Get in the KNOW

on LA Startups & Tech

X

Photo by Souvik Banerjee on Unsplash

Snapchat’s New Controls Could Let Parents See Their Kids’ Friend Lists

Christian Hetrick

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

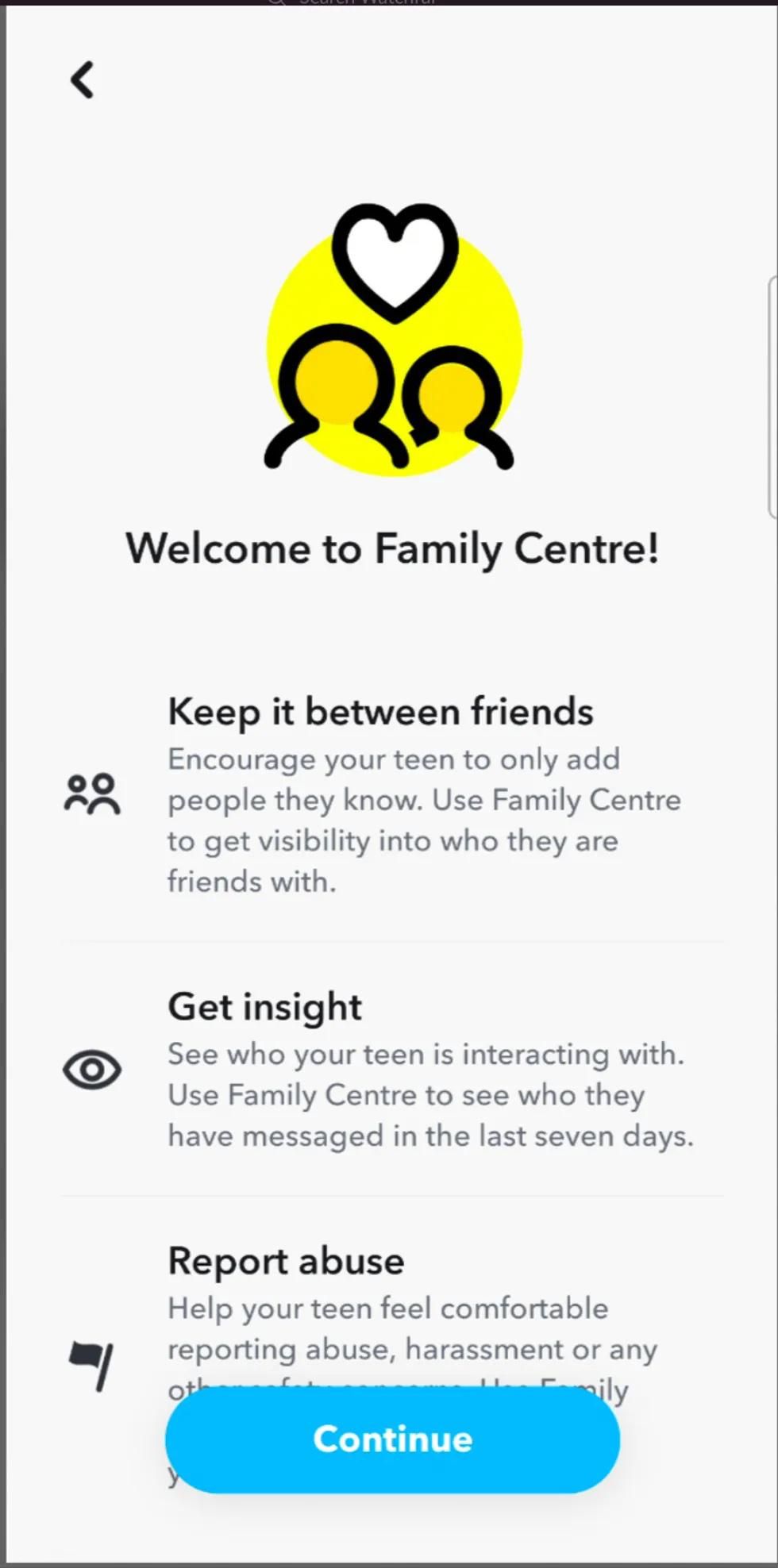

Snapchat is preparing to roll out enhanced parental controls that would allow parents to see who their teenagers are chatting with on the social media app, according to screenshots of the upcoming feature.

