Get in the KNOW

on LA Startups & Tech

X

Photo by Kristin Snyder

At VidCon, Investors Are Still ‘Betting Big’ on the Creator Economy

Kristin Snyder

Kristin Snyder is dot.LA's 2022/23 Editorial Fellow. She previously interned with Tiger Oak Media and led the arts section for UCLA's Daily Bruin.

The creator economy is the bedrock of this week’s VidCon convention, which is drawing creators, companies, investors and fans alike to Anaheim to discuss the rapidly growing realm of digital content and entertainment.

To discuss how investors, in particular, are viewing the booming creator landscape, Thursday’s “Betting Big on the Creator Economy” panel featured the likes of MaC Venture Capital partner Zhenni Liu, Investcorp managing director Anand Radhakrishnan, Team8 Fintech managing partner Yuval Tal and Paladin co-founder and CEO James Creech.

Liu said that her Los Angeles-based VC firm is paying closer attention to the influence that creators are having on how consumers spend their time and money. She cited the recent “healthy Coke” viral trend, in which people mix balsamic vinegar and seltzer water as a soda alternative, as an example—citing how the number of people who have viewed the original TikTok video that set off the craze surpasses the Coca-Cola TikTok account’s number of followers.

This growing influence stems from the surging number of creators, Radhakrishnan said. With the pandemic forcing many to reconsider their career paths, he said people now view content creation as a legitimate professional route—quipping that these days, more children want to be YouTube stars than astronauts.

“As an older person, I thought this was the downfall of Western civilization,” the Investcorp managing director said. “At the end of the day, I think it reflects that this is real—and as an investor, we’re looking at ways to invest in the next great economies.”

Creech said that the growing creator sector rests on three main pillars: content creation, audience growth and monetization. The constant evolution of creator platforms does present a challenge for investors, however, with Liu noting that more creators are looking to Web3 as an alternative to traditional outlets often offering a smaller slice of revenues.

“As a result, we’re seeing creators who can’t figure out how to build their audience, monetize and distribute,” Liu said. “With Web3, this opens up a new opportunity. There's a lot of chaos, but chaos provides the opportunity for creators to rise up.”

Additionally, the shift toward short-form content means that more investment dollars will be redirected away from longer-form shows and films, Tal observed. And even with an increasingly likely recession on the horizon—one that already appears to be hitting the creator economy, as well as the wider tech, startup and venture capital sectors—Tal and the other panelists remained optimistic about the creator economy’s prospects moving forward.

“It is almost winter-agnostic,” Tal said. “The shift [toward the creator economy] is so massive that no [economic] winter can slow it down.”

From Your Site Articles

- VidCon 2021 Returns In-Person As Events Slowly Come Online ... ›

- Famous Birthdays Launches Data Subscription Service - dot.LA ›

- VidCon 2021 Cancelled Amid Rising COVID Cases - dot.LA ›

- VidCon 2022 Featured Few High-Profile TikTok Creators - dot.LA ›

- VidCon 2022 Featured Few High-Profile TikTok Creators - dot.LA ›

- Why Creators Should Build Community Rather Than a Fan Base - dot.LA ›

- Influencers Are Launching Venture Capital Funds - dot.LA ›

- Keys to Success: Inside The Creator Economy's Middle Class - dot.LA ›

Related Articles Around the Web

Kristin Snyder

Kristin Snyder is dot.LA's 2022/23 Editorial Fellow. She previously interned with Tiger Oak Media and led the arts section for UCLA's Daily Bruin.

https://twitter.com/ksnyder_db

Event: How the Creator Economy Is Empowering Artists and Changing Hollywood

10:53 AM | June 28, 2021

Photo by David Ruano

Investors, influencers and entrepreneurs mingled and chatted about the creator economy as a robot served cocktails.

dot.LA's inaugural, in-person summer series event sought to bring some understanding to the creator economy and the myriad ways it's shifting power relationships in Hollywood.

The new model is already upending traditional advertising, spurring a slew of startups from old school talent agencies to AI-platforms aimed at boosting influencers' reach and giving once overlooked artists a bigger voice.

"Talent are [now] able to do much more than just brand deals," said Jake Webb, who runs talent management company Slash Management. Webb was on dot.LA's panel on Thursday night. He counts among his clients, Loey Lane, an influencer who with the help of Wheelhouse has leveraged her hundreds of thousands of followers. "They're able to create productions, create ventures."

Lane now has a Spotify podcast hit.

