Get in the KNOW

on LA Startups & Tech

X

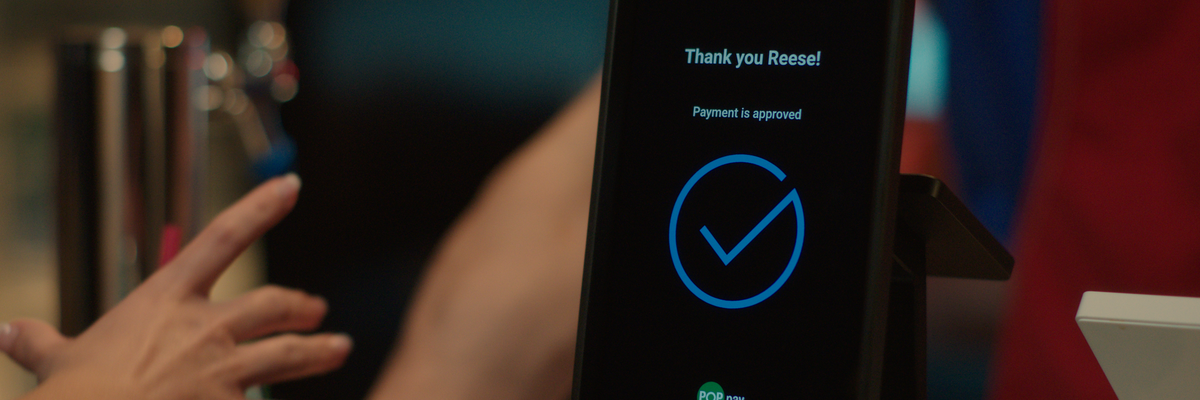

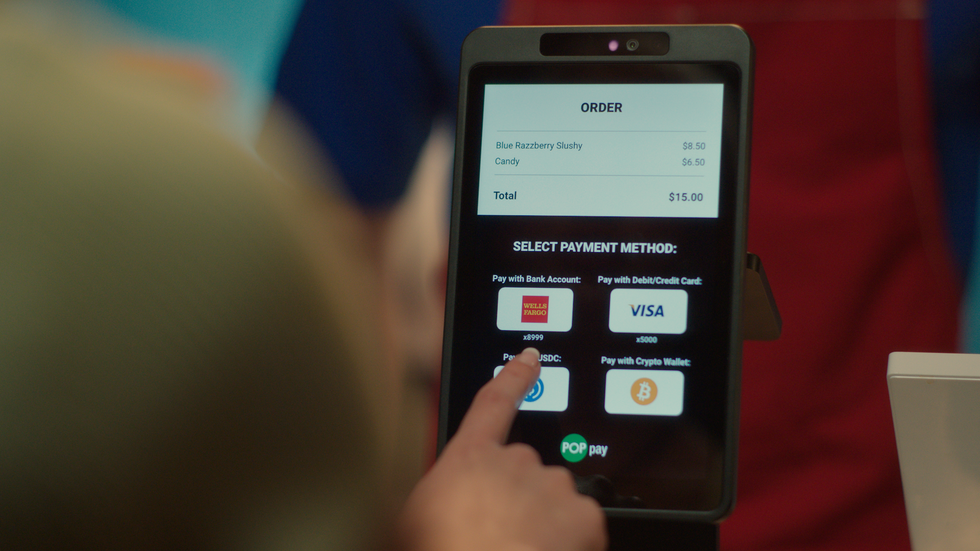

Photo courtesy of PopID.

PopID Teams With Visa To Bring Facial Payments to the Middle East

Decerry Donato

Decerry Donato is a reporter at dot.LA. Prior to that, she was an editorial fellow at the company. Decerry received her bachelor's degree in literary journalism from the University of California, Irvine. She continues to write stories to inform the community about issues or events that take place in the L.A. area. On the weekends, she can be found hiking in the Angeles National forest or sifting through racks at your local thrift store.

PopID, a Pasadena-based startup that uses facial recognition software to enable payments, is venturing into the Middle East.

On Tuesday, PopID announced a partnership with financial services giant Visa that will promote its facial payment solution PopPay in the Middle East. PopID, which scans biometric facial data in real time to verify payments, has also teamed with investment firm Dubai Holdings to deploy its face-pay technology at the firm's assets across the region.

