Get in the KNOW

on LA Startups & Tech

X

Design, Bitches

Looking to Build a Granny Flat in Your Backyard? Meet the Firms and Designs Pre-Approved in LA

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

Adding a backyard home in Los Angeles is now nearly as easy as buying a barbecue.

Homeowners who for years have wanted to build a granny flat in their backyard, but dreaded the red tape, can now choose from 20 pre-designed homes that the city has already approved for use.

The shift, made official last week, will speed up a weeks-long process and bring more badly needed units to an overpriced market. It also has the potential to elevate the 14 startups and firms building the next generation of homes.

The designs for the stand-alone residences range from a 200-square-foot studio to a 1,200-square foot, two-story, two-bedroom unit. And many of the homes are filled with design flourishes, reflecting the diverse architecture of the city, from a house in the silhouette of a flower to one with a spiral outdoor staircase leading to the roof.

It's no surprise. The program was spearheaded by Christopher Hawthorne, a former architecture critic at the Los Angeles Times and now the city's chief design officer.

The firms are primarily local and startup architecture and design firms, while others are well-known with a history of building granny flats, also know as accessory dwelling units, or ADUs.

The standard plans avoid the Los Angeles Department of Building and Safety's typical four-to six-week review process and can allow approvals to be completed in as quickly as one day.

Some aspects of the plans can be modified to fit a homeowner's preferences. Eight other designs are pending approval.

Mayor Eric Garcetti believes by adding more such units, the city can diversify its housing supply and tackle the housing crisis. Recent state legislation made it easier to build the small homes on the lot of single-family residences. Since then, ADUs have made up nearly a quarter of Los Angeles' newly permitted housing units.

Because construction costs are relatively low for the granny flats – the pre-approved homes start at $144,000 and can go beyond $300,000 – the housing is generally more affordable. The median home price in L.A. County in January was $690,000.

Here's a quick look at the designs approved so far:

Abodu

Abodu

Abodu, based in Redwood City in the Bay Area, exclusively designs backyard homes. In 2019, it worked with the city of San Jose on a program similar to the one Los Angeles is undertaking.

In October, it closed a seed funding round of $3.5 million led by Initialized Capital.

It has been approved for a one-story 340-square-foot studio, a one-story one-bedroom at 500 square feet, and a one-story, 610-square-foot two-bedroom.

The pricing for the studio is $189,900, while the one-bedroom costs $199,900 and the two-bedroom is $259,900.

Amunátegui Valdés Architects

Led by Cristobal Amunátegui and Alejandro Valdés, the firm was founded in 2011 and has offices in Los Angeles and Santiago, Chile. Amunátegui is an assistant professor at the Department of Architecture and Urban Design at UCLA.

The firm designs work in various scales and mediums, including buildings, furniture and exhibitions.

Its one-story, two-bedroom with a covered roof deck 934-square-foot unit is pending approval from the city.

Connect Homes

Connect Homes has a 100,000-square foot factory in San Bernardino and an architecture studio in Downtown L.A.

It specializes in glass and steel homes and has completed 80 homes in California. Its designs have an aesthetic of mid-century modern California residential architecture.

It has two one-bedroom models pre-approved by the city, one is 460 square feet, which costs $144,500 with a total average project cost of $205,000. The other is 640 square feet, which costs $195,200 with a total project cost of $280,000.

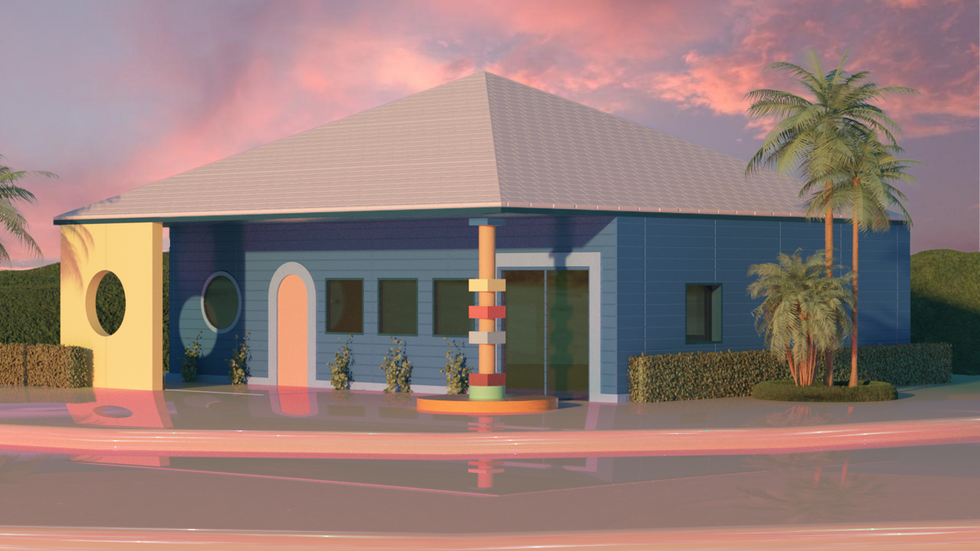

Design, Bitches

The Los Angeles-based architectural firm founded in 2010 describes itself as having a "bold and irreverent vision." Its projects include urban infill ground-up offices to single-family homes, adaptive re-use of derelict commercial buildings and renovations of historic landmarks.

Its pre-approved design, named "Midnight Room," is a guest house/ studio. Its bedroom can be left open for a loft feel or enclosed as a separate room. The design is a one-story, one-bedroom at 454 square feet.

Escher GuneWardena Architecture

Founded in Los Angeles in 1996, Escher GuneWardena Architecture has received international recognition and has collaborated with contemporary artists, worked on historical preservation projects and more.

The company has been approved for two different one-story, one- or two-bedroom units, one at 532 square feet with an estimated cost of $200,000 and another at 784 square feet with an estimated cost of $300,000. The firm noted the costs depend on site conditions and do not include soft costs. Those could add 10% to 12% to the total construction costs.

First Office

First Office is an architecture firm based in Downtown Los Angeles. Its approved ADUs will be built using prefabricated structural insulated panels, which allow for expedited construction schedules and high environmental ratings.

The interior finishes include concrete floors, stainless steel counters and an occasional element of conduit.

There are five options:

- A one-story studio, 309 to 589 square feet

- A one-story one-bedroom, 534 to 794 square feet

- And a one-story two-bedroom, 1,200 square feet

Fung + Blatt Architects

Fung + Blatt Architects is a Los Angeles-based firm founded in 1990.

The city has approved its 795-square-foot, one-story, one-bedroom unit with a roof deck. It estimates the construction cost to be $240,000 to $300,000, excluding landscape, site work and the solar array. Homeowners can also expect other additional costs.

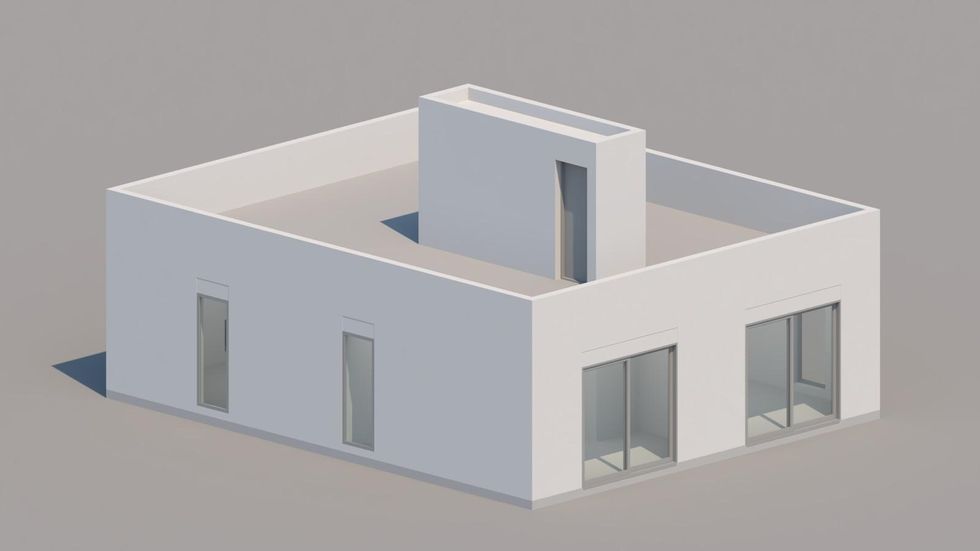

Taalman Architecture/ IT House Inc.

The design team behind "IT House" is Los Angeles-based studio Taalman Architecture. Over the past 15 years, IT House has built more than 20 homes throughout California and the U.S.

The IT House ADU standard plans include the tower, bar, box, cube, pod and court.

The city has approved four options, including:

- A two-story including mechanical room, 660 square feet

- A two-story including mechanical room, 430 square feet

- A one-story studio, 200 square feet

- A one-story including mechanical room, 700 square feet

The firm also has another two projects pending approval: a 360-square-foot one-story studio and a one-story, three-bedroom at 1,149 square feet.

LA Más

LA Más is a nonprofit based in Northeast Los Angeles that designs and builds initiatives promoting neighborhood resilience and elevating the agency of working-class communities of color. Homeowners who are considering their design must commit to renting to Section 8 tenants.

The city has approved two of LA Más' designs: a one-story, one-bedroom, 528 square feet unit and a one-story, two-bedroom, 768 square feet unit. The firm has another design for a one-story studio pending approval. That design would be the first 3D-printed ADU design in the city's program.

Jennifer Bonner/MALL

Massachusetts-based Jennifer Bonner/MALL designed a "Lean-to ADU" project, reinterpreting the stucco box and exaggerated false front, both Los Angeles architectural mainstays.

The design has been approved for a 525-square-foot one-story, one-bedroom unit with a 125-square-foot roof deck.

sekou cooke STUDIO

New York-based sekou cooke STUDIO is the sole Black-owned architectural firm on the project.

"The twisted forms of this ADU recalls the spin and scratch of a DJ's records" from the early 90s, the firm said.

Its design, still pending approval, is for a 1,200-square-foot, two bedroom and two bathroom can be adapted to a smaller one-bedroom unit or to include an additional half bath.

SO-IL

New York-based SO-IL was founded in 2008. It has completed projects in Leon, Seoul, Lisbon and Brooklyn.

Its one-story, one-bedroom 693-square-foot unit is pending approval. It is estimated the construction cost will be between $200,000 and $250,000.

WELCOME PROJECTS

Los Angeles-based Welcome Projects has worked on projects ranging from buildings, houses and interiors to handbags, games and toys.

Its ADU is nicknamed The Breadbox "for its curved topped walls and slight resemblance to that vintage counter accessory."

It has been approved for a one-story, one-bedroom 560-square-foot unit.

wHY Architecture

Founded in 2004, wHY is based in Los Angeles and New York City. It has taken on a landmark affordable housing and historic renovation initiative in Watts.

Its one-story, one- or two-bedroom 480 to 800-square-foot unit is pending approval.

Firms that want to participate in the program can learn more here . Angelenos interested in building a standard ADU plan can learn more the approved projects here.

From Your Site Articles

- United Dwelling Raises $10M to Address the Housing Shortage ... ›

- Plant Prefab Raises An Additional $30 Million - dot.LA ›

- How 3D Printing Could Help Tackle Homelessness in LA - dot.LA ›

- New Bills, New Startups Address Housing in California - dot.LA ›

- LA's ADU Culture Still Faces Financial Barriers - dot.LA ›

- What Will Take To Make Modular Homes Mainstream? - dot.LA ›

Related Articles Around the Web

Sarah Favot

Favot is an award-winning journalist and adjunct instructor at USC's Annenberg School for Communication and Journalism. She previously was an investigative and data reporter at national education news site The 74 and local news site LA School Report. She's also worked at the Los Angeles Daily News. She was a Livingston Award finalist in 2011 and holds a Master's degree in journalism from Boston University and BA from the University of Windsor in Ontario, Canada.

How Multiplayer Gaming Became One of the Hottest Forms of Entertainment

08:22 AM | December 29, 2020

Photo by Igor Karimov on Unsplash

If it seemed like everyone and their mother took up gaming this year, that may be because playing became far more popular as social media transforms the industry.

Nearly all games allow for multiple players to interact inside the game, but this year as the pandemic kept people at home, game worlds further converged with social media. Gamers used livestreaming platforms like Twitch and Discord to connect as they play.

Meanwhile social media companies like Facebook boosted their gaming platforms and Snap supersized its gaming effort with Bitmoji Paint, which it released in December.

Nintendo's "Animal Crossing: New Horizons" was embraced by politicians, with both congresswoman Alexandria Ocasio-Cortez and president-elect Joe Biden creating neighborhoods and encouraging their constituents to come pay them a virtual campaign trail visit.

It all meant a push toward a more social game.

And it was in a year that players spent big on their favorite titles - in November alone, digital games earned $11.5 billion, the highest monthly revenue ever recorded by Nieslen's SuperData.

Global gaming revenue smashed records with sales estimated to reach $174.9 billion by the end of this year, up roughly 20% from last year, NewZoo games analyst Tom Wijman wrote in a recent report. NewZoo predicts that by the end of 2021, roughly 2.8 billion people will be gaming worldwide.

Social media plays a crucial role in how well a game is received, and it hugely influenced which games took off this year. "Among Us" is a two-year-old game, but when streamers started broadcasting matches in early April, it quickly attracted new players.

Similarly, popular game streamers broadcasting Santa Monica-based Activision Blizzard's "Call of Duty: Warzone" game helped the game go viral and jumpstarted adoption of its newest title, "Black Ops Cold War," which was the top-selling console game in November with 5.7 million copies sold.

Adoption of multiplayer games and content is expected to keep rising, prompting startups including Playa Vista-based VENN to capitalize on a market ravenous for group entertainment.

VENN's network of gamer-friendly television is now expanding to smart TVs (it recently struck deals with Roku and Samsung) and existing social networks like YouTube, said Jimmy Wong, producer and co-host of VENN's talk show "The Download."

"Our view of the pandemic is one of someone dousing an already lit flame with lighter fluid," Wong said. "It's a step towards a wider acceptance of video gaming as being one of the most popular things for people to do."

In October roughly 931,000 people engaged with Santa Monica-based Riot Games' "League of Legends" page on Reddit, according to NewZoo's report on the most active gaming communities.

Ocasio-Cortez broke Twitch records streaming "Among Us," in November, when she linked up with several famous streamers for a live broadcast that reached over 400,000 people.

Social media not only expands the reach of a multiplayer game, but also its lifespan -- "League of Legends" is over a decade old, and Activision's "Call of Duty" franchise launched in 2003. "Among Us" came out in 2018, but it made $3.2 million in digital revenue this year and passed half a billion downloads in December.

"There's now so much evergreen video content surrounding these games which has made the lifespan and reach so much greater," said Ryan Horrigan(cq), CEO of West Hollywood-based Artie, a startup that designs multiplayer cloud-based browser games and will launch in 2021. "I do think gaming is becoming the next social network."

Social media and streaming drives players back to games but it's also a lucrative ad opportunity. "The world of gaming is permeating well beyond even the notion of a game," Horrigan noted, and lately includes film and TV adaptations of hit titles.

Scopely, a Culver-City based mobile publisher, both makes and acquires multiplayer games. "Marvel Strike Force," which it bought from Walt Disney Co. in January, is its biggest earner. "We will close the year above $900 million in revenue, nearly double the revenue of 2019," Scopely's head of strategic partnerships Mike DeLaet told dot.LA.

Tim Richards, vice president of publishing at Calabasas-based GreenPark Sports, is designing a virtual space for sports and esports fans to hang out and play that will launch in January. "We designed the idea around this data that 90% of Gen Z classify themselves as gamers," Richards said. He noted that even hardcore sports fans like virtual viewing -- "Even back in (pre-pandemic) days, very few folks went to every sports game."

Analysts agree gaming is now a more essential form of social entertainment than ever before and it will continue to grow in audience next year, as will streaming and virtual events that take place inside live games.

"Multiplayer games would have grown in popularity regardless of COVID-19," said Carter Rogers, principal analyst at SuperData. "This growth is sustainable, and we aren't likely to see any sort of video game 'crash' after most people are vaccinated. People are forming long-term habits as they play online games, many for the first time."

Correction: An earlier version of this piece mis-identified Tim Richards, GreenPark Sports' vice president of publishing.

From Your Site Articles

- Scopely Raises $340 Million Series E - dot.LA ›

- VENN Launches 24/7 Gaming Coverage - dot.LA ›

- Bitmoji Paint is Snap's Latest Collaborative Game - dot.LA ›

- Artie Reopens its Round and Goes After Gaming's Big Problem - dot ... ›

- Elodie Games Raises $32.5 Million from Andreessen Horowitz - dot.LA ›

- G4TV is Back After Seven Years Off the Air - dot.LA ›

- NZXT Raises $103.5 Million to Game the Chip Shortage - dot.LA ›

- Riot Games Give South LA Students Access to Tech Education - dot.LA ›

- Thatgamecompany to Build a Virtual “Theme Park” - dot.LA ›

- Gaming's Pandemic Boom Is Over - dot.LA ›

Related Articles Around the Web

Read moreShow less

nielsen's super datajoe bidenfacebooksnapbitmoji painnewzoovennriot gamesredditactivision blizzardscopelywalt disneytim richardsgreenpark sportscarter rogerssuperdatasocial gaminggaming

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

https://twitter.com/samsonamore

samsonamore@dot.la

Indie Game Studio Thatgamecompany Raises $160 Million to Build a Virtual 'Theme Park'

03:01 PM | March 03, 2022

Courtesy of Thatgamecompany

Sign up for dot.LA's daily newsletter for the latest news on Southern California's tech, startup and venture capital scene.

Santa Monica-based indie gaming studio Thatgamecompany has raised $160 million as it seeks to parlay games like “Sky: Children of Light” into a “theme park”-like metaverse experience.

The funding was led by private equity giant TPG—which invested through its tech-focused, $1.5 billion Tech Adjacencies fund—and venture firm Sequoia Capital. Thatgamecompany plans to use the capital to expand its roughly 100-person staff to more than 150 people and develop upcoming games, co-founder and CEO Jenova Chen told VentureBeat.

The startup was founded in 2006, by University of Southern California students Chen and Kellee Santiago, with the goal of creating games that put the player at the center of an emotional escapade. The studio got its start with the title “Flow” for Sony’s PlayStation 3; the Japanese firm was an early investor in Thatgamecompany, providing it with a three-game production deal and housing the four-person startup at Sony’s Los Angeles office.

Thatgamecompany co-founder and CEO Jenova Chen.

Courtesy of Thatgamecompany

Thatgamecompany later won critical acclaim for its 2012 PlayStation game “Journey,” as well as its most recent game, 2019’s “Sky: Children of Light,” which was released on mobile devices and the Nintendo Switch. “Sky” won several awards and has been downloaded more than 160 million times.

Chen told VentureBeat his larger goal is to turn games like “Sky” into an immersive, interactive “theme park” experience. “There isn’t that equivalent of a kind of Disneyland experience or a Pixar movie experience in the game industry even today,” he said. “Hopefully, Sky and our future games will all be part of the theme parks in the future, like in a connected metaverse.”

To that end, Thatgamecompany also announced that Pixar co-founder Ed Catmull has joined the company as a “principal advisor on creative culture and strategic growth.”

From Your Site Articles

- Gaming Became One of the Hottest Form of Entertainment - dot.LA ›

- Griffin Gaming Partners Invests in Mobile Game Studio Spyke - dot.LA ›

Related Articles Around the Web

Read moreShow less

Samson Amore

Samson Amore is a reporter for dot.LA. He holds a degree in journalism from Emerson College. Send tips or pitches to samsonamore@dot.la and find him on Twitter @Samsonamore.

https://twitter.com/samsonamore

samsonamore@dot.la

RELATEDTRENDING

LA TECH JOBS