Get in the KNOW

on LA Startups & Tech

X

Courtesy of Mercedes-Benz/Bosch

Mercedes-Benz Offers a Glimpse Into a Future Where Your Car Parks Itself

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

Sign up for dot.LA's daily newsletterfor the latest news on Southern California's tech, startup and venture capital scene.

Angelenos famously hate parking, but soon their cars may be able to park themselves thanks to a collaboration between Mercedes-Benz and German engineering firm Bosch.

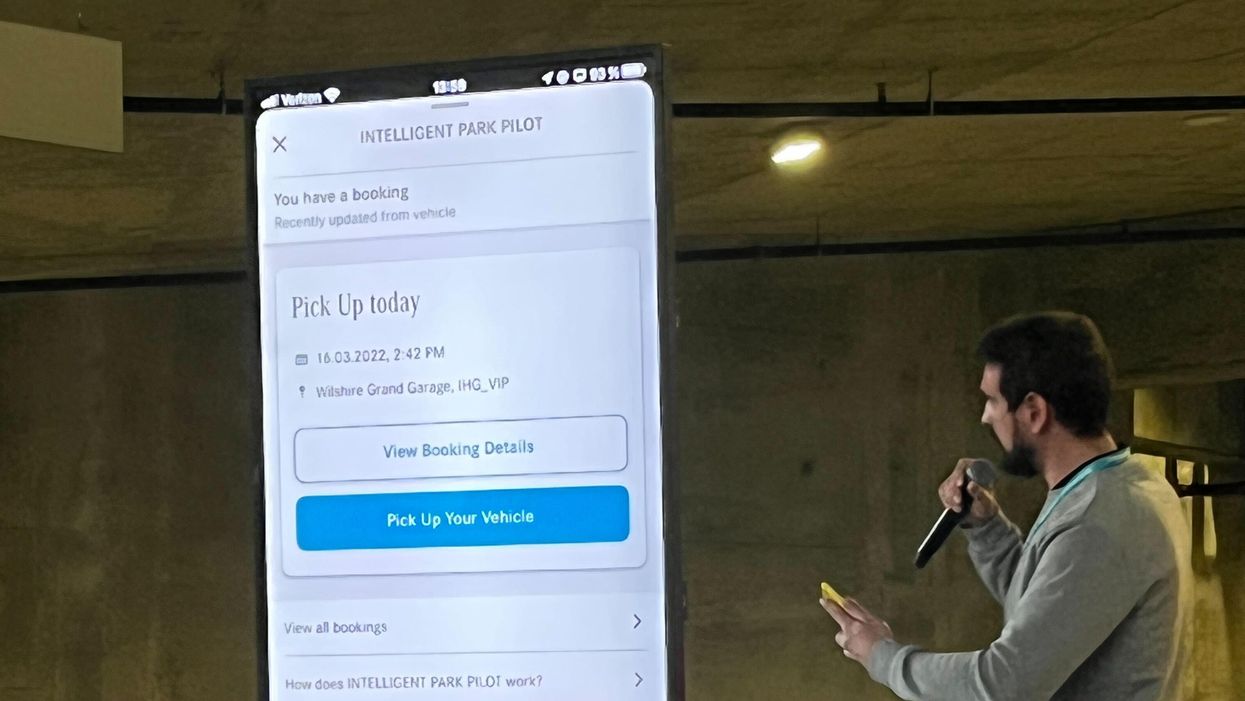

At a demonstration in Downtown Los Angeles on Wednesday, Mercedes and Bosch gave the first U.S. test run showcasing the fruits of their collaboration: an electric Mercedes-Benz 2022 EQS 580 luxury sedan capable of navigating itself into a parking spot.

Painted in bright teal stripes, the sedan first let its driver out at a designated spot. Then, a tap of a Mercedes-Benz phone app locked the vehicle and sent it, at a gradual pace, to the first available parking space. Later, a ping from the app woke up the car—which turned itself on, pulled out of the parking spot and slowly made its way to the driver’s pickup point.

A Bosch engineer stepped in front of the car several times as it was driving to demonstrate its safety features; if sensors detect a presence or any motion in front of the car, they’ll tell it to stop a safe distance away. (For extra security, a person walked alongside the car with an emergency shut-off button.)

Kay Stepper, Bosch’s senior vice president of automated driving for North America, noted that the self-parking technology relies on sensors and cameras built into its surrounding environment, which guide the car into its space. (The sensors are installed on the ground, while the cameras are mounted above.) He added that the technology could be applied to any type of car, so long as a manufacturer makes it compatible with its vehicle.

“The unique thing is really that we are not using any of the in-vehicle sensors—it’s a purely infrastructure-based solution,” Stepper told dot.LA.

The demo marked the first time that Mercedes and Bosch have tested the technology outside of Germany. In their home country, the driverless parking capability is already installed and ready to use at Stuttgart Airport pending final regulatory approval, according to Philipp Skogstad, Mercedes’ president and CEO of North American research and development.

A handful of other auto industry names are also investing in automated valets, including the Volkswagen Group-owned CARIAD, which demonstrated its technology at an industry summit in Munich last. Yet another competitor is Maryland-based STEER. Other companies focused on autonomous technology from more of a road-driving perspective are Google’s Waymo and, of course, Tesla.

Skogstad acknowledged the increasingly crowded playing field. “Automated driving is such a complex task requiring so many pieces to come together that nobody can do that alone,” he said. “No matter how much money you have, you need partners.”

Stepper noted that Bosch is “intensely” focused on finding collaborators in the “smart infrastructure” space who can help it implement a driverless parking network. The next step, he added, is to convince local parking operators to invest in the technology. Without human error (consider that driver in your apartment building’s garage who’s always double-parked), he estimated that a fully-automated parking lot could fit up to 20% more cars.

And what about the valet workers—such as those on hand at the demo, who were kind enough to park cars for the event’s attendees the old-fashioned way? A Bosch spokesperson noted that they wouldn’t exactly be put out of business, as self-parking garages would still need humans to operate and maintain their technology and act as a safeguard.

From Your Site Articles

- Autonomous Vehicle Companies Doubled Their Testing Miles - dot.LA ›

- Motional Expands Its Autonomous Vehicle Operations in LA - dot.LA ›

Related Articles Around the Web

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

https://twitter.com/samsonamore

samsonamore@dot.la

Watch: Fundraising for Female Founders, in Partnership with Bank of America

11:21 AM | March 24, 2021

Female founder and funders explored how female founders and investors are navigating the landscape during dot.LA's recent strategy session. Watch the full video, and read our takeaways here:

Watch: Fundraising for Female Founders

Five Tips for Women Entrepreneurs Raising Money

Female founders are gaining ground in venture capital, but the funding gap between genders remains broad. ILIA founder Sasha Plavsic, Rael CEO and co-founder Yanghee Paik, Bank of America Senior Vice President and Market Manager Grace Kangdani and Upfront Ventures Partner Aditi Maliwal explored how female founders and investors are navigating the landscape during dot.LA's recent strategy session.

From Your Site Articles

- Why Funding Inequity Isn't Deterring These Female Founders, VCs ... ›

- LA Female Founders See Big Drop in Funding - dot.LA ›

- New Data Show the Pandemic Has Hit Female Founders Harder ... ›

- Spencer Rascoff Offers Later Stage Fundraising Advice - dot.LA ›

- Rael Raises $35M To Grow Its Organic Feminine Care Brand - dot.LA ›

Related Articles Around the Web

Read moreShow less

women in vcwomen in techfemale entrepeneursventure capitalstrategy sessionsupfront venturesraelilia beautyhealth and beauty

Breanna De Vera

Breanna de Vera is dot.LA's editorial intern. She is currently a senior at the University of Southern California, studying journalism and English literature. She previously reported for the campus publications The Daily Trojan and Annenberg Media.

Billion-Dollar Beauty. Billion-Dollar Radios. Only in LA.

10:39 AM | May 30, 2025

🔦 Spotlight

Hello Los Angeles,

This week, LA proved it can scale in silence and shine in the spotlight, sometimes in the same breath.

Let’s start with the quiet powerhouse.

Culver City-based Silvus Technologies is being acquired by Motorola Solutions for $4.4 billion in up-front consideration, with the potential for an additional $600 million in earnout payments, bringing the total deal value to $5 billion. Silvus builds tactical mesh radios, rugged high-bandwidth systems used by militaries, emergency responders, and defense contractors in more than 40 countries. These aren’t just walkie-talkies. They are engineered to deliver secure, uninterrupted communications in places where cell service and Wi-Fi don't stand a chance. Think natural disasters, war zones, and remote terrains. The tech spun out of DARPA-funded research at UCLA, and this deal is a reminder that LA isn’t just cranking out consumer apps and AI models. We’re exporting national security infrastructure too.

But while Silvus was locking down defense contracts, another LA startup was breaking the internet.

Rhode, Hailey Bieber’s skincare brand, is being acquired by e.l.f. Beauty in a deal valued at up to $1 billion. The structure includes $600 million in cash, $200 million in stock at closing, and up to $200 million in earnout payments tied to Rhode’s performance over the next three years. Not bad for a brand that launched in June 2022 and built a cult following off just a handful of products and a crystal-clear brand identity.

Yes, it’s celebrity-founded. But Rhode didn’t just ride a name. It built a movement. The brand cut through a saturated beauty market by doing less: launching with a few standout hero products, keeping the aesthetic clean and consistent, and using community-first marketing that turned product drops into cultural events. The results speak for themselves. $100 million in net sales over the past year and a loyal fanbase that treats peptide lip treatments like limited-edition merch.

Bieber wasn’t just the face of the brand. She helped shape the strategy, led product development, and drove creative decisions from day one. Following the acquisition, she’ll continue as Chief Creative Officer and Head of Innovation, while also stepping into a new role as strategic advisor to e.l.f. Beauty. Rhode will continue to operate independently, with its headquarters remaining right here in LA.

This isn’t just a win for Rhode. It’s another clear signal that LA is where culture, commerce, and execution come together and scale fast.

Keep reading for the latest LA venture rounds, acquisitions, and fund moves making headlines this week.

🤝 Venture Deals

LA Companies

- Bezel, a luxury watch marketplace, recently secured a $670K investment from Hyperspace Ventures as part of a broader $6.8M funding initiative. This investment aims to support Bezel's growth and enhance its platform for authenticated luxury watch trading. - learn more

LA Venture Funds

- Sound Ventures participated in the Series A funding round for General Counsel AI, a startup using artificial intelligence to streamline in-house legal work. The platform helps legal teams draft documents faster, stay compliant, and eliminate repetitive tasks by embedding company knowledge directly into its AI workflows. With Sound Ventures' backing, GC AI plans to scale its team and expand the platform’s capabilities to serve more enterprise legal departments. - learn more

- Kairos Ventures participated in Vivodyne’s $40M Series A funding round, reaffirming its commitment to advancing human-relevant drug development technologies. Vivodyne, a biotech company based in Philadelphia and San Francisco, is pioneering the use of AI and robotics to grow and test thousands of lab-grown human tissues, aiming to replace traditional animal testing in drug development. This approach addresses the high failure rate of clinical trials by providing more predictive human data, potentially accelerating the development of effective therapies. The new funding will support the expansion of Vivodyne's operations, including the opening of a 23,000-square-foot fully robotic laboratory in South San Francisco, to meet the growing demand from pharmaceutical clients. - learn more

- Fifth Wall co-led Wander’s $50M Series B funding round, joining QED Investors and others to support the company’s mission of redefining luxury vacation rentals through technology and consistency. Wander operates a vertically integrated platform that combines premium vacation homes with hotel-grade service, powered by its proprietary AI system, WanderOS. With over 1,000 properties already live and a Net Promoter Score of 85, Wander aims to scale toward 300,000 homes globally, offering a trusted and seamless experience for travelers and property owners alike. - learn more

- Clocktower Technology Ventures and Overture VC participated in GridCARE’s $13.5M seed funding round, supporting the company's mission to address the growing power demands of AI infrastructure. GridCARE utilizes advanced AI to identify and unlock underutilized grid capacity, significantly reducing the time required to power data centers from several years to just 6–12 months. By bridging the gap between AI developers and utility providers, GridCARE aims to accelerate the deployment of AI technologies while enhancing energy resilience. - learn more

- Clocktower Technology Ventures participated in Monarch Money’s $75M Series B funding round, reaffirming its support for the personal finance platform's mission to enhance financial wellness for households. Monarch offers tools for aggregating financial accounts, visualizing net worth, tracking budgets, and collaborating with partners or advisors. The new funding will enable Monarch to expand its team and further develop its platform to better serve its growing user base. - learn more

LA Exits

- TinyWins, the LA-based digital creative studio known for blending emotional storytelling with performance-driven content, has been acquired by marketing consultancy The Shipyard.Best known for its work with brands like Disney, Netflix, and Google, TinyWins will continue to operate under its own name and leadership in Los Angeles. The acquisition gives TinyWins access to deeper strategic and media resources, while The Shipyard expands its creative firepower and strengthens its presence on the West Coast. - learn more

- Churchill Management Group has been acquired by Focus Partners Wealth, marking the firm’s first external acquisition since its January rebrand. The Los Angeles-based investment advisor manages $9.4 billion in assets and will expand Focus’s national footprint in wealth management. - learn more

- Dolby Theatre, renowned for hosting the Academy Awards, has been acquired by Master Investment Group in partnership with Jebs Hollywood. The new ownership plans to introduce a series of events celebrating Middle Eastern culture, aiming to showcase the region's rich heritage, music, and traditions. This initiative seeks to foster community engagement and promote cultural exchange by bringing diverse artistic expressions from the Middle East to a global audience. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS