Exclusive: Behind Electric Vehicle-Maker Karma's Plans to Go Public

Rachel Uranga is dot.LA's Managing Editor, News. She is a former Mexico-based market correspondent at Reuters and has worked for several Southern California news outlets, including the Los Angeles Business Journal and the Los Angeles Daily News. She has covered everything from IPOs to immigration. Uranga is a graduate of the Columbia School of Journalism and California State University Northridge. A Los Angeles native, she lives with her husband, son and their felines.

Luxury electric car company Karma is in talks with investment banks to help it go public, company officials told dot.LA.

Karma is hoping to ride the Tesla wave of success and capitalize on the soaring valuations of its competitors.

"We want to take advantage of the fact that the market is red hot right now, so we want to be fast," said Mikael Elley, chief of staff at Karma Automotive.

The Chinese-owned automaker hopes to go public either through a merger with a special purpose acquisition company or through an initial public offering in the U.S. or Hong Kong over the next six months, he said.

Elley didn't say how much the company, headquartered in an office park in Irvine, was hoping to raise but it's in the midst of carrying out ambitious plans to increase its production of cars by at least ten times its current output. It's also developing delivery vans and selling an electric vehicle startup platform to manufacturers.

"We know a lot of Tesla owners, they feel like 'it's my Silicon Valley Camry', right? I mean everybody else has got one, so they're looking for something else. There's definitely a void in the market."

Billing itself a "high-tech mobility incubator," the company says it can help larger car companies that are investing billions of dollars into capital for new green cars manufacture, design and engineer them.

"We are talking with investment bankers right now to take us down that path," he said. "I think that everybody realizes that there is still a void, there is still an opportunity to get into the EV space."

Elon Musk's publicly traded Tesla became the most valuable car company in the world this July. And while it only produces a fraction of the world's new cars, its skyrocketing share value has given momentum to the $95 billion electric vehicle market, with sales expected to quadruple by 2025.

Electric vehicle maker Rivian, which plans to sell electric pickup trucks next year, announced it raised $2.5 billion earlier this month. It was followed by Los Angeles-based Fisker's news that it will go public in a deal with a SPAC valued at $2.9 billion. Both are direct competitors, although neither is on the market yet.

"If you are an EV company, now is the time to go to market," said Asad Hussain, mobility tech analyst at Pitchbook. "Right now sentiment on EVs is so positive that less-established EV companies — even companies without a product — are getting high valuations, but that could change."

With production facilities in Moreno Valley, Karma is the only U.S.-based electric vehicle startup that is producing and selling vehicles other than Tesla. Last year it rolled out about 550 of its Revero GT, an ultra luxury electric vehicle that starts around $135,000.

But Elley said that Karma wants to ramp up production of the Revero GTE, set for release mid-year 2021, and bring down cost to $100,000 so the car appeals to a broader market.

"We think that we can get the price down to take advantage of more volume and still be the luxury premium space," he said. "We know a lot of Tesla owners, they feel like 'it's my Silicon Valley Camry', right? I mean everybody else has got one, so they're looking for something else. There's definitely a void in the market."

He expects to produce 5,000 to 10,000 of the new cars. Meanwhile, the company is tweaking a branding campaign that can extend its luxury reputation and building lifestyle events around their vehicles such as wine tasting or trips. It's also eyeing a new generation of drivers. Karma has created a partnership with TikTok to raise the company's profile.

"It's a step in the right direction. But it's still a competitive market," Hussain said.

The company is up against Porsche and Tesla in that price range, both with vehicles that have a reputation for better performance, he said. But Karma's "exceptional design" has made it attractive to enthusiasts.

Aston Martin designer Henrik Fisker created what is now Karma as Fisker Automotive in 2007 before it filed for bankruptcy in 2013. It was picked up the following year by auto parts manufacturer Wanxiang Group Corp. and renamed Karma. Four years ago, Henrik Fisker created an eponymously named competitor - which plans to sell its SUV Ocean in 2022.

Wanxiang has pumped about $2 billion into Karma, which has struggled to catch on. Earlier this month, president of Wanxiang's U.S. business Pin Ni said Karma secured $100 million from private investors and has been looking to raise $300 million through shares as it seeks to expand its line of cars. Elley said as part of the financing effort, its parent company has agreed to set the company down the path to an IPO. It comes amid an executive shake-up and layoffs at Karma earlier this year.

Karma is trying to penetrate a market that traditional carmakers from Audi to Hyundai are trying to establish a foothold. Despite the pandemic, most carmakers haven't pulled back electric vehicle investment, a sign of just how much the market is expected to grow.

But Karma executives said the company is not relying on its sporty car for success, it has pivoted to become a car and technology company, an acknowledgement that car-making alone is too capital-intensive to sustain.

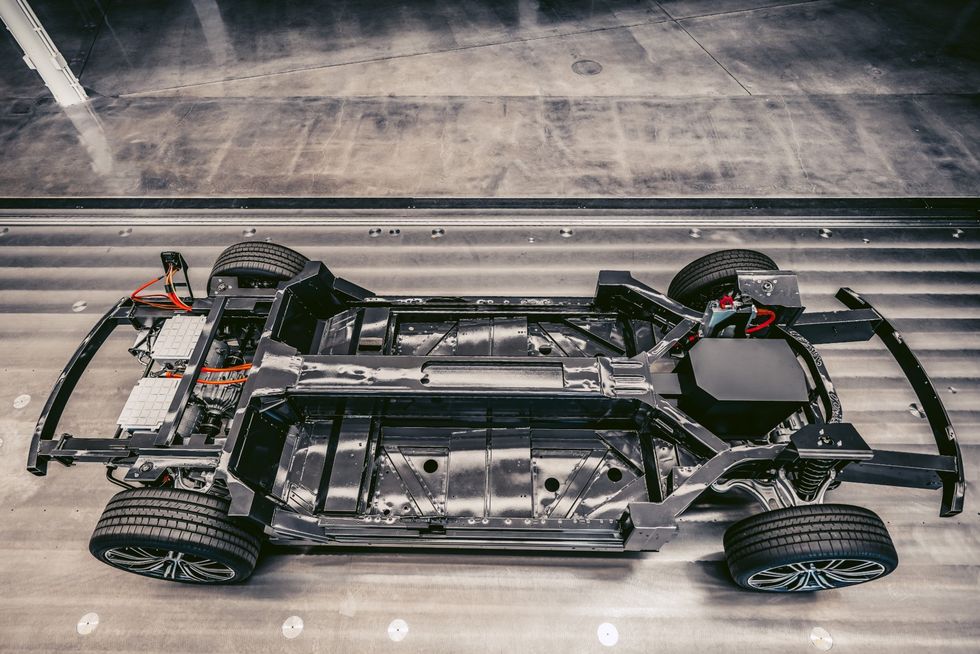

Inside their corporate headquarters five so-called platforms, these modular engine and frames that make up the undergirding design of their electric car, are laid out just beyond the lobby. Using their show floor for these boxy, under-the-hood products is a nod to just how central that strategy has become.

"It is a strategy we have to improve our efficiency and reduce the complexity," said Kevin Zhang, Karma chief technology officer. The modules can be used for Karma's own cars or be sold to larger manufacturers, he explained.

There's appetite for these. Earlier this year, Hyundai Motor Group - one of the world's largest carmakers - tapped Torrance-based startup Canoo for their platform . The terms of the deal weren't disclosed, but a similar deal between the Korean automaker and UK-based Arrival catapulted the startup to unicorn status.

Karma is also working on developing a delivery van that it hopes to sell to major fleet operators like Amazon, FedEx and UPS. Already, competitor Rivian has secured a commitment from Amazon for 100,000 cars.

"Amazon has much higher demand than the hundred thousand they're gonna get from Rivian. They also have a much higher demand for different types of vehicles..Same thing for UPS. Same thing for FedEx," Elley said. "There is a tremendous opportunity there."

Do you have a story that needs to be told? My DMs are open on Twitter @racheluranga. You can also email me.

- A Super-Charged Electric Vehicle Market: Rivian, Fisker and Karma ... ›

- Los Angeles Could Soon See More Jobs in the Electric Vehicle ... ›

- Rivian, Fisker and Karma Rake in Funds - dot.LA ›

- Karma Automotive Lays Off 60, Mostly in Irvine - dot.LA ›

- Karma Automotive Comes Up with $100M in New Funding - dot.LA ›

- Canoo Is Set to Go Public - dot.LA ›

- Karma prices its electric car at $79,000 - dot.LA ›

- Canoo to Go Public After Shareholders Approve Merger - dot.LA ›

- Foxconn Is Eyeing Sites in U.S., Thailand to Build EVs - dot.LA ›

- Rivian, Based in Irvine, Files to Go Public - dot.LA ›

- Just to Monitor Driving and Sell Insurance By the Mile - dot.LA ›

- Rivian IPO Filings Show Losses Before Going Public - dot.LA ›

Rachel Uranga is dot.LA's Managing Editor, News. She is a former Mexico-based market correspondent at Reuters and has worked for several Southern California news outlets, including the Los Angeles Business Journal and the Los Angeles Daily News. She has covered everything from IPOs to immigration. Uranga is a graduate of the Columbia School of Journalism and California State University Northridge. A Los Angeles native, she lives with her husband, son and their felines.

Image Source: Revel

Image Source: Revel