Get in the KNOW

on LA Startups & Tech

X

Shutterstock

Venture Deals in LA Are Slowing Down, And Other Takeaways From Our Quarterly VC Survey

Keerthi Vedantam

Keerthi Vedantam is a bioscience reporter at dot.LA. She cut her teeth covering everything from cloud computing to 5G in San Francisco and Seattle. Before she covered tech, Keerthi reported on tribal lands and congressional policy in Washington, D.C. Connect with her on Twitter, Clubhouse (@keerthivedantam) or Signal at 408-470-0776.

It looks like venture deals are stagnating in Los Angeles.

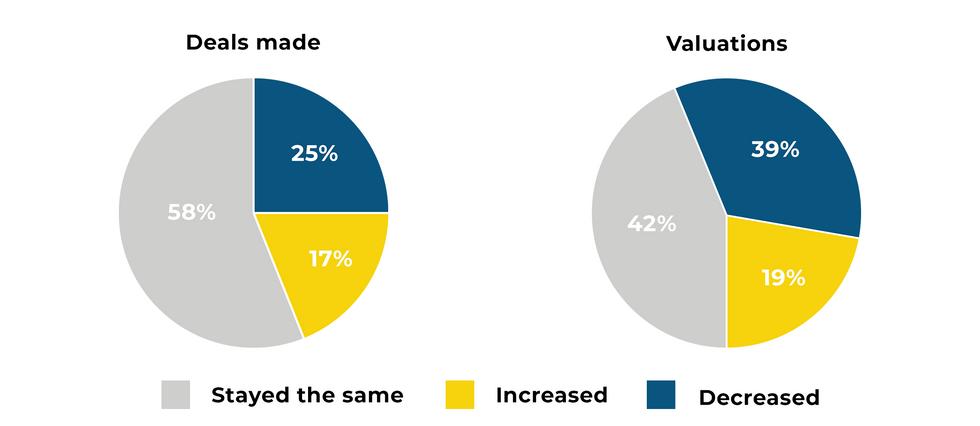

That’s according to dot.LA’s most recent quarterly VC sentiment survey, in which we asked L.A.-based venture capitalists for their take on the current state of the market. This time, roughly 83% of respondents reported that the number of deals they made in L.A. either stayed the same or declined in the first quarter of 2022 (58% said they stayed the same compared to the fourth quarter of 2021, while 25% said they decreased).

That’s not hugely surprising given the sluggish dynamics gripping the venture capital world at large these days, due to macroeconomic factors including the ongoing stock market correction, inflation and Russia’s invasion of Ukraine. While startups and VC investors haven’t been hit as hard as public companies, it looks like the ripple effects are beginning to bleed into the private capital markets.

In addition to slowing deal volumes, most investors said they’re seeing startup valuations lose momentum, as well: Roughly 81% said valuations either stayed the same or decreased from the previous quarter, with nearly 39% noting a decline.

Should that sentiment continue moving forward, it could spell bad news for startups as far as raising the money they need for growth, investors said.

“If I was a startup right now, I would be making sure I have plenty of runway,” said Krisztina ‘Z’ Holly, a venture partner at Good Growth Capital. “When it looks like there's some potential challenges ahead in the market, it’s good to fill your war chest.”

Among VC respondents, about 86% said they believed that valuations in the first quarter were too high—one potential reason why deals slowed down in the first quarter, according to TenOneTen Ventures partner Minnie Ingersoll. She noted that L.A.’s growing startup scene features more early-stage ventures, whose valuations haven’t come down the way later-stage startup valuations have.

“I would say we are just more cautious about taking meetings where the valuations are at pre-correction levels,” Ingersoll said. “We didn’t take meetings because their valuations weren’t in line with where we thought the market was.”

While most respondents said the Russia-Ukraine war didn’t have much impact on their investment strategies, some 22% said it did have an effect—with one VC noting they had to pass on a deal in Russia that they liked.

Is There a Flight Out of Los Angeles?

