PopID Wants You to Ditch Your Cards and Pay With Your Face

Decerry Donato is a reporter at dot.LA. Prior to that, she was an editorial fellow at the company. Decerry received her bachelor's degree in literary journalism from the University of California, Irvine. She continues to write stories to inform the community about issues or events that take place in the L.A. area. On the weekends, she can be found hiking in the Angeles National forest or sifting through racks at your local thrift store.

Sign up for dot.LA’s daily newsletter for the latest news on Southern California’s tech, startup and venture capital scene.

There are few activities that necessitate a working phone more than live concerts and events: It’s how you show your tickets, pay for food and merchandise, coordinate with friends and post on social media. Once a battery dies, an attendee is out of luck (and Instagram stories).

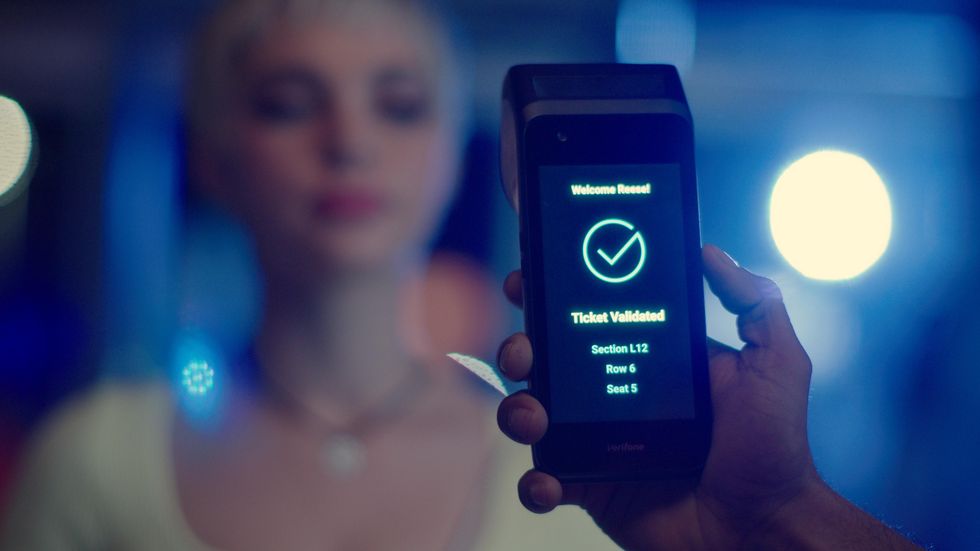

Enter PopID, a facial recognition software company that allows consumers to check in and pay with their face at partnered businesses. While it sounds high-tech, the service is as simple as signing up and uploading a selfie to PopID’s website. Once the user saves their payment information, PopID creates a “token” linking a user’s face to that payment method.

The Pasadena-based startup announced on Thursday that it has partnered with ASM Global, the Los Angeles-based venue and event management company, and Levy, a Chicago-based food-and-beverage retailer for venues, to install its PopPay pay-by-face technology and PopEntry authentication software at venues around the world.

Founded in 2016, the concept for PopID was born, as many great ideas are, in line for a Taylor Swift concert. Founder and CEO John Miller was waiting in line outside the venue with his daughter when a low phone battery threatened their night out.

“I was scared to death that my phone was going to die by the time we got to the front of the line, and I wasn't going to be able to pull up the QR code in the ticketing app,” Miller told dot.LA. “And then we weren't going to get in, and boy, was she going to be mad at me.”

PopPay is already in use at mom-and-pop restaurants such as Daddy’s Chicken Shack in Pasadena, Fair Oaks Burger in Altadena and California-based restaurant chain Lemonade. The first ASM venue that will implement the technology is Pechanga Arena in San Diego beginning this summer—though the venue operator has plans to launch it at facilities as far-reaching as Dubai’s Coca-Cola Arena.

PopID’s focus this year is to distribute its proprietary platform through national restaurant and fast food chains and also expand internationally. The startup has found traction on college campuses; it currently has 85,000 registered users across campuses including USC, UC Santa Barbara, Pasadena City College and San Diego State.

The company has also partnered with Japanese electronics manufacturer Panasonic, which provides the hardware for self-ordering kiosks that allow customers to walk up to a PopID device, scan their face and pay on the spot.

“The best way to prove out a face-pay platform, where you can register once and use it everywhere you go, would be to focus on creating dense networks,” Miller said. “In college communities, we can get lots of students enrolled because they love the idea of taking a picture of themselves to pay, because they've grown up doing TikTok and Snapchat and things like that.”

Facial recognition software can be a controversial topic. Clifford Neuman, director of USC’s Center for Computer Systems Security, said PopID’s technology raises potential issues because “a lot of the things we hear about facial recognition, from the privacy perspective, have a lot to do with all these video cameras we've got everywhere, and identifying individuals that haven't been specifically enrolled into the system.”

“You're going to have what we call false positives,” Neuman added. “That is, identifications that are incorrect. The danger of a false positive is that your accounts are going to get charged when it wasn't you that made the purchase.”

Miller does not share that concern. “We’ve made such a huge investment in our security infrastructure that I feel like we can sell this platform to the FBI,” he said. “We've hired some of the best security engineers in California to make sure the payment system is impenetrable.”

That may not do a lot to soothe concerns for privacy advocates—but for Swifties? Huge news.

Decerry Donato is a reporter at dot.LA. Prior to that, she was an editorial fellow at the company. Decerry received her bachelor's degree in literary journalism from the University of California, Irvine. She continues to write stories to inform the community about issues or events that take place in the L.A. area. On the weekends, she can be found hiking in the Angeles National forest or sifting through racks at your local thrift store.

Image Source: Revel

Image Source: Revel