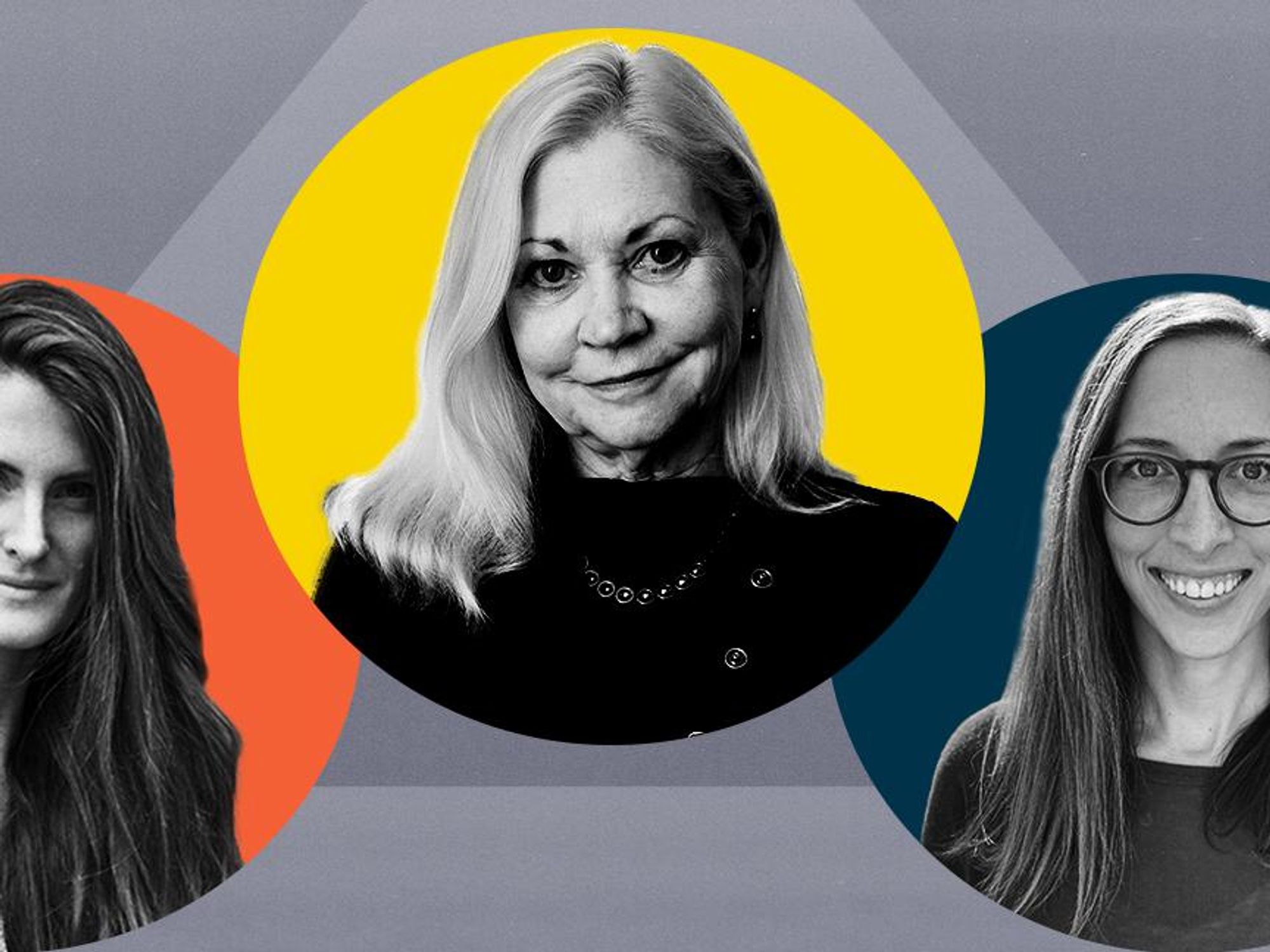

LA's Top VCs Are Watching These 10 Female Founders

From helping save beehives to healing the human body, some of L.A.'s most innovative companies are helmed by female founders. Who stands above the pack? We asked the region's top VCs participating in our recent dot.LA sentiment survey to weigh in.

Ara Katz, a serial entrepreneur and founder of probiotic company Seed tops our list. Katz found a niche in a multi-billion dollar industry, but she acknowledges that this past year has been especially tough for women, as the pandemic forced millions to drop out of the workforce.

"It is not lost on me what a privilege it is to be building a company as a female founder and mother given how impactful the pandemic and the past year has been on women and mothers in the workforce," said Katz. "My best advice to founders is to build with abandon — it is contagious, amplifying and makes it all meaningful."

Nationally, female-founded or co-founded companies earned less than 3% of all venture capital in 2020, according to data from Pitchbook. Although women founders say they still face issues of sexism and encounter more obstacles than their male counterparts, there are signs of improvement. In the first quarter of this year, women entrepreneurs reeled in $9.8 billion in capital investment nationally – an all-time high in quarterly investments over the past 12 years.

In Los Angeles, Long Beach and Santa Ana, $544 million was poured into female founded startups alone over that time.

Therese Tucker, founder of fintech company BlackLine, which also made our list, said that it's important for women to find people who believe in them as they build their companies.

"Don't be intimidated by condescension," Tucker said, "Look for people you can actually partner with who 'get' your business."

And just as importantly, founder of health platform Kensho, Krista Berlincourt, said stay true to who you are.

"It is not easy. And you'll be surrounded by men, so just find the people who get you and your vision, hold onto them tight, and go for it. Then remember that soft is strong. You don't have to 'crush it' to be successful," she said. "Be you. Be flexible. Soften. Grow. That's the only thing that has ever worked," Berlincourt added.

Here's the complete list:

Ara Katz, Seed

Ara Katz

Ara Katz is the co-founder and co-CEO of Seed, a Venice-based probiotic company designed to improve health and digestion. Katz's experience as a breastfeeding mother led her to explore the importance of microbes and their impact on bodily health. Among other leading roles, Katz was co-founder and CMO of ecommerce marketplace Spring, which was sold to ShopRunner in 2018. She was also on the founding team of Beach Mint, an e-commerce company for fashion and lifestyle brands.

Claire Schmidt, AllVoices

Claire Schmidt

Claire Schmidt aims to empower workers through AllVoices, an anonymous reporting and management platform, which allows employees to report issues in the workplace. The LA-based company has raised a total of $4.1 million with investments by Crosscut, Greycroft, Halogen Ventures and dot.LA founder Spencer Rascoff. Inspired by the the MeToo movement, the platform lets employees alert management to problems like discrimination, harrasment, or work bias. Prior to roles at AllVoices, Schmidt was vice president of technology and innovation at Fox properties and senior director of giving at Thrive Market, an e-commerce platform for organic products.

Ariel Kaye, Parachute

Ariel Kaye

Ariel Kaye used her design and brand background to launch Parachute in 2014. Parachute is a direct-to-consumer bedding brand based in Culver City. The startup has raised over $47 million in funding to date with investments by H.I.G Capital, Jaws Ventures and Brilliant Ventures. The brand avoids chemicals and synthetics in their products putting an emphasis on sustainability.

Therese Tucker, BlackLine

Therese Tucker

Therese Tucker is the founder and executive chair of BlackLine, an LA-based platform for accountants that takes on repetitive or complicated tasks. BlackLine pulled in nearly $352 million in revenues in 2020, and expects to grow that to at least $410 million this year. Ranked among Fortune's '50 fastest growing' women led companies in 2016, the company also received first place in G2's "Best Finance Products of 2021" ranking.

Sophia Amoruso, Nasty Gal

Sophia Amoruso

Southern California native Sophia Amoruso is the founder and former owner of Nasty Gal, a multi-million dollar clothing store originally started on eBay. Nasty Gal was sold at a value of $20 million, including $15 million in debt, to BooHo in 2017. Amoruso's newest project is an eight-week entrepreneurship course called Business Class, which aims to help female business leaders begin or grow their small businesses. The New York Times bestseller author of#GIRLBOSS, she detailed her entrepreneurial story that was later made into a Netflix series.