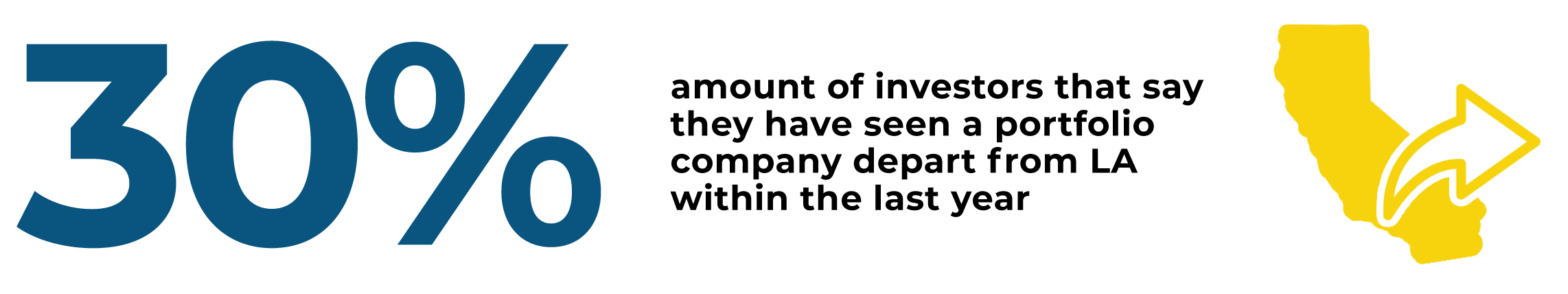

Los Angeles was heralded as the third-largest startup ecosystem in the U.S. at the beginning of the year, behind only San Francisco and New York. Yet nearly one-third (31%) of VC respondents said that at least one of their portfolio companies had left L.A. within the past year. It won’t come as a huge surprise that the city of Austin, Texas has been one of the prime beneficiaries of this shift—with roughly half of those who reported that a portfolio company had left L.A. identifying Austin as the destination.

The tech industry’s much-hyped “exodus” from California has been widely reported on, especially as more companies have embraced the work-from-home lifestyle and also opted to move their operations to lower-cost cities and states. Most notably, Elon Musk has recently moved two of his companies, electric automaker Tesla and tunnel infrastructure startup The Boring Company, from California to Texas (with both of those firms moving in and around Austin).

“In today's competitive market with lots of capital to invest, we think the next generation of successful VCs are going to be diverse in markets (not just Silicon Valley)... [and] have access to undiscovered founders from everywhere,” said one survey respondent.

NFTs Aren’t Popular With VCs—But Web 3 Is

“It’s the future,” according to one respondent. “Buckle up and get on board.”

Are NFTs...

More than 71% of VC survey respondents said they were bullish on Web3—the new blockchain-enabled iteration of the internet, which promises decentralization and a whole range of applications involving cryptocurrencies, NFTs, DeFi and more. It’s the same sentiment informing Santa Monica-based VC firm M13’s new $400 million fund, which considers Web3 a core piece of its investment thesis.

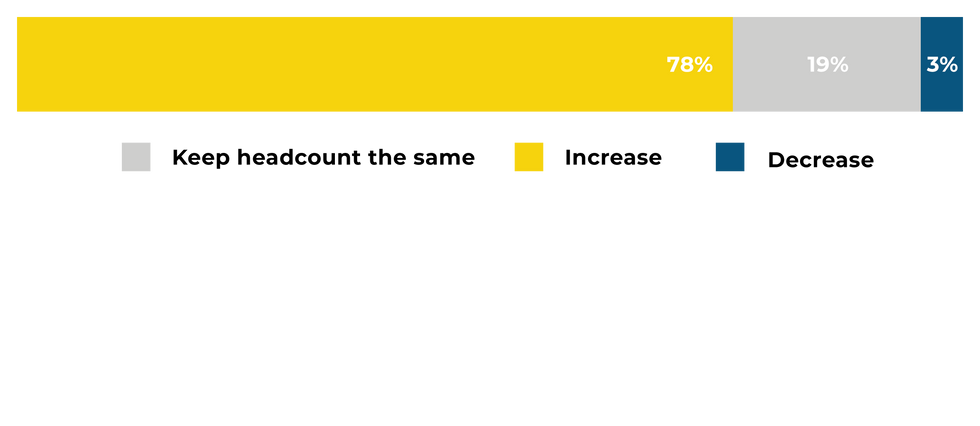

In Q2 2022, do you expect your portfolio companies to:

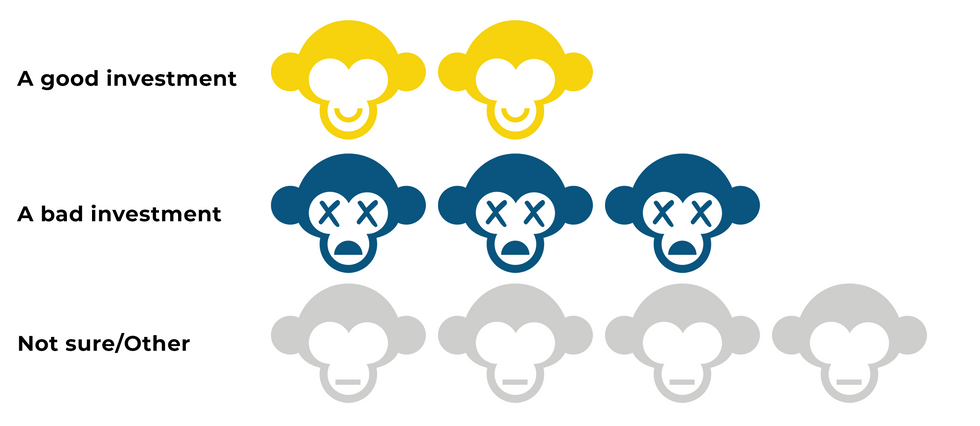

L.A. is home to an ever-growing cadre of Web3-focused startups operating across the realms of finance, entertainment and other industries. But while local investors are willing to pour money into blockchain-related ventures, one segment of the space continues to evoke skepticism: Only 18% of respondents would describe NFTs as “a good investment,” while 33% thought they were “bad” investments and 39% said they were unsure.

As in our last survey several months ago, it appears that NFTs continue to divide opinion, with respondents expressing differing perspectives on their value and utility. One referred to them as “get rich quick schemes,” but added that the art pieces and social communities that emerge from them may be valuable. Another said that “NFTs as a digital medium are a legitimate thing”—but noted the vast majority are “awful investments with no intrinsic value.”

Graphics courtesy of Hagan Blount.

From Your Site Articles

- Los Angeles Venture Funds Grow, but Spend Less in LA - dot.LA ›

- LA's Top Venture Capitalists of 2022 - dot.LA ›

- Los Angeles Venture Capital News - dot.LA ›

- Here Are Los Angeles' Top Venture Capitalists - dot.LA ›

- Venture Deals Fall in LA Amid Economic Worries - dot.LA ›

Related Articles Around the Web

Keerthi Vedantam

Keerthi Vedantam is a bioscience reporter at dot.LA. She cut her teeth covering everything from cloud computing to 5G in San Francisco and Seattle. Before she covered tech, Keerthi reported on tribal lands and congressional policy in Washington, D.C. Connect with her on Twitter, Clubhouse (@keerthivedantam) or Signal at 408-470-0776.

https://twitter.com/KeerthiVedantam

keerthi@dot.la

Sandbox Studios’ Jackie Fast on the New Ways Celebrities Are Partnering With Startups

06:00 AM | August 31, 2022

Jackie Fast doesn’t think celebrities make good entrepreneurs. Instead, they make great assets for young companies.

On this episode of the LA Venture podcast, the Sandbox Studios managing partner discusses why many celebrities are exploring startups. Sandbox is a $30 million seed-stage fund that invests in brands that are being built by celebrities.

“The motivation for me is absolutely everything,” Fast said. “Why is this person doing this? Often—I mean, 100 times out of 100—it's not because they care. They want to make more money.”

Fast started her consultancy, Slingshot Sponsorships, at 24, after she was passed over for a role at the organization at which she was working.

“I was very qualified for the role. Even to this day, I still am annoyed about it. I applied and the CEO just said, ‘You're too young. You need more experience’.” She quit soon afterward and by 26, Fast signed Prince as her second client—without realizing that the iconic musician was notoriously uninterested in sponsorships.

“Prince was one of my first clients and—I didn't know this at the time—but the reason we got Prince was because nobody wanted to work with him to do commercial stuff. Because he didn't care. He's all about the music.”

Fast helped launch his album “20Ten” through Spotify and the DailyMail. It was the first time an album had launched on the growing music platform, and the move helped Prince quickly climb the charts.

