B2U's Plan to Transform More Depleted Electric Car Batteries into Solar Storage

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

Nissan Leaf's were one of the first mass-marketed electric vehicles to hit the market. Now, as their first generation batteries are reaching the end of their ability to power electric vehicles, the question has become what to do with tens of thousands of batteries piling up.

One Santa Monica-based company, B2U Storage Solutions, has found a solution: transforming these batteries and those from other car manufacturers into storage for solar energy, effectively creating an 8.5 megawatt solar power plant in the Lancaster desert. The stored solar energy can then be sold to the grid to power the region in the evenings, when the demand for electricity is high and energy from the sun isn't available.

With a state ban on the sale of new gasoline-powered cars set to take effect by 2035, millions of electric vehicles are expected to be sold in California in the coming years. It's created a headache for policymakers who are grappling with how to regulate the disposal of these batteries.

Worried about the glut of batteries, state Assemblymembers Brian Dahle and Phil Ting wrote legislation that was signed into law in 2018 aimed at creating a plan. The Lithium-Ion Car Battery Recycling Advisory Group, consisting of car manufacturers, the salvage industry, recyclers and nonprofits and facilitated by the California Environmental Protection Agency, are studying what regulations should be in place when it comes to the disposal of EV batteries.

"With California continuing to expand its rollout of zero-emission vehicles, it is critical that we as a state prepare for the large-scale battery recycling necessary to accommodate the transition to greener technology," said Mark Isaac Isidro, legislative director for Assemblyman Tom Lackey, a co-author of the bill whose district includes Lancaster.

Recycling lithium-ion batteries can be tricky because they are comprised of metals like lithium, cobalt and nickel that are difficult to recycle. The battery cells are also glued together with strong adhesives, making it hard to separate them. It is often cheaper to mine new metals.

But energy storage is one solution.

B2U CEO Freeman Hall is making a pitch that the batteries should be given a second life before they're recycled.

"We're helping gain that trust with the [original equipment manufacturers] because they're such an important voice in how the rules will get written on lifecycle management and we want to make sure that they understand that reuse is a very good place to go when risk is managed appropriately," he said. "And we think we can be the leading reuse provider for batteries in second life stationary storage and we think that we have a good business model to manage that risk at scale."

Hall said his business sits at the intersection of two big societal and environmental needs: transforming the power sector into renewable energy and transitioning the transportation sector toward electrification.

Maria Xylia, a research fellow at SEI - Stockholm Environment Institute and co-author of a report called "Beyond the Tipping Point: Future Energy Storage," agrees. Batteries are often considered useless for cars after they reach 80% of their battery capacity, she said.

"So that means that you have a whole lot left which is not applicable for car vehicle applications, but it's great for stationary storage and all these other opportunities, so why waste this opportunity?," she said. "It's a great way of handling the question of what you do with batteries and improving even more the environmental benefits from electrification in the transport market."

And investors are watching. B2U recently closed a nearly $10 million Series A raise that will help it expand its capacity at the Lancaster site and to bring on another site in Southern California by the second or third quarter of next year. The round was led by the power division of Japanese trading conglomerate Marubeni.

By this time next year, Hall plans to produce about a total of 50 megawatt hours with both projects.

The Lancaster array contains about 500 batteries. By early next year, Hall expects that number to reach 1,000.

Hall said the typical cost of recycling a battery is $500 to $700. If the batteries can be reused, it will reduce the cost of recycling.

"We can pay for those batteries rather than OEMs having to pay for the recycling," he said.

B2U purchases the batteries from manufacturers like Nissan, typically when they're at 65% of their capacity or greater. Hall said he's looking at salvage yards as another supplier; that's generally where cars end up that can no longer run because of powertrain issues, for example.

The batteries are kept in their original casing, eliminating the need to repurpose them, and placed into large cabinets that are wired to each other, using the company's proprietary technology, to create a large-scale energy storage system.

The batteries slowly charge during the day and once the sun goes down, B2U sells the energy to the grid when wholesale market prices are more expensive.

Aging studies conducted by B2U show that each battery can run for about 2,000 cycles before they are no longer useful. Each day is about 1 cycle, resulting in an additional five and a half years of use.

"Things are working very well. We're making pretty good money and we do believe we're proving our thesis that our proprietary technology using these second-life batteries is going to be a lower cost and we will be able to sort of demonstrate the reliability and performance over time of the solution," Hall said.

- Universal Hydrogen Plans for a Hydrogen-Fueled Airline - dot.LA ›

- Thin Line Capital's Aaron Fyke on Clean Tech Investing - dot.LA ›

- DroneBase Raises $7.5M to Inspect Wind and Solar Farms - dot.LA ›

- Romeo Power’s CEO on the Future of E-Vehicles and Batteries - dot.LA ›

- California is Getting More Hydrogen Fueling Stations - dot.LA ›

- Electric Vehicle Industry Heading Toward Battery Shortage - dot.LA ›

- EV Battery Maker Statevolt Is Embracing a ‘Buy Local’ Ethos - dot.LA ›

- Here's What EVs Are Doing to California's Energy Grid - dot.LA ›

- Largest Battery Project in California Goes Online - dot.LA ›

- Largest Battery Project in California Goes Online - dot.LA ›

- B2U Storage Solutions Opens New Recycled EV Battery Facility - dot.LA ›

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

Image Source: Valar Atomics

Image Source: Valar Atomics Image Source: Waymo

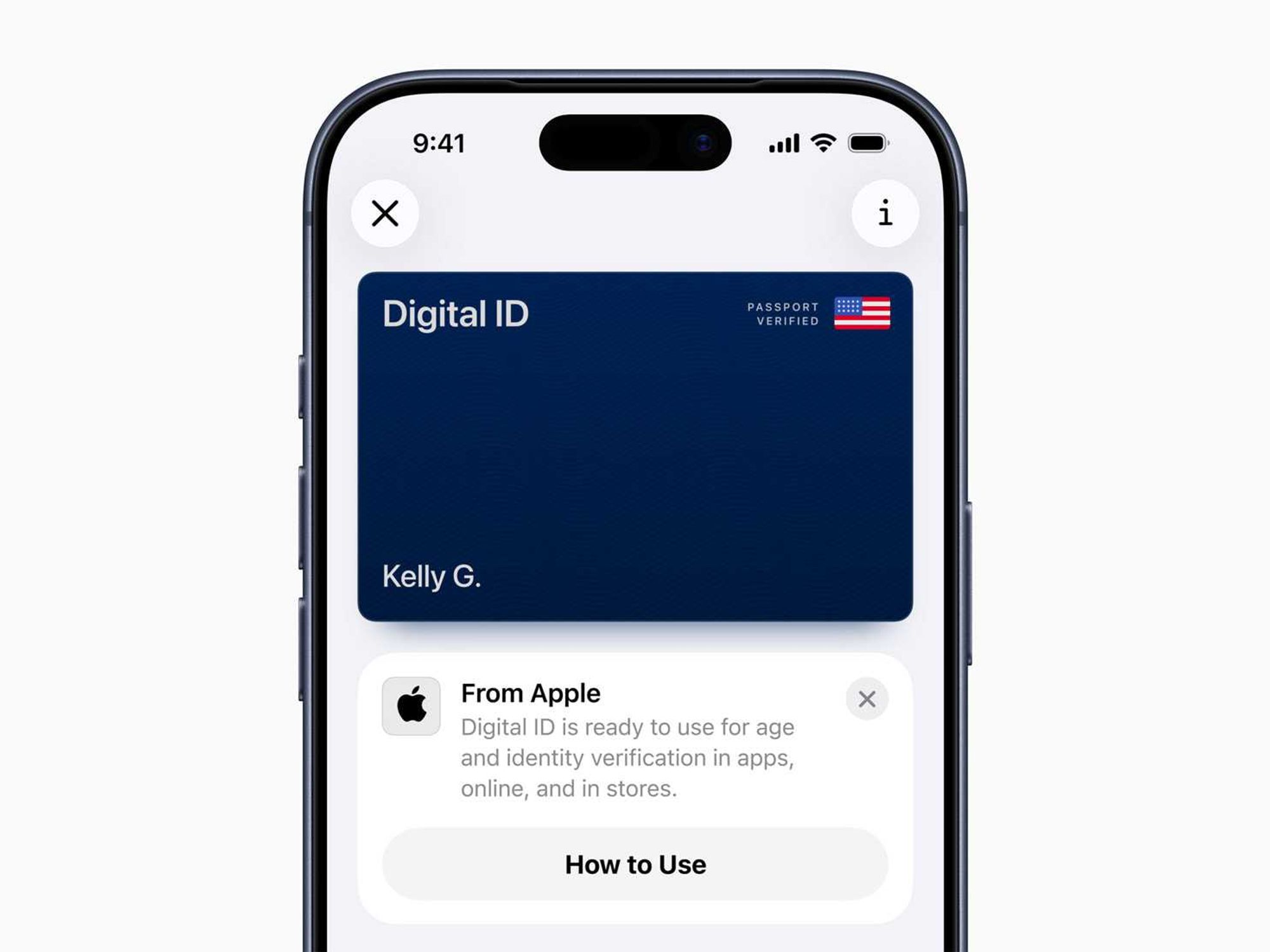

Image Source: Waymo Image Source: Apple

Image Source: Apple