies that have seen favorable legislation changes like telehealth or make years worth of progress in adoption because they provide services that have helped keep small and mid-size businesses in operation."

Software as a service (SaaS) startups once again raised the most money of any category, with Nacelle, which makes a web app platform for online retailers, leading the way. It raised $4.70 million in a deal led by Index Ventures and Accomplice VC in June.

Ecommerce startups got a boost as consumers stayed at home during the pandemic and wanted to upgrade their bedrooms and backyards. For instance, Ettitude, maker of bedding and bath products made from organic bamboo, raised $1.6 million in a deal led by Drumbeat Ventures in April. Outer, which sells outdoor sectional sofas, raised $4.3 million in a round led by Mucker Capital in June.

"We saw huge upticks in things related to home improvement, at-home leisure, and learning that benefited from people suddenly spending much more time at home," said Sundberg. "Companies w/ supply power and almost exclusively brick-and-mortar alternatives saw a lift."

However, it was not all good news for ecommerce startups, who faced increasing competition from competitors who had previously been more focused on their brick-and-mortar operations. There was also more competition for certain ad keywords, which drove up prices. And startups that sold travel or outdoor products struggled.

"It really has been a massive mix of outcomes and less of a rising-tide-lifts-all-boats phenomenon," said Sundberg. "The companies we've consistently seen do best, though, are those in ecommerce infrastructure. They benefit from competition from new companies starting to sell online and existing companies increasing sales or spending more to stay competitive. They're perfectly positioned as their bet is one on ecommerce as a whole, not on a specific product or category."

Seed deals were somewhat of a bright spot in the second quarter. Across all rounds, just 140 deals were completed in the second quarter in greater L.A, the fewest since Pitchbook and the National Venture Capital Association began tracking the data in 2014.

Venture funding around the globe was up 15% in the last quarter, accelerating from -5% in the first quarter, according to Goldman Sachs. Meanwhile, deal count fell 14% in each of the last two quarters, reflecting a trend of fewer deals but larger rounds.

As always, it is best not to read too much into quarterly fluctuations, which have a limited data set. But considering the ongoing severity of the pandemic and resulting recession, those trying to raise money in most categories can breathe a sigh of relief.

"I think the longer-term insight we've had is that despite quarterly swings one way or the other, the ecosystem as a whole is moving in a good direction," said Sundberg. "In the past few years, we've seen new funds open their doors, existing funds raise significantly more, and a number of exits that have thrown more talent and mentorship into the ecosystem."

- Los Angeles Venture Deal Activity Is Up in Q1 - dot.LA ›

- Venture Capital Reports See Tough Times Ahead For Startups - dot.LA ›

- Startup Dealmaking in Los Angeles is Down - dot.LA ›

- The Fund Launches a Venture Capital Firm in Los Angeles - dot.LA ›

- Top Ecommerce Companies in Los Angeles - dot.LA ›

- LA Seed Deals 2021: More Startups See Millions More Dollars - dot.LA ›

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: Tinder

Image Source: Tinder Image Source: Apple

Image Source: Apple