“That just catapulted me into the music scene,” Fast said.

She took on clients including The Rolling Stones, Duran Duran and One Direction.

“My whole ethos was that social media and digital technology was changing and shaping the way that consumers and fans could engage with the things that they loved,” Fast said.

Slingshot prepared Fast to evaluate celebrity-backed companies and consider how their audiences can help a product thrive.

“A brand fundamentally is trying to ship product. So there are certain times when consumers are more receptive to information. And a lot of that is when they are enjoying themselves, they're having fun, they're in a calm place,” she said. “So any of those kind-of core emotional, humanistic things that connect people with other people—if a brand can insert themselves in the middle of that—that's where the recall comes from. That's where you start associating your own individuality with a brand.”

Celebrities began eyeing equity deals more seriously after George Clooney sold his tequila company, Casamigos, for $1 billion in 2017. Instead of promoting the brand for cash as most celebrities do, Clooney—one of its founders—opted for equity. When the brand eventually sold, he did well.

“When George basically did nothing and made a billion dollars, everybody was like, ‘Oh my goodness, we should be doing this. Why are we taking fees?,” Fast said.

The problem, she added, is that most talent agents make their money through commission and wouldn’t benefit from equity deals. Many of them ignored celebrities’ requests, leading frustrated talent to reach out to startups on their own—sometimes even using DMs to initiate contact. Often the resulting deals were not good ones, Fast said. Large talent agencies including CAA and WME have since set up venture arms for their clients.

Sandbox’s portfolio includes Kylie Cosmetics, Fabletics and Aviation Gin. The fund also invested in the animation studio Invisible Universe, alongside partners including Reddit co-founder and investor Alexis Ohanian. Invisible Universe partners with celebrities to create animated characters and build their following on social media. Once they gain traction, they can become the basis for books, shows, podcasts and other creative ventures.

“With these small animation companies, they can turn around ideas in a day and a half,” Fast said. “They create short form content that goes on Instagram Stories, TikTok [and] Reels, and they build momentum and following through lots of short-form content.”

While Fast invests in products built by celebrities, she said she views them less as entrepreneurs and more as a way for companies to gain instant brand recognition.

“I'm investing in a route-to-market and an asset that most companies don't have access to,” she said. “I don't look at the celebrity as like a person or a founder. I look at the celebrity as the marketing arm or the marketing special dust that you can add to a product.”

dot.LA editorial intern Kristin Snyder contributed to this post.

Click the link above to hear the full episode, and subscribe to LA Venture on Apple Podcasts, Stitcher, Spotify or wherever you get your podcasts.

Read moreShow less

celebrity investmentsjackie fastl.a. venturesandbox studiosvirtual realityla ventureentertainment techinfluencer economy

Minnie Ingersoll

Minnie Ingersoll is a partner at TenOneTen and host of the LA Venture podcast. Prior to TenOneTen, Minnie was the COO and co-founder of $100M+ Shift.com, an online marketplace for used cars. Minnie started her career as an early product manager at Google. Minnie studied Computer Science at Stanford and has an MBA from HBS. She recently moved back to L.A. after 20+ years in the Bay Area and is excited to be a part of the growing tech ecosystem of Southern California. In her space time, Minnie surfs baby waves and raises baby people.

$100M and a Space Force Deal: Northwood’s One-Two Punch

08:42 AM | January 30, 2026

🔦 Spotlight

Hello Los Angeles

The most underrated part of the space boom isn’t what gets launched, it’s what happens after. A satellite can be flawless in orbit and still be functionally useless if you can’t talk to it fast, often, and reliably, especially when something breaks.

Torrance is proving the next space race is won on the ground

Northwood Space, operating out of a 35,000-square-foot facility in Torrance, just landed a rare one-two punch: a $100M Series B and a roughly $49.8M U.S. Space Force contract tied to upgrades for the Satellite Control Network, the system that supports launches, early operations, tracking and control, and emergency support when satellites go sideways. The Series B was led by Washington Harbour Partners, co-led by Andreessen Horowitz, and included participation from Alpine Space Ventures, Founders Fund, StepStone, Balerion, Fulcrum, Pax, 137 Ventures, and others.