Snap’s parental controls.

Courtesy of Watchful.

Snapchat is planning to introduce Family Center, which would allow parents to see who their children are friends with on the app and who they’ve messaged within the last seven days, according to screenshots provided by Watchful, a product intelligence company. Parents would also be able help their kids report abuse or harassment.

The parental controls are still subject to change before finally launching publicly, as the Family Center screenshots—which were first reported by TechCrunch—reflect features that are still under development.

Santa Monica-based Snap and other social media giants have faced mounting criticism for not doing more to protect their younger users—some of whom have been bullied, sold deadly drugs and sexually exploited on their platforms. State attorneys general have urged Snap and Culver City-based TikTok to strengthen their parental controls, with both companies’ apps especially popular among teens.

A Snap spokesperson declined to comment on Friday. Previously, Snap representatives have told dot.LA that the company is developing tools that will provide parents with more insight into how their children are engaging on Snapchat and allow them to report troubling content. (Disclosure: Snap is an investor in dot.LA.)

Yet Snap’s approach to parental controls could still give teens some privacy, as parents wouldn’t be able to read the actual content of their kids’ conversations, according to TechCrunch. (The Family Center screenshots seen by dot.LA do not detail whether parents can see those conversations).

In addition, teenage users would first have to accept an invitation from their parents to join the in-app Family Center before those parents can begin monitoring their social media activity, TechCrunch reported.

From Your Site Articles

- Teen Who Was Sexually Exploited on Snapchat Sues Tech Giants ›

- Snap, TikTok must strengthen parental controls, AGs say - dot.LA ›

- Snap Announces 'My AI' Feature and We Have Concerns - dot.LA ›

Related Articles Around the Web

Christian Hetrick

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

Meet the LA Startup Founder Who Had Two Hours To Prep Her 'Shark Tank' Pitch

03:48 PM | April 01, 2022

Photo courtesy of Curie

One Sunday afternoon last September, Sarah Moret was hiking through Griffith Observatory when she received a voicemail from the producer of “Shark Tank,” ABC’s hit entrepreneurial reality show. The voice message notified her that she had just two hours to get to the “Shark Tank” studio and pitch Curie, her aluminum-free deodorant brand, to the show’s “Sharks”—its panel of investor judges featuring Mark Cuban, Lori Greiner, Barbara Corcoran, Daymond John and Kevin O'Leary.

"I just jumped in the car; my fiancé was driving, and he brought me home as fast as possible in the carpool lane," Moret told dot.LA. "I curled my hair, got ready in 20 minutes and did my makeup in the passenger seat of his car for a primetime TV show."

Sarah Moret at the top of her hike, moments before she received a call from the producers of "Shark Tank."

Photo courtesy of Curie

Moret first applied to be on “Shark Tank” in 2020, but didn't receive a callback. She heard back from the show after reapplying the following year, with initial plans to film in July—but the producers bumped her filming date and put her on standby until September.

"I compare it to being like an understudy in a play," she explained. "I didn't have a set filming date. I was just told that I would get a phone call if there was space in the schedule for me to film.”

But Moret was confident she had a product worth waiting for, and the entrepreneurial know-how to scale it into a successful business. Most conventional antiperspirants in the market are made out of aluminum that can cause armpit irritation; while there are natural, aluminum-free deodorant brands, Moret said they also irritated her skin or left her smelling like a gym bag. Curie, her solution to these problems, uses sage oil and probiotics to beat the stink, arrowroot powder to absorb the sweat, and chamomile and aloe to soothe the armpits.

Prior to launching Curie in 2018, Moret worked as an associate at Santa Monica-based venture capital firm Crosscut Ventures, where she earned a spot on the investing team. There, she learned the ins and outs of the startup world.

“Curie started from a personal need,” Moret said. “I'm an athlete and at the time was a marathon runner, and just couldn't find anything that worked.”