Dubai's Coca-Coca Arena, as well as retailers like Costa Coffee and grocery chain Géant, will be among the first merchants to use PopID’s technology in the Middle East. PopID CEO John Miller said the technology would begin rolling out in the next couple of weeks.

Shoppers can enroll to use PopPay through a store’s app—where their face can be linked to loyalty rewards programs—or through their bank’s mobile app to link their face to a card.

“It's about validation and getting people comfortable with the idea of face-pay as an alternative to the card and the phone,” Miller said of the partnership with Visa.

This news comes a month after PopID inked a deal with events and venue management company ASM Global to install PopPay and PopEntry, its health screening and temperature checks platforms, at ASM venues around the world. The startup also partnered with SoftBank in November to launch its technology at restaurants in Japan. Since then, PopID has registered 5,000 new clients, bringing its total users to 90,000.

“We're moving faster with the vision of a global face-pay platform than probably we had ever contemplated,” Miller told dot.LA. “The international community is embracing it faster than we expected.”

The controversy behind facial recognition software is nothing new, with many observers expressing concerns regarding the privacy and security practices behind their biometric data being stored. Miller acknowledges that there are skeptics as with any new technology, but said the adoption of PopPay overseas is higher because “people aren't as concerned about privacy and data issues as they might be in America.”

From Your Site Articles

Related Articles Around the Web

Decerry Donato

Decerry Donato is a reporter at dot.LA. Prior to that, she was an editorial fellow at the company. Decerry received her bachelor's degree in literary journalism from the University of California, Irvine. She continues to write stories to inform the community about issues or events that take place in the L.A. area. On the weekends, she can be found hiking in the Angeles National forest or sifting through racks at your local thrift store.

Fuel Innovation: 7 Unforgettable Team Building Experiences in LA

02:58 PM | July 10, 2024

Image Source: Discover LA

In today's competitive business landscape, team building activities have emerged as a crucial tool for fostering a positive work environment, enhancing productivity, and crucially, improving employee retention. Studies have shown that such activities help employees feel valued, with one report indicating that 93% of those who felt appreciated were more motivated at work. Importantly, team building events may improve retention rates, as employees who feel connected to their colleagues and company culture are more likely to stay long-term. With these benefits in mind, let's explore some of the most engaging and effective team building activities available in Los Angeles.

Pickleball

Image Source: Modern Luxury Angelino

Pickleball is a fantastic team bonding activity because of the easy-to-grasp rules and gentle pace make it perfect for everyone, regardless of age or fitness level. The game thrives on communication and teamwork, as players must collaborate and strategize to outplay their opponents, boosting team cohesion. Plus, the lively, fast-paced action sparks friendly competition and laughter, creating a fun and spirited atmosphere that brings everyone closer together. Los Angeles boasts numerous pickleball courts that are easy to rent if you have your own equipment. If you need additional assistance organizing your pickleball outing, there are plenty of full-service companies ready to handle every detail for you.

Resources: Pickle Pop, Corporate Pickle

Escape Room

Image Source: The Escape Game

Escape rooms are a great way to build camaraderie. They require participants to work together, combining their problem-solving skills and creativity to overcome challenges and puzzles. The immersive and time-sensitive nature of escape rooms fosters collaboration and communication. Additionally, the shared experience of tackling complex tasks and reaching a common goal helps build trust and foster positive emotions among colleagues.

Resources: The Escape Game, 60Out

Day Trip to Catalina Island

Image Source: Love Catalina

Catalina Island is a perfect day trip for a team because it provides a break from the usual work environment, allowing team members to relax and connect in a new setting. Shared experiences during the trip, such as exploring new places and participating in fun activities, help build stronger relationships and foster a sense of camaraderie. There are numerous team-building activities such as an arboreal obstacle course, an island tour, scavenger hunts and more.

Resources: Catalina Island Group Activities

Top Golf

Image Source: Topgolf

Topgolf is an excellent team building event because it provides an inclusive, relaxed atmosphere that accommodates players of all skill levels, fostering personal connections and improving team morale. The unique blend of competition and entertainment creates an ideal setting for building trust, enhancing communication, and revealing hidden skills among team members. Additionally, Topgolf offers structured team building packages with guided activities, discussion prompts, and lessons on culture, change, collaboration, and strategy, making it a versatile and effective platform for strengthening relationships and boosting overall team performance.