Madeline Fraser, Gemist

Madeline Fraser

Madeline Fraser is the CEO and founder of Gemist, a mobile app that allows users to design a ring and try it on at home before they buy. Fraser used her experience in growing tech-startups to create one of her own. The sustainable jewelry brand raised $1 million in funding in its first seed round in 2019 and last year was backed by De Beers Group Ventures, Hawke Ventures and Monique Woodward last year for an undisclosed amount.

Krista Berlincourt, Kensho

Krista Berlincourt

Berlincourt is the CEO and co-founder of Kensho, an Los Angeles-based health platform and guide to natural medicine. Kensho provides users with specialized wellness services from surfing to acupuncture. The company has raised $1.3 million and is backed by top investors like CrossCut Ventures, Female Founders Fund and Evolve Ventures. Prior to creating her own company, Berlincourt worked in public relations at venture-backed Simple.

Katherine Power, Who What Wear

Katherine Power

Katherine Power co-founded Who What Wear 15 years ago out of frustration with a fashion industry that was often out of reach for many. The brand focuses on providing affordable and size-inclusive fashion. She is now CEO of Clique Media Group, a parent company that oversees Who What Wear and other consumer brands. As of 2017, Clique Media Group raised over $15 million in funding with investments by Amazon, Greycroft and e.ventures. Power was also listed in Fortune's 40 under 40 in 2016.

Cat Chen, Skylar

Cat Chen

Cat Chen is the founder and CEO of Skylar, a fragrance and body care brand. Chen developed a hypo-allergenic and cruelty free fragrance after being dismayed by the lack of clean ingredients in high-priced perfumes. The company founded in 2017 has raised a total of $11 million backed by Amplify, FirstMark Capital and GingerBread Capital. Prior to Skylar, Chen was was an executive of operations at The Honest Company, where she helped grow the company to $300 million of revenue in her four years there.

Shivani Siroya, Tala

Shivani Siroya

The founder and CEO of Tala, a Santa Monica-based consumer credit smartphone app, Shivani Siroya created the company to assist people in underrepresented markets. Tala uses advanced data science to provide personalized financial services, such as disbursing loans to people with no formal credit history. The startup has raised over $217 million in funding by top investors, and has since been mentioned in TedTalks, Wall Street Journal and Financial Times. Siroya's company is valued at an estimated $750 million dollars as of 2019, and was deemed one of the top FinTech companies in the world by Forbes.

Lead image by Ian Hurley.

- Watch: Our Startup Pitch Showcase Featuring Female Founders ... ›

- New Data Show the Pandemic Has Hit Female Founders Harder ... ›

- Halogen Ventures Closes $21 Million Round to Fund Women - dot.LA ›

- Why Funding Inequity Isn't Deterring These Female Founders, VCs ... ›

- VCs Fund More Early Stage Female Founders in LA - dot.LA ›

- Los Angeles' Startup Scene is Still a Male-Dominated Game - dot.LA ›

- The Women of Cloud9 White Talk Sexism in Gaming - dot.LA ›

- Event: Girls in Tech LA Open House and Career Day - dot.LA ›

- Female Founded Unicorns Quadrupled in 2021 - dot.LA ›

- Shiloh Johnson On Increasing Diversity: 'Don't Focus on It' - dot.LA ›

- Julia Boorstin: Why VCs Should Stop Undervaluing Women-Led Startups - dot.LA ›

- CNBC’s Julia Boorstin on How Women Entrepreneurs Can Thrive - dot.LA ›

- Bullpen Capital's Ann Lai on Overcoming Industry Sexism - dot.LA ›

- LA Tech Week: Female Founders and Women-Led Startups - dot.LA ›

- LA Tech Week: Female Founders and Women-Led Startups - dot.LA ›

Image Source: Northwood Space

Image Source: Northwood Space

Image Source: JetZero

Image Source: JetZero