🔦 Spotlight

Hello LA!

If you are reading this while watching the clouds stack up over the city, you are not wrong. The forecast is calling for heavy rain and possible flooding through Sunday, so consider this your permission slip to cancel a few plans, stay dry and catch up on what the hard-tech crowd has been building this week.

Let us start with the least subtle name in local defense tech. CHAOS Industries just closed a $510 million dollar round led by Valor Equity Partners, valuing the company at $4.5 billion dollars and pushing its total funding past the $1 billion dollar mark in under three years. The company builds Coherent Distributed Networks radar, essentially a mesh of smaller, lower cost sensors that can pick up drones and other low flying threats minutes earlier than legacy radar systems, a gap that has become painfully obvious on modern battlefields. The new capital is going toward product development and manufacturing so militaries and border agencies can actually field these systems at scale rather than treating them as one-off experiments.

What makes CHAOS interesting is not just the size of the round but the architecture choice. Instead of a single massive radar on a hill, they are betting on distributed, software first networks that can be upgraded, repositioned and re-tasked as threats change. It is a very cloud-era way of thinking about defense hardware, and it is pulling engineers from a mix of aerospace, gaming and traditional software backgrounds into a category that used to be the domain of slow, closed incumbents.

Image Source: Valar Atomics

Image Source: Valar Atomics

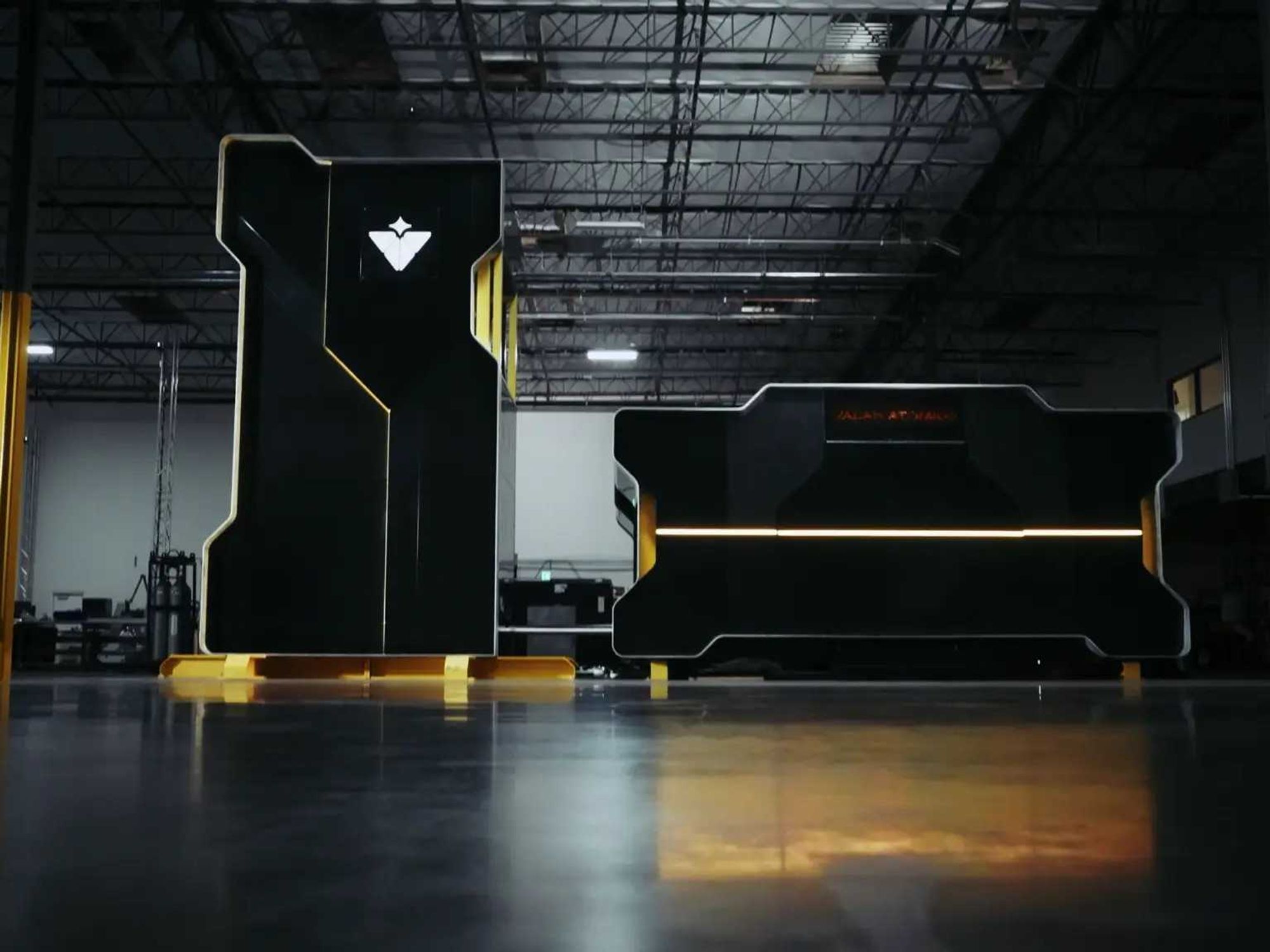

If CHAOS is focused on keeping the skies manageable, Valar Atomics wants to keep the lights on for everything that needs compute. The Hawthorne based nuclear startup raised $130 million dollars in Series A funding led by Snowpoint Ventures, with participation from Crosscut Ventures and a roster of deep tech backers that includes Palmer Luckey and Palantir CTO Shyam Sankar. Valar is building compact, high temperature gas reactors that use TRISO fuel and helium coolant, designed for strong safety characteristics and very high operating temperatures.

Instead of a single gigantic nuclear plant, Valar’s plan is to mass produce one standardized reactor design and cluster hundreds of them on “gigasites” that sit directly behind the meter for big energy users. Think hydrogen production, AI data centers, heavy industry and synthetic fuel plants, not just electrons on the grid. Construction is already underway on a first test reactor in Utah, targeted for completion in 2026, and the company is positioning itself as part of a new wave of nuclear companies that treat reactors as a product you replicate, not a megaproject you tolerate.

Image Source: Waymo

Image Source: Waymo

On the consumer side, your weekend mobility options are getting an upgrade too, weather permitting. Waymo has begun routing paid robotaxi rides onto freeways in Los Angeles, alongside San Francisco and Phoenix, after years of staying mostly on surface streets. The company says freeway segments can cut some trip times by as much as half, making a driverless ride to LAX or a cross town trek on the 405 feel less like a novelty and more like a practical option. Regulators and human drivers now have to figure out what it means to share the fast lane with cars that never get tired and never text at red lights.

Image Source: Apple

Image Source: Apple

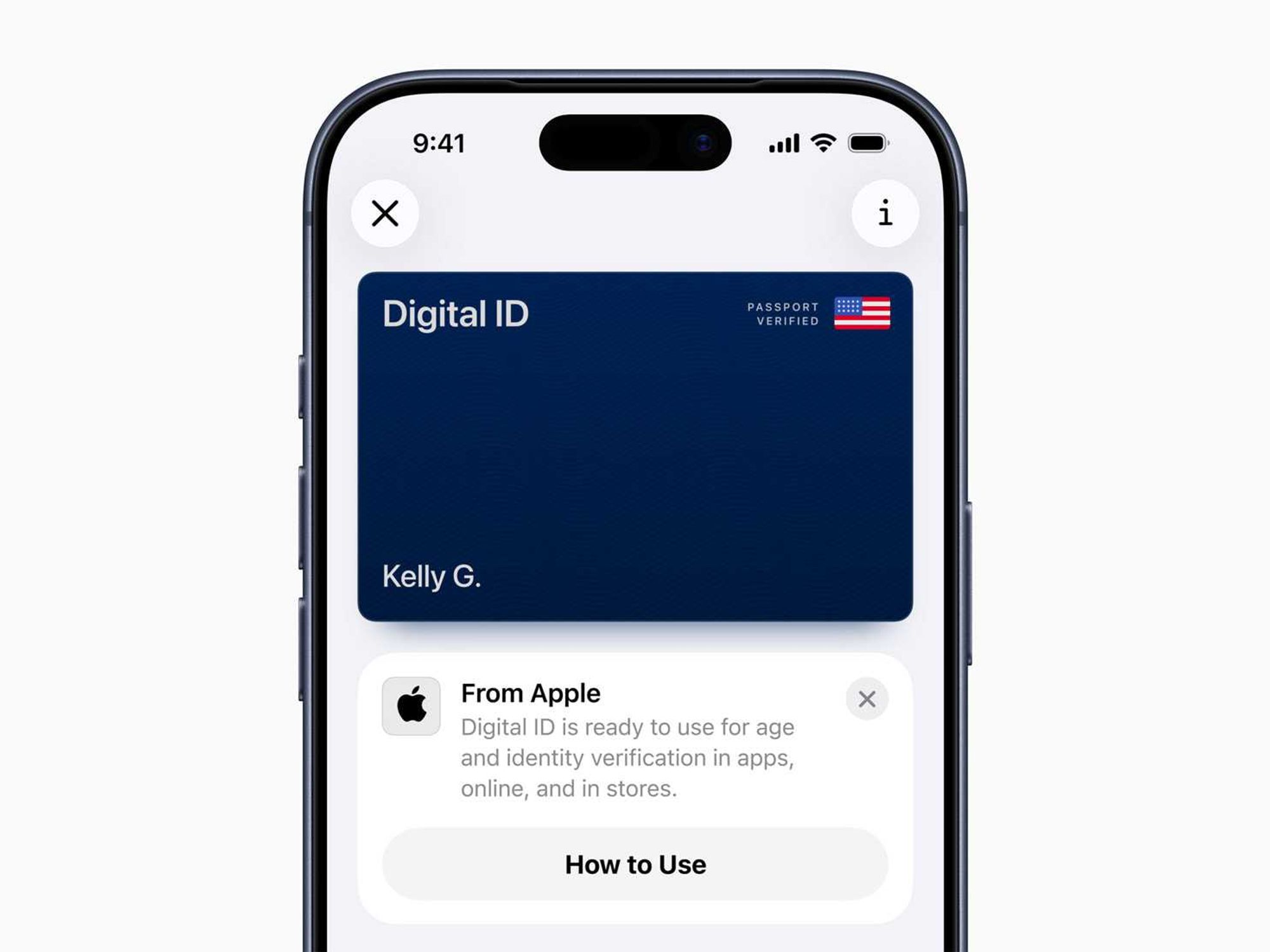

Apple is also coming for the least fun part of any LA trip: the airport ID check. The new Digital ID feature lets you create a passport based identity inside Apple Wallet that TSA will accept at more than 250 airports for domestic travel, including LAX. You scan your passport, verify with Face ID and then present your Digital ID at TSA checkpoints using your iPhone or Apple Watch without handing over your device. It will not replace a physical passport for international flights, but it does mean boarding passes, credit cards and ID can all live in the same tap-to-go flow the next time you sprint to Terminal 4.

Between radar that sees drones earlier, reactors that promise industrial scale clean power and robotaxis that hop on the freeway, a lot of the future is quietly being wired in while you hunt for an umbrella. Stay safe, stay dry this weekend and keep scrolling for this week’s venture rounds, fund announcements and acquisitions.

