Get in the KNOW

on LA Startups & Tech

X

Design, Bitches

Looking to Build a Granny Flat in Your Backyard? Meet the Firms and Designs Pre-Approved in LA

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

Adding a backyard home in Los Angeles is now nearly as easy as buying a barbecue.

Homeowners who for years have wanted to build a granny flat in their backyard, but dreaded the red tape, can now choose from 20 pre-designed homes that the city has already approved for use.

The shift, made official last week, will speed up a weeks-long process and bring more badly needed units to an overpriced market. It also has the potential to elevate the 14 startups and firms building the next generation of homes.

The designs for the stand-alone residences range from a 200-square-foot studio to a 1,200-square foot, two-story, two-bedroom unit. And many of the homes are filled with design flourishes, reflecting the diverse architecture of the city, from a house in the silhouette of a flower to one with a spiral outdoor staircase leading to the roof.

It's no surprise. The program was spearheaded by Christopher Hawthorne, a former architecture critic at the Los Angeles Times and now the city's chief design officer.

The firms are primarily local and startup architecture and design firms, while others are well-known with a history of building granny flats, also know as accessory dwelling units, or ADUs.

The standard plans avoid the Los Angeles Department of Building and Safety's typical four-to six-week review process and can allow approvals to be completed in as quickly as one day.

Some aspects of the plans can be modified to fit a homeowner's preferences. Eight other designs are pending approval.

Mayor Eric Garcetti believes by adding more such units, the city can diversify its housing supply and tackle the housing crisis. Recent state legislation made it easier to build the small homes on the lot of single-family residences. Since then, ADUs have made up nearly a quarter of Los Angeles' newly permitted housing units.

Because construction costs are relatively low for the granny flats – the pre-approved homes start at $144,000 and can go beyond $300,000 – the housing is generally more affordable. The median home price in L.A. County in January was $690,000.

Here's a quick look at the designs approved so far:

Abodu

Abodu

Abodu, based in Redwood City in the Bay Area, exclusively designs backyard homes. In 2019, it worked with the city of San Jose on a program similar to the one Los Angeles is undertaking.

In October, it closed a seed funding round of $3.5 million led by Initialized Capital.

It has been approved for a one-story 340-square-foot studio, a one-story one-bedroom at 500 square feet, and a one-story, 610-square-foot two-bedroom.

The pricing for the studio is $189,900, while the one-bedroom costs $199,900 and the two-bedroom is $259,900.

Amunátegui Valdés Architects

Led by Cristobal Amunátegui and Alejandro Valdés, the firm was founded in 2011 and has offices in Los Angeles and Santiago, Chile. Amunátegui is an assistant professor at the Department of Architecture and Urban Design at UCLA.

The firm designs work in various scales and mediums, including buildings, furniture and exhibitions.

Its one-story, two-bedroom with a covered roof deck 934-square-foot unit is pending approval from the city.

Connect Homes

Connect Homes has a 100,000-square foot factory in San Bernardino and an architecture studio in Downtown L.A.

It specializes in glass and steel homes and has completed 80 homes in California. Its designs have an aesthetic of mid-century modern California residential architecture.

It has two one-bedroom models pre-approved by the city, one is 460 square feet, which costs $144,500 with a total average project cost of $205,000. The other is 640 square feet, which costs $195,200 with a total project cost of $280,000.

