Get in the KNOW

on LA Startups & Tech

XGR0 Presents: 7 Tips to Dominate SEO For Your Brand

Google doesn’t publicly reveal the “secret sauce” that powers their search algorithm, and the company makes tweaks and adjustments all the time to continually make results cleaner and more effective. But despite all of this mystery and complexity, it’s still possible to improve your site’s performance using a few relatively straight-forward steps.

According to Kevin Miller, the co-founder and CEO of the Los Angeles-based digital marketing agency GR0, having a major positive impact on these rankings can be as simple as setting up profiles on major social media sites and web directories. “Platforms like Glassdoor, BuiltIn and Clutch to name a few have incredibly strong domain rankings, allowing those profiles to rank highly on Google searches,” Miller explained. “For most companies, if your profile is built out properly, it has a very strong chance of ranking on the first page of your brand name. This allows a brand to basically dominate Page 1 SERPs (Search Engine Results Pages) within a short span of time."

GR0 offers a bespoke B2B service with just one mission: to help brands rank #1 on Google. GR seeks to demystify the SEO process for their clients, allowing them to realize their full potential and deliver unmatched value to every customer. Now, in collaboration with dot.LA/the Founders guide, they are for the first time sharing its secret sauce: 7 tips to get your brand conquering SEO.

STEP 1: GETTING STARTED / BASIC TIPS

The first and most important step of all comes right at the top: making a list of the keywords and phrases, in addition to your brand name, that you most want to emphasize in Google results. Bear in mind that the most popular and commonly searched words and phrases are extremely competitive, so it’s wise to choose some secondary or tertiary keywords as well. (Rather than trying to rank for the term “dentist,” for example, try “West Philadelphia dentist” or “painless West Philadelphia dentist” or “painless low-cost West Philadelphia dentist.”)

You’re going to include these keywords in every item about your product or company or service that you post on other sites, so they should be relevant and natural for you to work into sentences.

STEP 2: GLASSDOOR

Glassdoor is a large and very well-established service allowing tech employees to rate and review their employers.

As with Comparably, there are a number of benefits to having an “Employer Profile” on Glassdoor. It’s a way to take control of the conversation and showcase your company and brand in the most positive and effective way possible, giving potential hires a clearer idea of what it’s like to work for you.

STEP 3: GOOGLE MY BUSINESS PAGE

“My Business” pages are a free tool from Google that helps companies manage their online presence. This is a particularly important tool for local businesses seeking to gain greater exposure in their immediate region or primary area of operation, because Google organizes search results based on your location while searching. This means a business with a clearly marked location will perform better in searches from people in that area.

Google uses the date from the My Business pages to power its “Knowledge Graph,” an important component in how the algorithm structures and organizes information. As well, Google creates a Maps location for every My Business listing, so your company will now appear in Google Maps searches and searches within any third-party platform using the Google Maps API.

STEP 4: CRUNCHBASE

Crunchbase collects basic information about startups and industry trends, and contains profiles on individual companies. Because it’s a long-standing and trusted resource that also allows business owners to customize and flesh out their profiles, it’s also a powerful SEO tool.

When filling out your Crunchbase profile, specifics are always better than vague generalities or “marketing speak.” As well, avoid using phrases like “my company” or “our company.” Whenever you can, without sacrificing readability, throw your brand name in there.

Fill out the complete profile without missing any major steps. “Founding date” is a popular search among Crunchbase users, so make sure you have this filled in as well. Also, bear in mind that investors primarily use Crunchbase to investigate funding, so the more thorough you can be in those sections – including links to articles about your previous rounds, if available – the better. Also be sure to update your Crunchbase file when there’s important news about your company.

STEP 5: BUILT-IN LA

This community for startups, tech companies, and their employees has a local element: in addition to Los Angeles, there are Built-In sites serving Austin, Boston, Chicago, Colorado, New York, San Francisco, Seattle, and more. The site is largely structured around employee satisfaction and recruitment, but it’s also another quality link pointing back to your business, which increases your visibility among people scanning LA tech startups more generally.

STEP 6: COMPARABLY

Comparably is a community tool allowing staffers to review and discuss their employers safely and anonymously. For employers, in addition to the SEO benefits of setting up a Comparably profile, having a favorable Comparably page with fair and accurate employee reviews can be a great way to attract additional talent.

Because Comparably is established in its vertical, and features original editorial content that keeps the site active and relevant, their pages show up high on Google for dozens of search terms related to jobs and job seeking. This helps not only with recruitment but media visibility as well; these profiles are a great way to amplify public-facing employee perks and programs, such as diversity and inclusion efforts.

STEP 7: CLUTCH

Clutch.co is also built around ratings and reviews, but from a B2B perspective rather than employee and employer. The Clutch platform provides in-depth reviews of companies offering B2B services based on analytics and feedback from former clients, to see how businesses and their services compare within specific markets. These profiles have all the same benefits as the employee-facing services, but exclusively for businesses that want to catch the attention of other managers, founders, and startups in the B2B space.

STEP 8: SOCIAL MEDIA

While the previous steps were based around setting up one-time profiles, some of which require occasional updates, it’s also important for your company to regularly post fresh content to major social media sites, including Twitter, LinkedIn, and Facebook.

Social media posts don’t directly contribute to your SEO ranking, but links that are shared across these platforms increase your company’s exposure, and can ultimately help improve your rankings in a number of ways. Studies have repeatedly found a correlation between social shares and SEO ranking for individual links.

It’s a good practice to tweet at least once or twice every single day, and then post this same content to your company’s LinkedIn and Facebook profiles.

From Your Site Articles

- How to Bootstrap a Startup Company - dot.LA ›

- Anorak Ventures 8 Marketing Principles for Early Startups - dot.LA ›

- Ranker Makes its Mark on LA's Skyline In Mid-Wilshire - dot.LA ›

Related Articles Around the Web

In 2013, one of my first assignments in graduate school was to read an article in The New Yorker about Google’s new autonomous car. Back then it sounded like autonomous vehicle (AV) technology was just around the corner—that we stood on the precipice of some new golden era in transportation where cars would form fuel-efficient caravans on highways and parents could send those cars to pick the kids up at school without having to leave the office early. People with disabilities would have access to new levels of personal freedom. Traffic accidents would be a thing of the past.

Now, a full decade later, exactly none of those things have come to pass, and in the process autonomous vehicles have become emblematic of the tech companies’ tendency to over-promise and under-deliver. “Self-driving cars have been one year away for ten years,” the joke goes.

And no company has felt this scorn more directly than Tesla. The electric vehicle giant has endured a series of high profile missteps related to its autonomous technology, and CEO Elon Musk has been extremely incorrect about the timeline for its implementation. Last week Tesla announced a recall of 363,000 vehicles due to issues with its full self-driving software, which, despite its name, does not even offer full self-driving.

This is all to say that it was not without some trepidation that I decided to accept an invitation earlier this month to a ride in Waymo’s autonomous vehicle. Waymo began as the “Google Self-Driving Car Project” in 2009–four years before I’d read the New Yorker Story. The company changed its name and became a subsidiary of Alphabet Inc (Google’s parent company) in December 2016. Waymo is headquartered in Mountain View, CA, which would ordinarily put it outside the watchful purview of dot.LA, but the self-driving start up is setting up shop in Santa Monica.

I meet Waymo Communications Manager Sandy Karp and product manager Vishay Nihalani a few miles from the Pacific Ocean at Virginia Avenue Park around 10am. They’re standing outside a white Jaguar E-PACE equipped with an ostentatious array of cameras, lidars, and radars. Our plan is to have the car drive us to a donut shop on Wilshire Blvd, get a donut, rendez-vous with the car again, and instruct it to chauffeur us back to the park.

The trip begins with the press of a button on a touch screen on the back of the center console. The elephant in the room (or in this case the car), is that there’s actually a person in the driver’s seat. Lindsay Alara, an Autonomous Specialist for Waymo, keeps her fingertips lightly in contact with the steering wheel and her feet waiting near the pedals just in case the vehicle does something it shouldn’t.

In Arizona, Waymo has been running its fully autonomous ride hailing operation with no human present in the car since as early as 2020. But California’s stricter regulatory environment means that her job is safe here, for now.. Waymo is applying for the necessary permits to move the system to fully autonomous, but the process is likely to take months, says Nihalani. The company is spending that time training and validating its AI in new neighborhoods.

“We've expanded in the cities that we're operating in,” says Nihalani. “In San Francisco we’re driving 24/7; in downtown Phoenix we’re driving 24/7. We're driving an increasing set of road speeds, weather conditions, so on and so forth,” says Nihalani. With its primary education complete in Arizona, Nihalani says the AI is picking up the subtleties driving in Los Angeles and San Francisco quite quickly. “That’s something that we're really excited by, I think it’s what's enabling an acceleration of momentum, which may have been different than what we've seen in the past few years.”

Waymo’s city-by-city, street-by-street approach to autonomous driving illuminates a paradigm shift in the way we need to think about the technology, says, Alex Bayen, a transportation and systems engineer at Berkeley. Autonomous driving will probably never be something that’s “solved” all at once, but rather something that develops over time. “I think the right way to look at things is that every year there are more and more use cases where an increased level of automation has become a reality,” says Bayen. “Every company which is trying to grab some real estate in this new technological world, what they're doing is they're trying new use cases. Autonomous vehicles are not going to go everywhere initially, and they are not going to be there all the time. They are only going to operate in specific conditions.”

As that envelope of use cases pushes outward, Bayen and other researchers say now is the time to talk about how autonomous vehicles should be regulated. As easy as it is to imagine the benefits of driverless cars, it’s equally easy to imagine the potential for pitfalls.

Ride sharing services, in general, have been shown to increase traffic and congestion in cities. So the potential for fleets of unoccupied “ghost cars” to exacerbate Los Angeles’ already abhorrent traffic conditions should be a real concern for policy makers today. Likewise, for private owners, it may prove cheaper to send a vehicle back home during the work day rather than pay for parking at the office. Or the convenience of autonomous vehicles may make it tempting for parents to use one to chauffeur their kids to school rather than have them take the bus. All of these scenarios would worsen traffic and increase emissions–even if the cars are electric. In one study, researchers at the University of Washington found that AVs could either cut our greenhouse gas emissions roughly in half or double them, depending on how the technology is implemented.

“There's a potential for real net positive, if we get leaders in the public sector and the private sector to work together to ameliorate some of those known problems that we suspect will happen,” says Ben Clark, a professor of public administration planning, public policy and management at the University of Oregon. “We don't want to be in the same position as we were when Uber came to town and we were very reactive.”

According to Clark, state governments should be thinking about how to tax or charge for miles driven by unoccupied vehicles and how to incentivize sharing individual vehicles between multiple people, families, or groups. As the use case envelope for autonomous vehicles expands, the model for car ownership may have to change in order for us to actually reap the benefits. The never ending delays to autonomous vehicles may be frustrating or amusing to consumers, but they also should be giving policy makers ample time to see these issues coming. “It's actually an invitation to elected officials to look at this and figure out how to not have a jungle, but how to have a well organized garden where things work properly,” says Bayen.

On our donut run, the vehicle moves cautiously and smoothly; it navigates streets lined with parked cars and turns with poor visibility. It identifies and avoids construction cones. It deftly changes lanes and passes unloading trucks.

Riding in an autonomous vehicle invites you to see the streets with fresh eyes, and suddenly it becomes easy to see why the technology has taken so much longer to arrive than we might’ve expected. Our roads are littered with “edge-case” obstacles. Other drivers don’t always follow the exact rule of law; people go out of turn at 4-way stops; cyclists filter through traffic at red lights, pedestrians jaywalk; emergency vehicles trump all the rules. “The California Stop is a real thing,” jokes Nihalani.

Still, none of that explains one strange moment as we cross over the 10 freeway where the car begins to slow down as we approach a greenlight even though there’s no obvious sign of danger or obstacle in our path. I instinctively look over my shoulder to see if someone is going to rear end us, but the moment passes quickly and the car–for whatever reason–decides the way forward is safe once more. While Alara never has to intervene, it’s a small reminder that the technology is still on its way.

Are we there yet? We’ll get there when we get there.

From Your Site Articles

- Motional Links With Uber to Make Robotaxis a Reality ›

- Autonomous Vehicle Companies Doubled Their Testing Miles In California Last Year ›

- Motional Will Double Its Staff As It Begins Testing Autonomous Vehicles in Santa Monica ›

- The Evolution of LA’s Robotaxi Industry: A Timeline ›

- 🚙 DotLA's Experience in Waymo's Self-Driving Car - dot.LA ›

Related Articles Around the Web

Read moreShow less

Coronavirus Updates: Talespin's HR Tips Managing WFH Staff; TikTok Ticks Up 2 Billion Downloads

Apr 29 2020

Here are the latest headlines regarding how the novel coronavirus is impacting the Los Angeles startup and tech communities. Sign up for our newsletter and follow dot.LA on Twitter for the latest updates.

- Talespin releases learning tools for HR as staff works remotely in pandemic world

- TikTok's 2 billion download record as quarantine drives hunt for content

Talespin releases learning tools for HR as staff works remotely in pandemic world

Talespin

Culver-City virtual reality training startup Talespin announced Wednesday it is unveiling a series of learning modules for the COVID-19 age called "Leading Through Uncertainty." Modules include Creating Calmness Through Succinct Communication, Regulating Emotions During Uncertain Times, Communicating Productively with a Distraught Employee, De-Escalating an Emotionally Charged Situation, and Disagreeing Productively During Challenging Times.

Talespin is best known for a dystopian demonstration it released showing an older worker being laid off, but Talespin CEO and Co-Founder Kyle Jackson tells dot.LA the new modules are more focused on helping employees adapt to how their companies are changing rather than layoffs. He also says Talespin is getting more interest lately from Fortune 250 companies interested in training a more remote workforce. "There's a big belief that we're going to make a leap forward in the next phase of work," said Jackson. "They are starting to explore this stuff more meaningfully."

The new modules will be available in partnership with Cornerstone, which invested in Talespin's $15 million Series B funding round last month. "The current climate has created a renewed focus on workplace learning and has accelerated the need for leaders to develop new skills to help their organizations respond and adapt quickly to their new environment," Heidi Spirgi, Cornerstone's Chief Strategy and Marketing Officer, said in a statement.

TikTok's 2 billion download record as quarantine drives hunt for content

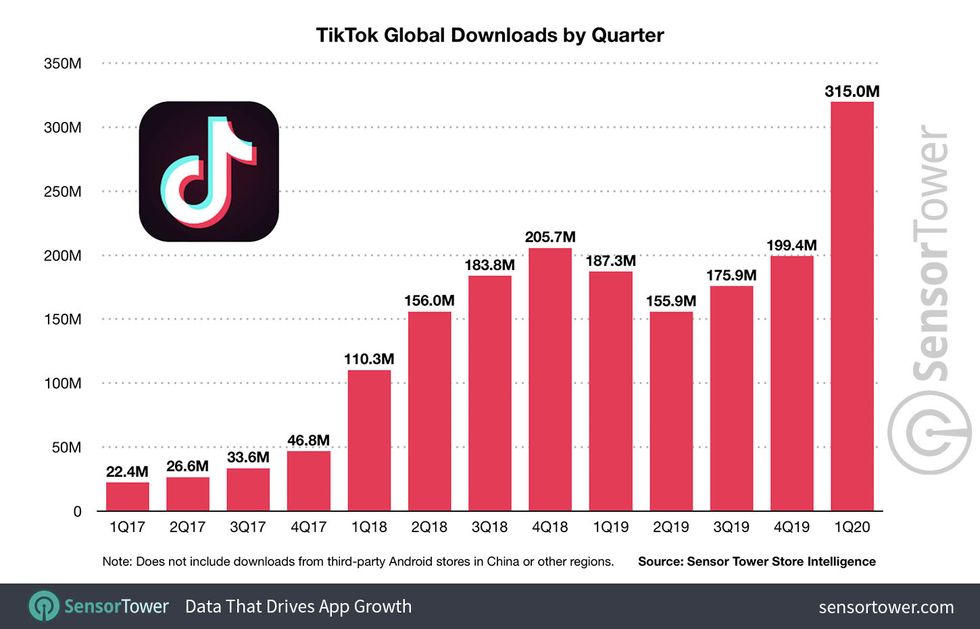

Social video app TikTok, the popular video sharing app owned by Chinese media company ByteDance, has been downloaded more than 2 billion times globally on the App Store and Google Play, according to Sensor Tower Store Intelligence estimates. The latest milestone comes just five months after TikTok surpassed 1.5 billion downloads. In Q1 2020, it generated the most downloads for any app ever in a quarter, accumulating more than 315 million installs across the App Store and Google Play.

Sensor Tower reports that "while the app was already popular and backed by a large user acquisition campaign, TikTok's latest surge comes amid the global COVID-19 pandemic, which has seen consumers drawn to their mobile devices more than ever as they look for new ways to shop, work, and connect with others."

From Your Site Articles

- Coronavirus Updates: Talespin's HR Tips Managing WFH Staff ... ›

- Coronavirus Updates ›

- Talespin's VR Employee Training Program - dot.LA ›

Related Articles Around the Web

Read moreShow less

RELATEDEDITOR'S PICKS

LA TECH JOBS