Lane built her social media following primarily on Instagram and TikTok by focusing on body positivity. She later expanded her brand to also include paranormal ghost-hunting, which she initially pursued largely on YouTube. Wheelhouse, one of many agencies in Hollywood that have thrown their resources behind influencers, helped her and her co-host spin their show into a Spotify podcast – exemplifying the enduring allure of "traditional media."

Photos by David Ruano

From left: Wheelhouse executive Avi Gandhi, influencer Loey Lane, Slash Management's Jake Webb and dot.LA host Kelly O'Grady.

She's hardly the only one who is using her social media celebrity to clinch deals. Brands from Dunkin' Donuts to Crocs rely on celebrities to drive interest in their products. And Hollywood is even scouting on social media.

"It goes both ways," said Wheelhouse digital executive Avi Gandhi. While influencers like Lane who've built a following on social media may seek to migrate into more established entertainment pathways, the reverse is also happening. Noah Schnapp is a case in point, Gandhi said; the child actor leveraged his success on Netflix's "Stranger Things" to build a big social following of his own.

Gandhi, who helps creators build their brand, said aspiring influencers need to spread their presence across numerous platforms.

"If you want to grow your business you have to be in as many places as possible, because there is money in all of those different places if you approach it right. And different content works in different places," Gandhi said.

The company is currently helping the influencer group Hype House launch a show on Netflix.

So where does he spend his free time? Online, of course.

"I watch TikTok when I'm bored and only have my phone; I listen to podcasts when I'm in my car; I watch Netflix on Friday when I just want my brain to shut off," Gandhi said. "They all coexist and I don't foresee any of them going away."

dot.LA's inaugural, in-person summer series was hosted Thursday night by dot.LA's Kelly O'Grady.

It was presented in partnership with Wheelhouse.

From Your Site Articles

- Super.Fans Launches to Move Creators Beyond Subscriptions - dot.LA ›

- Launch House Accelerator Expands to New York and Beyond - dot.LA ›

- California’s Film and TV Tax Credit 3.0 Tabled Till 2023 - dot.LA ›

- Why Creators Should Build Community Rather Than a Fan Base - dot.LA ›

- Creatorland Launches as Content Creator Networking Platform - dot.LA ›

- The Innovative LA Startups Changing the Creator Economy - dot.LA ›

Related Articles Around the Web

Read moreShow less

Sam Blake

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

https://twitter.com/hisamblake

samblake@dot.la

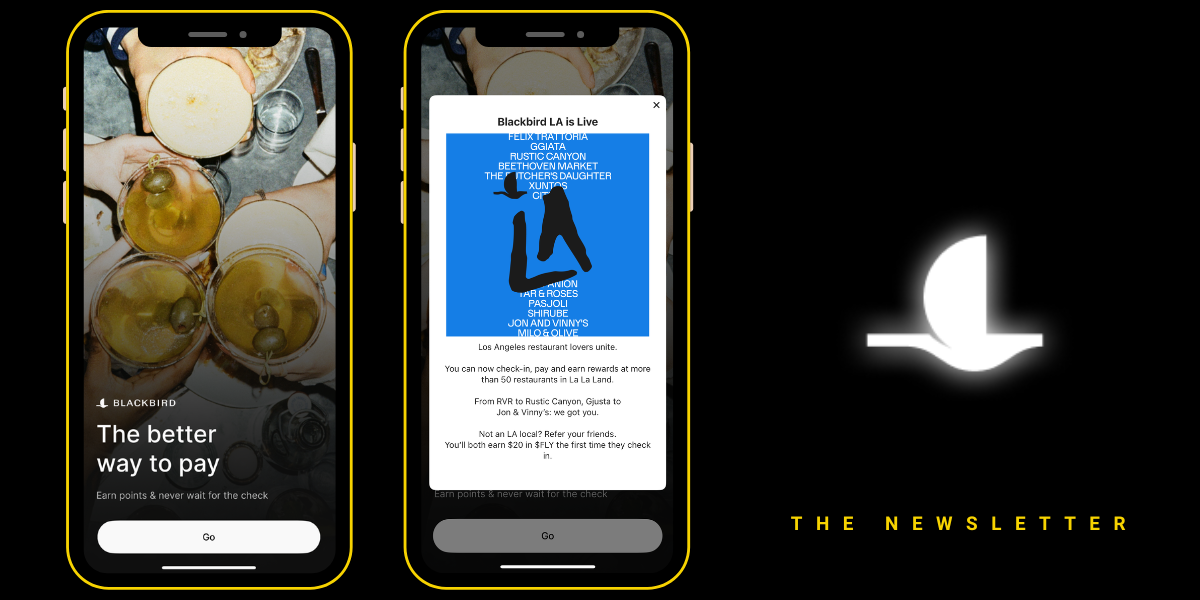

Resy Cofounder’s New App Lands in LA: A Loyalty Tool Restaurants Actually Want

10:08 AM | October 24, 2025

🔦 Spotlight

Hello LA,

Blackbird, the loyalty and payments startup from Resy and Eater co-founder Ben Leventhal, officially landed in LA this week. The product is simple in the wild: you check in, pay through the app, and earn rewards that restaurants can actually act on, helping them spot and serve regulars without guessing. The LA launch goes live with more than 50 partners centered on the Westside, including names like Gjelina and Felix, plus spots across groups such as Rustic Canyon and Citrin, with expansion planned beyond Venice and Santa Monica.

