Goodbye, Diesel: Inside Romeo Power’s Plan to Electrify Trucks Nationwide

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

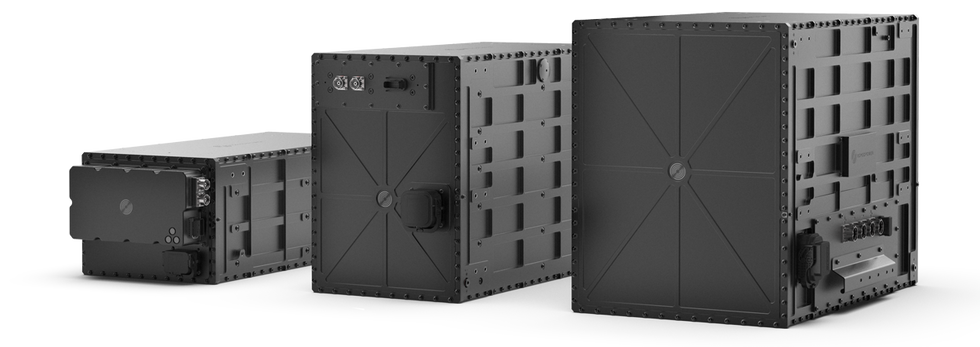

At a time when most electric vehicle manufacturers are struggling to deliver cars or finance their operations, electric battery maker Romeo Power is surging ahead. The five-year-old company founded by former SpaceX and Tesla engineers manufactures and sells renewable electric batteries to the makers of delivery vehicles and long-haul trucks.

The company went public last December and so far this year has reported $47.5 million in income, compared to a net loss of $22.7 million this time last year.

Romeo Power President and CEO Susan Seilheimer Brennan said the company has secured orders from several buyers — though she won't disclose who — including at least one commercial customer in Southern California. To keep up with demand, the company will be moving to a new 215,000 square-foot headquarters in Cypress from their home base in Vernon. The layout will give Romeo more lab space to develop new battery products.

But Brennan has larger goals. She wants to electrify the pollution-emitting trucking industry, one fleet at a time.

With over three decades of experience in the auto industry under her belt, she has worked at legacy auto manufacturers including running plants at Ford, General Motors and Nissan, where she led development of its electric Nissan Leaf vehicle and was the vice president of Nissan North America's manufacturing. Right before coming to Romeo, Brennan was the chief operations officer for San Jose-based clean energy firm Bloom Energy.

Brennan spoke with dot.LA over the phone to discuss Romeo's recent earnings and how its business might be able to mitigate the damage the trucking industry is causing to our planet.

This interview has been lightly edited for length and clarity.

What are some of the buyer concerns you've had to address and what converts them?

The number one concern is reliability. Trucking companies are only making money when the truck is moving, so if there is an issue with reliability, and the truck isn't moving, that's their most significant issue. You can have whatever opinion you have on diesel, (but) there's probably 100 years of reliability data on diesel. It's challenging to make change anyway, it's exceptionally challenging to make change, when the incumbent has most of the attributes that are most important to the customer.

Today diesel has the reliability. (But) it's noisy, which is something I hadn't thought of until I heard one of our customers on a panel speaking about truck drivers they had interviewed after driving our product and how the (electric) driving experience is so much better for them — it's quieter, it doesn't rattle them to death, they can see that their knees and their backs will take much less wear and tear.

But if you look at just the pure economic model, we need to make sure that we are not having any negative impact on distance, charge time (which would be the equivalent of filling it up with diesel) and reliability.

People generally will convert based on total cost of ownership.We're in a little bit of a unique situation, because we're not selling the vehicle, so we have to convey that our piece of the total cost of ownership of their vehicle is a sell.

What in your background drew you to working with Romeo Power? What about the company made you decide to take the role of CEO?

I'm passionate about solving really, really hard problems — that's my passion and that's followed me throughout my career. I grew up in a steel town, so air quality is more than just theoretical. For me it's something I'm very passionate about, and my family still lives in that field town.

So I want to see American manufacturing be successful and I completely believe that manufacturing and communities can coexist, if done the right way. What I saw in my community — what is now known as the rust belt — is these factories pollute or these industries pollute, so let's move them somewhere else and that's not the right answer. The right answer is to figure out how to make the factories better and make the communities better and have that coexistence.

Now I find myself taking my scientific background, my automotive experience, and my energy experience along with my passion for technology and for a planet that everyone can coexist in and putting that all into Romeo power. Being on the board of Romeo got me immersed into the auto industry from a 50,000-foot level. So the reason I chose Romeo was really that it is a company that's trying to solve really hard problems.

What are your goals for Romeo Power's upcoming next fiscal year? Where's the company headed?

Our goal is to sell to vehicle manufacturers that have fleets.

With our customers right now, because our goal is to have as much range as possible. So the vision that I painted for my team is let's understand what drivers do today, and how do we make that trip the same for them, if you can imagine a charger there instead of a gas pump. Ultimately, our goal has to be that we don't add any more burden to the user of the product, we actually take away the burden.

For us to be relevant and stay relevant, we have to grow very quickly. We have backlog (and) we have to satisfy our customers. So in order to do that, we need to take the customers that we have today and have commitments to and fill those orders.

Why open the new facility in Cypress?

The reason that we are successful with the technology is we have manufacturing and engineering under the same roof. As new opportunities, new players and new technology arises, we can test it immediately. So we have engineering, testing and production all under one roof. But we are exploding the roof (in Vernon) right now. We could have left production here and used the floor here for manufacturing and moved engineering and the corporate offices, but it's really imperative for us to keep everybody together for now.

We have about 250 employees and are growing, and we are hiring - we need manufacturing engineers, we need manufacturing technicians. We need (research and development) engineers (and) we need salespeople.

How has the demand for Romeo's power supply changed the business?

So, right now, what we're working on is meeting the demand that has been created. The transition you're seeing is coming out of our backlog, we're converting those orders.

We understand what it takes to build the battery, you know, the industrialization of the battery, we now are targeting people that we are confident will benefit from our battery. We are really working hard so that people can come here and touch and see the product, and drive demand with you know, with reality. So we're here in a real factory, we have real products, we have real throughput.

There's always a fair amount of skepticism when you're changing something, and changing something as significant as a powertrain on a vehicle but we now are very comfortable that we have the visibility and the credibility to start bringing it to customers.

Does being an independent battery manufacturer have any benefits or drawbacks attached?

Clearly if you have the support of a major company some things are easier but what is harder is getting these really interesting technologies through the bureaucracy.

The reason that I enjoy working at Romeo is… if you look at the speed at which innovation comes out of these very large companies, in my opinion, it is much slower than the speed at which innovation comes out of a nimble and smaller company.

- B2U Transforms Electric Car Batteries into Solar Storage - dot.LA ›

- LA City Officials Push For Electric Vehicle Master Plan - dot.LA ›

- Electric Vehicles' Charging Challenges - dot.LA ›

- LA Auto Show Unveils 7 Electric Vehicles You've Never Seen - dot.LA ›

- Nikola Acquires Romeo Power - dot.LA ›

- The Weirdest and Wildest Gadgets from CES 2023 - dot.LA ›

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

Image Source: Skyryse

Image Source: Skyryse