dot.La kicked off its inaugural in-person summit on Oct. 28-29 at the Fairmont Miramar hotel in Santa Monica. This year's summit features over 45 speakers covering cryptocurrency, telehealth, urban mobility and women in tech, among others. You can find a full schedule of this year's summit here and read the recap below!

Updates:

- As Attitudes Shift Around Drugs and Mental Health, 'It's Time' for Psychedelic Therapies

- The Concerts of the Future Will Be Hybrid, Says Wave Co-Founder

- What to Expect When Breaking Into Tech Startups

- LA's 'Moonshot' Moment

- Metropolis' Plan for Changing Urban Mobility

- How to Bring More Women into LA's Tech Scene

- How Telehealth Has Changed the Game -- for Most

- Beyond Lip Service on DEI

- Pixar-Level Storytelling on Social Media

- How the Pandemic Transformed Entertainment Tech

- What It Takes to Transition From Founder to CEO

- The Challenge of Finding Male Allies in Tech Circles

- Crypto and Creativity: How Blockchain is Affecting Entertainment

- Dapper's Virtual Influencer Lil' Miquela Will Soon Be Run By Her Community

- LA Investors on Bouncing Back from the Pandemic

- Everlaunch Wins dot.LA's Startup Pitch Competition

- Jam City's Vision for Blockchain Gaming

- What to Expect at This Year's In-Person Summit

dot.LA Summit: As Attitudes Shift Around Drugs and Mental Health, ‘It’s Time’ for Psychedelic Therapies

Keerthi Vedantam

Keerthi VedantamFifty years after President Nixon announced the war on drugs, changing cultural attitudes around psychedelics have led to a slew of decriminalization and legalization efforts across the U.S. The Food and Drug Administration is now reviewing psychedelic-based drug, a sea change from just a few years ago.

Mike Dow from Field Trip Health, one of the many companies testing psychedelic-based drugs, and cannabis company Kurvana CEO Mehran Moghaddam believe that this shift will change the course of mental health treatment as the drugs become more accepted for medicinal use.

Canada-based Field Trip Health has clinics around the world, including Santa Monica, where therapists perform ketamine-assisted psychotherapy. Ketamine, once known as a rave drug, has long been studied for its correlation with positive mental health outcomes in patients who use it. Read more >>

dot.LA Summit: The Concerts of the Future Will Be Hybrid, Says Wave Co-Founder

Joshua Letona

Joshua LetonaAs the pandemic shut down, cancelled and delayed events people had been looking forward to, Wave co-founder and CEO Adam Arrigo saw an opportunity.

His company was founded in 2016 at a time when brands like Oculus and PlayStation were looking to bring virtual reality into the mainstream. Not knowing how ready people would be, Arrigo and his team were conservative with the company's money.

"We basically didn't spend any money because we weren't sure how quickly people were going to strap these things to their heads… And we were kind of right because VR sort of petered out," said Arrigo. Read more >>

dot.LA Summit: What to Expect When Breaking Into Tech Startups

Decerry Donato

Decerry DonatoThere is no one secret to breaking into the tech industry, but one thing helps, a strong support system of colleagues and believing in yourself.

A group of powerhouse tech veterans talked about the roadblocks faced when starting out. Grace Kangdani, senior vice president market manager at Bank of America moderated a discussion on the pitfalls of coming up in a fast-paced industry. BallerTV Chief Technology Officer Kavodel Ohiomoba, Zella Life CEO Remy Meraz and Supernatural's Vice President of People Operations Lynnette Scarratt and Elisabeth Tuttass, head of community at Grid110 all agreed that there's no one path to success.

Finding success is oftentimes a matter of seeking out the right people to help you.

"At the end of the day people are genuinely wanting to help people," said Meraz who runs the life coaching platform. "And I guarantee you within two degrees of separation, there's a connection and people are really willing to make introductions and help in any way they can."

It's not uncommon for even accomplished people to feel as if they aren't competent. Read more >>

Once a Moonshot, Los Angeles' Venture Scene is Bigger Than Ever

Los Angeles has long taken a back seat to San Francisco when it comes to investing in and incubating local companies, but in recent years the venture capital scene in Silicon Beach has exploded.

Greycroft Partners co-founder and partner Dana Settle told dot.LA co-founder Spencer Rascoff during the second annual dot.LA summit Friday that when she started Greycroft 15 years ago, her fellow investors in Northern California balked at her choice to leave the Bay Area and start investing in what was then a seldom talked-about market: Los Angeles. But since then, Settle's happily proved the haters wrong.