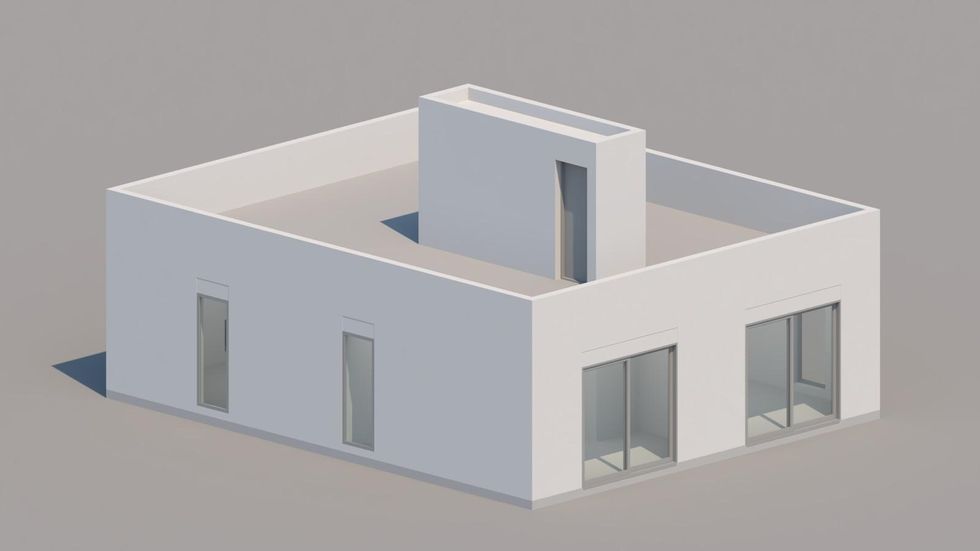

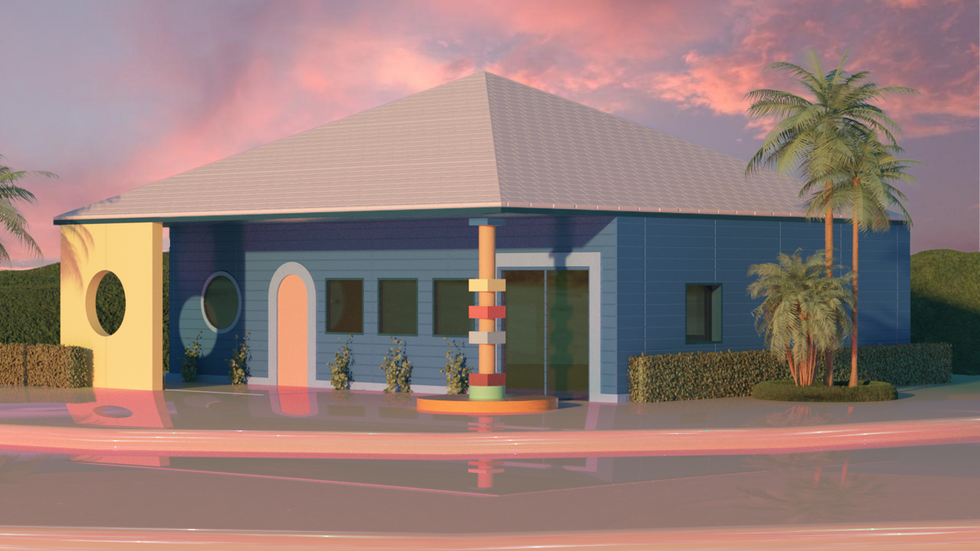

Design, Bitches

The Los Angeles-based architectural firm founded in 2010 describes itself as having a "bold and irreverent vision." Its projects include urban infill ground-up offices to single-family homes, adaptive re-use of derelict commercial buildings and renovations of historic landmarks.

Its pre-approved design, named "Midnight Room," is a guest house/ studio. Its bedroom can be left open for a loft feel or enclosed as a separate room. The design is a one-story, one-bedroom at 454 square feet.

Escher GuneWardena Architecture

Founded in Los Angeles in 1996, Escher GuneWardena Architecture has received international recognition and has collaborated with contemporary artists, worked on historical preservation projects and more.

The company has been approved for two different one-story, one- or two-bedroom units, one at 532 square feet with an estimated cost of $200,000 and another at 784 square feet with an estimated cost of $300,000. The firm noted the costs depend on site conditions and do not include soft costs. Those could add 10% to 12% to the total construction costs.

First Office

First Office is an architecture firm based in Downtown Los Angeles. Its approved ADUs will be built using prefabricated structural insulated panels, which allow for expedited construction schedules and high environmental ratings.

The interior finishes include concrete floors, stainless steel counters and an occasional element of conduit.

There are five options:

- A one-story studio, 309 to 589 square feet

- A one-story one-bedroom, 534 to 794 square feet

- And a one-story two-bedroom, 1,200 square feet

Fung + Blatt Architects

Fung + Blatt Architects is a Los Angeles-based firm founded in 1990.

The city has approved its 795-square-foot, one-story, one-bedroom unit with a roof deck. It estimates the construction cost to be $240,000 to $300,000, excluding landscape, site work and the solar array. Homeowners can also expect other additional costs.

Taalman Architecture/ IT House Inc.

The design team behind "IT House" is Los Angeles-based studio Taalman Architecture. Over the past 15 years, IT House has built more than 20 homes throughout California and the U.S.

The IT House ADU standard plans include the tower, bar, box, cube, pod and court.

The city has approved four options, including:

- A two-story including mechanical room, 660 square feet

- A two-story including mechanical room, 430 square feet

- A one-story studio, 200 square feet

- A one-story including mechanical room, 700 square feet

The firm also has another two projects pending approval: a 360-square-foot one-story studio and a one-story, three-bedroom at 1,149 square feet.

LA Más

LA Más is a nonprofit based in Northeast Los Angeles that designs and builds initiatives promoting neighborhood resilience and elevating the agency of working-class communities of color. Homeowners who are considering their design must commit to renting to Section 8 tenants.

The city has approved two of LA Más' designs: a one-story, one-bedroom, 528 square feet unit and a one-story, two-bedroom, 768 square feet unit. The firm has another design for a one-story studio pending approval. That design would be the first 3D-printed ADU design in the city's program.

Jennifer Bonner/MALL

Massachusetts-based Jennifer Bonner/MALL designed a "Lean-to ADU" project, reinterpreting the stucco box and exaggerated false front, both Los Angeles architectural mainstays.

The design has been approved for a 525-square-foot one-story, one-bedroom unit with a 125-square-foot roof deck.

sekou cooke STUDIO

New York-based sekou cooke STUDIO is the sole Black-owned architectural firm on the project.

"The twisted forms of this ADU recalls the spin and scratch of a DJ's records" from the early 90s, the firm said.

Its design, still pending approval, is for a 1,200-square-foot, two bedroom and two bathroom can be adapted to a smaller one-bedroom unit or to include an additional half bath.

SO-IL

New York-based SO-IL was founded in 2008. It has completed projects in Leon, Seoul, Lisbon and Brooklyn.

Its one-story, one-bedroom 693-square-foot unit is pending approval. It is estimated the construction cost will be between $200,000 and $250,000.

WELCOME PROJECTS

Los Angeles-based Welcome Projects has worked on projects ranging from buildings, houses and interiors to handbags, games and toys.

Its ADU is nicknamed The Breadbox "for its curved topped walls and slight resemblance to that vintage counter accessory."

It has been approved for a one-story, one-bedroom 560-square-foot unit.

wHY Architecture

Founded in 2004, wHY is based in Los Angeles and New York City. It has taken on a landmark affordable housing and historic renovation initiative in Watts.

Its one-story, one- or two-bedroom 480 to 800-square-foot unit is pending approval.

Firms that want to participate in the program can learn more here . Angelenos interested in building a standard ADU plan can learn more the approved projects here.

From Your Site Articles

- United Dwelling Raises $10M to Address the Housing Shortage ... ›

- Plant Prefab Raises An Additional $30 Million - dot.LA ›

- How 3D Printing Could Help Tackle Homelessness in LA - dot.LA ›

- New Bills, New Startups Address Housing in California - dot.LA ›

- LA's ADU Culture Still Faces Financial Barriers - dot.LA ›

- What Will Take To Make Modular Homes Mainstream? - dot.LA ›

Related Articles Around the Web

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

Behind Her Empire: Hitha Palepu on Women Founders and the 'True' Failure

05:00 AM | October 21, 2021

Rhoshan Pharmaceuticals CEO Hitha Palepu joins this week's Behind Her Empire to talk about how she became an angel investor focused on women-founded businesses and her latest book, "We're Speaking: The Life Lessons of Kamala Harris."

Palepu is the daughter of immigrants who came to the U.S. from India. Her father lost his hearing when he was 10 years old. He got through school by lip reading; it wasn't until he arrived in the states he got his first hearing aid.

"All he wanted was the chance to get started in the scientific world. He had his master's in chemistry," said Palepu. He worked scrubbing toilets at McDonalds while trying to land a job as a bench chemist. Her mother left behind a life of privilege in India.

"I think that sums up who I am today, I was born a daughter of incredibly tenacious, hard-working parents who got rejected over and over and over again, and never let that stop them," said Palepu.

With the help of her parent's money manager, Palepu realized she could become a serious investor. It wasn't until about her third investment she felt like calling herself an actual investor.

"I do like to get my hands dirty with my companies and help out however I can. I'm not here to tell them how to run [them], I invest in people that I trust to run their companies," said Palepu.

She learned quickly that women face more hurdles as CEO and investors, as opposed to men, who often get a pass when their companies fail.

"It makes me so mad," she said. "Not only are we not allowed to fail, [but] the business press loves building up a woman CEO or any underrepresented CEO or founder just to tear them down."

For Papelu, business losses don't define failure. "There's just a failure to progress, staying still and not growing and not striving and not learning. That's the true failure."

In this wide-ranging conversation, we hear about Papelu's time in the corporate world, why she ultimately decided to go out on her own, and the many lessons she learned from her first "failure" in the startup world.

From Your Site Articles

Related Articles Around the Web

Read moreShow less

Yasmin Nouri

Yasmin is the host of the "Behind Her Empire" podcast, focused on highlighting self-made women leaders and entrepreneurs and how they tackle their career, money, family and life.

Each episode covers their unique hero's journey and what it really takes to build an empire with key lessons learned along the way. The goal of the series is to empower you to see what's possible & inspire you to create financial freedom in your own life.

JetZero Just Raised $175M to Rewrite How We Fly

07:06 AM | January 16, 2026

🔦 Spotlight

Happy Friday, Los Angeles ✈️

While everyone in tech is still busy arguing about the next AI model, one startup based out of Long Beach just raised a whole lot of money to change the shape of the airplane itself.

JetZero closed a $175 million Series B to build its blended wing body “all-wing” airliner, with B Capital leading the round alongside United Airlines Ventures, Northrop Grumman, 3M Ventures, Trucks VC and RTX Ventures. The company is working toward a full-scale Demonstrator aircraft that targets at least 30% better fuel efficiency than today’s tube-and-wing jets, with a first flight planned for 2027 and a commercial Z4 airliner to follow in the early 2030s.

This is not a small bet. JetZero’s pitch is that airlines and regulators need a way to hit climate targets without waiting on sci-fi batteries or hydrogen infrastructure, and that a radically more efficient airframe is the most realistic path. It is also very much an LA story: deep aerospace talent, strategic money at the table, and a product that looks like a mashup of climate tech, defense tech and old-school manufacturing rather than another SaaS dashboard.

There is still a long way to go. The next few years are about turning simulations and wind-tunnel charts into flight data, working with regulators and proving that a manta-ray-shaped jet can slot into a world built for Boeings and Airbuses. But if JetZero gets anywhere close, it will mean that one of the most ambitious hardware bets in commercial aviation is being engineered out of Long Beach.

Scroll on for the latest LA venture rounds, fund news and acquisitions.

🤝 Venture Deals

LA Companies

- No Agent List secured $10M in private investment to launch its AI powered real estate platform ahead of a planned Spring 2026 debut. The Los Angeles based company aims to put “agent level” tools directly in the hands of buyers, sellers and vendors, offering direct access to off market properties, FSBOs, distressed assets, foreclosures, tax liens and auctions that have traditionally been gated by agents and insiders. The funding will support product development and rollout of the platform, which promises more control over transactions while using AI to surface opportunities and streamline the deal process. - learn more

- Hadrian, the Los Angeles based advanced manufacturing startup, announced new capital led by accounts advised by T. Rowe Price Associates to accelerate its push to “reindustrialize” American manufacturing. The financing, which also includes Altimeter Capital, D1 Capital Partners, StepStone Group, 1789 Capital, Founders Fund, Lux Capital, a16z, Construct Capital and others, values the company at $1.6B and will be used to expand its high-throughput factories, grow its workforce and deploy more AI, software and automation across its “factories-as-a-service” platform for aerospace, defense and critical infrastructure customers.- learn more

LA Venture Funds

- Blue Bear Capital joined Hydrosat’s $60M Series B, backing the thermal infrared satellite data company alongside lead investors Hartree Partners, Subutai Capital Partners and Space 4 Earth. The funding will help Hydrosat expand its constellation beyond its two current satellites, ramp global coverage and deepen its AI-powered “thermal intelligence” products for water resource management, agriculture, civil government and defense customers worldwide. - learn more

- Elysian Park Ventures led a $12M growth round for Diamond Kinetics, backing the Pittsburgh-based baseball tech company as it doubles down on youth development. The new capital will help Diamond Kinetics scale sidelineHD, its AI-powered youth baseball and softball live streaming and highlights platform, and expand its broader suite of training tools as MLB’s Trusted Youth Development Platform. - learn more

- MANTIS Ventures participated in Depthfirst’s $40M Series A round, backing the San Francisco based applied AI lab alongside lead investor Accel, Alt Capital, BoxGroup, Liquid 2 Ventures and SV Angel. Depthfirst is building an AI-native “General Security Intelligence” platform that uses autonomous agents to detect, triage and remediate software vulnerabilities across code and infrastructure, aiming to outpace a new wave of AI-powered cyberattacks. The fresh capital will fund R&D, go-to-market efforts and hiring as the company scales its security platform for enterprise customers. - learn more

- Cedars-Sinai Health Ventures participated in Vista AI’s $29.5M Series B, joining a slate of leading health systems backing the company’s automated MRI scanning software. The Palo Alto-based startup will use the funding to expand its FDA-cleared cardiac MRI platform to additional anatomies like brain, prostate and spine, and to roll out remote scanning services that let hospitals without in-house MRI expertise offer advanced imaging while easing backlogs and technologist shortages - learn more

- Fourward Ventures is leading a new strategic growth investment in Mermaid Gin, backing the Isle of Wight–based premium spirits brand as it accelerates expansion in the U.S. market. The round brings Fourward’s founder Will Ward onto the board as lead investor and is paired with a national distribution partnership with Southern Glazer’s Wine & Spirits, plus the appointment of longtime Moët Hennessy veteran Jim Clerkin as CEO for the U.S. push. The capital and partnership are aimed at scaling Mermaid Gin in the fast-growing U.S. super-premium gin segment while preserving its sustainability-focused, Isle of Wight roots. - learn more

- Hyperion Capital joined Haiqu’s $11M seed round, backing the quantum software startup alongside Primary Venture Partners, Collaborative Fund, Alumni Ventures, Qudit Ventures, Silicon Roundabout Ventures, Harlow Capital, Toyota Ventures and MaC Venture Capital. Haiqu is building a hardware-aware quantum operating system and middleware layer that boosts the performance of today’s noisy quantum hardware, with the new funding going toward productizing its platform and enabling near-term commercial use cases in areas like finance, cybersecurity and scientific computing. - learn more

- Sound Ventures led WitnessAI’s $58M strategic funding round, backing the Mountain View based AI security and governance platform alongside investors including Fin Capital, Qualcomm Ventures, Samsung Ventures and Forgepoint Capital Partners. The company will use the capital to accelerate global go-to-market efforts and expand its platform, which secures AI agents and models by monitoring agent activity, linking human and agent actions, and blocking prompt injection and other attacks in real time. WitnessAI also unveiled new agentic AI governance tools that give enterprises deeper observability and policy control as they scale AI agents across their operations. - learn more

- Alexandria Venture Investments joined Proxima’s oversubscribed $80M seed financing, backing the newly rebranded AI-native biotech (formerly VantAI) alongside lead investor DCVC, NVentures (NVIDIA’s venture arm), Braidwell, Roivant and others. Proxima is building a generative AI driven platform for “proximity-based medicines” that modulate protein protein interactions, including molecular glues and PROTACs, to go after historically undruggable targets in oncology, immunology and beyond. The new capital will accelerate its NeoLink structural proteomics and Neo AI model stack, and advance a pipeline of first-in-class proximity-modulating therapeutics toward the clinic. - learn more