What’s intriguing here isn’t just the dollars, it’s the thesis. Northwood is arguing that the next wave of space companies won’t be constrained by rockets, but by operations and connectivity, meaning the ground layer becomes the strategic choke point. Their approach combines vertically integrated ground infrastructure with phased-array systems (“Portal”) that can steer multiple beams electronically and support missions across LEO, MEO, and GEO, aiming to make ground access feel less like bespoke aerospace procurement and more like scalable infrastructure.

Why this matters right now

In a market where “space” headlines often center on what’s above the atmosphere, this week’s signal is that the decisive advantage may live down here. If Northwood can make satellite communications more frequent, more flexible, and easier to scale, it doesn’t just help one mission, it changes the economics of operating entire fleets.

Scroll on for the latest LA venture rounds, fund news and acquisitions.

🤝 Venture Deals

LA Companies

- Origin, a pelvic floor physical therapy and women’s musculoskeletal care provider, raised a Series B led by SJF Ventures with participation from Blue Venture Fund and Gratitude Railroad, plus financing from California’s IBank and several angel investors. The company says it will use the funding to expand access to its hybrid model of in-person clinics and nationwide virtual care, and to invest in AI-enabled clinical tools, clinician training through Origin University, and additional clinical research. - learn more

- OpenDrives announced new funding led by IAG Capital Partners to support growth of its software platform for video data management used by media, sports, and enterprise teams. Alongside the investment, the company named longtime COO Trevor Morgan as CEO as it continues shifting from a hardware-first business to a software-focused platform. - learn more

LA Venture Funds

- MANTIS Venture Capital participated in Rogo’s $75M Series C, a round led by Sequoia that values the AI “agent” platform at about $750M. The company says it will use the new funding to scale its AI system for investment-banking workflows and accelerate its European expansion, including opening its first international office in London. - learn more

- B Capital led PaleBlueDot AI’s $150M Series B, pushing the AI compute platform’s valuation to over $1B. The company says it will use the funding to deepen its core tech and platform engineering, expand go-to-market, and scale across North America and Asia to meet rising enterprise demand for cost-efficient AI infrastructure. - learn more

- Rebel Fund participated in Modelence’s seed round, which raised $3M and was led by Y Combinator alongside other investors. Modelence is building an all-in-one TypeScript toolkit that bundles essentials like auth, databases, hosting, and LLM observability to reduce the “stitching things together” headaches that come with vibe-coding and modern app infrastructure. - learn more

- Alexandria Venture Investments participated in TRexBio’s oversubscribed $50M financing alongside several new investors and existing backers. The company says it will use the funds to advance TRB-061, its TNFR2 agonist designed to selectively activate regulatory T cells, in an ongoing Phase 1a/b study for atopic dermatitis, and to move preclinical programs TRB-071 and TRB-081 toward the clinic. - learn more

- Bonfire Ventures led Risotto’s $10M seed round to help the startup bring AI into help desk workflows and make ticketing systems easier to use. Risotto aims to autonomously resolve support tickets by sitting between tools like Jira and a company’s internal systems, using an AI layer designed to keep model outputs reliable and controlled. - learn more

- Calibrate Ventures participated as a returning investor in Grid Aero’s $20M Series A, which was co-led by Bison Ventures and Geodesic Capital. The aerospace and defense startup says it will use the funding to move its Lifter Lite autonomous aircraft from testing into operational deployments, supporting major exercises and early customer use cases as it scales long-range, low-cost autonomous airlift for contested environments. - learn more

LA Exits

- Bridg is being acquired by PAR Technology (from Cardlytics) in a deal valued at $27.5M in PAR stock, with the price potentially adjusting up to $30M, and it’s expected to close in Q1 2026. PAR plans to integrate Bridg’s identity-resolution capabilities so restaurants and retailers can unify loyalty and non-loyalty purchase data, recognize previously anonymous customers, and run and measure marketing more effectively. - learn more

- Assembly, an employee recognition and rewards platform founded in 2018 and used by 500+ organizations, is being acquired by talent-management provider Quantum Workplace. The deal adds built-in rewards to Quantum Workplace’s suite and is intended to connect recognition data with engagement, performance, development, and retention insights so leaders can better spot impact, reinforce values, and invest in keeping top talent. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS