Get in the KNOW

on LA Startups & Tech

X

Shutterstock

Venture Deals in LA Are Slowing Down, And Other Takeaways From Our Quarterly VC Survey

Keerthi Vedantam

Keerthi Vedantam is a bioscience reporter at dot.LA. She cut her teeth covering everything from cloud computing to 5G in San Francisco and Seattle. Before she covered tech, Keerthi reported on tribal lands and congressional policy in Washington, D.C. Connect with her on Twitter, Clubhouse (@keerthivedantam) or Signal at 408-470-0776.

It looks like venture deals are stagnating in Los Angeles.

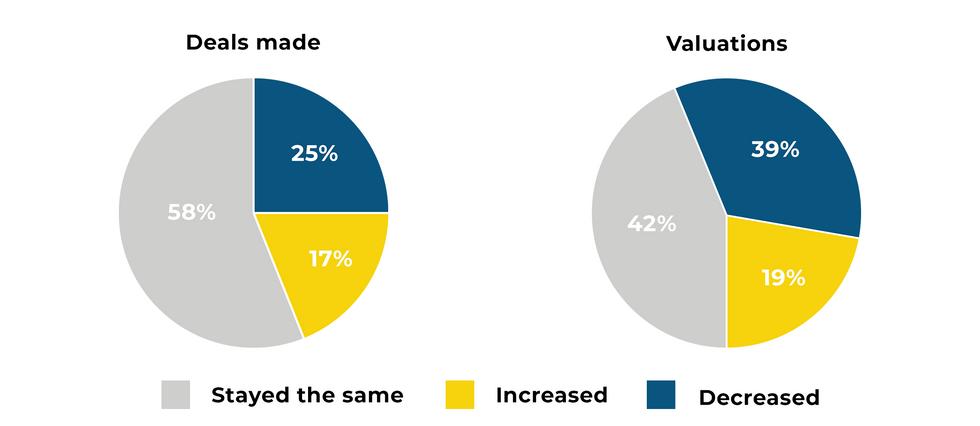

That’s according to dot.LA’s most recent quarterly VC sentiment survey, in which we asked L.A.-based venture capitalists for their take on the current state of the market. This time, roughly 83% of respondents reported that the number of deals they made in L.A. either stayed the same or declined in the first quarter of 2022 (58% said they stayed the same compared to the fourth quarter of 2021, while 25% said they decreased).

That’s not hugely surprising given the sluggish dynamics gripping the venture capital world at large these days, due to macroeconomic factors including the ongoing stock market correction, inflation and Russia’s invasion of Ukraine. While startups and VC investors haven’t been hit as hard as public companies, it looks like the ripple effects are beginning to bleed into the private capital markets.

In addition to slowing deal volumes, most investors said they’re seeing startup valuations lose momentum, as well: Roughly 81% said valuations either stayed the same or decreased from the previous quarter, with nearly 39% noting a decline.

Should that sentiment continue moving forward, it could spell bad news for startups as far as raising the money they need for growth, investors said.

“If I was a startup right now, I would be making sure I have plenty of runway,” said Krisztina ‘Z’ Holly, a venture partner at Good Growth Capital. “When it looks like there's some potential challenges ahead in the market, it’s good to fill your war chest.”

Among VC respondents, about 86% said they believed that valuations in the first quarter were too high—one potential reason why deals slowed down in the first quarter, according to TenOneTen Ventures partner Minnie Ingersoll. She noted that L.A.’s growing startup scene features more early-stage ventures, whose valuations haven’t come down the way later-stage startup valuations have.

“I would say we are just more cautious about taking meetings where the valuations are at pre-correction levels,” Ingersoll said. “We didn’t take meetings because their valuations weren’t in line with where we thought the market was.”

While most respondents said the Russia-Ukraine war didn’t have much impact on their investment strategies, some 22% said it did have an effect—with one VC noting they had to pass on a deal in Russia that they liked.

Is There a Flight Out of Los Angeles?

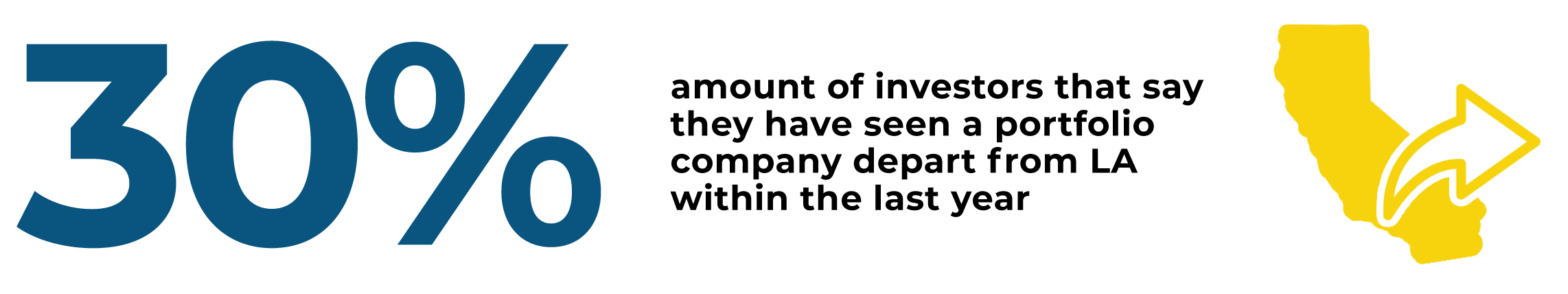

Los Angeles was heralded as the third-largest startup ecosystem in the U.S. at the beginning of the year, behind only San Francisco and New York. Yet nearly one-third (31%) of VC respondents said that at least one of their portfolio companies had left L.A. within the past year. It won’t come as a huge surprise that the city of Austin, Texas has been one of the prime beneficiaries of this shift—with roughly half of those who reported that a portfolio company had left L.A. identifying Austin as the destination.

The tech industry’s much-hyped “exodus” from California has been widely reported on, especially as more companies have embraced the work-from-home lifestyle and also opted to move their operations to lower-cost cities and states. Most notably, Elon Musk has recently moved two of his companies, electric automaker Tesla and tunnel infrastructure startup The Boring Company, from California to Texas (with both of those firms moving in and around Austin).

“In today's competitive market with lots of capital to invest, we think the next generation of successful VCs are going to be diverse in markets (not just Silicon Valley)... [and] have access to undiscovered founders from everywhere,” said one survey respondent.

NFTs Aren’t Popular With VCs—But Web 3 Is

“It’s the future,” according to one respondent. “Buckle up and get on board.”

Are NFTs...

More than 71% of VC survey respondents said they were bullish on Web3—the new blockchain-enabled iteration of the internet, which promises decentralization and a whole range of applications involving cryptocurrencies, NFTs, DeFi and more. It’s the same sentiment informing Santa Monica-based VC firm M13’s new $400 million fund, which considers Web3 a core piece of its investment thesis.

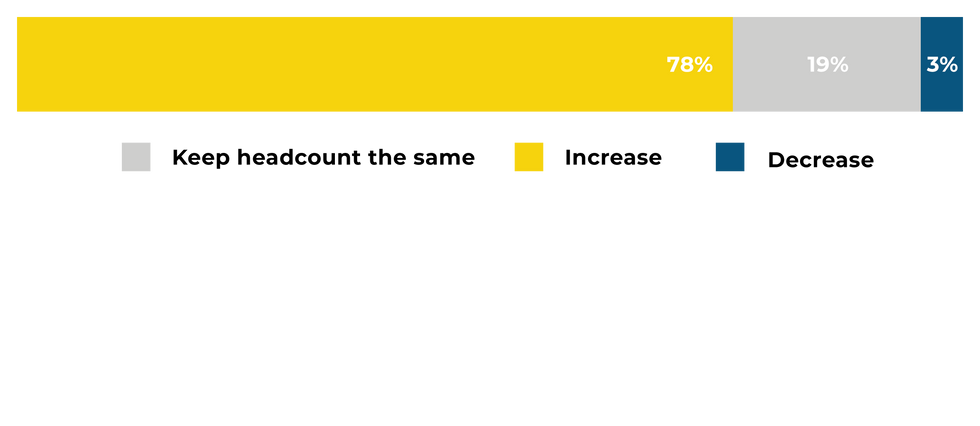

In Q2 2022, do you expect your portfolio companies to:

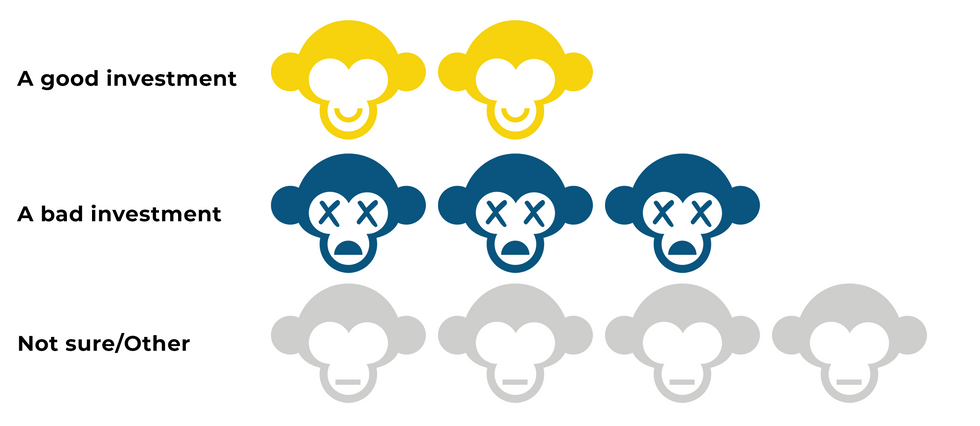

L.A. is home to an ever-growing cadre of Web3-focused startups operating across the realms of finance, entertainment and other industries. But while local investors are willing to pour money into blockchain-related ventures, one segment of the space continues to evoke skepticism: Only 18% of respondents would describe NFTs as “a good investment,” while 33% thought they were “bad” investments and 39% said they were unsure.

As in our last survey several months ago, it appears that NFTs continue to divide opinion, with respondents expressing differing perspectives on their value and utility. One referred to them as “get rich quick schemes,” but added that the art pieces and social communities that emerge from them may be valuable. Another said that “NFTs as a digital medium are a legitimate thing”—but noted the vast majority are “awful investments with no intrinsic value.”

Graphics courtesy of Hagan Blount.

From Your Site Articles

- Los Angeles Venture Funds Grow, but Spend Less in LA - dot.LA ›

- LA's Top Venture Capitalists of 2022 - dot.LA ›

- Los Angeles Venture Capital News - dot.LA ›

- Here Are Los Angeles' Top Venture Capitalists - dot.LA ›

- Venture Deals Fall in LA Amid Economic Worries - dot.LA ›

Related Articles Around the Web

Keerthi Vedantam

Keerthi Vedantam is a bioscience reporter at dot.LA. She cut her teeth covering everything from cloud computing to 5G in San Francisco and Seattle. Before she covered tech, Keerthi reported on tribal lands and congressional policy in Washington, D.C. Connect with her on Twitter, Clubhouse (@keerthivedantam) or Signal at 408-470-0776.

https://twitter.com/KeerthiVedantam

keerthi@dot.la

Meet the LA Startup Founder Who Had Two Hours To Prep Her 'Shark Tank' Pitch

03:48 PM | April 01, 2022

Photo courtesy of Curie

One Sunday afternoon last September, Sarah Moret was hiking through Griffith Observatory when she received a voicemail from the producer of “Shark Tank,” ABC’s hit entrepreneurial reality show. The voice message notified her that she had just two hours to get to the “Shark Tank” studio and pitch Curie, her aluminum-free deodorant brand, to the show’s “Sharks”—its panel of investor judges featuring Mark Cuban, Lori Greiner, Barbara Corcoran, Daymond John and Kevin O'Leary.

"I just jumped in the car; my fiancé was driving, and he brought me home as fast as possible in the carpool lane," Moret told dot.LA. "I curled my hair, got ready in 20 minutes and did my makeup in the passenger seat of his car for a primetime TV show."

Sarah Moret at the top of her hike, moments before she received a call from the producers of "Shark Tank."

Photo courtesy of Curie

Moret first applied to be on “Shark Tank” in 2020, but didn't receive a callback. She heard back from the show after reapplying the following year, with initial plans to film in July—but the producers bumped her filming date and put her on standby until September.

"I compare it to being like an understudy in a play," she explained. "I didn't have a set filming date. I was just told that I would get a phone call if there was space in the schedule for me to film.”

But Moret was confident she had a product worth waiting for, and the entrepreneurial know-how to scale it into a successful business. Most conventional antiperspirants in the market are made out of aluminum that can cause armpit irritation; while there are natural, aluminum-free deodorant brands, Moret said they also irritated her skin or left her smelling like a gym bag. Curie, her solution to these problems, uses sage oil and probiotics to beat the stink, arrowroot powder to absorb the sweat, and chamomile and aloe to soothe the armpits.

Prior to launching Curie in 2018, Moret worked as an associate at Santa Monica-based venture capital firm Crosscut Ventures, where she earned a spot on the investing team. There, she learned the ins and outs of the startup world.

“Curie started from a personal need,” Moret said. “I'm an athlete and at the time was a marathon runner, and just couldn't find anything that worked.”

Curie generated revenues of $125,000 in its first year of selling deodorant sticks. The following year, the startup had $700,000 in sales. At the start of 2020, she raised $1 million through a convertible note capped at $5 million to continue growing the brand. It has gradually expanded its product offerings to include body wash, moisturizing body oil, a detox mask and hand sanitizers.

Before appearing on “Shark Tank,” Curie’s body products were already sold in over 300 stores nationwide including Nordstrom, Anthropologie and fitness gym Soulcycle. It had also frequently appeared on shopping network QVC.

Fast forward to September 2021, and Moret finally entered “the Tank” with her eyes set on Corcoran and Greiner. She wanted to make a deal with one or both of them because, as Moret put it, “I just gravitate towards female investors or founders.”

When Moret’s episode of “Shark Tank” finally aired last month, she was surprised to find herself the first one up. Moret confidently introduced Curie on national television without a hint of sweat on her face or dirt from the hiking trail. She charmed the Sharks with her background and solid numbers—her opening pitch was for a $300,000 investment in exchange for a 5% equity stake—but four out of the five Sharks didn’t bite, saying she had raised too much money early on and had too many products.

This wasn’t new to Moret: Her first efforts at pitching Nordstrom and QVC had been rebuffed as well. “Rejection is a part of being an entrepreneur,” she said. “You're always going to get no’s; you can't let those no’s stop you or discourage you.”

It all came down to the final Shark, Daymond. When he produced an offer—$300,000 for 20% equity—that Moret deemed too low, she shot back: “I know my worth, I know the company's worth and I'm not backing down.”

After Moret countered with $300,000 for 12% equity, Cuban and Corcoran combined on an offer of $300,000 in exchange for 14% equity. Moret took the deal, as Cuban quipped: “I never thought I would be in a women’s deodorant business, ever.”

After the show aired, Curie sold out all of its deodorant products in 24 hours and now has some 5,000 customers on its waitlist. Moret said the company has plans to roll out further products, but supply chain issues have impacted their progress.

“Our biggest hurdle right now is just getting back in stock quickly, so we can get people their deodorant,” she said.

From Your Site Articles

- Beauty Counter's Gregg Renfrew Sees Makeup as a Movement - dot ... ›

- HatchBeauty Brands CEO Tracy Holland on Work-Life Balance - dot ... ›

- Cherie, an App to Build Community Around Beauty, Donates $60k to ... ›

- Los Angeles Health and Beauty Startup News - dot.LA ›

Related Articles Around the Web

Read moreShow less

Decerry Donato

Decerry Donato is a reporter at dot.LA. Prior to that, she was an editorial fellow at the company. Decerry received her bachelor's degree in literary journalism from the University of California, Irvine. She continues to write stories to inform the community about issues or events that take place in the L.A. area. On the weekends, she can be found hiking in the Angeles National forest or sifting through racks at your local thrift store.

OpenView’s Blake Bartlett on How Product-Led Growth Can Break the 'Fundamental Physics' for Startups

02:59 PM | September 07, 2022

Courtesy of OpenView

Investor Blake Bartlett spent high school exploring different passions, from skateboarding to photography.

He now sees himself as the “song and dance man” at OpenView Venture Capital, a growth-stage venture capital firm. On this episode of the LA Venture podcast, the L.A.-based VC talks about coining the term “product-led growth” and building companies in the “end user age.”

OpenView is currently investing from its sixth fund. Focused on B2B software, the firm invests in companies that are actively scaling up, usually around the Series A or Series B, Bartlett said. Based in Boston, the firm has led investments in startups including Calendly, Expensify and Highspot, among others.

OpenView’s “value-add,” he said, is its 75- to 80-member expansion team, which focuses on helping its portfolio companies grow.

While many investors have a reputation for being interested mainly in metrics and math, Bartlett prides himself on bringing imagination to his investing approach.

“I'm much more wired like a creative,” Bartlett said. “Creativity means lots of different things. Creative problem solving, and how do we sort of really have a unique angle to diligence and this investment thesis like that is creativity, and that certainly comes to bear, but also having other outlets.”

Currently, he also uses that vision through his YouTube series, “PLG123,” and his podcast, “Build.” Both allow him to explore finding his voice and presenting a unique perspective to a wider audience by discussing topics relevant to the VC community.

That creativity came into play in 2016, when he noticed more companies were using product development—rather than sales or marketing—to grow. These companies were different both in operation and performance, Bartlett said, and were expanding quickly without burning capital.

“These businesses were growing incredibly fast on the top line, and then also being capital efficient, if not profitable on the bottom line,” Bartlett said. “For me, that kind of broke the fundamental rules of physics of startups, because I had heard and been taught that there's a fundamental trade off more times than not—almost all the time—between growth and profitability.”

Where a traditional business might invest heavily in its sales and marketing teams in order to expand, Bartlett said, a product-led organization looks first at tactical problems and seemingly small details like signup processes, paywalls and other features. These types of startups were building their product to serve the end user, rather than the division lead who might be purchasing software for a large company, for instance.

“So it's a difference first and foremost, the building for the user, not for the buyer. And then you distribute it to the user, not to the buyer.”

Bartlett said one of the benefits of this model is that companies can build a user base before dealing with administrative issues that software companies have to deal with when selling to much larger companies. Instead, product-led companies can focus on how to turn individual users’ love for a product into revenue, and then scale it from there.

“What is the business case and how do we take all this user love and this thing that people say they can't live without, how do we articulate that into ROI in dollars and cents for this organization that's considering [purchasing in] six figures, seven figures or something of that nature?” Bartlett said.

dot.LA editorial intern Kristin Snyder contributed to this post.

Click the link above to hear the full episode, and subscribe to LA Venture on Apple Podcasts, Stitcher, Spotify or wherever you get your podcasts.

From Your Site Articles

- Real Ways to Increase Diversity in the Workplace - dot.LA ›

- Product Science Lands $18M, Preveta Gains $6.2M - dot.LA ›

Related Articles Around the Web

Read moreShow less

Minnie Ingersoll

Minnie Ingersoll is a partner at TenOneTen and host of the LA Venture podcast. Prior to TenOneTen, Minnie was the COO and co-founder of $100M+ Shift.com, an online marketplace for used cars. Minnie started her career as an early product manager at Google. Minnie studied Computer Science at Stanford and has an MBA from HBS. She recently moved back to L.A. after 20+ years in the Bay Area and is excited to be a part of the growing tech ecosystem of Southern California. In her space time, Minnie surfs baby waves and raises baby people.

RELATEDTRENDING

LA TECH JOBS