- Clocktower Technology Ventures participated in WeatherPromise’s oversubscribed $12.8M Series A, backing the weather-guarantee startup alongside lead investor Maveron, 1Sharpe, Lerer Hippeau, Commerce Ventures, MS Transverse, Start Ventures, 1Flourish and others. WeatherPromise partners with major travel brands like Marriott, Expedia and JetBlue to offer “weather guarantees” that automatically refund trips when conditions are worse than promised, driving demand for travel, events and outdoor experiences. The new capital will accelerate product development, expand strategic partnerships and scale the platform across more consumer categories. - learn more

- MANTIS Ventures participated in Sandstone’s $10M seed round, backing the AI-native legal tech startup alongside lead investor Sequoia Capital and others. Sandstone is building an operating system for in-house legal teams that uses AI agents to route requests, draft and review contracts, and surface answers directly inside tools like email, Slack and Salesforce, turning institutional legal knowledge into reusable workflows. The new capital will help the Brooklyn-based company scale its product and grow its customer base of corporate legal departments. - learn more

- Strong Ventures participated in Hupo’s $10M Series A round, backing the Singapore-based AI sales coaching startup alongside lead investor DST Global Partners, Collaborative Fund, January Capital and Goodwater Capital. Hupo’s platform uses AI to coach frontline banking, insurance and financial services sales teams in real time, helping them ramp faster and close more deals across highly regulated markets in APAC and Europe. The new funding will support product development, expansion of its coaching features and scaling enterprise deployments as the company eyes broader international growth. - learn more

- Freeflow Ventures joined Vivere Oncotherapies’ more than $10M funding round, backing the UC Berkeley spinout alongside YK Bioventures, Pillar, Berkeley Frontier Fund and the National Cancer Institute. Vivere is developing targeted immunotherapies for “cold” solid tumors like colorectal and ovarian cancers, aiming to activate the immune system against tumors that typically evade detection and resist existing treatments. The new capital will support advancement of its proprietary bioengineering platform and pipeline of therapies for patients with few effective options today. - learn more

- Alexandria Venture Investments joined Precede Biosciences’ $63.5M Series B equity round, part of an $83.5M total financing package that also includes a $20M strategic, non-dilutive credit facility. The Boston based precision diagnostics and data company is scaling its blood-based platform, which measures target expression and pathway activity to support next-generation cancer therapies like drug, radio and immune conjugates. The new capital will help Precede meet growing demand from biopharma partners developing these precision medicines and accelerate commercialization and health system adoption. - learn more

- Alexandria Venture Investments participated in Recludix Pharma’s new equity financing round alongside Access Biotechnology, NEA and Westlake BioPartners, with additional strategic investment from Eli Lilly. The San Diego based, clinical-stage biotech will use the $123M in total equity raised to advance clinical development of its novel SH2 domain inhibitor pipeline for inflammatory diseases and to tap Lilly’s TuneLab AI/ML platform to accelerate discovery across its broader SH2 domain program. - learn more

- BOLD Capital Partners participated in MagicCube’s $10M funding round, backing the Cupertino-based software security company alongside strategic investor Verifone and other existing backers. MagicCube plans to use the capital to expand beyond its core tap-to-phone payments offering into biometrics, identity verification and AI-driven device security, while scaling its Software Defined Trust platform that delivers hardware-grade protection through software on standard mobile and IoT devices.- learn more

LA Exits

- Webalo is being acquired by Prometheus Group, which is folding the Los Angeles based “no-code for the frontline” platform into its enterprise asset management software suite. The deal will combine Webalo’s mobile, real-time workflows for frontline workers with Prometheus Group’s planning and scheduling tools, aiming to create a closed-loop digital execution platform that connects shopfloor actions directly back into systems of record like SAP and Oracle. - learn more

Read moreShow less

RELATEDTRENDING

LA TECH JOBS