Curie generated revenues of $125,000 in its first year of selling deodorant sticks. The following year, the startup had $700,000 in sales. At the start of 2020, she raised $1 million through a convertible note capped at $5 million to continue growing the brand. It has gradually expanded its product offerings to include body wash, moisturizing body oil, a detox mask and hand sanitizers.

Before appearing on “Shark Tank,” Curie’s body products were already sold in over 300 stores nationwide including Nordstrom, Anthropologie and fitness gym Soulcycle. It had also frequently appeared on shopping network QVC.

Fast forward to September 2021, and Moret finally entered “the Tank” with her eyes set on Corcoran and Greiner. She wanted to make a deal with one or both of them because, as Moret put it, “I just gravitate towards female investors or founders.”

When Moret’s episode of “Shark Tank” finally aired last month, she was surprised to find herself the first one up. Moret confidently introduced Curie on national television without a hint of sweat on her face or dirt from the hiking trail. She charmed the Sharks with her background and solid numbers—her opening pitch was for a $300,000 investment in exchange for a 5% equity stake—but four out of the five Sharks didn’t bite, saying she had raised too much money early on and had too many products.

This wasn’t new to Moret: Her first efforts at pitching Nordstrom and QVC had been rebuffed as well. “Rejection is a part of being an entrepreneur,” she said. “You're always going to get no’s; you can't let those no’s stop you or discourage you.”

It all came down to the final Shark, Daymond. When he produced an offer—$300,000 for 20% equity—that Moret deemed too low, she shot back: “I know my worth, I know the company's worth and I'm not backing down.”

After Moret countered with $300,000 for 12% equity, Cuban and Corcoran combined on an offer of $300,000 in exchange for 14% equity. Moret took the deal, as Cuban quipped: “I never thought I would be in a women’s deodorant business, ever.”

After the show aired, Curie sold out all of its deodorant products in 24 hours and now has some 5,000 customers on its waitlist. Moret said the company has plans to roll out further products, but supply chain issues have impacted their progress.

“Our biggest hurdle right now is just getting back in stock quickly, so we can get people their deodorant,” she said.

From Your Site Articles

- Beauty Counter's Gregg Renfrew Sees Makeup as a Movement - dot ... ›

- HatchBeauty Brands CEO Tracy Holland on Work-Life Balance - dot ... ›

- Cherie, an App to Build Community Around Beauty, Donates $60k to ... ›

- Los Angeles Health and Beauty Startup News - dot.LA ›

Related Articles Around the Web

Read moreShow less

Decerry Donato

Decerry Donato is a reporter at dot.LA. Prior to that, she was an editorial fellow at the company. Decerry received her bachelor's degree in literary journalism from the University of California, Irvine. She continues to write stories to inform the community about issues or events that take place in the L.A. area. On the weekends, she can be found hiking in the Angeles National forest or sifting through racks at your local thrift store.

QR Codes Will Be LA Schools' First Line of COVID Defense When Students Return Monday

09:00 AM | August 14, 2021

Photo by Kelly Sikkema on Unsplash

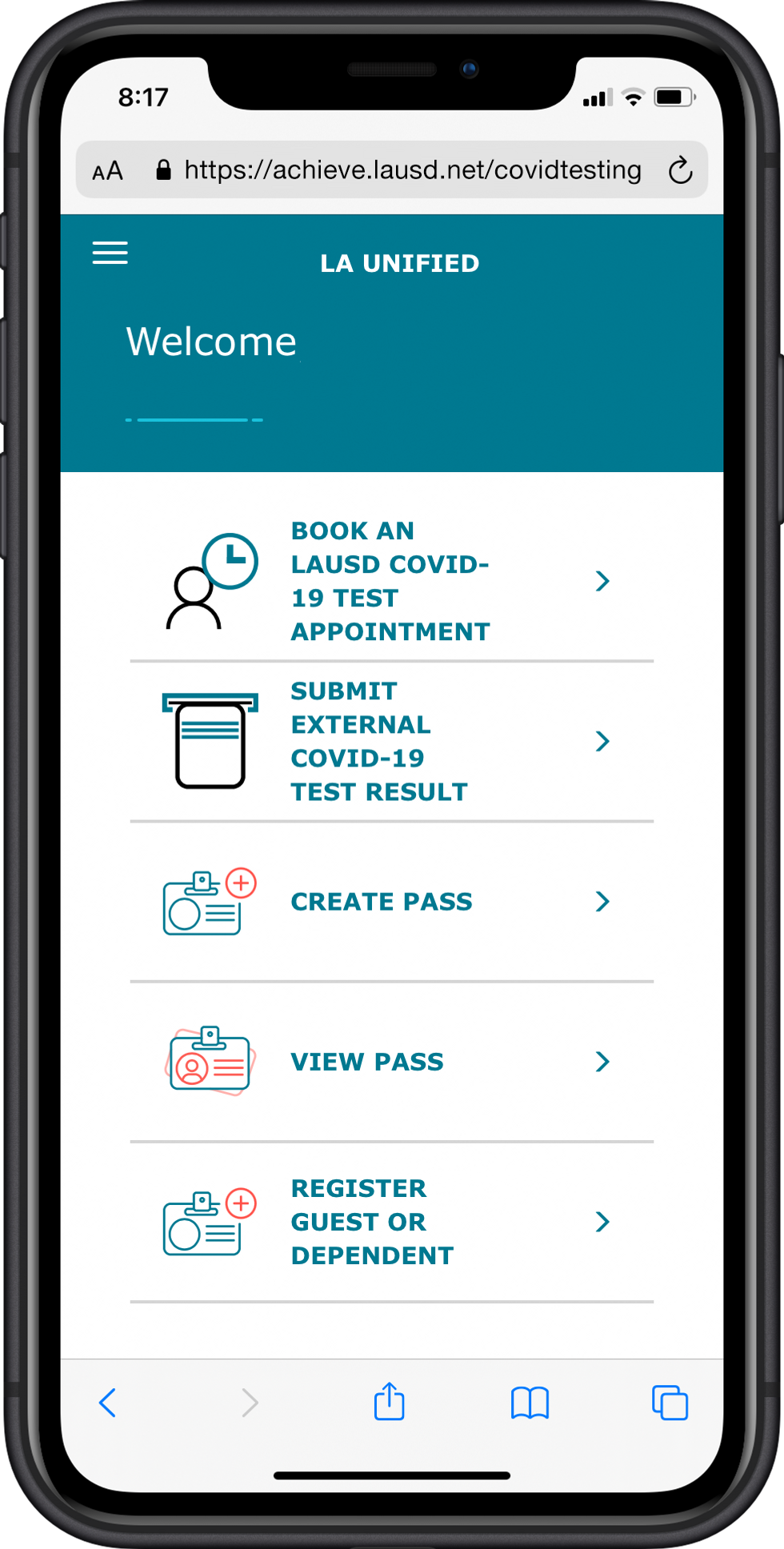

When students at the nation's second largest school district return to school Monday, they will be carrying not only a backpack, but a QR code that is supposed to be the first line of defense against spreading COVID-19.

The QR code is like a pass school officials scan to make sure teachers and students' health screenings, COVID test results and vaccination records are aligned with safety rules. The district called the technology, created in partnership with Microsoft at no cost to the district, "groundbreaking" and the first of its kind in the nation, but glitches have already emerged.

Some parents are preparing for potential "lines around the block" on Monday as children are screened.

The application is effectively a massive living database that will track the more than half a million students and about 75,000 employees that will have to undergo weekly COVID testing.

To keep children safe, district officials plan on administering and processing 100,000 COVID tests each day.

The Daily Pass was first used in the spring when 1 in 4 students attended in-person classes. Starting Monday, the district will be faced with vastly increasing the scale of its use.

Some parents who sent their children to school in the spring are raising concerns. Several said the website crashed some mornings and that test results didn't load within the expected 24 to 36 hour timeframe necessary.

Still the Los Angeles Unified School District boasts that it has the "strongest safety standards in the country," and a spokesperson said the Daily Pass is part of its "robust" mitigation measures.

On Monday, the website will again be put to the test.

Gov. Gavin Newsom this week ordered that all teachers and staff must either be vaccinated or submit to a weekly test that shows they are not infected with COVID-19, a protocol backed by the nation's largest teachers union and Dr. Anthony Fauci, the director of the National Institute of Allergy and Infectious Diseases and President Joe Biden's chief advisor on COVID-19. LAUSD Interim Superintendent Megan Reilly said Friday LAUSD employees must be vaccinated by Oct. 15.

And the district is going even further than the state's mandate, requiring weekly testing for students and staff regardless of their vaccination status. Masks will also be required indoors and outdoors while on school campuses. The L.A. County Department of Public Health guidelines only require masks be worn indoors, but school districts can enforce more stringent protocols.

LAUSD's Daily Pass app

Problems With the App

In the spring, if a negative COVID test result was not loaded into the app, students couldn't return to campus on the first day of school.

Leo Jungeun Oh said her daughter missed three weeks because her results didn't appear in the app even after taking three tests at a district vaccination site.

She said her 9-year-old stood outside the gate in tears while she spoke to the principal. In the car, her daughter's sadness turned into anger as she couldn't understand why she was excluded from school, while her older sister wasn't.

Oh enrolled both children in the Santa Clarita Unified School District where they don't require weekly testing.

"Why do I have to get victimized, and my children, it's just too much for us; I'm done with this," she said.

Parents are responsible for getting their child a "baseline" COVID test before Monday and the district has established several testing sites throughout the sprawling district. Test results are added to a child's Daily Pass profile. Parents can call a hotline at 213-443-1300 if test results are not appearing on the app. Once it does load, parents recommend taking a screen shot of the QR code or printing it out.

At the testing sites, some parents have reported waiting two to three hours in line, errors in the system with spelling of names and birthdates, and challenges for new student enrollees in getting an ID number to go into the system, Jenny Hontz, spokesperson for the parent advocacy organization Speak Up, said.

Not everyone has had such bad experiences. Others said there was a quick turnaround with results and the testing sites were very convenient.

If a student hasn't been tested by the first day of school, rapid antigen tests may be available so children will not be turned away.

"However this is not guaranteed and parents are encouraged to schedule the baseline test for their child as soon as possible," a district spokesperson said. No appointments are necessary.

Easing Anxiety

LAUSD officials said at Tuesday's school board meeting that the enhanced safety measures should ease parents' worries about sending their unvaccinated children to school, the vast majority for the first time since March 2020.

"We learned so much from the spring and we are in fact looking joyfully to back to school 2021," the district's chief of schools, David Baca, said.

To take on the massive undertaking, 900 healthcare professionals will administer COVID tests at about 1,000 campuses across the county.

The district is sharing the data collected through the Daily Pass with Stanford University, UCLA, The Johns Hopkins University, Anthem Blue Cross, Healthnet and Cedars Sinai to "to provide insights for strategies" for creating a safe environment. While the data is anonymized, some parents and advocates have privacy concerns.

And there are worries about the district's ability to just carry out the feat.

"There are some questions about the capacity for LAUSD to get every student tested weekly with the number of students expected to return to campus in the fall," Hontz said.

In the spring, the weekly COVID testing requirement was extended to every 14 days after the district failed to keep up with demand. The district said students will be able to answer screening questions verbally when they arrive if they don't have the QR code.

Negeen Ben-Cohen, a parent of three LAUSD students, is part of California Students United, a group of parents that filed a lawsuit opposing the district's weekly testing protocols. She is hoping the website can handle the influx of parents that will be logging on Monday.

"There were a couple days (in the spring) that I had to struggle, standing at the gate trying to get QR codes to load so that my kids could get in," she said.

From Your Site Articles

- Disney, Walmart Will Require Worker Vaccinations - dot.LA ›

- Long Lines at LA Schools as 'Daily Pass' Servers Crash - dot.LA ›

- LA Schools See Rise in Virtual Enrollments Amid COVID Fears - dot.LA ›

- Los Angeles Schools Expected To Mandate Student Vaccinations - dot.LA ›

- Here's How Much LAUSD Spent on Tech During the Pandemic - dot.LA ›

Related Articles Around the Web

Read moreShow less

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

RELATEDTRENDING

LA TECH JOBS