As the rest of the United States remains in a slowdown for venture capital investing, Los Angeles is slowly rebounding from a previous quarter slump but remains far off the record-breaking year it saw in 2021.

Analysts at PitchBook Data Inc. and the National Venture Capital Association found that nationwide, investors are still skittish, investing in fewer deals and cutting smaller checks. Total money invested in the U.S. in the third quarter reached a nine-quarter low of $43 billion, and deal counts also fell across all sectors, down 20% from the first quarter of this year, according to PitchBook’s most recent Venture Monitor report for the months of July through September.

Companies that target sales are seeing exit activity fall, too. PitchBook noted that 2022’s exit activity has been “lethargic,” and reported the combined value of company sales so far this year is on pace to fall below $100 billion for the first time since 2016. Of all the exit revenue generated so far this year across the country, PitchBook found that almost 50% of that value came from acquisitions.

Only 59 public listings have happened so far this year, compared to a record 303 VC-backed companies that went public last year. PitchBook reported only five companies went public through traditional IPOs in this third quarter.

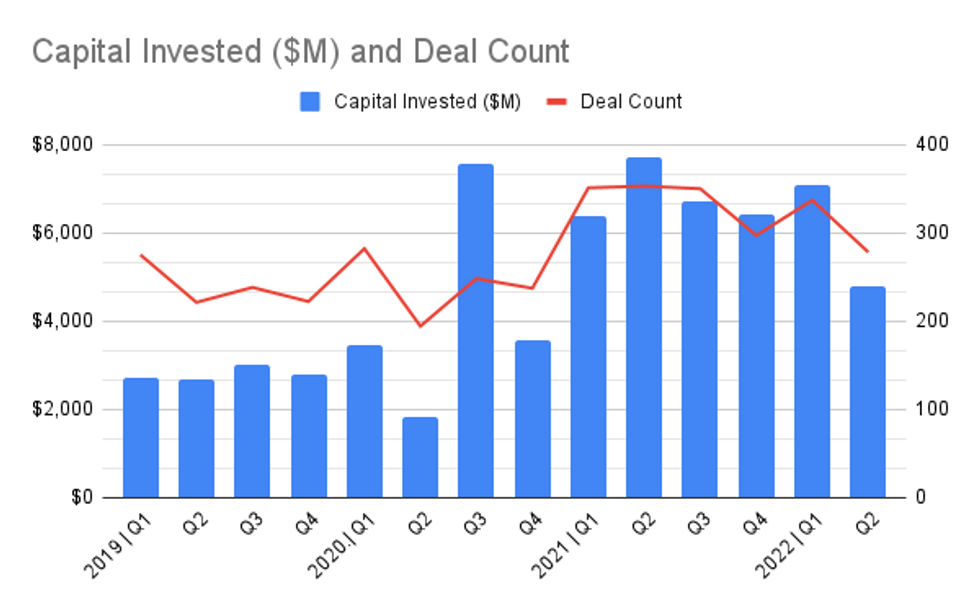

In Los Angeles, however, there might be some light at the end of the tunnel for investors and startup founders. The number of deals conducted in the third quarter totaled 321, and the overall deal value was $7.1 billion. That’s up roughly 39% from the previous quarter, which saw VCs invest a combined $4.8 billion in L.A. startups across 278 deals.

“I think a lot of capital is on the sidelines,” said Tarek Waked, founding partner of West Hollywood-based Type One Ventures. “Things are slowing down, people are spending less. [Limited partners] are being more risk-averse with their money.”

Nonetheless, according to PitchBook, L.A. saw some of the highest valued deals last quarter. Its average deal size was around $15 million, slightly behind the Bay Area, but more than other key metro areas like New York or Boston.

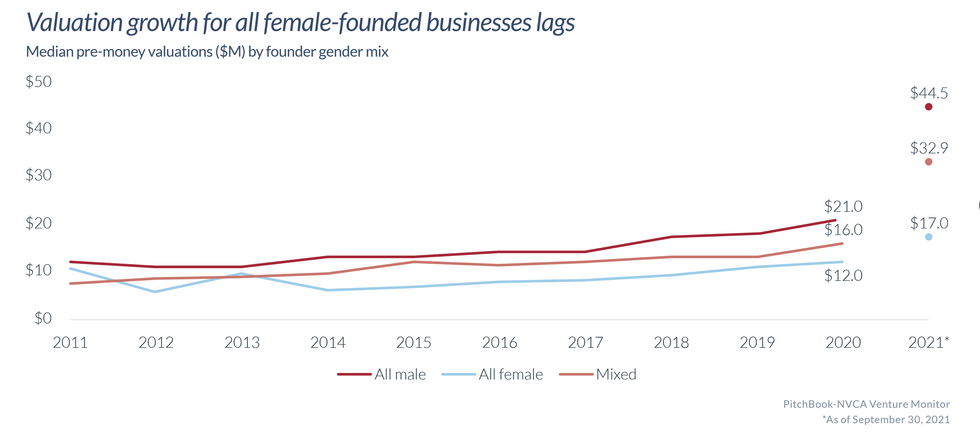

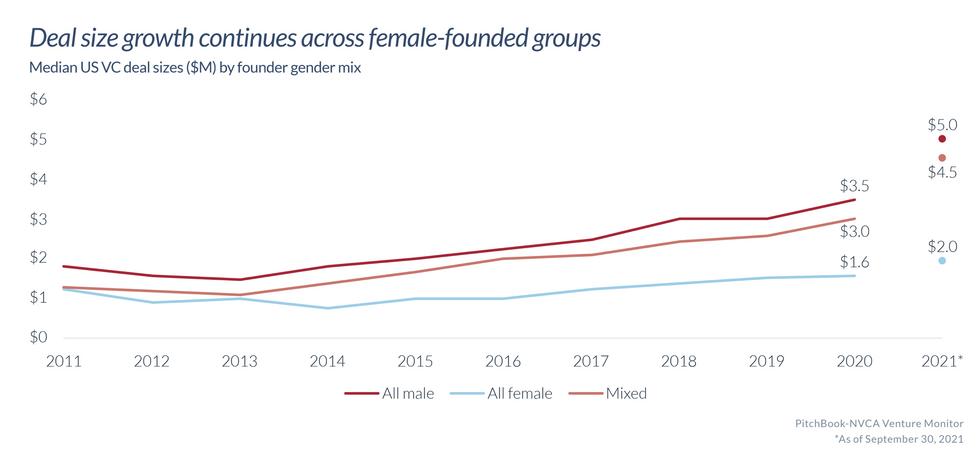

But not everyone is feeling the momentum. Los Angeles' women founders have had a tough year so far. PitchBook recently began tracking capital raised by companies with all-female founding teams and found they only raised a combined $1.9 billion so far since 2019, far behind New York and the Bay Area, where female founders raised $4.9 billion and $5.5 billion, respectively. PitchBook reported that “amid economic downturn, female-founded companies are receiving less capital.”

“The VC slowdown narrative that has been pervasive in the market this year has finally materialized in the data, with nearly every metric aside from fundraising falling sharply in Q3,” PitchBook CEO John Gabbert said in a statement Thursday. “The VC ecosystem, however, has shown remarkable resilience in the face of continued economic headwinds, raising record levels of capital and closing an unexpectedly high number of deals.”

This so-called downturn might just be a correction, or regression to the norm, after 2021’s record highs.

“In many ways, 2021 was an outlier year, and the VC market is now returning to pre-pandemic levels and long-term trends of steady growth,” Gabbert added.

Anna Barber, partner at Santa Monica-based VC M13, said she agreed that last year's boom in activity was outside the norm.

"I think the venture market of 2021 was the anomaly and we'll see venture activity return to a measured pace given all the money sitting on the sidelines right now," Barber told dot.LA. She added that M13 expects residential property tech companies in particular to be in for a rough ride given rising interest rates which could cause a slump in home sales, but noted some industries M13 is targeting as potential growth sectors include financial services, identity management, ecommerce and Web3 consumer technology and developer tools and platforms. (Disclosure: M13 is an investor in dot.LA).

"Many VCs, including us, have been focused for the past few months on our own portfolio and ensuring our companies are well-positioned and well-capitalized. But no one should expect a massive rush of VC funding all of a sudden," Barber cautioned. "What's more likely to happen is that deployment timelines will be extended... Meaning VCs will take slightly longer to invest the capital they currently have rather than going back to the market to raise more when the market is challenging."

Even if they aren’t doling out checks at the same generous rate in the past, VCs still continue to raise funds at a rapid pace. So far this year, VC fundraising nationwide already surpasses last year’s record high – PitchBook found that VC funds set a new annual high of roughly $151 billion raised throughout 2022, compared to $147 billion raised throughout all of 2021.

"I agree that there is a lot of VC money that has been raised and needs to be deployed," said Minnie Ingersoll, partner at Los Angeles-based TenOneTen Ventures. "Personally, I think that as valuations come down and we get back to 'normal' multiples, then this should be a great time to be deploying capital."

According to Waked, some investors seem to be trying to wait out the storm, because markets have been subject to so much volatility in the past year. But he expects that to rebound soon, adding that, “once that uncertainty is quelled, I think you're going to see an uptick.”

While the overall venture community might be hitting a speed bump, Waked said that in his specific areas of investment, including space and deep technology, investment isn’t showing signs of slowing down.

“I'm not blind to the state of the world and the market,” he noted. “But I think as a VC, you're ultimately an optimist… You're investing in the potential upside, not the potential downside.”

Ingersoll said the slowdown seems to be hitting later stage companies in particular.

"We have not seen a slowdown in our pipeline or in our pace of deployment, but I see it and hear about it from later stage companies -- both in our portfolio and outside our portfolio," Ingersoll told dot.LA. "In the growth stages it's more obvious which are the breakout companies and most of the really good growth companies raised in 2021. Also, if a company has plenty of runway, then they wouldn't choose to go to market to raise now."

Ingersoll predicted that more layoffs could hit tech in the near future; she added, "another round is coming and so there is going to be more pain before we get back to the go-go days. That said, entrepreneurship continues to be a bright spot in our country and a less tight labor market may enable more startup growth as we know that times of change and turbulence do lead to innovation."

This story has been updated to reflect additional comment from M13.

Deal activity in the Los Angeles MSA since 2019. Source: PitchBook Data

Deal activity in the Los Angeles MSA since 2019. Source: PitchBook Data