Resources: Topgolf El Segundo

SoFi Stadium Tour

Image Source: Discover LA

A SoFi Stadium tour offers a unique, behind-the-scenes experience of one of the world's most advanced sports venues, allowing team members to explore exclusive areas like premium suites, team locker rooms, and the player tunnel together. The tour provides a shared, memorable experience that can foster camaraderie and spark conversations among team members, regardless of their interest in sports. Additionally, the stadium's state-of-the-art features and impressive architecture can inspire creativity and innovation, while the group setting encourages interaction and collaboration, making it an engaging and enjoyable activity for teams of various sizes and backgrounds

Resources: SoFi Stadium Group Tours

Corporate Volunteering

Image Source: L.A. Works

Volunteer work serves as an excellent team building activity by uniting employees around a shared, meaningful cause, fostering a sense of purpose and collective accomplishment. It provides opportunities for team members to collaborate in new ways, often revealing hidden strengths and leadership qualities that may not be apparent in the regular work environment. Additionally, engaging in community service can boost morale, enhance the company's reputation, and instill a sense of pride among employees, leading to improved workplace relationships and increased job satisfaction.

Resources: Habitat for Humanity, L.A. Works, VolunteerMatch

Corporate Improv Sessions

Image Source: Improv for the People

A corporate improv class encourages spontaneity, creativity, and quick thinking, skills that are valuable in the workplace. It promotes active listening and collaboration, as participants must work together to create scenes and respond to unexpected situations, fostering better communication and trust among team members. Additionally, the playful and often humorous nature of improv helps break down barriers, reduces stress, and creates a shared positive experience that can improve team morale and cohesion long after the event.

Resources: Improv-LA, Groundlings, Improv for the People

Read moreShow less

Skyryse Raised $300M+ to Do What Most Startups Can’t

09:26 AM | February 06, 2026

🔦 Spotlight

Hello Los Angeles

LA just minted another aviation unicorn, and it is not because someone built a prettier helicopter demo. It's because Skyryse is trying to do the rarest thing in tech: turn software into something regulators will sign their name to, and that pilots will trust when conditions are at their worst.

El Segundo’s newest unicorn is simplifying the cockpit

Skyryse raised $300M+ in a Series C at a $1.15B valuation. The round was led by Autopilot Ventures and returning investor Fidelity Management & Research Company, with participation from Qatar Investment Authority, ArrowMark Partners, Atreides, BAM Elevate, Baron Capital Group, Durable Capital Partners, Positive Sum, Rokos (RCM Private Markets Fund), and Woodline Partners, among others.

The pitch is bold and deceptively simple. Skyryse is building a “universal operating system for flight,” SkyOS, designed to replace the cockpit’s maze of mechanical controls with a computer-driven system that makes routine flight easier and emergency situations more manageable. The bigger claim is standardization: if you can make the interface and controls feel consistent across aircraft, you reduce training friction, lower pilot workload, and create fewer opportunities for human error when the stakes spike.

The real work starts after the press release

Skyryse says the funding will be used to accelerate FAA certification and scale SkyOS across additional aircraft platforms, including the Black Hawk. That is the hard part, and also the part most startups never reach. Aviation is where software has to prove itself in edge cases, repeatedly, with zero tolerance for surprises, because “mostly works” is another way of saying “eventually fails.”

The bet hiding inside the headlines

If Skyryse clears certification and can port SkyOS across aircraft types the way software ports across devices, it could unlock a new category of safety automation for fleets that cannot afford downtime, confusion, or long training cycles. Emergency response, defense modernization, and industrial aviation are all markets where reliability is the product, and simplicity is the differentiator. In a world obsessed with shipping faster, Skyryse is playing a different game: getting permission to ship at all.

Keep scrolling for the latest LA venture rounds, fund news and acquisitions.

