Despite Better Unemployment Numbers, Job Sites See 'an Early Tsunami Warning' in Hiring Data

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake

- Although Friday's U.S. jobs data show continued declines in unemployment, many economists, such as from ZipRecruiter and LinkedIn, are concerned at the data they're seeing.

- One of them called the decline in employers' job postings on ZipRecruiter "an early tsunami warning" and a "pull-the-ripcord emergency moment."

- Several factors suggest pessimism from businesses about the near future, including the recent dry-up of government stimulus alongside ongoing operating constraints due to the pandemic.

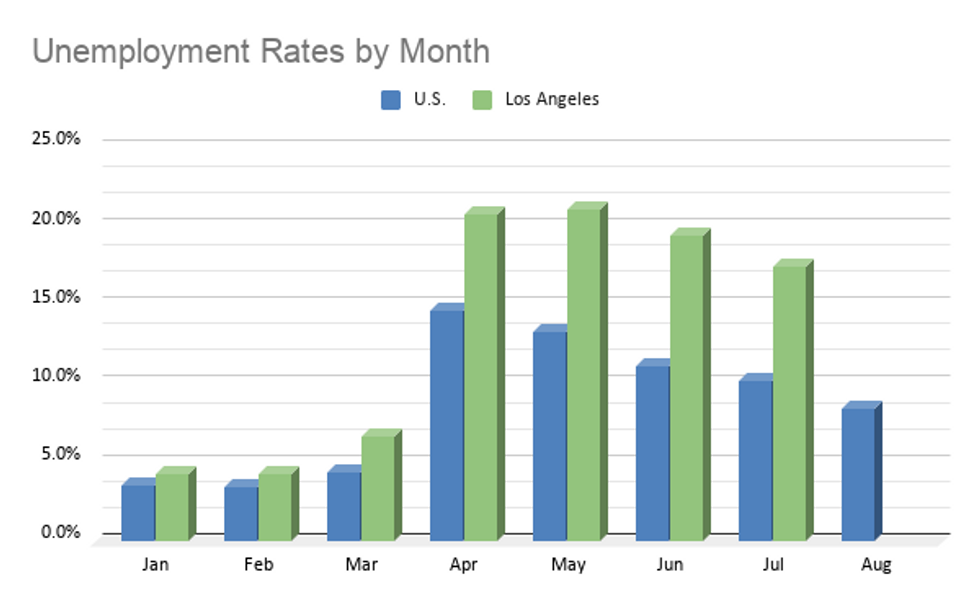

Friday's jobs report showed the U.S. unemployment figures continuing their decline to 8.4% in August, from a high of 14.7% in April.

Despite that welcome news, more recent data from L.A.-based ZipRecruiter contains unsettling signs for the future. After 10 weeks of rising activity from employers, job postings have reverted to a downward trend since mid-August.

"This is an early tsunami warning," ZipRecruiter labor economist Julia Pollak told dot.LA. "It could be the start of exactly the sort of systemic breakdown the government was trying to avoid in the beginning [of the pandemic]."

Unemployment rates don't tell a full story about where the economy is headed, Pollak said. It's a reminder that she wants people in power to heed.

"I think Congress should see this as an emergency sign," she said, noting that job postings on ZipRecruiter tend to be an early indicator of job growth – or decline.

The job picture in California and Los Angeles is similar to that of the country at large, according to ZipRecruiter's data. Los Angeles has one of the highest rates of unemployment among large metro areas.

LinkedIn, another job board, found hiring was 16.2% lower this August than last year.

It's not surprising to Jerry Nickelsburg, an economist at the UCLA Anderson School of Management. He worries it will exacerbate inequality in Los Angeles, as industries being hit hardest tend to skew toward lower-income sectors, like logistics and tourism.

Nickelsburg said the federal unemployment data paints it a murky picture. The regulatory changes in recent months that led to a number of re-openings "mask what's going on underneath" at the economic level, he said. "We have less visibility than we normally have," Nickelsburg added. Assuming a continuation of the start-and-stop pace of opening up and the regulatory response, he foresees a "soft labor market in spite of the strong jobs report," noting that the job growth in today's data is fueled in part by temporary positions associated with the U.S. Census.