Under the hood, Blackbird has been building a national network and says it is live at more than 1,000 restaurants. The company raised fresh capital earlier this year to expand markets and roll out cross-restaurant rewards, positioning LA as a key beachhead for growth. If you dine out a lot, the appeal is that the app collapses discovery, payment, and loyalty into one flow. If you run a dining room, the promise is cleaner data on guests you actually see, instead of a generic points program that lives somewhere else.

For LA specifically, the draw is that this model fits how the city eats. We spread across neighborhoods, follow chefs, and rotate between a small set of favorites and a long list of next-ups. A networked loyalty layer that recognizes that pattern could move real dollars, particularly for independents that want to keep the relationship direct. We’ll be watching how quickly the footprint moves east from the coast and which operators lean into memberships and targeted rewards first.

Scroll for this week’s LA venture deals, funds, and acquisitions.

🤝 Venture Deals

LA Companies

- GammaTime, a Los Angeles based premium micro drama platform founded by former Miramax CEO Bill Block, raised $14M seed led by vgames and Pitango, with participation from Alexis Ohanian, Kris Jenner, Kim Kardashian, and Traverse Ventures. The app is live on iOS and Android, features more than 20 vertical phone native originals, and plans new series from “CSI” creator Anthony E. Zuiker as it scales a freemium model for U.S. audiences. - learn more

- Wolf Games, a generative-AI gaming startup backed by Dick Wolf, raised a $9M Series A led by Main Street Advisors. The company also inked a partnership with NBCUniversal to develop interactive games using NBCU IP, built on Wolf Games’ platform for creating “living, cinematic” game worlds. Notable participants include Maverick Carter, Tom Werner, and Rashid Johnson, alongside returning investors Jimmy Iovine, Paul Wachter, and Dick Wolf. - learn more

- Quantum Elements, a Los Angeles based startup, launched Constellation, an AI native platform that helps teams build quantum software and co design hardware using agentic AI, natural language prompts, and a large noisy qubit simulator. The company emerged from stealth with funding from QDNL Participations and support from USC Viterbi, and says Constellation can speed code generation, debugging, and testing for applications in pharma, energy, and finance. - learn more

- Arbor Energy raised a $55M Series A co-led by Lowercarbon Capital and Voyager Ventures, with Gigascale Capital and Marathon Petroleum Corporation participating, to accelerate deployment of its zero-emission, fuel-flexible turbines. The funding completes a 1 MW pilot called ATLAS and advances HALCYON, a 25 MW modular turbine that uses oxy-combustion with supercritical CO₂ for efficient, carbon-neutral baseload power aimed at data centers, utilities, and industrial customers. - learn more

- Dialogue AI raised a $6M seed led by Lightspeed Venture Partners to scale its AI-native research platform, which uses a live conversational AI interviewer to run real-time customer interviews and deliver insights faster. Participants include Seven Stars, Uncommon Projects, the Tornante Company, and notable angels, and the funds will accelerate product and go-to-market efforts with early customers such as Wayfair, Square, Nextdoor, and Suno. - learn more

LA Venture Funds

- March Capital participated in Uniphore’s $260M Series F, joining strategic investors NVIDIA, AMD, Snowflake, and Databricks. The funding will accelerate development and adoption of Uniphore’s Business AI Cloud and expand its partner ecosystem, alongside investors like NEA, BNF Capital, National Grid Partners, and Prosperity7 Ventures. - learn more

- Beast Ventures participated in Nutropy’s latest funding round to scale precision-fermented casein for next-gen dairy ingredients. The France-based startup will use the capital to ramp production and deliver larger samples of its “cheeseable milk” powder to food manufacturers as it targets a 2027 launch. - learn more

- Patron participated in Notch’s $8M seed financing round, alongside investors such as Wing, Samsung, and Balaji, to scale the company’s AI platform for generating performance ads. Notch has since launched a “URL-to-animated-ads” feature that turns a product link into ready-to-run animated creatives within minutes, supporting a faster workflow for marketers rolling out motion ads. - learn more