🤝 Venture Deals

LA Companies

- Accrual announced it has raised $75M in new funding led by General Catalyst, with participation from Go Global Ventures, Pruven Capital, Edward Jones Ventures, and a group of founders and industry executives. The company says the raise supports its official launch and continued buildout, alongside early partner firms, investors, and advisors. - learn more

- Morpheus Space secured a $15M strategic investment led by Alpine Space Ventures and the European Investment Fund, with continued support from existing investors, to fuel its next phase of growth. The company says it will use the capital to expand mass-production capacity and its team at its Dresden “Reloaded” facility, helping industrialize its GO-2 electric propulsion systems and meet rising demand from large satellite constellations. - learn more

- Machina Labs raised a $124M Series C to build its first large-scale “Intelligent Factory,” a U.S.-based production site aimed at rapidly manufacturing complex metal structures for defense, aerospace, and advanced mobility. The company says the funding, backed by investors including Woven Capital, Lockheed Martin Ventures, Balerion Space Ventures, and Strategic Development Fund, will help it scale its AI-and-robotics “software-defined” manufacturing approach from breakthrough tech into high-throughput production infrastructure. - learn more

- Midi Health raised a $100M Series D led by Goodwater Capital, with new investors Foresite Capital and Serena Ventures joining and existing backers including GV, Emerson Collective, and others returning, valuing the company at over $1B. The women’s telehealth provider says it will use the funding to scale beyond menopause care into a broader, AI-enabled women’s health platform, expanding access and using AI to personalize care and streamline clinical operations. - learn more

- Mitra EV raised $27M in financing, combining equity led by Ultra Capital with a credit facility from S2G Investments, to expand its “no upfront capital” fleet electrification model. The Los Angeles-based company says it will use the money to grow its shared charging network, roll out additional fleet solutions, and expand into new markets, positioning itself as a fully managed package that bundles EV leasing, overnight charging, and access to shared fast-charging hubs. - learn more

- Plug raised a $20M Series A to scale its EV-first marketplace, following $60M in used EV sales since launching in 2024. The round was led by Lightspeed with participation from Galvanize and existing investors including Autotech Ventures, Leap Forward Ventures, and Renn Global, as Plug positions itself as infrastructure for the coming wave of off-lease EV inventory with EV-native pricing, battery health insights, and faster dealer transactions. - learn more

- Breezy, a Los Angeles-based AI operating system for residential real estate professionals, raised an oversubscribed $10M pre-seed round led by Ribbit Capital, with participation from Fifth Wall, DST Global, Liquid 2 Ventures, O.G. Venture Partners, and others. The company says it will use the funding to strengthen its product and data platform, grow engineering and design, invest in security, and prepare for broader U.S. and international rollout. - learn more

LA Venture Funds

- Upfront Ventures participated in Daytona’s $24M Series A, a round led by FirstMark Capital with participation from Pace Capital and existing investors E2VC and Darkmode, plus strategic checks from Datadog and Figma Ventures. Daytona is building “composable computers” for AI agents, essentially programmatic, stateful sandboxes that can be spun up, paused, and snapshotted on demand so agents can safely run code and explore many paths in parallel at scale. - learn more

- Second Sight Ventures participated in Willie’s Remedy+’s $15M Series A, a round led by Left Lane Capital to fuel national retail expansion and continued product development for its hemp-derived THC beverages positioned as an alcohol alternative. The company says it has already sold 400,000+ bottles in under a year and claims the top spot for online THC beverage sales as it gears up for broader distribution in 2026. - learn more

- Navitas Capital led Cadastral’s $9.5M funding round, with participation from JLL Spark Global Ventures, AvalonBay, Equity Residential, and 1Sharpe. Cadastral says it will use the capital to accelerate product development and expand go-to-market for its vertical AI platform, positioning the product as an “AI analyst in a box” that automates core commercial real estate workflows like underwriting and due diligence. - learn more

- B Capital participated in Lunar Energy’s $232M raise, which the company disclosed as two rounds: a $102M Series D led by B Capital and Prelude Ventures, and a previously unannounced $130M Series C led by Activate Capital. The startup says it will use the capital to rapidly scale home-battery manufacturing and deployments, turning those distributed systems into a grid-supporting virtual power plant as electricity demand surges. - learn more

- B Capital participated in Goodfire’s $150M Series B at a $1.25B valuation, a round that also included investors like Juniper Ventures, DFJ Growth, Salesforce Ventures, Menlo Ventures, Lightspeed, South Park Commons, Wing, and Eric Schmidt. Goodfire says it will use the funding to scale its interpretability-driven “model design environment,” aimed at helping teams understand, debug, and deliberately shape how AI models behave in high-stakes settings. - learn more

- Helena participated in Positron AI’s oversubscribed $230M Series B at a post-money valuation above $1B, alongside strategic investors including Qatar Investment Authority and Arm. The round was co-led by ARENA Private Wealth, Jump Trading, and Unless, and the company says it will use the capital to scale energy-efficient AI inference now and accelerate its next-generation “Asimov” silicon roadmap. - learn more

- Smash Capital participated in ElevenLabs’ $500M Series D, which values the company at $11B as it scales its voice and conversational AI products for enterprise use. The round was led by Sequoia Capital with support from existing backers like Andreessen Horowitz and ICONIQ Capital, plus additional participation including Lightspeed Venture Partners. - learn more

- MTech Capital participated in Pasito’s $21M Series A, a round led by Insight Partners with additional participation from Y Combinator. Pasito says it’s building an AI-native workspace for group health, life, and retirement benefits that turns messy, unstructured plan and census data into a unified layer so carriers and brokers can automate workflows end-to-end, from quoting and enrollment to support and claims. - learn more

- Rebel Fund participated in Ruvo’s $4.6M seed round, led by 1confirmation with participation from Coinbase Ventures and others, as the Y Combinator-backed fintech expands its cross-border payments infrastructure between Brazil and the U.S. Ruvo says it operates like a U.S. dollar account for Brazilians, combining Pix, stablecoins, ACH/wire transfers, and a Visa card in one app to speed up remittances by reducing intermediaries. - learn more

- Rainfall Ventures participated in a seed funding round for Deft Robotics alongside Spring Camp, backing the company’s push to build AI-driven automation tools for manufacturers. The round amount wasn’t disclosed in the announcement, but the funding is positioned to help Deft scale product development and customer deployments in industrial settings. - learn more

- Trousdale Ventures participated in CesiumAstro’s Series C by leading the $270M equity portion of a $470M total growth-capital raise, alongside investors including Woven Capital, Janus Henderson Investors, and Airbus Ventures. CesiumAstro says the broader financing also includes $200M from Export-Import Bank of the United States and J.P. Morgan, and will fund a major U.S. scale-up including a new 270,000-square-foot HQ and expanded manufacturing to accelerate deployment of its software-defined, AI-enabled space communications platforms. - learn more

- Mucker Capital participated in Linq’s $20M Series A, which was led by TQ Ventures to help the company become infrastructure for AI assistants that run directly inside messaging apps. Linq’s platform lets developers and businesses deploy assistants through channels like iMessage, RCS, and SMS, and the company says the funding will go toward expanding the team, building a go-to-market motion, and continuing to develop the product. - learn more

- Sound Ventures participated in Day AI’s $20M Series A, which was led by Sequoia Capital with additional participation from Greenoaks, Conviction, and Permanent Capital. Day AI says the funding will help scale its AI-native CRM platform and support its move into general availability, positioning “CRMx” as a faster, context-driven alternative to legacy systems that turn simple questions into slow projects. - learn more

- Chaac Ventures participated in Arbor’s $6.3M seed round, which was led by 645 Ventures with additional backing from Next Play Ventures, Comma Capital, and angel investors. Arbor is building an AI interview and research platform that captures frontline employee and customer conversations and turns that qualitative “ground truth” into structured operational intelligence leaders can act on quickly, without slow surveys or pricey consultants. - learn more

- B Capital participated in When’s $10.2M Series A, a round co-led by ManchesterStory and 7wire, with new investor Mairs & Power Venture Capital and returning backers Enfield Capital Partners, TTV Capital, and Alumni Ventures. When says it helps employers and departing or transitioning employees navigate health coverage changes by steering people to more affordable alternatives to COBRA through an AI-powered marketplace and targeted reimbursements, with the new capital going toward team growth and expanding into more transition scenarios like Medicare eligibility and early retirements. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS