Get in the KNOW

on LA Startups & Tech

X

Design, Bitches

Looking to Build a Granny Flat in Your Backyard? Meet the Firms and Designs Pre-Approved in LA

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

Adding a backyard home in Los Angeles is now nearly as easy as buying a barbecue.

Homeowners who for years have wanted to build a granny flat in their backyard, but dreaded the red tape, can now choose from 20 pre-designed homes that the city has already approved for use.

The shift, made official last week, will speed up a weeks-long process and bring more badly needed units to an overpriced market. It also has the potential to elevate the 14 startups and firms building the next generation of homes.

The designs for the stand-alone residences range from a 200-square-foot studio to a 1,200-square foot, two-story, two-bedroom unit. And many of the homes are filled with design flourishes, reflecting the diverse architecture of the city, from a house in the silhouette of a flower to one with a spiral outdoor staircase leading to the roof.

It's no surprise. The program was spearheaded by Christopher Hawthorne, a former architecture critic at the Los Angeles Times and now the city's chief design officer.

The firms are primarily local and startup architecture and design firms, while others are well-known with a history of building granny flats, also know as accessory dwelling units, or ADUs.

The standard plans avoid the Los Angeles Department of Building and Safety's typical four-to six-week review process and can allow approvals to be completed in as quickly as one day.

Some aspects of the plans can be modified to fit a homeowner's preferences. Eight other designs are pending approval.

Mayor Eric Garcetti believes by adding more such units, the city can diversify its housing supply and tackle the housing crisis. Recent state legislation made it easier to build the small homes on the lot of single-family residences. Since then, ADUs have made up nearly a quarter of Los Angeles' newly permitted housing units.

Because construction costs are relatively low for the granny flats – the pre-approved homes start at $144,000 and can go beyond $300,000 – the housing is generally more affordable. The median home price in L.A. County in January was $690,000.

Here's a quick look at the designs approved so far:

Abodu

Abodu

Abodu, based in Redwood City in the Bay Area, exclusively designs backyard homes. In 2019, it worked with the city of San Jose on a program similar to the one Los Angeles is undertaking.

In October, it closed a seed funding round of $3.5 million led by Initialized Capital.

It has been approved for a one-story 340-square-foot studio, a one-story one-bedroom at 500 square feet, and a one-story, 610-square-foot two-bedroom.

The pricing for the studio is $189,900, while the one-bedroom costs $199,900 and the two-bedroom is $259,900.

Amunátegui Valdés Architects

Led by Cristobal Amunátegui and Alejandro Valdés, the firm was founded in 2011 and has offices in Los Angeles and Santiago, Chile. Amunátegui is an assistant professor at the Department of Architecture and Urban Design at UCLA.

The firm designs work in various scales and mediums, including buildings, furniture and exhibitions.

Its one-story, two-bedroom with a covered roof deck 934-square-foot unit is pending approval from the city.

Connect Homes

Connect Homes has a 100,000-square foot factory in San Bernardino and an architecture studio in Downtown L.A.

It specializes in glass and steel homes and has completed 80 homes in California. Its designs have an aesthetic of mid-century modern California residential architecture.

It has two one-bedroom models pre-approved by the city, one is 460 square feet, which costs $144,500 with a total average project cost of $205,000. The other is 640 square feet, which costs $195,200 with a total project cost of $280,000.

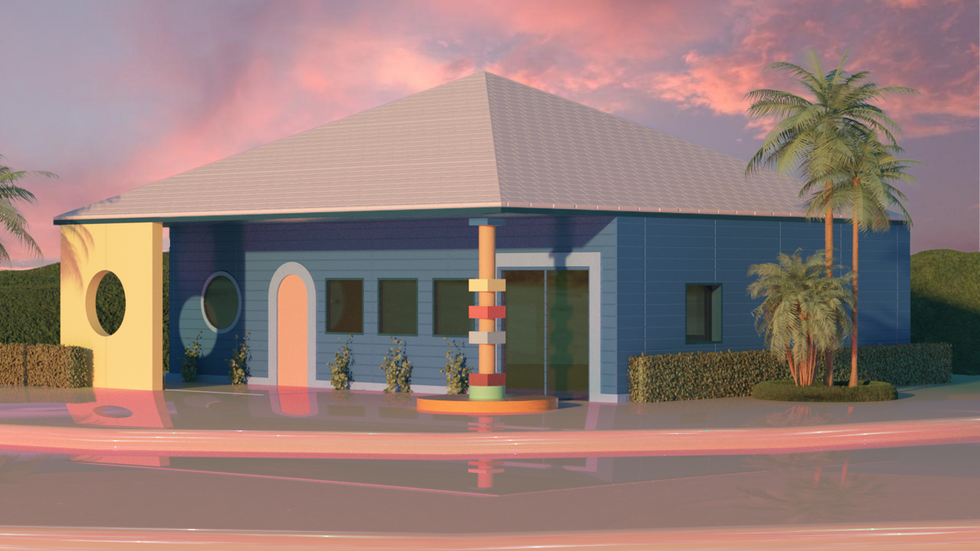

Design, Bitches

The Los Angeles-based architectural firm founded in 2010 describes itself as having a "bold and irreverent vision." Its projects include urban infill ground-up offices to single-family homes, adaptive re-use of derelict commercial buildings and renovations of historic landmarks.

Its pre-approved design, named "Midnight Room," is a guest house/ studio. Its bedroom can be left open for a loft feel or enclosed as a separate room. The design is a one-story, one-bedroom at 454 square feet.

Escher GuneWardena Architecture

Founded in Los Angeles in 1996, Escher GuneWardena Architecture has received international recognition and has collaborated with contemporary artists, worked on historical preservation projects and more.

The company has been approved for two different one-story, one- or two-bedroom units, one at 532 square feet with an estimated cost of $200,000 and another at 784 square feet with an estimated cost of $300,000. The firm noted the costs depend on site conditions and do not include soft costs. Those could add 10% to 12% to the total construction costs.

First Office

First Office is an architecture firm based in Downtown Los Angeles. Its approved ADUs will be built using prefabricated structural insulated panels, which allow for expedited construction schedules and high environmental ratings.

The interior finishes include concrete floors, stainless steel counters and an occasional element of conduit.

There are five options:

- A one-story studio, 309 to 589 square feet

- A one-story one-bedroom, 534 to 794 square feet

- And a one-story two-bedroom, 1,200 square feet

Fung + Blatt Architects

Fung + Blatt Architects is a Los Angeles-based firm founded in 1990.

The city has approved its 795-square-foot, one-story, one-bedroom unit with a roof deck. It estimates the construction cost to be $240,000 to $300,000, excluding landscape, site work and the solar array. Homeowners can also expect other additional costs.

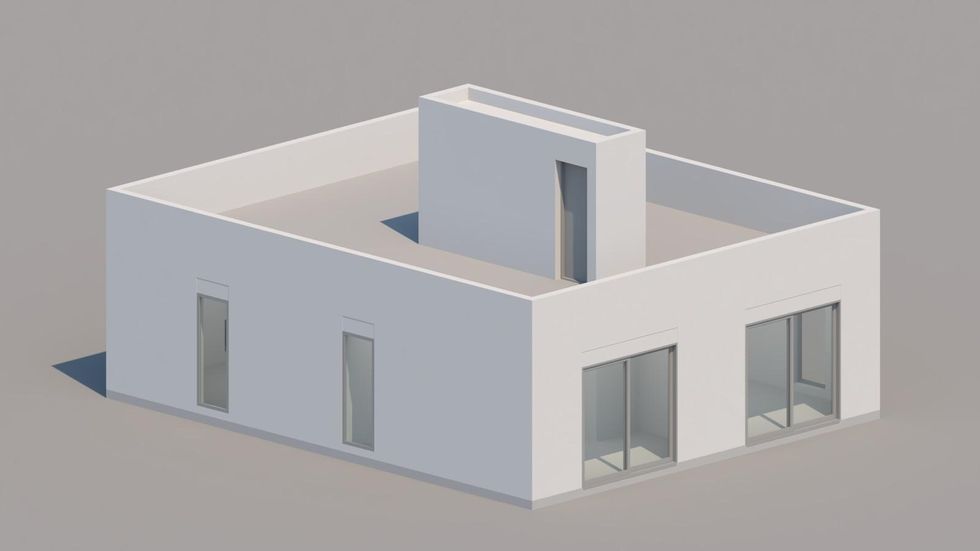

Taalman Architecture/ IT House Inc.

The design team behind "IT House" is Los Angeles-based studio Taalman Architecture. Over the past 15 years, IT House has built more than 20 homes throughout California and the U.S.

The IT House ADU standard plans include the tower, bar, box, cube, pod and court.

The city has approved four options, including:

- A two-story including mechanical room, 660 square feet

- A two-story including mechanical room, 430 square feet

- A one-story studio, 200 square feet

- A one-story including mechanical room, 700 square feet

The firm also has another two projects pending approval: a 360-square-foot one-story studio and a one-story, three-bedroom at 1,149 square feet.

LA Más

LA Más is a nonprofit based in Northeast Los Angeles that designs and builds initiatives promoting neighborhood resilience and elevating the agency of working-class communities of color. Homeowners who are considering their design must commit to renting to Section 8 tenants.

The city has approved two of LA Más' designs: a one-story, one-bedroom, 528 square feet unit and a one-story, two-bedroom, 768 square feet unit. The firm has another design for a one-story studio pending approval. That design would be the first 3D-printed ADU design in the city's program.

Jennifer Bonner/MALL

Massachusetts-based Jennifer Bonner/MALL designed a "Lean-to ADU" project, reinterpreting the stucco box and exaggerated false front, both Los Angeles architectural mainstays.

The design has been approved for a 525-square-foot one-story, one-bedroom unit with a 125-square-foot roof deck.

sekou cooke STUDIO

New York-based sekou cooke STUDIO is the sole Black-owned architectural firm on the project.

"The twisted forms of this ADU recalls the spin and scratch of a DJ's records" from the early 90s, the firm said.

Its design, still pending approval, is for a 1,200-square-foot, two bedroom and two bathroom can be adapted to a smaller one-bedroom unit or to include an additional half bath.

SO-IL

New York-based SO-IL was founded in 2008. It has completed projects in Leon, Seoul, Lisbon and Brooklyn.

Its one-story, one-bedroom 693-square-foot unit is pending approval. It is estimated the construction cost will be between $200,000 and $250,000.

WELCOME PROJECTS

Los Angeles-based Welcome Projects has worked on projects ranging from buildings, houses and interiors to handbags, games and toys.

Its ADU is nicknamed The Breadbox "for its curved topped walls and slight resemblance to that vintage counter accessory."

It has been approved for a one-story, one-bedroom 560-square-foot unit.

wHY Architecture

Founded in 2004, wHY is based in Los Angeles and New York City. It has taken on a landmark affordable housing and historic renovation initiative in Watts.

Its one-story, one- or two-bedroom 480 to 800-square-foot unit is pending approval.

Firms that want to participate in the program can learn more here . Angelenos interested in building a standard ADU plan can learn more the approved projects here.

From Your Site Articles

- United Dwelling Raises $10M to Address the Housing Shortage ... ›

- Plant Prefab Raises An Additional $30 Million - dot.LA ›

- How 3D Printing Could Help Tackle Homelessness in LA - dot.LA ›

- New Bills, New Startups Address Housing in California - dot.LA ›

- LA's ADU Culture Still Faces Financial Barriers - dot.LA ›

- What Will Take To Make Modular Homes Mainstream? - dot.LA ›

Related Articles Around the Web

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

LA Tech Updates: TikTok pays Creators as Rivals Dig In, Amazon Reportedly Eyes Sears, J.C. Penny Stores

12:24 PM | August 10, 2020

Photo by Bryan Angelo on Unsplash

Here are the latest updates on news affecting Los Angeles' startup and tech communities. Sign up for our newsletter and follow dot.LA on Twitter for more.

Today:

- TikTok Pays Creators as Rivals Dig In

- Amazon Wants to Use Sears and J.C. Penny Stores as Fulfillment Centers: WSJ

TikTok Doles Out Money to Creators, Batting Away Rivals

Tiktok announced today the first receipts of a $200 million creator fund including several Los Angeles-based app stars. It comes as the social app faces increased competition from those trying to lure away talent and the threat of an outright ban.

The company has promised to up their funds for rising U.S. creators to $1 billion over the coming three years.

Among the 19 selected so far is Los Angeles-based Alex Stemplewski, a photographer who shares the impromptu photo shoots he has with strangers in public with his 9.6M followers.

There's also Justice Alexander, one of the top Latino creators on the app, who captures quick video of the many pranks he plays on his girlfriend and daughter with his 5.4M followers.

Well-known TikTok-er David Dobrik recently gave away a Tesla to one of his more than 20M followers as part of a sweepstakes for the most heartfelt story.

The Creator Fund will open their applications in the middle of the month for anyone 18 years or older looking to expand their work on Tiktok. To be considered, creators must have 10,000 followers or at least 10,000 video views in the last 30 days and follow community guidelines.

President Trump recently signed an executive order that will ban the Chinese-owned company by September 20th unless it's sold to an American company before that date. TikTok has responded by threatening legal action.Amazon Wants to Use Sears and J.C. Penny Stores as Fulfillment Centers: WSJ

live.staticflickr.com

live.staticflickr.com

Amazon is in talks with mall operator giant Simon Property Group to convert Sears and J.C. Penney department stores into package distribution centers, according to a report from The Wall Street Journal.

The discussions come as Amazon continues to grow its e-commerce empire which has helped contribute to the downfall of brick-and-mortar retailers including Sears and J.C. Penney, which both filed for Chapter 11 bankruptcy protection. That trend accelerated with the pandemic as malls closed and millions of consumers rely on Amazon for online shopping.

Shares of Simon Property Group, which has 21 malls in California including the Del Amo Fashion Center, Brea Mall and Ontario Mills, jumped on the news. The company is set to report earnings after Monday's market close.

Adding more warehouses would help Amazon speed up deliveries as the company plans to offer its Prime members 1-day delivery of their orders. Amazon posted $5.2 billion in profits in the second quarter, doubling its bottom line from the same quarter a year ago, despite spending more than $4 billion on COVID-19 initiatives.

From Your Site Articles

- Amazon faces unprecedented challenges as dozens of warehouses ... ›

- TikTok Signs Music Distribution Deal with UnitedMasters - dot.LA ›

- TikTok Signs Music Distribution Deal with UnitedMasters - dot.LA ›

- Who's Paying What for Creator Content - dot.LA ›

Related Articles Around the Web

Read moreShow less

Taylor Soper, GeekWire

Taylor Soper is GeekWire's managing editor, responsible for coordinating the newsroom, planning coverage, and editing stories. A native of Portland, Ore., and graduate of the University of Washington, he was previously a GeekWire staff reporter, covering beats including startups and sports technology. Follow him @taylor_soper and email taylor@geekwire.com.

Meet the LA Startup Founder Who Had Two Hours To Prep Her 'Shark Tank' Pitch

03:48 PM | April 01, 2022

Photo courtesy of Curie

One Sunday afternoon last September, Sarah Moret was hiking through Griffith Observatory when she received a voicemail from the producer of “Shark Tank,” ABC’s hit entrepreneurial reality show. The voice message notified her that she had just two hours to get to the “Shark Tank” studio and pitch Curie, her aluminum-free deodorant brand, to the show’s “Sharks”—its panel of investor judges featuring Mark Cuban, Lori Greiner, Barbara Corcoran, Daymond John and Kevin O'Leary.

"I just jumped in the car; my fiancé was driving, and he brought me home as fast as possible in the carpool lane," Moret told dot.LA. "I curled my hair, got ready in 20 minutes and did my makeup in the passenger seat of his car for a primetime TV show."

Sarah Moret at the top of her hike, moments before she received a call from the producers of "Shark Tank."

Photo courtesy of Curie

Moret first applied to be on “Shark Tank” in 2020, but didn't receive a callback. She heard back from the show after reapplying the following year, with initial plans to film in July—but the producers bumped her filming date and put her on standby until September.

"I compare it to being like an understudy in a play," she explained. "I didn't have a set filming date. I was just told that I would get a phone call if there was space in the schedule for me to film.”

But Moret was confident she had a product worth waiting for, and the entrepreneurial know-how to scale it into a successful business. Most conventional antiperspirants in the market are made out of aluminum that can cause armpit irritation; while there are natural, aluminum-free deodorant brands, Moret said they also irritated her skin or left her smelling like a gym bag. Curie, her solution to these problems, uses sage oil and probiotics to beat the stink, arrowroot powder to absorb the sweat, and chamomile and aloe to soothe the armpits.

Prior to launching Curie in 2018, Moret worked as an associate at Santa Monica-based venture capital firm Crosscut Ventures, where she earned a spot on the investing team. There, she learned the ins and outs of the startup world.

“Curie started from a personal need,” Moret said. “I'm an athlete and at the time was a marathon runner, and just couldn't find anything that worked.”

Curie generated revenues of $125,000 in its first year of selling deodorant sticks. The following year, the startup had $700,000 in sales. At the start of 2020, she raised $1 million through a convertible note capped at $5 million to continue growing the brand. It has gradually expanded its product offerings to include body wash, moisturizing body oil, a detox mask and hand sanitizers.

Before appearing on “Shark Tank,” Curie’s body products were already sold in over 300 stores nationwide including Nordstrom, Anthropologie and fitness gym Soulcycle. It had also frequently appeared on shopping network QVC.

Fast forward to September 2021, and Moret finally entered “the Tank” with her eyes set on Corcoran and Greiner. She wanted to make a deal with one or both of them because, as Moret put it, “I just gravitate towards female investors or founders.”

When Moret’s episode of “Shark Tank” finally aired last month, she was surprised to find herself the first one up. Moret confidently introduced Curie on national television without a hint of sweat on her face or dirt from the hiking trail. She charmed the Sharks with her background and solid numbers—her opening pitch was for a $300,000 investment in exchange for a 5% equity stake—but four out of the five Sharks didn’t bite, saying she had raised too much money early on and had too many products.

This wasn’t new to Moret: Her first efforts at pitching Nordstrom and QVC had been rebuffed as well. “Rejection is a part of being an entrepreneur,” she said. “You're always going to get no’s; you can't let those no’s stop you or discourage you.”

It all came down to the final Shark, Daymond. When he produced an offer—$300,000 for 20% equity—that Moret deemed too low, she shot back: “I know my worth, I know the company's worth and I'm not backing down.”

After Moret countered with $300,000 for 12% equity, Cuban and Corcoran combined on an offer of $300,000 in exchange for 14% equity. Moret took the deal, as Cuban quipped: “I never thought I would be in a women’s deodorant business, ever.”

After the show aired, Curie sold out all of its deodorant products in 24 hours and now has some 5,000 customers on its waitlist. Moret said the company has plans to roll out further products, but supply chain issues have impacted their progress.

“Our biggest hurdle right now is just getting back in stock quickly, so we can get people their deodorant,” she said.

From Your Site Articles

- Beauty Counter's Gregg Renfrew Sees Makeup as a Movement - dot ... ›

- HatchBeauty Brands CEO Tracy Holland on Work-Life Balance - dot ... ›

- Cherie, an App to Build Community Around Beauty, Donates $60k to ... ›

- Los Angeles Health and Beauty Startup News - dot.LA ›

Related Articles Around the Web

Read moreShow less

Decerry Donato

Decerry Donato is a reporter at dot.LA. Prior to that, she was an editorial fellow at the company. Decerry received her bachelor's degree in literary journalism from the University of California, Irvine. She continues to write stories to inform the community about issues or events that take place in the L.A. area. On the weekends, she can be found hiking in the Angeles National forest or sifting through racks at your local thrift store.

RELATEDTRENDING

LA TECH JOBS