Settle told Rascoff that being an early investor in LA technology wasn't easy, and that over the years she also struggled to raise funding for Greycroft at first, which informs how she advises new companies.

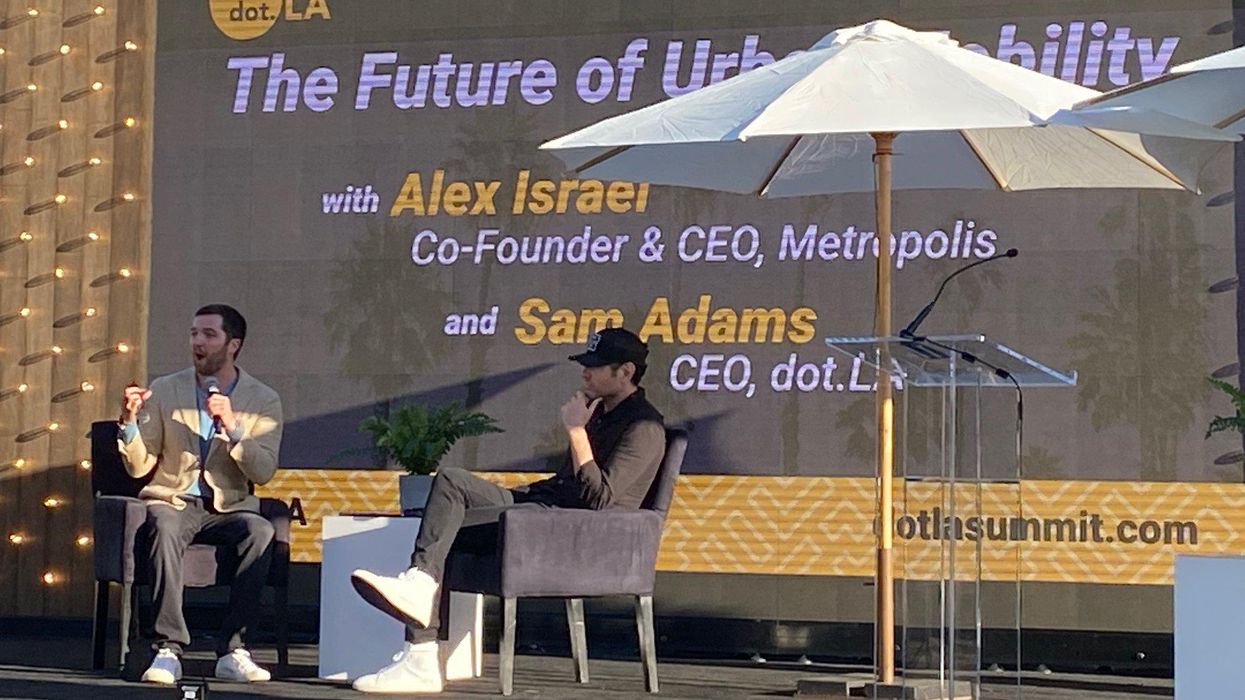

Solving LA's Big Problem: How Metropolis Wants to Change Mobility

Metropolis co-founder Alex Israel has a grand plan to fix L.A.'s infrastructure. It just won't happen overnight.

Speaking to dot.LA co-founder Sam Adams during the "The Future of Urban Mobility" session out closed out dot.LA's summit, Israel described his vision of a complete repurposing of parking spaces and mobility that looks ahead at least 30 years into the future. Electric cars fit into this vision; rideshare companies do, too.

"Parking is the wild, wild west of real estate," said Israel. "It's a component of real estate that represents a large swath of the city that is non-institutionalized."

The startup raised $41 million in Series A financing earlier this year. It has parking garages throughout the U.S., in cities that include Los Angeles and Nashville.

Israel laid out three components that are at the core of Metropolis' work in understanding how to improve and empower the future they hope to create. The first is to understand the inventory of the facility in real time. The second is to have the ability to provision access to that facility in real time. Finally, one must be able to price inventory in real time.

"You have to understand the underlying infrastructure before you can repurpose the infrastructure," said Israel.

In a city as car-dependent as L.A., Israel will certainly have a lot of people rooting for his company's success.

"Getting around L.A. is one of the biggest obstacles to [Los Angeles] being, objectively, one of the nicest places on Earth to be," said Adams.

dot.LA Summit: Women at the Top on How to Expand LA's Tech Scene

As women in tech and venture, Kara Nortman and Robyn Ward heard a lot of nos when they started out. No we won't fund you. No, we don't have positions.

But, it was the yeses that kept them going.

"We have to expand the tent, we have to figure out how to continue. The tent needs to get bigger every day. If every one of us every day can find one more woman to bring into this tent, in some way it gets bigger and bigger," Nortman said.

dot.LA Summit: Telehealth Changed the Game for Health Care -- for Most

Even before the coronavirus pandemic, telehealth had been lauded as a great equalizer in the health care world.

The benefits were clear: It could help patients avoid travelling long distances and allow those with dependents to seek help without looking for childcare. And for poor neighborhoods and rural areas, where health care options are few and far between, telehealth could send specialists straight to their doors.

Those advantages have only become obvious during the pandemic, as executives from Honeybee Health, Advekit and Kenshō Health explained during dot.LA's panel "Telehealth: The New Way To Stay Healthy." The conversation was moderated by dot.LA's Rachel Uranga.

Going Beyond Lip Service

Pledges to boost diversity and inclusion are widespread in the tech and startup world, but the industry chronically fails to realize its own goals.

That's no coincidence. The venture capital world, which provides much of the capital fueling fledgling startups, remains a boys club with a bias towards white male founders. And that bias has a ripple effect, warping industry hiring practices and decision making. The problem is repelling workers, too, as post-lockdown resignations skyrocket and companies weigh new policies, such as remote work and hybrid schedules, to retain staffers.

"It's about being able to show up at work as your full self, said Ricardo Vazquez, executive officer at the mayor's Office of Economic Development, in a dot.LA Summit panel on building diversity and inclusion within startups and larger firms.

Pixar-Level Storytelling on Social Media

In just a few weeks, social media users can meet Jennifer Aniston's brand new 3D animated character—and though the avatar is mostly under wraps, word on the street is that it's "very cute." That character comes thanks to a partnership with Invisible Universe, an entertainment technology company partnering with celebrities to capitalize on their unique IP.

In a conversation with Rachel Horning (CEO of RippleFX Events), Invisible Universe CEO Tricia Biggio described the company as the "Pixar of the internet." The company creates beloved, celebrity-sponsored animated characters who live on social media and interact with fans.

Biggio, who started in television, is passionate about bringing Hollywood quality storytelling and worldbuilding to social media characters:

"We really think about being platform agnostic and story and character obsessed," she said. Pandemic isolation and scrolling was a boon for the company, with ten times the rate of growth on TikTok versus YouTube, Instagram and others.

How the Pandemic Changed Entertainment Tech Forever

Like so many other industries, the world of entertainment went through some radical shifts during the pandemic. And, for the speakers at dot.LA's "The Evolution of the Digital Landscape in Shaping the Entertainment & Tech World" panel, that wasn't always a bad thing.

Take the music sector, for example. When the pandemic put a pause on live concerts—leaving musicians, promoters and stage crews without a main source of income—industry players pivoted to streaming.

"We found other ways to get our clients into people's homes, whether it was through a digital series or just releasing music in a more unconventional manner," said Allison Kaye, president of SB Projects. "Our clients really turned into content creators in a way that they hadn't been before."

"The need for kids content, especially digital-first, escalated tremendously as kids were stuck at home with nothing else to do except hang out on YouTube," added Kerry Tucker, chief marketing and franchise officer at pocket.watch, which works with kid stars/influencers on YouTube. "We actually saw a rise in our constant consumption, and then we also saw a rise in our consumer products."

Many artists, however, needed a helping hand when dabbling into the new digital space. That's where a company like Wave enters the picture. Wave is at the forefront of virtual entertainment, helping artists create virtual—and interactive—performances to livestream to viewers all over the world. "We are in this really cool, exciting space and everyone wants to get in on the action," said Tina Rubin, CMO at Wave. "In terms of the artists we work with, the way I think about it is virtual concept art. It's still evolving. We're still trying to figure out what is the art form and how does it encapsulate various types of performances?"

Technology can also help to strengthen traditional models such as the sale and purchase of a concert ticket. There are many issues that fans and promoters face when purchasing or selling a ticket. Scalpers use bots to scoop up tickets en masse and resell them on a secondary market. There's also the risk that a fan will purchase a fake ticket from a scammer. Tech such as blockchain and crypto can help with these challenges.

"Blockchain technology, crypto technology, can solve that," said Brent Weinstein, chief innovation officer & partner at United Talent Agency. "That's really, really exciting because that is a chance to completely change the nature of how people buy tickets to live events [and] how they relate to artists. That's a real life problem that people have been trying to solve for a long time and I finally have some hope that can be solved."

What It Takes to Transition From Founder to CEO

A good founder will have a clear yet flexible vision. The same might be said of a good CEO. Still, there are plenty of differences between the two titles, as the speakers at dot.LA's "From Founder to CEO" discussion made clear.

"To be an entrepreneur you are the tip of the spear," said Boba Guys and Tea People USA founder and CEO Andrew Chau. "You want to be apologetic, you want to be authentic."

Chau chatted with KraveBeauty founder and CEO Liah Yoo about starting their businesses from the ground up. He said that as the company grew, he became much more than "a guy who owns a boba shop"; Yoo said she, too, morphed into something beyond a YouTube influencer.

"I call myself an accidental entrepreneur because I now have a skin care brand. Nowhere in my life did I ever think that I would be starting a company and second running a company," Yoo said.

One might assume a business' creator would spearhead its strategies, but that's often not the case. In fact, in a World Management Survey that looked at 212 startups over a 20-year period, only 50% of founders were still in control of their companies.

For Chau, the key lies in embracing both the micro- and macro-level problems. He said that though he has successfully transitioned into CEO, he sometimes can't help but treat his business like a grassroots operation, picking up trash he finds in front of his Boba Guys storefront in Culver City. Yet he's also often talking business strategies with other entrepreneurs over Zoom.

For Yoo, becoming a CEO was also an exercise in self-acceptance. "You keep comparing yourself to another CEO," she said. "I think the more I did that and then when we got started, I started to trick myself into this vicious cycle of 'I'm not good enough.'"

The Challenge of Finding Male Allies in Tech Circles

Women-led startups made up just 2.3% of venture capital funding in 2020. In addition, only about 12.4% of decision makers at venture capital firms are women. Though these numbers have increased throughout the years, the industry is still very much a boys' club, and, as the women at dot.LA's "Elevating Your Presence as a Woman in Tech" panel discussed, it can be tough to break through the glass ceiling.

"We are talking into an echo chamber about our problems, so it is also going to require a man to help us change that," said Samantha Ettus, founder and CEO of Park Place Payments.

Ettus was joined by founder and CEO of Makelene, Dulma Altan; co-founder and CEO of Vurbl Media, Audra Gold; and Head of Community at How Women Invest, Sophie Nazerian. Their discussion was centered around how they have managed to navigate leadership and microaggressions from co-workers, all while climbing the corporate ladder as an anomaly in the tech world.

Ettus discussed how she has experienced microaggressions firsthand; she remembered being on a conference call with a bank executive when he mentioned he brought a guest: his daughter. Ettus thought it was sweet until he mentioned he wouldn't have put her on the screen if it were a male CEO because he would not want to be seen as less professional. Ettus reminded him he has the power to change that.

"It's always on our shoulders to speak up or to wrong the right or to have this panel where 90% of the attendees are women," she said.

The panelists also talked about the importance of finding a good work/life balance — something that doesn't always come naturally. "The biggest thing I'm proud of, I've learned that not everything is actually on fire," said Altan. "My ability to discern what actually is from what isn't has increased, and my mental health has stabilized."

dot.LA Summit: How Crypto Is Changing the Creative Industries

NFTs aren't just remaking investments but they are changing how entertainment is being produced and distributed.

Non fungible tokens were the focus of the panel with Scott Greenberg, CEO of Blockchain Creative Labs; Andrew Klungness, Partner at Fenwick & West LLP; and Michelle Munson, CEO of Eluvio.

"When you own an NFT, you actually own what we call a convertible electronic record on the blockchain. You own a space in a ledger," said Klungness. As an example, it's the difference between owning the record versus owning the commercial rights to the property, like owning a baseball card doesn't give you the right to use that image commercially.

Virtual Influencer Lil' Miquela Will Soon Be Run By Her Community

Dapper Labs, the company that helped bring NFTs into the mainstream, is set on decentralization. And it's turning to its signature virtual social media influencer Lil Miquela to drive home the idea, company executives told a crowd at Friday's Future of Storytelling panel at the dot.LA Summit.

The NFT startup behind NBA Top Shot, Dapper Labs clearly sees the value of virtual influencers. Brands are expected to spend about $15 billion on influencer marketing by 2022, according to Business Insider Intelligence. And the company is betting that a rising number of dollars will be spent on virtual influencers who can be fully controlled.

LA Investors on Tech Resilience and the Future of Work

Plenty of tech firms laid off workers as the pandemic took hold, but the industry ultimately raked in record profits as schools and offices spent big on remote tools and lockdowns drove shoppers toward digital services.

But there are challenges ahead for the startup community, like adapting to workers' evolving needs and expectations and building climate change mitigation into investment strategies.

Those were some of the takeaways from dot.LA's Town Hall panel on "rising from the COVID-19 ashes as a thriving startup ecosystem," which also explored how the virus is reshaping work. The talk was moderated by dot.LA CEO Sam Adams and featured Barber, RippleFX Events CEO Rachel Horning, Grid110 CEO Miki Reynolds, M13 partner Anna Barber and Leila Lee, of the mayor's Office of Economic Development.

Everlaunch Wins dot.LA's Startup Pitch Competition

A startup that offers gamified how-to guides for aspiring entrepreneurs was declared the winner of the second annual dot.LA pitch competition on Thursday in Santa Monica.

"My mission is to 'Pinky and the Brain' all of the currently available resources," said Everlaunch CEO Michelle Heng, referring to a cartoon where the main character was obsessed with taking over the world. Heng's service sets out to build a community for entrepreneurs and bring together essential business resources in a single hub.

Jam City's Josh Yguado on How the Blockchain WIll Change Gaming

At dot.LA's second annual summit, mobile game publisher Jam City's Chief Operating Officer Josh Yguado said he believes the next generation of mobile gaming will enable users to own parts of their favorite games on the blockchain.

"More than anything we're investing in where gaming is going, so we're making huge investments right now in augmented reality and cryptocurrency," Yguado said during the summit's fireside chat Thursday evening. "We've talked about the metaverse a bit today, but we're really thinking about where gaming is going to be two to three years from now."

What to Expect at This Year's In-Person Summit

The Annual dot.LA Summit Kicks Off in Santa Monica

The Annual dot.LA Summit Kicks Off in Santa MonicaThe two-day conference will begin with a pitch showcase competition for early-stage startup companies that have raised less than $1 million in funding. Judges for the event include Boba Guys and Tea People USA co-founder and CEO Andrew Chau, Worklife Venture Capital founder Brianne Kimmel and Plug and Play Ventures Associate Kiswana Browne. The winner will receive a prize package from Fenwick, Coda Search and TriNet.

The pitch competition will be followed by a fireside chat and podcast taping with Jam City co-founder & President Josh Yguado. Jam City isa leader in mobile entertainment and Yguado has proven himself a mastermind behind it, leading the company's operations, growth strategies and game portfolio.

While this event will be in person, the panels will be covered by dot.LA and those interested are still able to register for the conference here. Last year, the event drew over 500 guests virtually. This year's summit expects over 300 in-person guests. There is no livestream this year.

On Friday, the activities will begin at 9 a.m. An L.A. tech and startup town hall will focus on the tech and startup landscape as the effects of COVID-19 retreat. There will also be panels on the future of cryptocurrency and storytelling at this hour.

The afternoon's speakers will include United Talent Agency Chief Innovation Officer Brent Weinstein, BallerTV Chief Technology Officer Kavodel "Kav" Ohiomoba, KraveBeauty founder & CEO Liah Yoo, Makelane founder and CEO Dulma Altan and many other CEOs, technologists, founders and innovators.

Join us here and on Twitter and Instagram for updates from the summit. And let us know your thoughts using the hashtag #DOTLASUMMIT.

- The dot.LA Summit Focuses on L.A.'s Growing Startup Scene - dot.LA ›

- dot.LA's First 'Intersect' Entertainment Tech Summit - dot.LA ›

- Jam City's Josh Yguado's Predictions for Gaming's Future - dot.LA ›

- Invisible Universe Inspires Serena Williams' First Book - dot.LA ›

- Metropolis Lands $167M, Alpha Edison Seeks $340M for Fund - dot.LA ›

- A New Metaverse Platform Arrives To Help Fans Support Virtual Influencers - dot.LA ›

Image Source: Skyryse

Image Source: Skyryse