Why Bored Ape NFTs Are Showing Up in Movies, TV Shows and Novels

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

On a Zoom call last week, Gene Nubla was explaining the name and origin story he gave “Nicky Nickels,” his Bored Ape NFT who will be a character in a forthcoming novel.

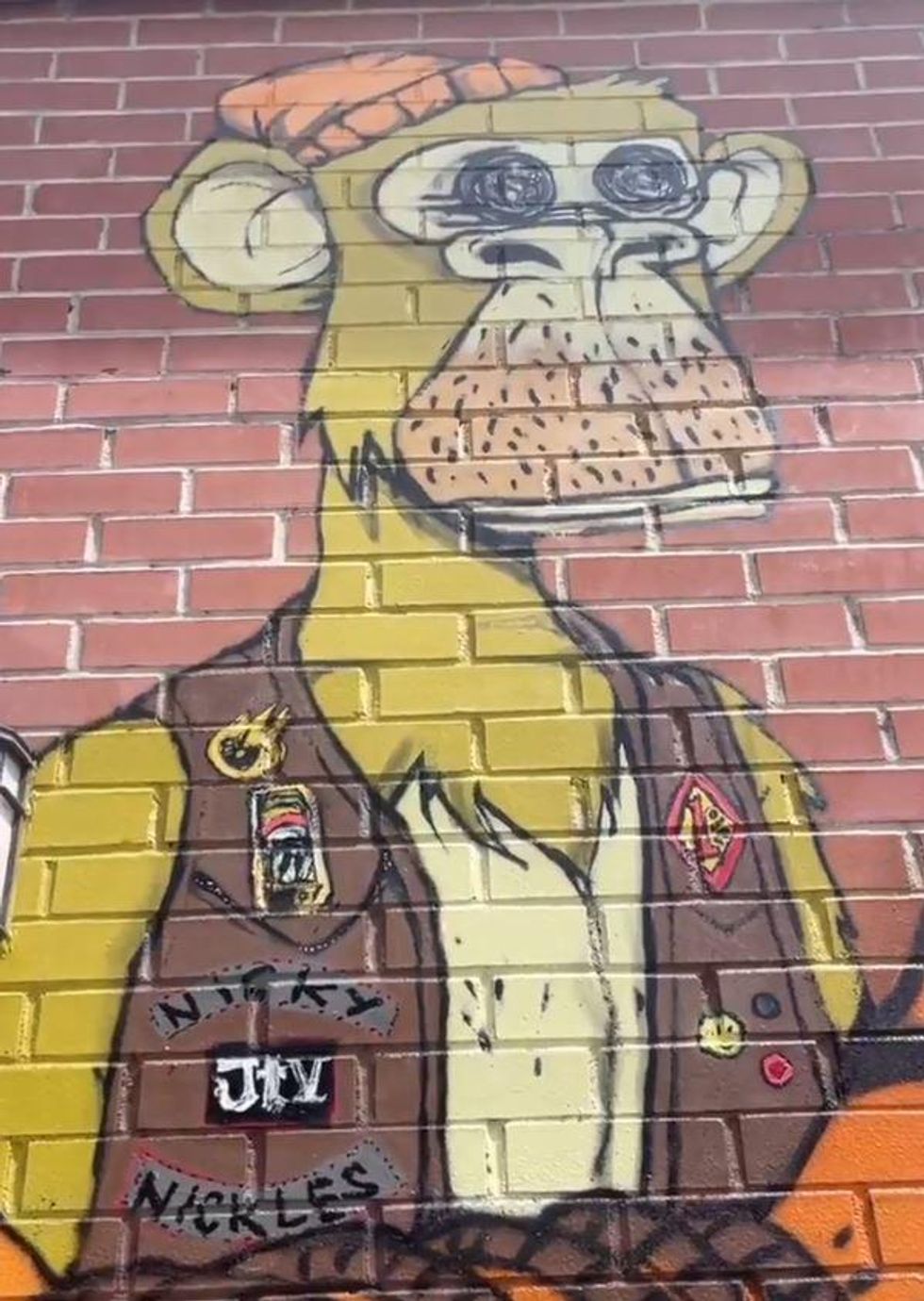

Nubla’s Bored Ape Yacht Club #6717 wears a leather vest and orange beanie hat, but the cartoon ape’s most distinctive feature is the silver coins covering his eyes. The 39-year-old Nubla—an associate vice president for a flower delivery service—imagined his Bored Ape as a member of a biker gang called the “Apes of Anarchy” who died during a botched cargo heist. Loved ones sometimes place silver dollars over the eyes of the dead during funerals, but Nicky’s family used plain old nickels, Nubla told dot.LA. That somehow barred the ape from properly entering the afterlife, rendering him undead.

It may not be the best ghost story to come out of Los Angeles, but Nicky will soon haunt the pages of a book written by bestselling author Neil Strauss, who has penned autobiographies for the likes of Marilyn Manson and Jenna Jameson. Nubla has licensed Nicky to an NFT storytelling project called Jenkins the Valet, which is backed by Creative Artists Agency and will see Strauss cobble together stories from various Bored Ape holders.

Nubla’s Bored Ape Yacht Club #6717, which he affectionately named "Nicky Nickels."

Photo courtesy of Gene Nubla“This goes into the philosophy of Web3—like, I can participate as an owner now,” said Nubla. “I'm in the door now, versus on the outside looking in and just watching the movies [and] paying the ticket.”

These days, there are scores of artists, startups and entertainment companies—as well as ordinary NFT holders—who are parlaying non-fungible tokens into commercialized intellectual property. Santa Monica-based Universal Music Group, one of the world’s largest record labels, has created a “metaverse group” consisting of four Bored Apes who ostensibly make music, while crypto exchange Coinbase is using Bored Apes as characters for a film trilogy. Talent agencies like WME and United Talent Agency, meanwhile, have added Bored Apes and other NFT characters to their client rosters.

These creative works are possible because blockchain firms like Yuga Labs, the company behind Bored Ape Yacht Club, have attached broad commercialization rights to NFTs, which are unique digital assets verified using blockchain technology. Granting those rights could boost the value of NFT collections by making them more culturally relevant, according to experts, though it remains to be seen whether such projects can appeal to audiences beyond NFT adopters.

A lot of legal questions remain, too, as actor and producer Seth Green just learned the hard way. Green is developing a hybrid live-action/animated comedy called “White Horse Tavern,” in which the creator’s own Bored Ape—whom Green affectionately named “Fred”—comes to life as a friendly neighborhood bartender. The project was almost sabotaged last month when a scammer duped Green in an online phishing scheme—stealing four of his NFTs, including Fred. Since Bored Ape NFTs come with a license to commercialize the art, Green may have momentarily lost the rights to produce the show (Fred has since returned home safely). The drama turned Green into a poster child for how sketchy the world of NFTs can still be—the “Wild West” of digital assets, as some observers have put it.

Ready for Primetime?

Jeremy Goldman, a Los Angeles attorney who leads the blockchain group at law firm Frankfurt Kurnit Klein & Selz, credits companies like Yuga Labs for generating immense value for their NFT collections. The problem, as he sees it, are the collections’ relatively brief terms and conditions that don’t spell out what happens in certain situations, like when an NFT is stolen. That has the risk of killing projects and productions if investors or distributors are uncertain of the consequences.

“All of these NFT projects, including Bored Ape Yacht Club, are highly experimental and in some ways were never meant for primetime,” Goldman told dot.LA. “A lot of questions about the license are sort of unanswered.”

That hasn’t stopped some entertainment tech firms from sticking NFT avatars in their stories. L.A.-based Invisible Universe is developing an animated parody called “The R3al Metaverse,” which will include characters from five NFT collections. (Disclosure: dot.LA co-founder and executive chairman Spencer Rascoff is an investor in Invisible Universe).

The startup bought three NFTs and secured licenses for two more that fit well with the story, CEO Tricia Biggio told dot.LA. Just to be sure, Invisible Universe approached the creators behind the NFT projects, as well. While those organizations had varying views on using the IP, they all saw the value of Invisible Universe’s project, she noted.

“It was funny—some of them would be like, ‘Well, you actually don't have to run it by us,’” Biggio said.

In “The R3al Metaverse,” NFTs who live in the digital world come over to the real one after they’re cast in a reality TV show and move in together. The parody pokes fun at the debate around the value of NFTs, as well: In one episode, the characters stare at a painting and are confused by its lack of “real-world application” besides being a wall decoration. (“Like zero utility,” one observes, according to a storyboard of the scene.) Invisible Universe will release around 40 episodes of the program on social media platforms starting in late July, with each episode running between 45 and 90 seconds.

Who will watch a show about NFTs—which, for all of their recent hype, are still owned by just a tiny fraction of the population? Biggio said that the audience for “The R3al Metaverse” will primarily be holders of its featured NFT communities: Bored Ape Yacht Club, Cool Cats, Doodles, World of Women and Robotos, which collectively have roughly 50,000 tokens in circulation. That said, Biggio believes the show can build an audience outside the not-yet-mainstream NFT market and, in turn, boost the value of those collections.

“Because we aren't gating the content, we have a unique opportunity to onroad people into the Web3 space who enjoy the content, fall in love with the characters and want to be a part of the collaborative storytelling experience,” Biggio said.

‘A Unique Opportunity To Create Wealth’

At their most basic level, NFTs—like artwork at large—generate much of their value from their scarcity and cultural relevance. Yet companies like Yuga Labs have popularized the idea of giving NFT holders commercial rights as well, allowing Bored Ape holders to put their ape’s face on a t-shirt or other merchandise and sell it. That not only makes the NFT itself more lucrative, but may well make the entire collection more valuable as Bored Apes are plastered on storefronts or featured in films.

“By giving broad IP rights—either making them public domain or granting commercial rights to holders—you're increasing the chances, potentially, that these items are going to get out there and go viral and become culturally relevant, and therefore sought after,” said Goldman, the attorney.

Bill Starkov, a real estate developer who lives near Calabasas, “right by the Kardashians,” in his words, is the founder of another primate-inspired NFT project, Apocalyptic Apes. (The collection’s zombified primates look like scarier versions of Bored Apes.) Starkov said his team gave NFT holders the right to do “whatever you want” with the artwork—so long as they don’t use the Apocalyptic Apes brand name. “We have to make sure they use it properly enough and it's used to promote our project and our brand in a good way,” he explained.

Apocalyptic Ape holders have placed their simians on hot sauce bottles, exercise equipment and sunglasses, he noted, while on the entertainment side, a car-racing game, comic books and movies depicting the apes are all in the works, too. Starkov, who goes by Fity.Eth online, has also partnered with Nicky Diamonds, the owner of clothing company Diamond Supply, on licensing deals with Ape holders to create merchandise. Those deals are generating tens of thousands of dollars for ape holders who collaborated with Diamond, he said.

“One thing that people are sleeping on is the understanding of IP rights,” Starkov said of some people in the NFT community. “They think it's a quick flip, but it's not. It's something long-term. It's something that's here to stay. It's a unique opportunity to create wealth.”

Nubla is among the NFT holders who have taken advantage of those IP rights. Speaking through an augmented reality filter on his computer that made him look like Nicky Nickels, Nubla said he’s earned some cash by allowing artists to make works based on his Bored Ape, including one artist who sells lapel pins bearing NFT art. A street painting of Nicky also adorns the side of a brick building in Brooklyn—part of a mural by the graffiti artist Masnah, who was paid for his work by NFT holders.

When the Florida-based startup Tally Labs launched the Jenkins the Valet project last June, Nubla was one of the 69 lucky people to randomly mint a rare “Yacht” NFT. That allowed him to license his Bored Ape as a character in Strauss’ novel and receive a share of the book’s royalties. Nubla debated selling the Yacht NFT as its value reached six figures, but ultimately decided to keep it and build out Nicky’s IP “just to see where it goes.”

Nubla does see some risk in NFT collections decentralizing their IP; he noted that there isn’t much stopping another Bored Ape holder from using their NFT to promote ideas or views that others may disagree with or find offensive. But like a lot of people involved in the space, he’s enamored with the idea of Web3—a decentralized vision for the internet that runs on blockchain-powered applications.

“It'd be nice to be able to benefit off the royalties of anything that comes off this,” Nubla said of the Strauss novel, which is coming out this summer. “But I'm doing it mainly just for the vibes.”

- Seth Green, Bored Ape NFTs and Intellectual Property - dot.LA ›

- WME's Newest Clients Are A Pair Of Bored Ape NFTs - dot.LA ›

- Beverage Startups Are Using NFTs to Build Their Brands - dot.LA ›

- NFT Show ‘The R3al Metaverse' Launches Via Invisible Universe - dot.LA ›

- Cameo Adds a Bored Ape to Its Celebrity Video Platform - dot.LA ›

- Bored Ape Founder Zeshan Ali Buys New Home - dot.LA ›

Christian Hetrick is dot.LA's Entertainment Tech Reporter. He was formerly a business reporter for the Philadelphia Inquirer and reported on New Jersey politics for the Observer and the Press of Atlantic City.

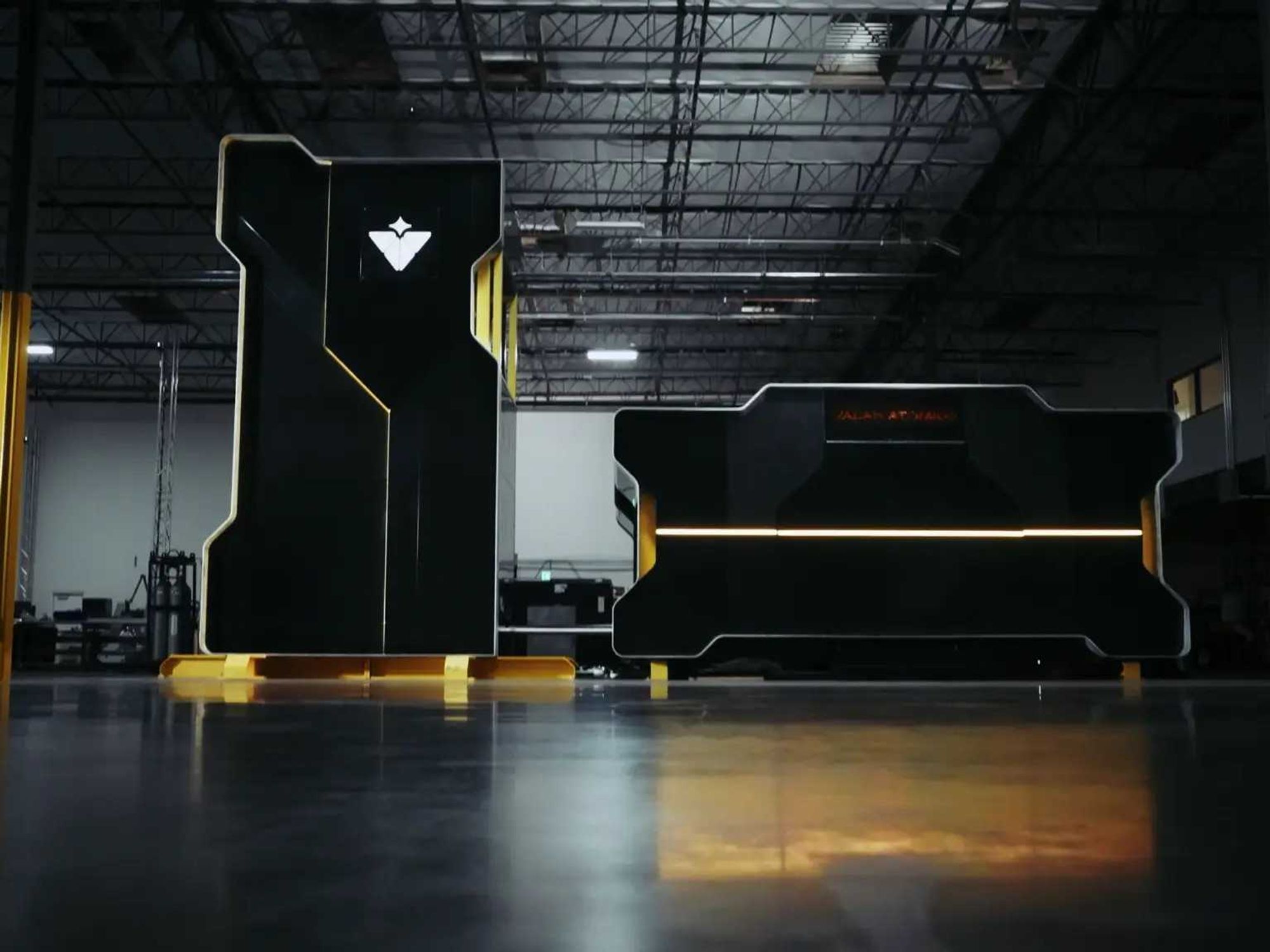

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

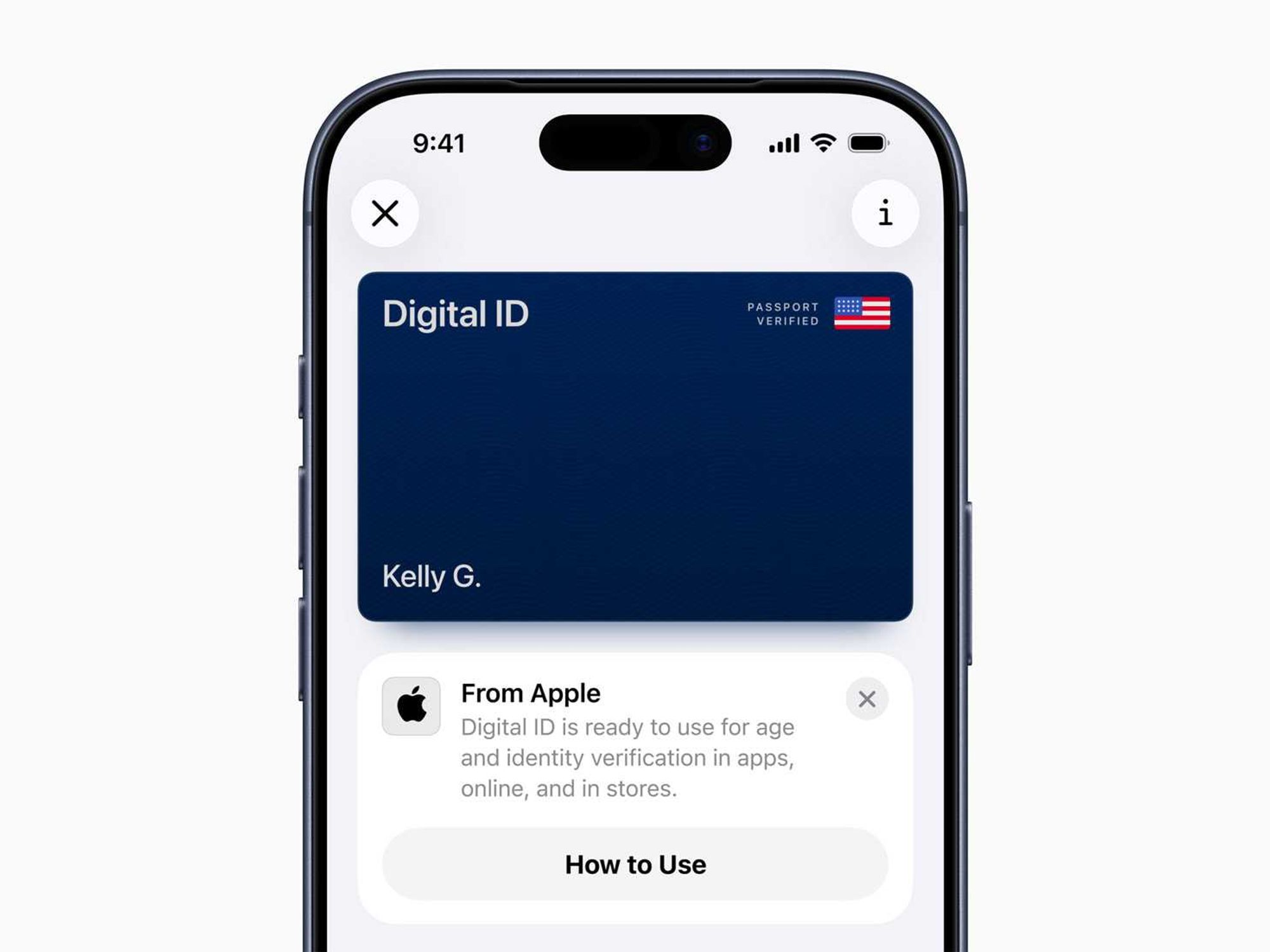

Image Source: Waymo Image Source: Apple

Image Source: Apple