🤝 Venture Deals

LA Companies

- Skims has raised $225M in new funding at a $5B valuation, in a round led by Goldman Sachs Alternatives with participation from BDT & MSD Partners. The company plans to use the capital to accelerate its shift toward brick-and-mortar retail and international expansion, while continuing to invest in product innovation across intimates, shapewear, apparel, and activewear, including its new NikeSKIMS collaboration; Skims is on track to surpass $1B in net sales in 2025, just six years after launch. - learn more

- Neros has raised $75M in a Series B round led by Sequoia Capital, with participation from existing investors Vy Capital US and Interlagos, bringing its total funding to over $120M. The El Segundo based defense drone startup will use the capital to massively scale production of its Archer and Archer Strike FPV drone platforms and ground control systems, expand industrial capacity, and deepen a China-free, allied supply chain. The raise coincides with Neros being selected as one of the primary FPV drone suppliers for the U.S. Army’s Purpose-Built Attritable Systems program, following a major Marine Corps drone order. - learn more

LA Venture Funds

- BAM Ventures joined Exowatt’s new $50M financing round, backing the Miami based company’s push to deliver dispatchable, American made solar power to AI data centers and other energy hungry industrial sites. The round, an extension of Exowatt’s $70M Series A led by MVP Ventures and 8090 Industries, brings the company’s total funding to $140M in under two years. Exowatt will use the capital to expand U.S. manufacturing and scale deployments of its modular P3 system, which stores solar energy as heat and converts it to electricity on demand to provide round the clock, grid independent power. - learn more

- WndrCo joined the $145M Series B round for Alembic, the AI marketing analytics startup it first backed in early 2024, as the company’s valuation jumped to $645M. The round was led by Prysm Capital and Accenture and will help Alembic scale its platform, which uses AI to link brand marketing across channels like TV, podcasts and social media to real sales outcomes. Alembic also plans to use part of the funding to build a new Nvidia powered supercomputing cluster in San Jose to support growing demand from enterprise customers. - learn more

- Magnify Ventures joined Joy’s $14M Series A round, backing the San Francisco based startup’s push to build an AI powered parenting platform that blends machine intelligence with real human experts. Co-led by Forerunner and Raga Partners, the funding coincides with the launch of the Joy Parenting Club app, which gives new parents and parents of toddlers 24/7 access to certified coaches plus AI driven guidance, milestone tracking and personalized product recommendations. Joy plans to use the capital to further develop its AI model, expand partnerships with baby and parenting brands, and grow its expert network to support families through more stages of childhood. - learn more

- Overture VC, via its climate focused Overture Climate fund, reupped in Harbinger’s $160M Series C round as the medium duty electric and hybrid truck maker continues to scale its U.S. built EV platform. The round was co led by FedEx, Capricorn’s Technology Impact Fund, and THOR Industries, and includes existing backers like Tiger Global, Ridgeline, Maniv Mobility, Schematic Ventures, Ironspring Ventures, ArcTern Ventures, Litquidity Ventures, and The Coca Cola System Sustainability Fund. Harbinger will use the capital to ramp production of its electric stripped chassis platform and fulfill an initial FedEx order for 53 Class 5 and 6 trucks, supporting large fleet electrification and last mile delivery use cases. - learn more

- Sound Ventures joined the $60M Series B round for GC AI, an AI platform built for in-house legal teams, alongside lead investors Scale Venture Partners and Northzone. The new funding values the San Francisco based startup at $555M and brings its total capital raised to $73M. GC AI will use the money to accelerate product development and deepen its integrations and AI agents, building on rapid growth to more than 1,000 customers, $10M in ARR, and 1.75 million legal prompts processed in under a year. - learn more

- Fulcrum Venture Group doubled down on its backing of Code Metal, joining the startup’s $36.5M Series A to support its push to bring verifiable AI powered code translation to mission critical industries. Led by Accel at a $250M valuation, the round also brought in RTX Ventures, Bosch Ventures, Smith Point Capital, Overmatch VC, AE Ventures, Shield Capital, J2 Ventures, and several strategic angels. Code Metal will use the capital to expand its platform across defense, automotive, and semiconductor customers, promising formally verified, regulation-ready code that can be ported between chips and modernized much faster than traditional methods. - learn more

- MarcyPen Capital Partners led Rebel’s $25M oversubscribed Series B to scale the company’s returns recommerce marketplace, which helps retailers resell open box and overstock goods instead of sending them to landfills. The new capital will fund expansion into outdoor and sporting goods categories with existing retail partners and support broader growth of Rebel’s tech platform, which processes and resells returned products at up to 70 percent off retail while tackling the trillion dollar returns problem. - learn more

- Halogen Ventures joined Auditocity’s $2M seed round alongside Techstars, Innovate Alabama, and several angel investors to help scale the company’s AI driven HR compliance auditing platform. The Alabama based startup plans to use the capital to expand nationally and deepen its intelligent automation tools so HR teams can spot compliance risks in real time and resolve issues before they become costly problems. - learn more

- Upfront Ventures joined Majestic Labs’ more than $100M financing as the AI infrastructure startup emerged from stealth with a new memory centric server architecture. Founded by ex Google and Meta executives, the company claims its all in one servers deliver up to 1000 times the memory capacity of top tier GPU systems, effectively replacing multiple racks with a single box for the largest AI workloads. Majestic will use the capital to grow its team, finish its full software stack, and run pilot deployments with customers looking to cut power use and costs while training massive models. - learn more

- Alexandria Venture Investments and Freeflow Ventures joined an oversubscribed round of more than $100M for Iambic, a San Diego based biotech using an AI driven discovery platform to develop new cancer therapies. The clinical stage company will use the fresh capital to expand its operations and advance a pipeline that includes IAM1363, a HER2 targeted candidate that has already shown early anti tumor activity, as well as additional AI designed programs and pharma partnerships. - learn more

- EGB Capital joined Extellis’ $6.8M oversubscribed seed round, backing the Durham based startup’s push to deliver reliable, all weather satellite imagery at industrial scale. Led by Oval Park Capital with participation from Duke Capital Partners, First Star Ventures, New Industry Ventures, Front Porch Venture Partners, and Blue Lake VC, the funding will support Extellis’ first satellite launch and initial product rollout. - learn more

- Core Innovation Capital joined Arrived’s $27M Series B style funding round, backing the Seattle startup’s push to make fractional real estate investing feel more like buying stocks. Led by Neo with participation from Forerunner Ventures, Bezos Expeditions, and other investors, the new capital will help Arrived scale its “stock market for real estate” platform and recently launched Secondary Market, which lets investors buy and sell shares of individual rental homes across the U.S. with just a few clicks. - learn more

- Strong Ventures participated in a new pre Series A round for Provotive, the company behind AI packaging design platform Packative. The round was led by Japanese VC firm Miraise, with Korean fund VNTG and a Japan based strategic CVC also joining. Provotive plans to use the capital to expand its AI driven packaging services across Japan, Korea, and the broader Asian market, helping brands quickly generate localized, customized packaging at scale. - learn more

LA Exits

- Nativo is being acquired by family safety and location app Life360 in a cash and stock deal valued at about $120M. The acquisition folds Nativo’s native ad platform, programmatic tools, and publisher network into Life360’s advertising business so brands can reach families both inside the Life360 app and across CTV, mobile, and premium web environments. The companies say the combined platform will offer a full funnel, privacy minded, “family safe” ad solution and expect the deal to close in January 2026, pending customary approvals. - learn more

- RealtyMogul, an online real estate crowdfunding and investment platform, has been acquired from its venture backers by The Wideman Company, a cash flow focused, high touch real estate investment firm. The deal gives RealtyMogul a long term owner while keeping its brand and digital marketplace intact, supporting a member base that has invested more than $1.2B of equity into properties valued above $8B. The Wideman Company says the acquisition will bring additional capital and strategic support to expand RealtyMogul’s offerings and deal flow for individual investors and real estate sponsors. - learn more

Download the dot.LA App

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

Image Source: Waymo Image Source: Apple

Image Source: Apple