- B Capital participated in CurbWaste’s $28M Series B, which was led by Socium Ventures with Flourish Ventures, TTV Capital, and Squarepoint Capital also joining. The funding brings total capital to $50M and will accelerate product and go-to-market work on CurbWaste’s operating system for independent waste haulers, including AI-driven dispatch, reporting, and payments. - learn more

- Thin Line Capital participated in SenseNet’s $14M Series A to scale its AI wildfire-detection network in the United States. The round was led by Stormbreaker with Fusion Fund, Plaza Ventures, FOLD36 Capital, and B Current also joining; funds go toward new offices and installations as SenseNet fuses gas sensors, AI cameras, satellites, and weather data to spot fires before they are visible. The company says it already monitors about 130 million acres and can flag ignitions within minutes. - learn more

- MANTIS Venture Capital participated in Keycard’s $38M financing for its identity and access platform for AI agents. The combined seed and Series A were led by Andreessen Horowitz, Acrew Capital, and Boldstart Ventures, and coincide with Keycard’s early-access launch. Keycard says its system issues short-lived, auditable identity tokens to help developers govern agent actions and data across apps. - learn more

- WndrCo participated in Defakto’s $30.75M Series B, a round led by XYZ Venture Capital with The General Partnership and Bloomberg Beta also joining. Defakto, formerly SPIRL, builds a Non-Human Identity and Access Management platform that replaces static credentials with dynamic, auditable identities for services, pipelines, workloads, and AI agents across multi-cloud environments. The company will use the capital to accelerate product development and expand go-to-market efforts. - learn more

- CIV co led 1001’s $9M round alongside General Catalyst and Lux Capital to build an AI native operating system for decision making in critical industries. 1001 combines live data ingestion, operational mapping, AI driven decisioning, and governance to help operators act in real time, with early pilots in aviation, logistics, and large infrastructure projects. The raise also includes backers like Chris Ré and Amjad Masad and will fund early deployments and hiring in Dubai, London, and beyond. - learn more

- Brentwood Associates led Throne Labs’ $15M Series B initial close to expand the company’s smart restroom infrastructure across new and existing U.S. markets. Existing investors including Uncorrelated Ventures, DiPalo Ventures, Rabil Ventures, and Arpiné Capital participated as Throne scales its network of sensor-equipped, ADA-compliant restrooms and city partnerships. - learn more

- M13 led Estuary’s $17M Series A, with participation from FirstMark and Operator Partners, to scale the company’s “right-time data” platform. Estuary unifies change data capture, streaming, and batch into one managed system with BYOC deployment so enterprises can control latency and feed AI applications more reliably; funds will support product and go-to-market expansion. - learn more

- Strong Ventures provided follow-on funding in Unjeonseonsaeng’s ₩2.8B (~$2.0M) Series A, backing the driving-school comparison and booking platform as it scales nationwide. New investors Fast Ventures and Korea Credit Guarantee Fund joined the round, with proceeds going to expand the company’s SaaS tools for driving schools and enhance data-driven features like AI recommendations and advertising. The startup reports monthly GMV above ₩1B and its first profitable quarter in 2025. - learn more

- Interlagos led Adaptyx Biosciences’ $14M seed, with Hyperlink Ventures participating alongside Overwater Ventures, Starbloom Capital, Stanford University, the Chan Zuckerberg Biohub, and others. Adaptyx is developing a biowearable for continuous, multi-analyte molecular monitoring; the raise brings total funding to about $23M and supports R&D, clinical progress toward FDA clearance, and platform scaling. - learn more

- B Capital participated in Faeth Therapeutics’ new $25M financing, which brings the company’s total funding to $92M and supports a randomized Phase 2 trial of its PIKTOR regimen in endometrial cancer with the GOG Foundation. The raise, led by S2G Ventures with additional new and existing backers, follows Phase 1b data showing an 80% overall response rate and 11-month median PFS when PIKTOR was combined with paclitaxel. - learn more

- Btech Consortium participated in PortX’s strategic growth round, joining renewed backers alongside new investors Allied Solutions and the American Bankers Association. The funding extends PortX’s Series B and underscores industry support for its AI-powered data integration platform for banks and credit unions. - learn more

LA Exits

- Breez was acquired by JumpCloud to bolster JumpCloud’s identity threat detection and response capabilities and accelerate its security roadmap. The deal brings Breez’s ITDR technology and team into JumpCloud’s platform; terms were not disclosed. The Breez group is led by former Adobe executive Abhinav Srivastava. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS