Watch: Investing in Uncertain Times: Why a Reset in Valuations Could be Liberating for Founders

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

A decade-long run-up in startup valuations that came to a screeching halt after the novel coronavirus froze much of the worldwide economy last month could have a silver lining for company founders.

"They can build great businesses but don't have to be chasing a growth rate," said Carter Reum, co-founder of M13. "It can be liberating. We've lived in a world the past few years where an artificially high valuation was nothing more than a vanity mark."

Reum spoke in a dot.LA webinar on the state of investing along with Kara Nortman, a partner at L.A.'s largest venture firm, Upfront Ventures.

dot.LA Strategy Session: Investing in Uncertain Timeswww.youtube.com

Both invest heavily in consumer companies and pointed out that a softening of direct-to-consumer companies began last year after well-documented stumbles at WeWork, Caspar, and other brands.

"There was a lot of shame around the resets in valuations and now I think that's gone," Nortman said. "I've seen that be liberating for founders."

Reum said he is excited to be able to invest in businesses he sees long-term potential in, but could not justify the lofty valuations they demanded from investors. He says now VCs and founders alike can focus more on creating sustainable companies.

"Whereas growth-at-all-costs was really cool that last few years, the coolest thing going forward is controlled growth-with-profitability," he said.

Upfront and M13 are still deploying capital but knowing their next fund could be harder to raise they are being more conservative. Nortman says Upfront is preferring to write checks in the $3 to $4 million range rather than the $10 million sums it would deploy before the crisis out of its sixth series-A fund. The firm normally invests in one new company a month, a pace that has continued.

"Things are still moving at Upfront," she said, but also added: "There's still a big question about how to price things and how to invest in people you've never met."

Nortman said even after the virus subsides there will be less travel and perhaps fewer gatherings. Asked whether her firm was still planning to host the Upfront Summit, a splashy annual conference that brings over a thousand investors and founders to L.A. each winter, Nortman said to stay tuned.

"We view the Upfront Summit as a permanent endeavor and an important element to the community," she said.

"Everyone just breathed a sigh of relief," laughed Reum.

Speakers Include:

- Kara Nortman, partner at Upfront Ventures

- Carter Reum, partner and co-founder of M13

- Ben Bergman, senior reporter at dot.LA

Kara Nortman is a partner at Upfront Ventures

Kara Nortman, Partner at Upfront Ventures

Kara is a Partner at Upfront Ventures, the largest venture capital firm based in Los Angeles. Some of her notable investments include Parachute Home, The Wing, Fleetsmith, Stem, Territory, Strive, and Qordoba. Before Upfront, Kara co-founded the children's e-commerce company Moonfrye and also spent seven years at IAC where she co-headed the M&A group and acted as the Senior Vice President and General Manager of Urbanspoon and Citysearch. During her tenure at IAC she oversaw the initial investment in Tinder. Earlier in her career, she also spent time at Morgan Stanley, Microsoft, and Battery Ventures. She received her AB in Politics from Princeton University and her MBA from Stanford University. Kara is also a founding member of All Raise, a VC-led group dedicated to increased diversity in funders and founders and serves as an advisor to the Women's National Soccer Team Players Association. Kara resides in Los Angeles with her husband and three daughters. @upfrontvc

Carter Reum is a partner and cofounder of M13.

Carter Reum is an Investor, Entrepreneur and Author

Carter and his brother Courtney are Partners and Co-Founders of M13, a full-service venture engine with offices in Los Angeles, New York and San Francisco. M13 executes a "founders first" focus to build and scale leading consumer technology companies. M13's holdco model consists of a $200M consumer tech fund, active support of its founding teams and a launchpad brand studio that incubates ideas into sustainable companies with partners such as P&G Ventures. With more than 80 direct investments and 16 exits, M13's prior investments total over $137B in enterprise value and includes Lyft, Pinterest, Ring, Daily Harvest, FabFitFun, Rothy's and more. The brothers began their careers at Goldman Sachs before launching their first company, VEEV Spirits, one of the fastest-growing independent brands and an early leader in sustainability and wellness. Carter is active in culture and arts as a member of the LACMA Board of Trustees, the digital advisory of The Metropolitan Museum of Art and an Executive in Residence for the City of Los Angeles. @M13Company

Ben Bergman is dot.LA's senior reporter, covering venture capital.

Ben Bergman, Senior Reporter at dot.LA

Ben Bergman is dot.LA's senior reporter, covering venture capital. Previously he was a senior reporter/host at KPCC, a producer at Gimlet Media and NPR and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to NPR and Marketplace and has written for The New York Times. Bergman was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. He enjoys skiing, playing poker, and cheering on The Seattle Seahawks. @thebenbergman

- venture-capital - dot.LA ›

- Coronavirus Stokes Investor Fears – From Venture Capital to Wall ... ›

- Leading VC Warns Coronavirus is a 'Black Swan' Event - dot.LA ›

- Investors Are Still Writing Checks During the Coronavirus Pandemic ... ›

- Here Are the Investors Still Writing Checks During the Coronavirus ... ›

- Kara Nortman Named Upfront Ventures' Co-Managing Partner - dot.LA ›

- Mint 10 Investment Fund Launches Dedicated to Sports Cards - dot.LA ›

- 'VC is Like a Pimple' - dot.LA ›

- Pool, Gym? Check. Electric Car? - dot.LA ›

- Streaming for the Arab Diaspora - dot.LA ›

- A Startup's Stark COVID Pivot - dot.LA ›

- Making Audio Sharable - dot.LA ›

- A 3D Revolution - dot.LA ›

- Podcast Nation - dot.LA ›

- COVID Crashes Thanksgiving Holiday - dot.LA ›

- Can a Former Wolf of Wall Street Partner Make the Next Big Social Network? - dot.LA ›

- Los Angeles Tech and Startups 2020 Year in Review ›

- Sinai Ventures' Zach White on Secondary Shares, LA's Future - dot.LA ›

Ben Bergman is the newsroom's senior finance reporter. Previously he was a senior business reporter and host at KPCC, a senior producer at Gimlet Media, a producer at NPR's Morning Edition, and produced two investigative documentaries for KCET. He has been a frequent on-air contributor to business coverage on NPR and Marketplace and has written for The New York Times and Columbia Journalism Review. Ben was a 2017-2018 Knight-Bagehot Fellow in Economic and Business Journalism at Columbia Business School. In his free time, he enjoys skiing, playing poker, and cheering on The Seattle Seahawks.

Image Source: Perelel

Image Source: Perelel

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

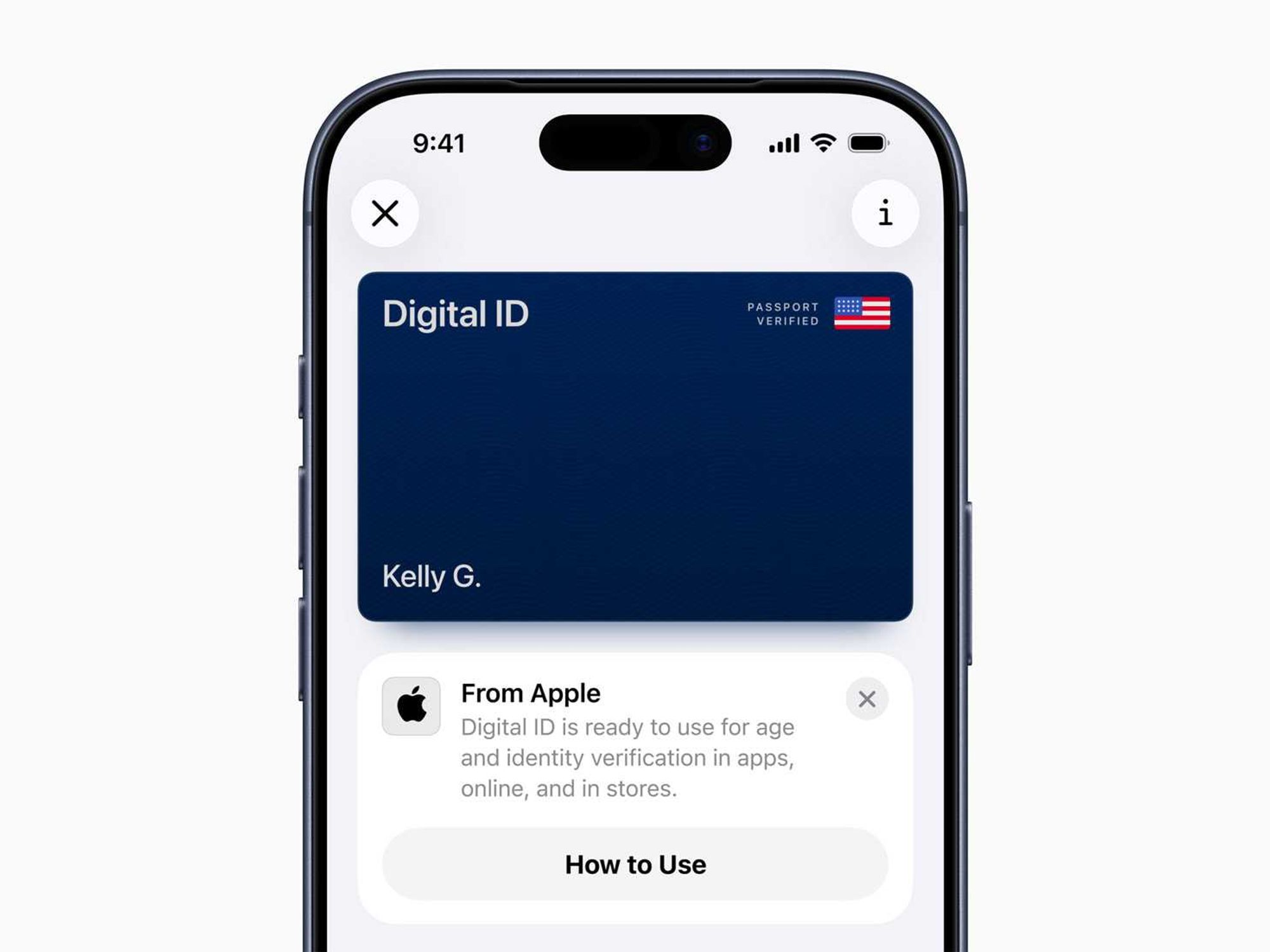

Image Source: Waymo Image Source: Apple

Image Source: Apple