Watch: Our Startup Pitch Showcase on Real Estate Tech

Annie Burford is dot.LA's director of events. She's an event marketing pro with over ten years of experience producing innovative corporate events, activations and summits for tech startups to Fortune 500 companies. Annie has produced over 200 programs in Los Angeles, San Francisco and New York City working most recently for a China-based investment bank heading the CEC Capital Tech & Media Summit, formally the Siemer Summit.

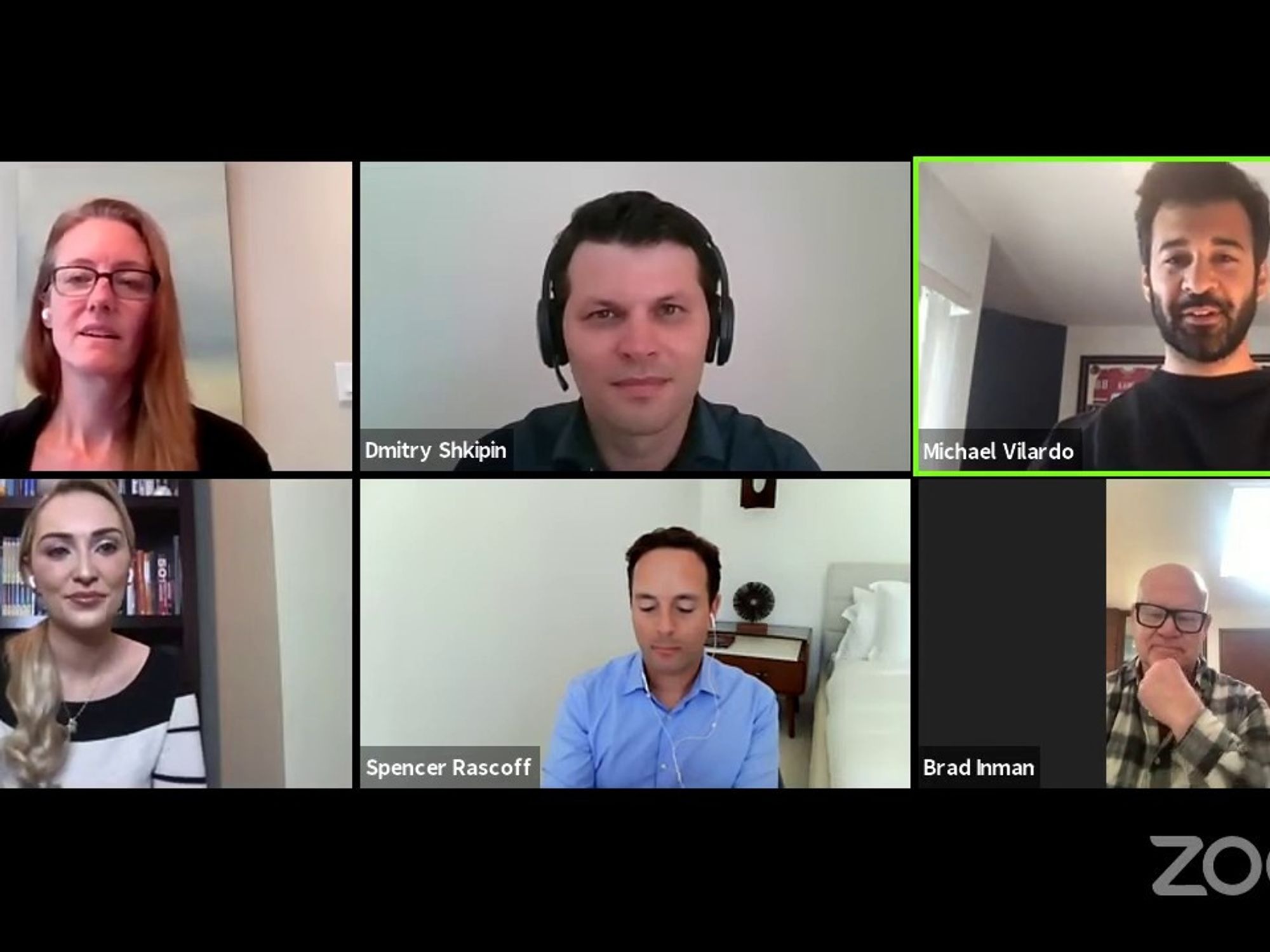

This week's virtual pitch showcase featured emerging real estate tech startups HomeOpenly, VHomes, and JoyHub.

Brad Inman, founder of Inman, the leading real estate news source along with Spencer Rascoff, co-founder, executive chairman at dot.LA will be leading the discussion as the two leading active investors and experts in this space.

Startup Pitch Showcase: Real Estate Techyoutu.be

HomeOpenly helps our users to make the opportunity of homeownership transparent, affordable, and an open experience. HomeOpenly is an innovative and young Internet company that designs, builds, and maintains a series of online marketplace solutions with focus on home search, automated valuation modeling (AVM), home buyer's and seller's representation services, mortgage origination, refinance, home insurance, renovation, design, staging, home inspections, home security, moving, home maintenance, title, escrow, cash offer stand-in programs, home warranty, and other real estate products and services. HomeOpenly utilizes Open Systems Design and Privacy by Design principles behind the unbiased information we provide and the value-added Open Marketplace™ that we maintain.

VHomes is disrupting the antiquated motel / affordable housing industries. A proptech startup that strategically identifies distressed and vacant housing opportunities, leveraging these assets and turning them into nightly, weekly, or monthly budget rental options. By providing travel or living options to those that need it most we are able to provide significant impact for our customers' lives. VHomes provides the best budget accommodation in the Sun Belt United States.

JoyHub is developing an open platform to connect and automate existing multifamily operator systems to improve operating performance, increase revenue opportunities and enhance resident engagement.

Brad Inman, founder at Inman

Brad Inman, Founder at Inman

Award-winning journalist and publisher, Brad Inman is the founder and owner of Inman, real estate's leading name in news, information and innovation since 1983. In addition, his Inman-branded real estate business and technology conferences bring thousands of thought leaders together each year to share best practices and promote innovation. Countless new products and companies have been launched at Inman conferences.

A native of Carlinville, Illinois, and a graduate of Boston University, Inman began his career as a housing policy analyst and community advocate who parlayed a weekly real estate column in the San Francisco Examiner at the dawn of the Internet era into a series of entrepreneurial ventures. In 1999, Inman founded HomeGain.com, an early provider of online marketing programs. HomeGain was sold to Classified Ventures, LLC, in 2005. That same year, Inman founded TurnHere, an online commercial video platform and, in 2008, founded Vook, an online e-publishing platform. He also was an early investor in Curbed.com and served as chairman of the board before it was sold to Vox Media. A compelling speaker, he is a regular at real estate events around the nation and has been a visiting lecturer in the School of Journalism at the University of California, Berkeley.

Spencer Rascoff, Co-Founder, Executive Chairman

Spencer Rascoff, Co-Founder, Executive Chairman

Spencer Rascoff is an entrepreneur and company leader who co-founded Zillow, Hotwire and dot.LA, and who served as Zillow's CEO for a decade. He is currently executive chairman of dot.LA and a board member at Zillow and TripAdvisor. In fall 2019 Spencer was a Visiting Executive Professor at Harvard Business School where he co-taught the "Managing Tech Ventures" course. In 2015, Spencer co-wrote and published his first book, the New York Times' Best Seller "Zillow Talk: Rewriting the Rules of Real Estate." Spencer is the host of "Office Hours," a monthly podcast on dot.LA featuring candid conversations between prominent executives on leadership, diversity and inclusion, and startups.

- Nomination a Company for Our Startup Pitch Showcase Finale ›

- Vote for Your Favorite Startup in Our Pitch Showcase Competition - dot.LA ›

- We're Looking for Startups Focused on Diverse Founders ›

- LeaseLock Wants to Take the Rent Deposit Out of Leasing - dot.LA ›

- Startup Pitch Showcase: Diverse and Underrepresented Founders in LA - dot.LA ›

Annie Burford is dot.LA's director of events. She's an event marketing pro with over ten years of experience producing innovative corporate events, activations and summits for tech startups to Fortune 500 companies. Annie has produced over 200 programs in Los Angeles, San Francisco and New York City working most recently for a China-based investment bank heading the CEC Capital Tech & Media Summit, formally the Siemer Summit.

Image Source: JetZero

Image Source: JetZero