Rivian CEO RJ Scaringe took to Instagram last weekend to answer questions from the public about his company and its future. Topics covered included new colors, sustainability, production ramp, new products and features. Speaking of which, viewers also got a first look at the company’s much-anticipated R2 platform, albeit made of clay and covered by a sheet, but hey, that’s…something. If you don’t want to watch the whole 33 minute video, which is now also on Youtube, we’ve got the highlights for you.

Production Ramp

Scaringe calls production ramp the most important part of Rivian’s business at the moment. To anyone who’s been following the company closely this likely won’t come as much of a surprise. “Production ramp drives so much of the business. It’s core to our path to profitability, it’s core to our customers who are waiting for their vehicles. It also allows us to get the whole organization humming, the supply chain, our production plant, our teams,” says Scaringe. “You’re going to see quarter over quarter more production units coming out, along with that the business really start to achieve its clear path to profitability.”

Vertical Integration Enables Upgrades

At several points during the interview, Scaringe mentions vertical integration or explains how having control over the electronics and the entire tech stack will allow the company to improve and iterate on its vehicles even after they’ve been sold. This has always been a core philosophy for Rivian, and while the advantages of controlling everything in-house are easy to understand in the long run, it’s also incredibly expensive in the short term compared to outsourcing aspects of production or buying off-the-shelf parts.

On the subject of upgrades, Scaringe says Rivian owners can expect to see improvements in their vehicles’ mapping software. There’s also an augmented reality feature coming that will allow drivers to place a virtual camera anywhere around their car in 3D space, which allows them to watch themselves drive on the main display, which theoretically could help with parking or other tight manuevers? The rear screen for the passengers in the back is also getting a slew of upgrades.

Adventure Network

Like Tesla, Rivian is building its own fast charging network. That’s still happening, and Scaringe confirmed again that it will be an open network, available to non-Rivian EVs, too. Rollout will happen first in the United States, but the goal is to eventually deploy chargers all over the globe.

New Drive Units in addition to Enduro motor

Rivian has long promised a second, less expensive drivetrain configuration called the Enduro motor, which would be developed entirely in-house and will use a dual-motor configuration rather than the super high performance quad motor configuration supplied by Bosch that is currently on offer. Deliveries with the dual motor configuration could start as early as next month. There’s also another drive unit coming somewhere down the line that’s still unannounced, but Scaringe calls it a “really high performance drive unit.” Based on Rivian’s predilection for vertical integration, a smart bet might be that it’s their own in-house quad motor, but that’s merely speculation at this point.

Max Pack and Bidirectional Charging

Rivian’s gargantuan extended range battery pack option is also still coming. Scaringe says he expects it sometime this summer and it will be available first on the dual motor configurations. Scaringe also confirmed that the company is working on a bidirectional charger that would allow customers to use their Rivian to send electrons out, either to the grid or into their house or wherever else. Bidirectional charging holds a lot of potential value, both for vehicle owners and the grid at large, but isn’t possible without specific hardware. With the enormous size (130 kWh+) of some of these vehicles’ batteries, bidirectional charging could be a real selling point for the company.

R2

Nothing new on Rivian’s next generation of vehicles, which are purportedly going to be significantly cheaper and designed for much larger volumes.No update from Scaringe on the timetable either, so we’ll assume it’s still pegged to 2026. Here’s the best shot of the R2 we’ve seen so far.

- Rivian's Roadmap Includes Price Bumps and Tech Pivots ›

- Will Rivian Survive Long Enough to Launch Its Next Model? ›

- Electric Vehicle Industry Heading Toward Major Battery Shortage, Rivian CEO Says ›

- Rivian Q2 Earnings Are a Much-Needed Nothing Burger ›

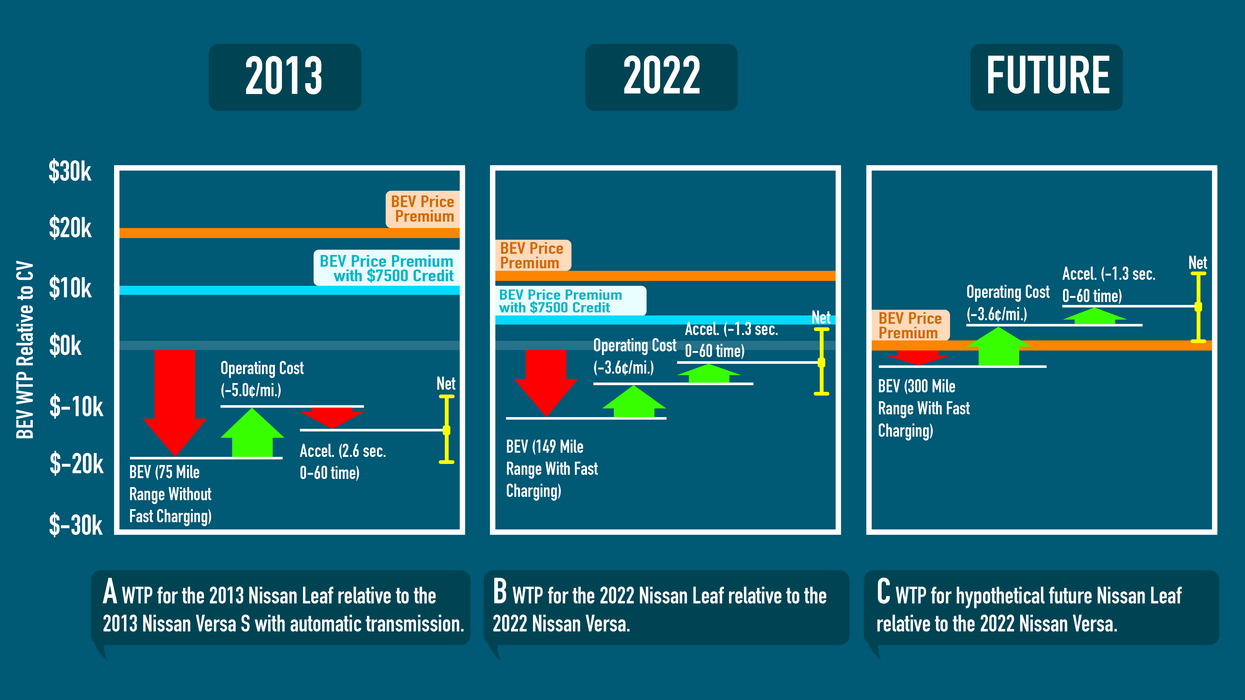

Willingness-to-purchase (WTP) for attributes for Nissan Leaf relative to Nissan Versa

Willingness-to-purchase (WTP) for attributes for Nissan Leaf relative to Nissan Versa