LinkedIn's principal economist Guy Berger also reported this week that hiring observed on LinkedIn (measured by the share of members adding a new employer to their profiles) fell from July to August. "Our takeaway is that this month's data shows that the virus has created a 'ceiling' on just how much the economy can return to normal," he said. "Given how much higher COVID transmission is here in the U.S. vs. aboard, the ceiling might be lower here."

"My real fear is what will happen in September," Pollak said. "I look at a downturn in job postings as a break-the-glass, pull-the-ripcord emergency moment."

Pollak said her alarm follows weeks of optimism. More companies had been signing up for ZipRecruiter's services. Every single industry and every single state had seen job postings increase in July and August, she said. But now, those trends have stopped, and a number of factors appear to be turning that summer of hope into a fall reckoning:

Ongoing Uncertainty: Without clarity on the pandemic and the government's policy to stop it, businesses remain inclined to do what they usually do in the face of uncertainty: sit and wait. Berger, the LinkedIn economist, said this is due at least in part to a "less centralized U.S. response" to the pandemic and that the uncertainty is holding businesses back from long-term investing and hiring.

Reduced Economic Activity: Anticipated closures of spectator sports, performing arts, colleges and ski resorts will hurt not just the businesses in those industries, but also adjacent ones like bars and restaurants. This expected dampening follows a quiet summer, which is normally the banner season for many such businesses. "Summer profit margins weren't large enough to sustain many businesses," Pollak said. Facing a future with fewer customers, "many will have to close in the fall."

Government Stimulus Is Drying Up: The $350 billion payment protection program loans designed to help employers pay their workers during the shutdowns ceased on August 8th. $600 weekly unemployment checks expired in July, causing a $60 billion reduction in unemployment payouts in August. "That is almost certainly reducing consumer spending right now," Pollak said, pointing to a survey ZipRecruiter conducted this summer that found over 40% of respondents would be unable to pay their rent if unemployment payments shrunk. Congressional talks on renewing a stimulus program have been gridlocked.

Schools Aren't Opening: Berger called virtual classes and delayed school re-openings "a severe challenge for households where all parents work." That's behind his topline takeaway that, in addition to a vaccine, his data point to a "need to get money back in the hands of Americans who need it and a childcare solution for the interim."

Consumer Confidence Is Down: Conference Board, a think tank, released data this week that consumer confidence has fallen two months in a row. "If confidence goes down, we can expect spending to go down," Pollak said – both among those who have no choice and those on the fence about, say, buying a house or a new car.

Pollak added that since neither the stock market nor housing values have crashed, her data point to widespread "concern about COVID, the future course of policy, and the ability for businesses to reopen and be sustainable given reduced sales and rules limiting their capacity."

Over the coming months she and others will be closely watching for the speed at which jobs are able to return to their pre-COVID baseline, and other indicators of a dynamic labor market. These include participation rates among prime-age workers and women, wage growth and long-term unemployment. But as long as the pandemic lingers, those indicators may be tepid.

"We can't fully bounce back until there is more certainty around the virus," Berger said.

- California's Rebound Will Be Like a 'Nike Swoosh' - dot.LA ›

- UCLA sees the US economy dropping further amid COVID-19 - dot.LA ›

- ZipRecruiter Lays Off 39% of Staff - dot.LA ›

- Could Coronavirus Push the U.S. Economy Into a Recession? ›

- Fewer Job Searchers Are Looking to Work at Startups - dot.LA ›

- Top Talent is Scrambling for Shelter - dot.LA ›

Sam primarily covers entertainment and media for dot.LA. Previously he was Marjorie Deane Fellow at The Economist, where he wrote for the business and finance sections of the print edition. He has also worked at the XPRIZE Foundation, U.S. Government Accountability Office, KCRW, and MLB Advanced Media (now Disney Streaming Services). He holds an MBA from UCLA Anderson, an MPP from UCLA Luskin and a BA in History from University of Michigan. Email him at samblake@dot.LA and find him on Twitter @hisamblake