On this episode of Office Hours, host Spencer Rascoff talked with ZipRecruiter CEO and founder Ian Siegel about how he built his company, the lessons he's learned along the way and how he's seen the pandemic drastically reshape the job market—probably for good.

Siegel moved to L.A. to be a writer in Hollywood. But he quickly realized he hated it. Instead, he moved into the fledgling online division at Warner Bros., From there, he found himself working at a series of VC-backed startups that became successful. As a result, he became known in the industry as an expert in taking online businesses that had plateaued and figuring out a way to help them grow. He said he hated every minute of it.

“What you are in that situation is you're an agent of change. And what I learned is you can be good at that, but no one likes you because everybody fears change.”

Instead, Siegel worked up the courage to start his own business.

“Why do I let people pay me such a small amount of money to turn around these businesses?,” he asked himself. “If I'm so good at this, why don't I just start my own and build it right from the very beginning. And that's what ultimately gave me the conviction to go launch ZipRecruiter.”

His time working at young startups too small to have their own HR departments gave Siegel the idea. After posting the same job position across multiple websites and printing out every single resume submitted, he realized he was facing a problem technology is built to solve.

“I just wanted a magic button that I could push. And it would send a job to all job boards at once, and then all the candidates from all those different sites would go into one easy to review list. That's exactly what we built with the first version of ZipRecruiter,” said Siegel.

Over time, ZipRecruiter’s mission has changed, he said, from a company aimed at solving a single pain point to a company trying to reinvent how the labor market functions. That, he added, is orders of magnitude more difficult, because “you are retraining America or potentially the world on a new way to do something.”

“And now you are knife fighting in the jungle, you are trailblazing,” he added. “I don't worry about how anybody in the current ecosystem operates. I'm truly fundamentally trying to change the labor market in the United States right now.”

Siegel said he’s seen the job market drastically change over the past couple years, as the pandemic accelerated the move to remote work and hybrid and remote positions surged. Fewer than 2% of jobs on ZipRecruiter had the words “remote” in them before COVID-19 stuck. Now, 60% of applicants say they’re seeking remote or hybrid work, and 12% of the jobs listed on the site offer a remote option—and that number is growing.

That reality has changed how he runs his own business.

“What I've done at ZipRecruiter is accept change,” Siegel said. “We are fully embracing remote. I believe remote is not only here to stay, it's a huge benefit.”

That, he says, is because employees and employers both save time on driving and grooming. They save money on gas and parking. The office, he added, will still have a purpose, but it will probably be more for building culture, and less for work.

"It'll be a much smaller space entirely designed around fun," he said. "No one will ever go in there every day purely for the purpose of doing their job, probably ever again."

One of the lessons Siegel said he’s learned as a serial entrepreneur is to make sure the work you pick is meaningful to you.

“It turns out every business takes the same amount of time, which is all your time,” he said. “So be thoughtful about how you spend it. Pick work that's meaningful for you. Pick work that has scale opportunity to it and that you're going to be excited to go into every day.”

Want to hear more episodes? Subscribe to Office Hours on Stitcher, Apple Podcasts, Spotify, iHeart Radio or wherever you get your podcasts.

dot.LA Engagement Fellow Joshua Letona contributed to this post.

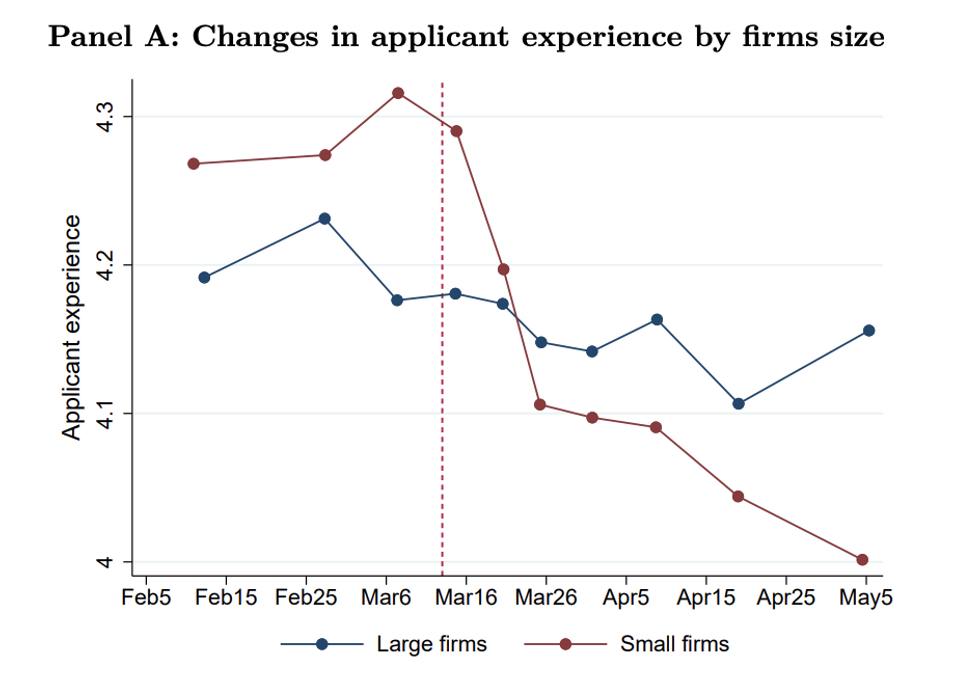

Panel A (Panel B) shows within-firm changes in the average experience (quality score) of job applicants from February to May 2020. Data from AngelList Talent

Panel A (Panel B) shows within-firm changes in the average experience (quality score) of job applicants from February to May 2020. Data from AngelList Talent